This version of the form is not currently in use and is provided for reference only. Download this version of

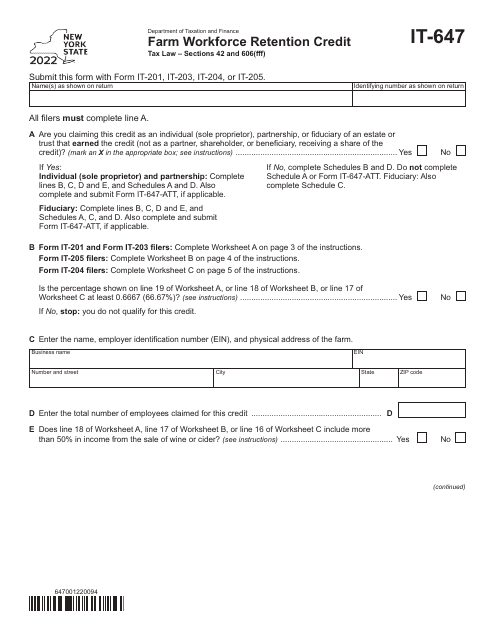

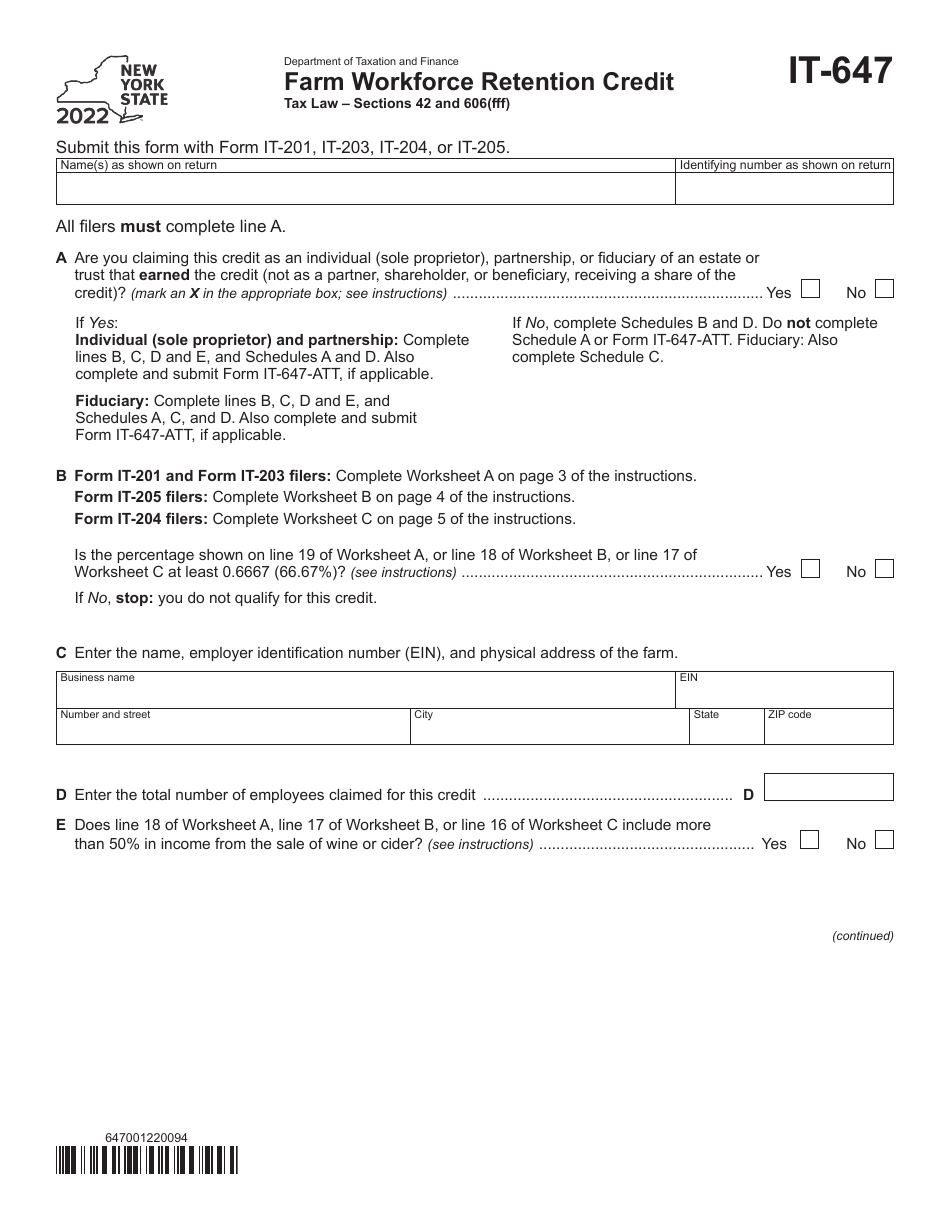

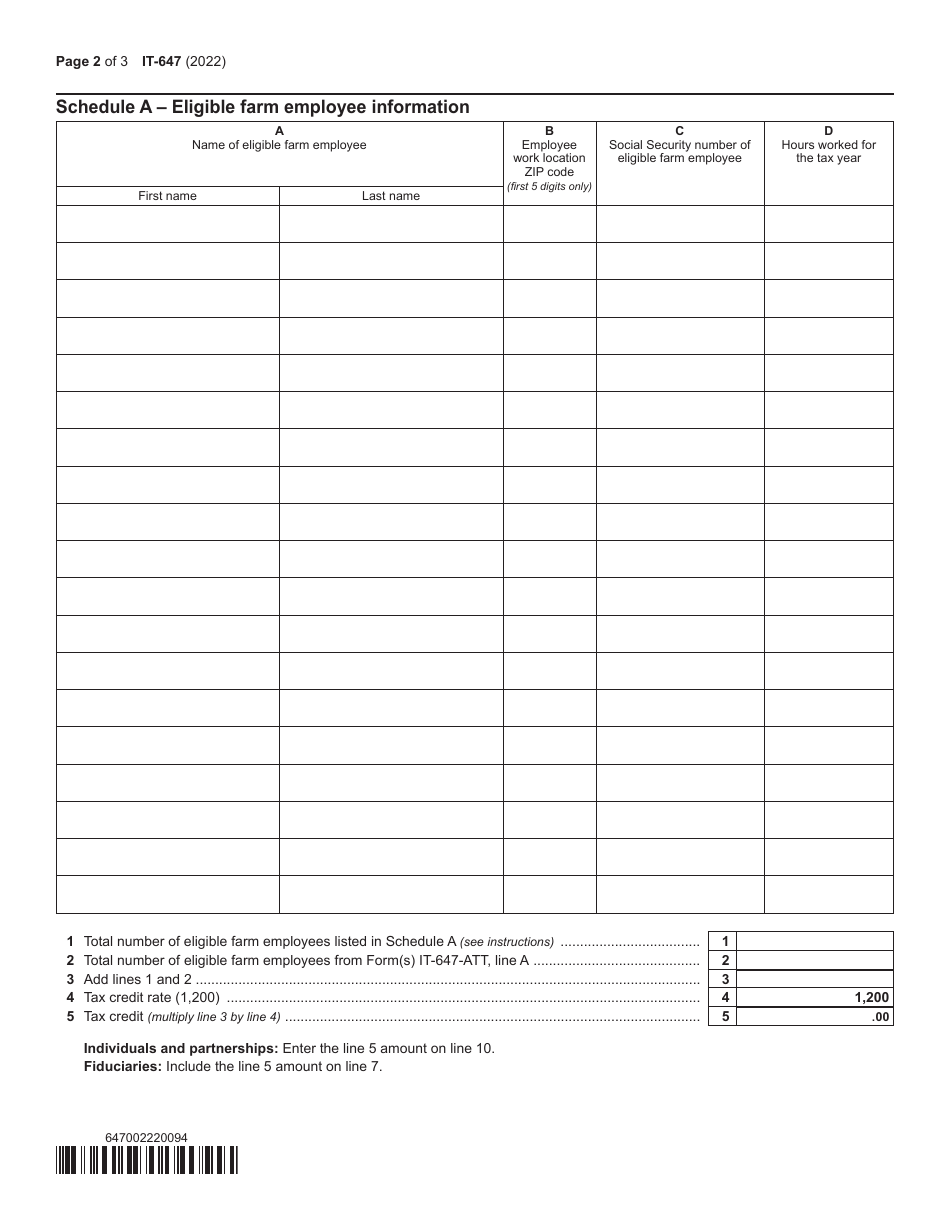

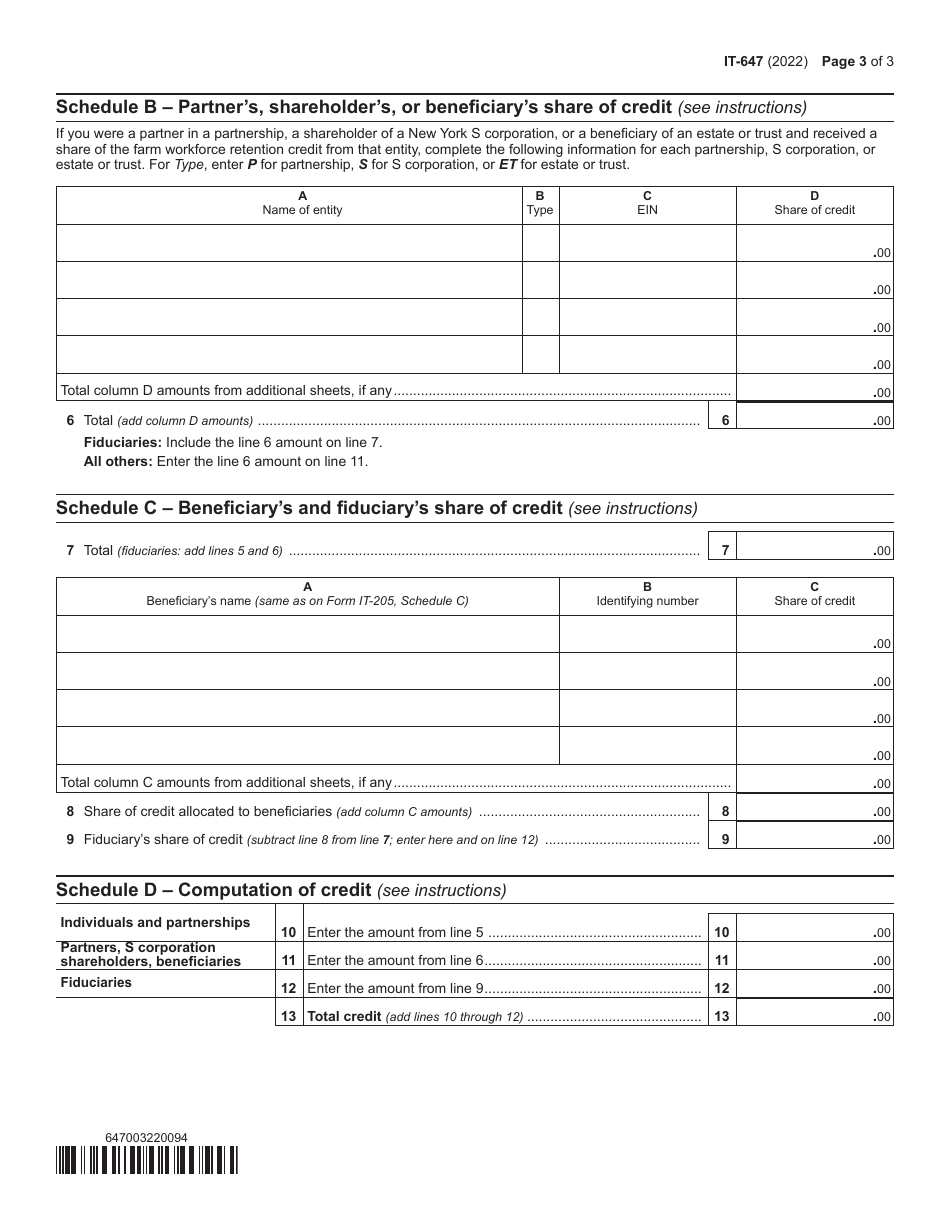

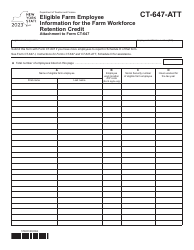

Form IT-647

for the current year.

Form IT-647 Farm Workforce Retention Credit - New York

What Is Form IT-647?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-647?

A: Form IT-647 is a tax form used in New York to claim the Farm Workforce Retention Credit.

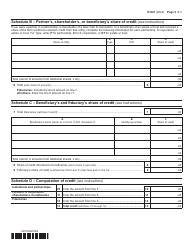

Q: What is the Farm Workforce Retention Credit?

A: The Farm Workforce Retention Credit is a tax credit available to agricultural employers in New York who provide qualified wages to farm laborers.

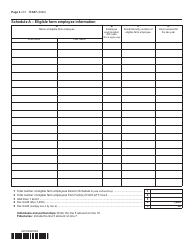

Q: Who is eligible to claim the Farm Workforce Retention Credit?

A: Agricultural employers in New York who employ farm laborers and meet certain requirements are eligible to claim the credit.

Q: What are qualified wages for the purposes of this credit?

A: Qualified wages are wages paid to farm laborers in New York who work at least 500 hours during the calendar year.

Q: How much is the Farm Workforce Retention Credit?

A: The credit is equal to $600 for each eligible farm laborer.

Q: How do I calculate the credit?

A: To calculate the credit, multiply the number of eligible farm laborers by $600.

Q: How do I claim the Farm Workforce Retention Credit?

A: To claim the credit, you must complete and file Form IT-647 with your New York state tax return.

Q: When is the deadline to submit Form IT-647?

A: Form IT-647 must be filed by the due date of your New York state tax return, which is generally April 15th.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-647 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.