This version of the form is not currently in use and is provided for reference only. Download this version of

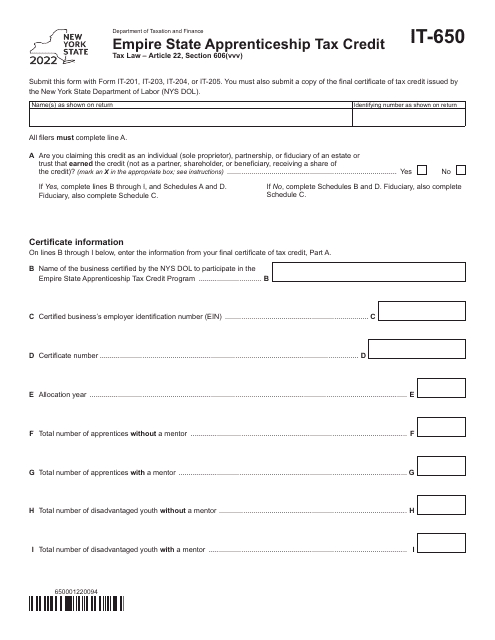

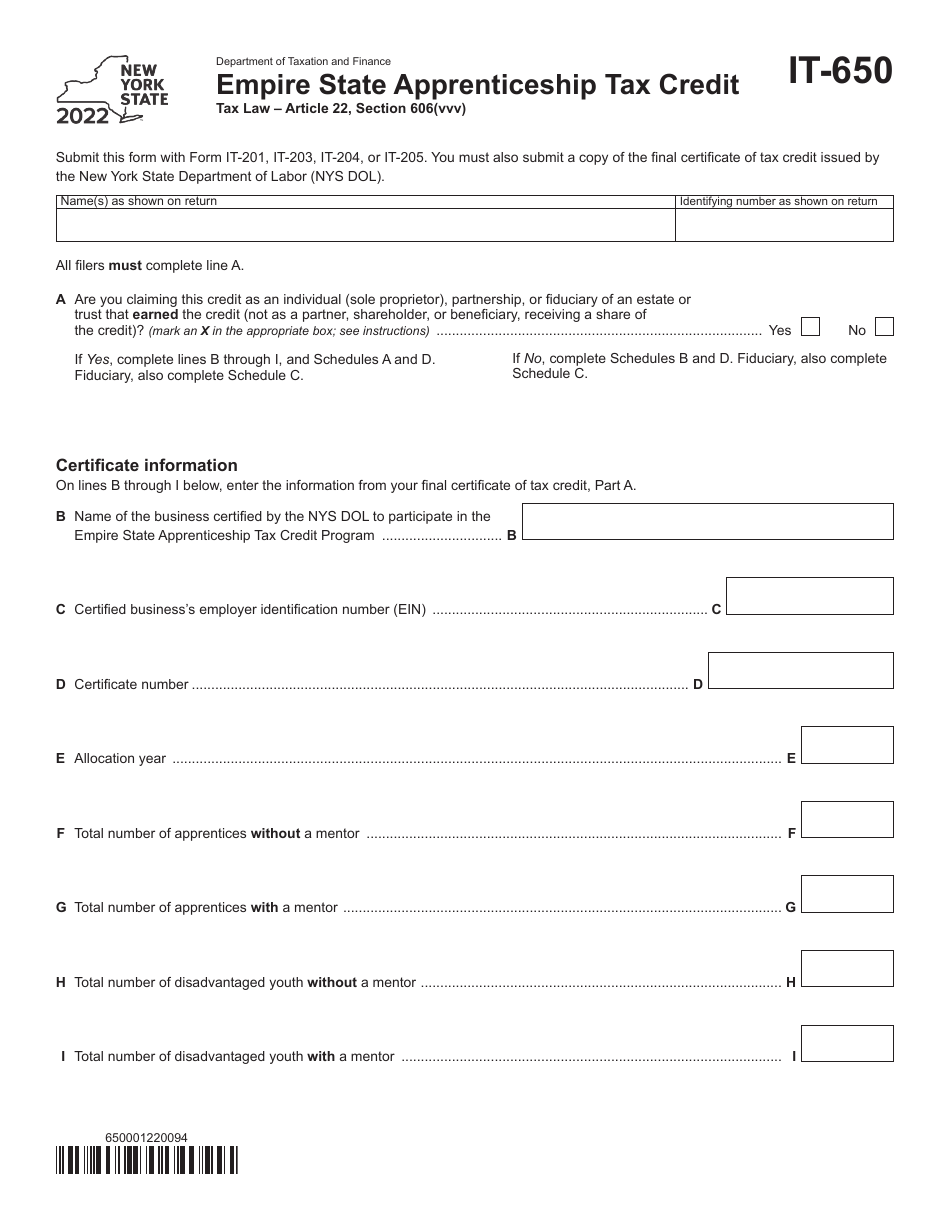

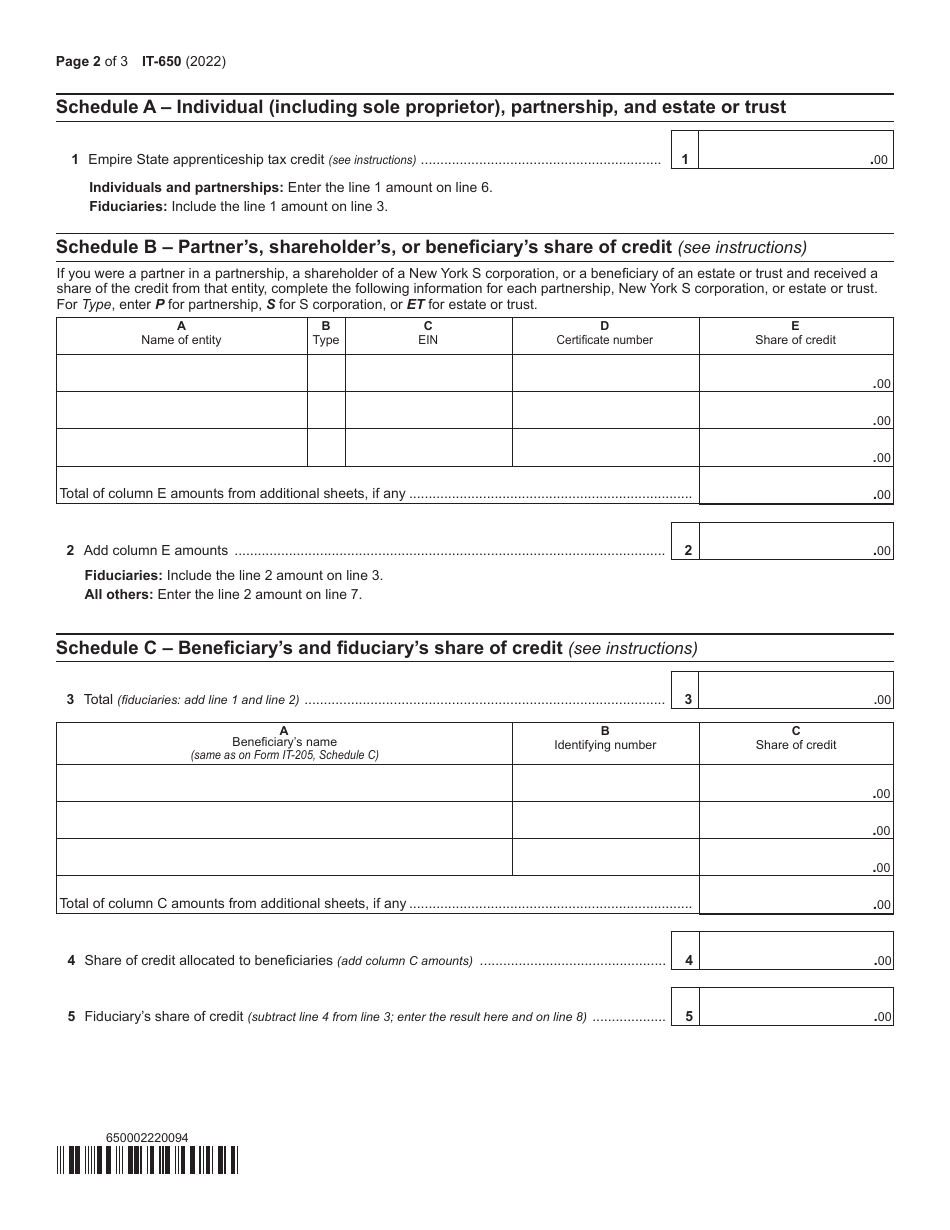

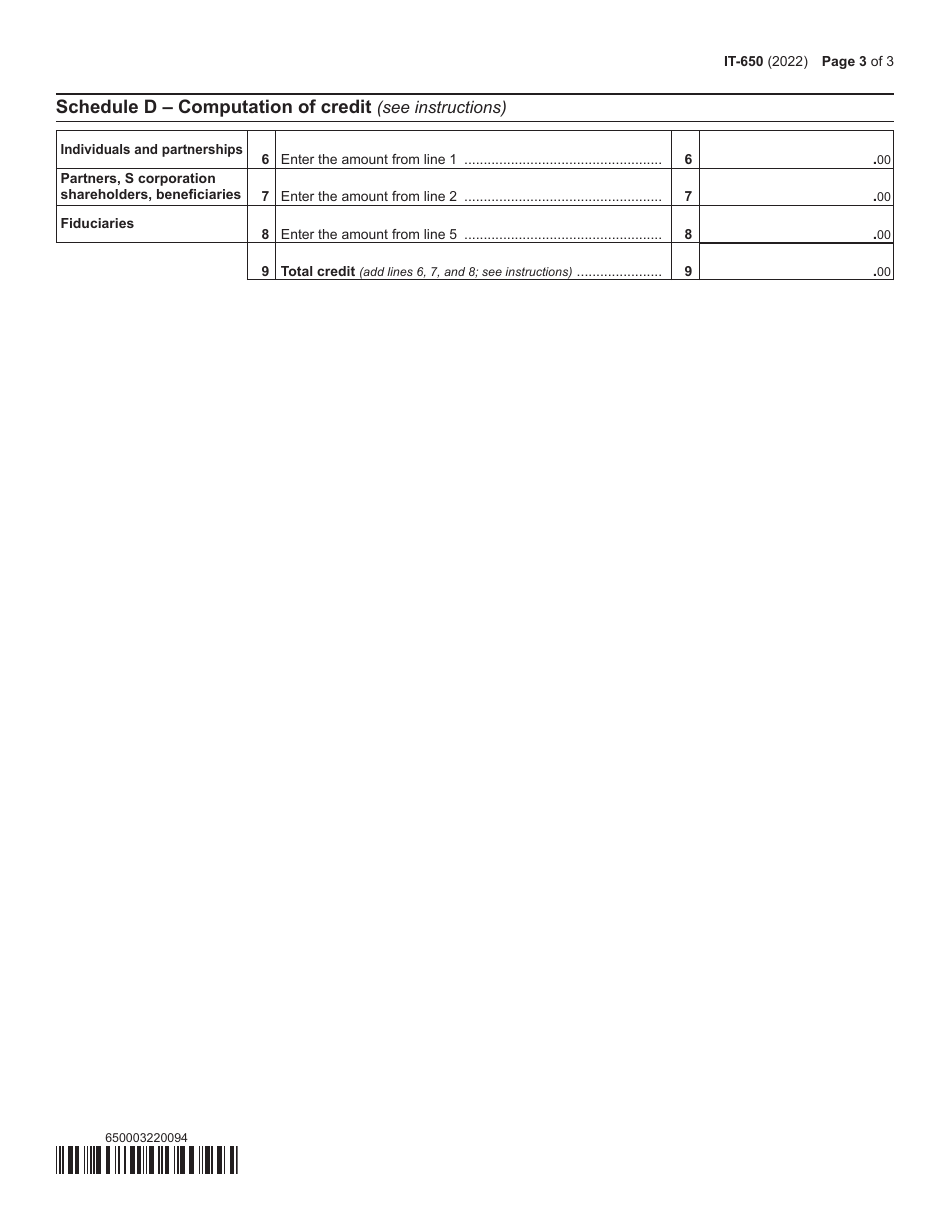

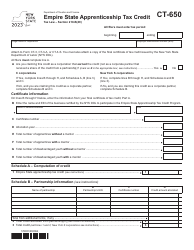

Form IT-650

for the current year.

Form IT-650 Empire State Apprenticeship Tax Credit - New York

What Is Form IT-650?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-650?

A: Form IT-650 is the Empire StateApprenticeship Tax Credit form in New York.

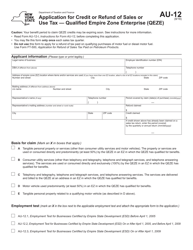

Q: What is the Empire State Apprenticeship Tax Credit?

A: The Empire State Apprenticeship Tax Credit is a tax credit available to employers in New York State who participate in approved apprenticeship programs.

Q: Who is eligible for the Empire State Apprenticeship Tax Credit?

A: Employers in New York State who hire qualifying apprentices and participate in approved apprenticeship programs are eligible for the tax credit.

Q: How much is the Empire State Apprenticeship Tax Credit?

A: The amount of the tax credit varies based on the apprentice's wages and the length of their apprenticeship program.

Q: How do I apply for the Empire State Apprenticeship Tax Credit?

A: To apply for the tax credit, employers must complete and file Form IT-650 with the New York State Department of Taxation and Finance.

Q: Is there a deadline to file Form IT-650?

A: Yes, Form IT-650 must be filed by the due date for the employer's tax return, including extensions.

Q: Are there any other requirements to qualify for the Empire State Apprenticeship Tax Credit?

A: Yes, employers must meet certain criteria and requirements set by the New York State Department of Labor to qualify for the tax credit.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-650 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.