This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form IT-651

for the current year.

Instructions for Form IT-651 Recovery Tax Credit - New York

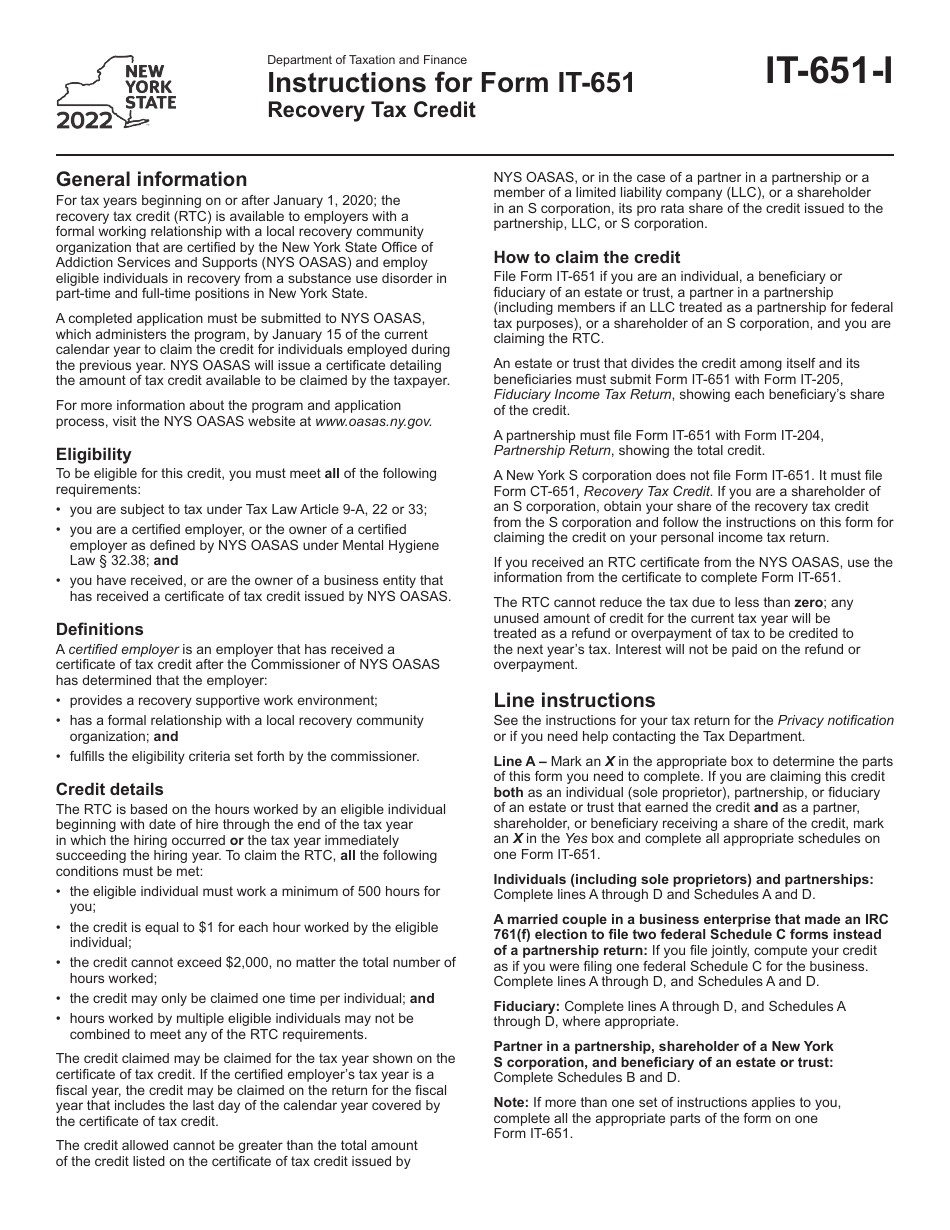

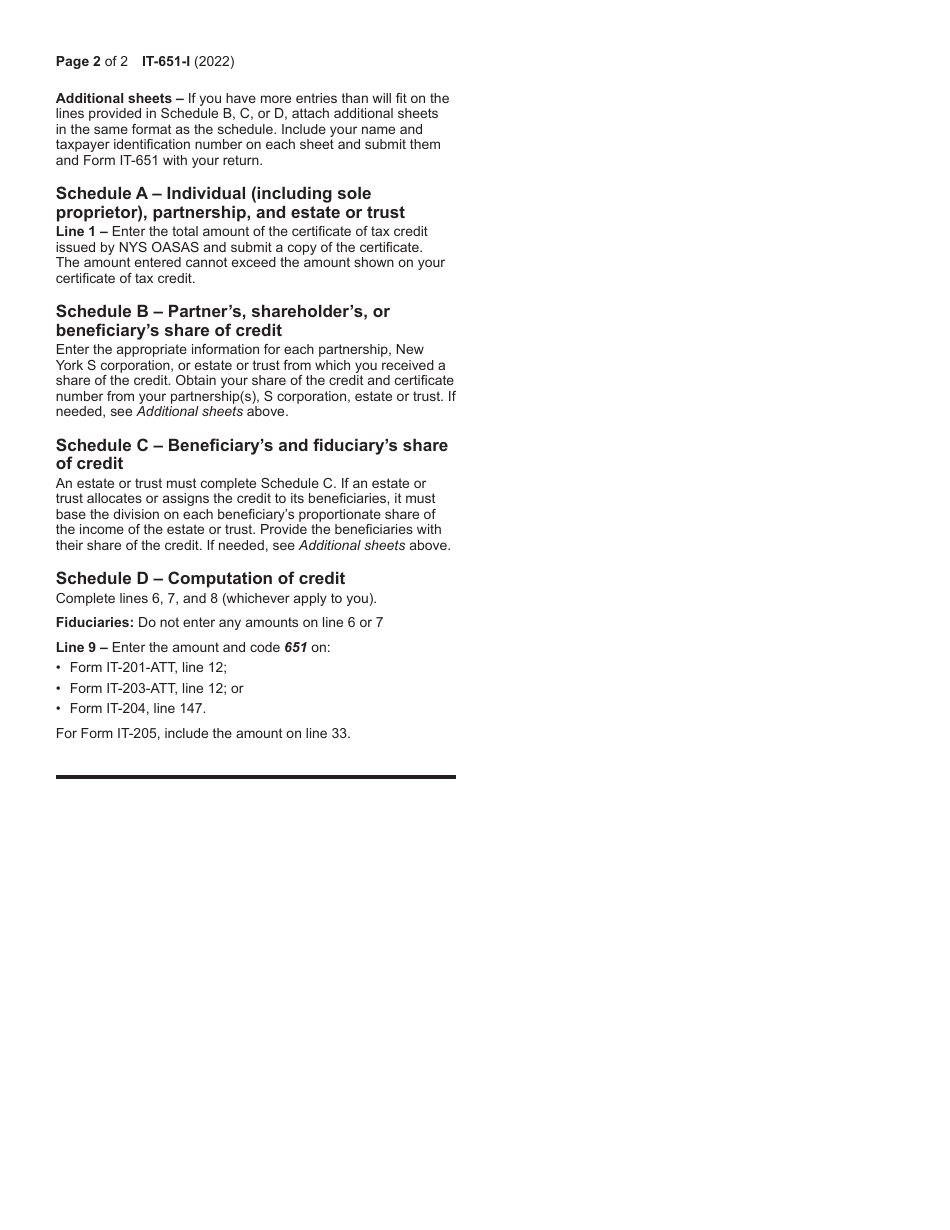

This document contains official instructions for Form IT-651 , Recovery Tax Credit - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form IT-651 is available for download through this link.

FAQ

Q: What is Form IT-651 Recovery Tax Credit?

A: Form IT-651 Recovery Tax Credit is a form used by residents of New York to claim a tax credit related to the COVID-19 pandemic.

Q: Who is eligible to claim the Recovery Tax Credit?

A: New York residents who experienced economic hardship and meet certain criteria due to the COVID-19 pandemic may be eligible to claim the Recovery Tax Credit.

Q: What are the requirements to be eligible for the tax credit?

A: To be eligible for the Recovery Tax Credit, you must have been a resident of New York State for all or part of the tax year, experienced economic hardship due to the pandemic, and meet other specified criteria.

Q: What expenses can be claimed for the tax credit?

A: Expenses related to business interruption, supply chain disruption, employee retention, and COVID-19 testing are among the eligible expenses that can be claimed for the Recovery Tax Credit.

Q: What documentation is required to support the tax credit claim?

A: Documentation such as financial statements, payroll records, and receipts may be required to support your tax credit claim. Be sure to review the instructions provided with the form for detailed requirements.

Q: When is the deadline to file Form IT-651 Recovery Tax Credit?

A: The deadline to file Form IT-651 Recovery Tax Credit is typically the same as the deadline for filing your New York State income tax return. Check the form and instructions for the specific due date.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.