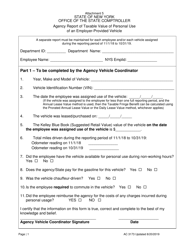

This version of the form is not currently in use and is provided for reference only. Download this version of

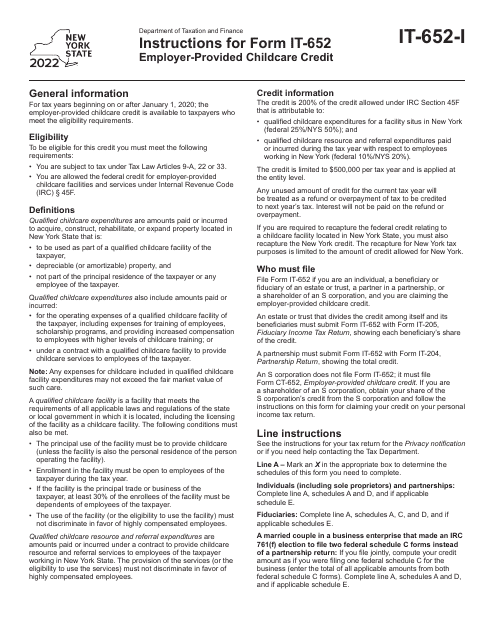

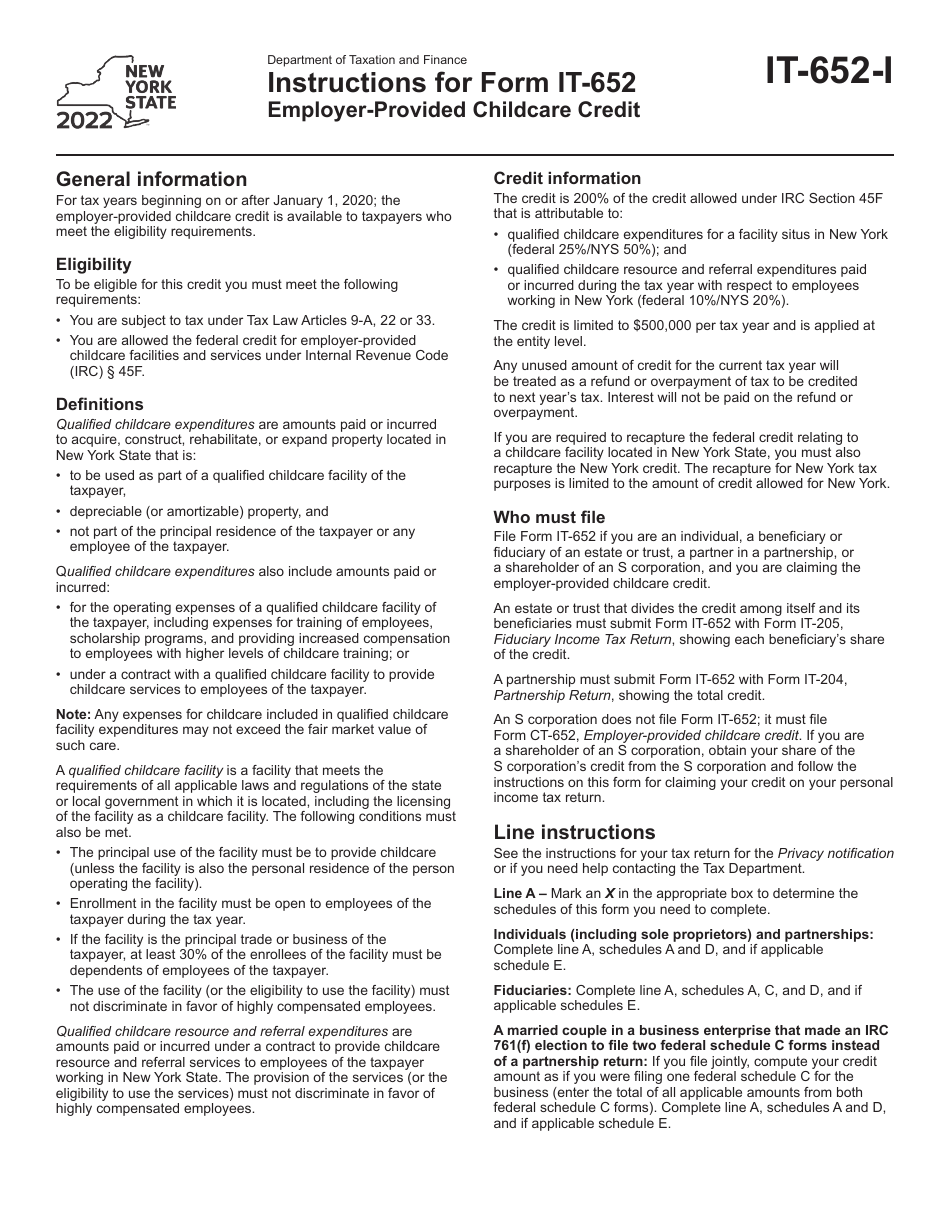

Instructions for Form IT-652

for the current year.

Instructions for Form IT-652 Employer-Provided Childcare Credit - New York

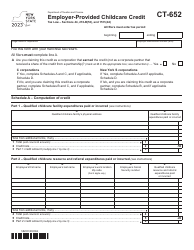

This document contains official instructions for Form IT-652 , Employer-Provided Childcare Credit - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form IT-652 is available for download through this link.

FAQ

Q: What is Form IT-652?

A: Form IT-652 is a tax form used in New York to claim the Employer-Provided Childcare Credit.

Q: What is the Employer-Provided Childcare Credit?

A: The Employer-Provided Childcare Credit is a tax credit available to employers in New York who provide childcare services to their employees.

Q: Who is eligible to claim the Employer-Provided Childcare Credit?

A: Employers in New York who provide childcare services to their employees are eligible to claim the Employer-Provided Childcare Credit.

Q: What expenses are eligible for the Employer-Provided Childcare Credit?

A: Expenses related to providing childcare services to employees, such as wages and benefits for childcare providers, are eligible for the credit.

Q: How do I complete Form IT-652?

A: You must provide information about your business and the childcare services you provide. Follow the instructions on the form to complete it accurately.

Q: Are there any deadlines for filing Form IT-652?

A: Yes, the form must be filed by the due date of your employer's annual corporate tax return.

Q: Can I claim the Employer-Provided Childcare Credit if I am self-employed?

A: No, the credit is only available to employers who provide childcare services to their employees.

Q: What is the purpose of the Employer-Provided Childcare Credit?

A: The credit is intended to incentivize employers in New York to provide childcare services to their employees.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.