This version of the form is not currently in use and is provided for reference only. Download this version of

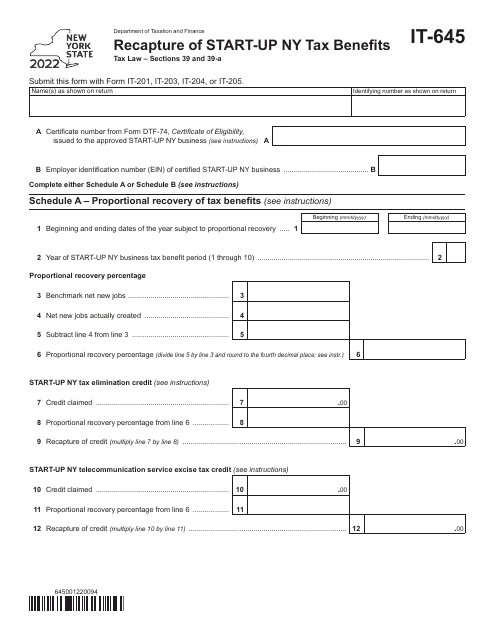

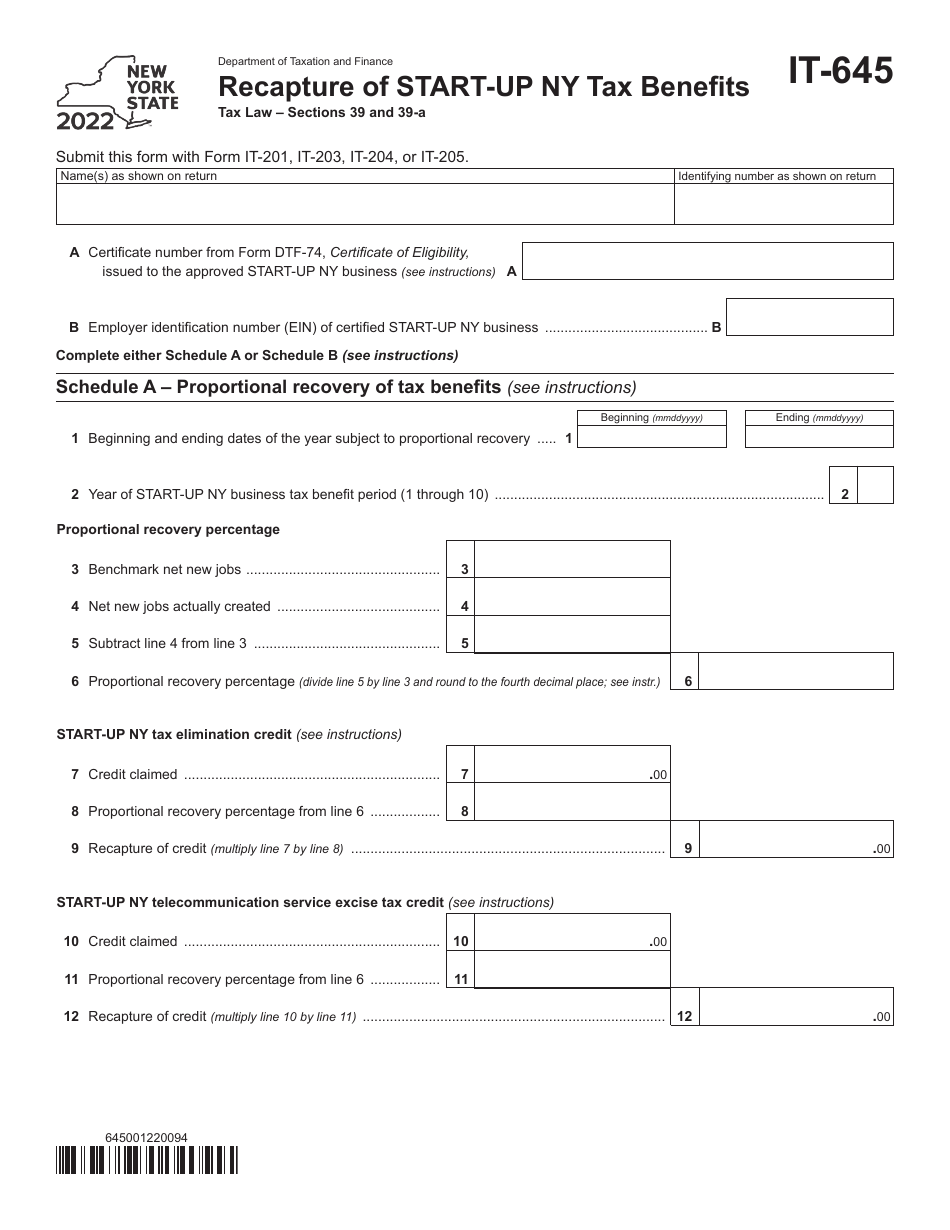

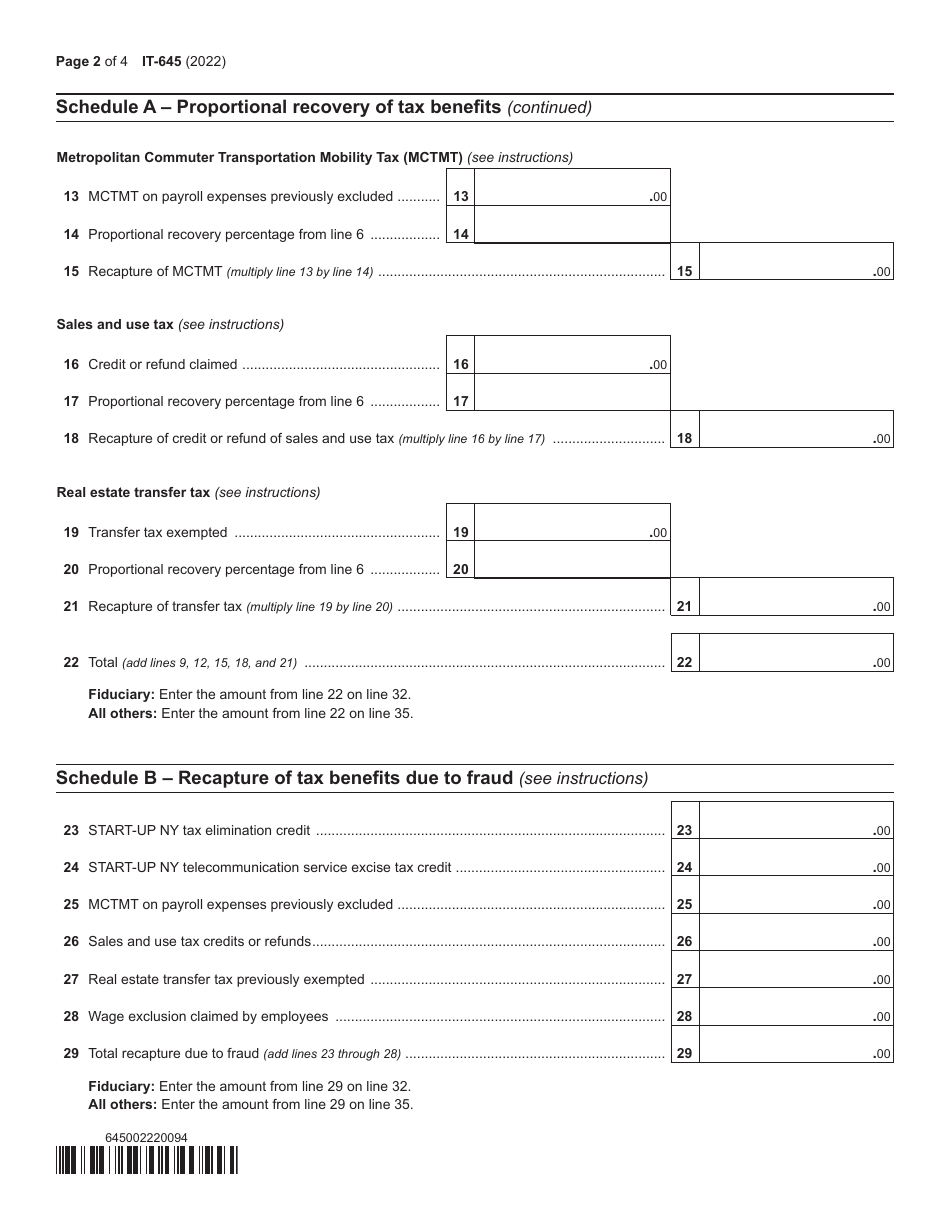

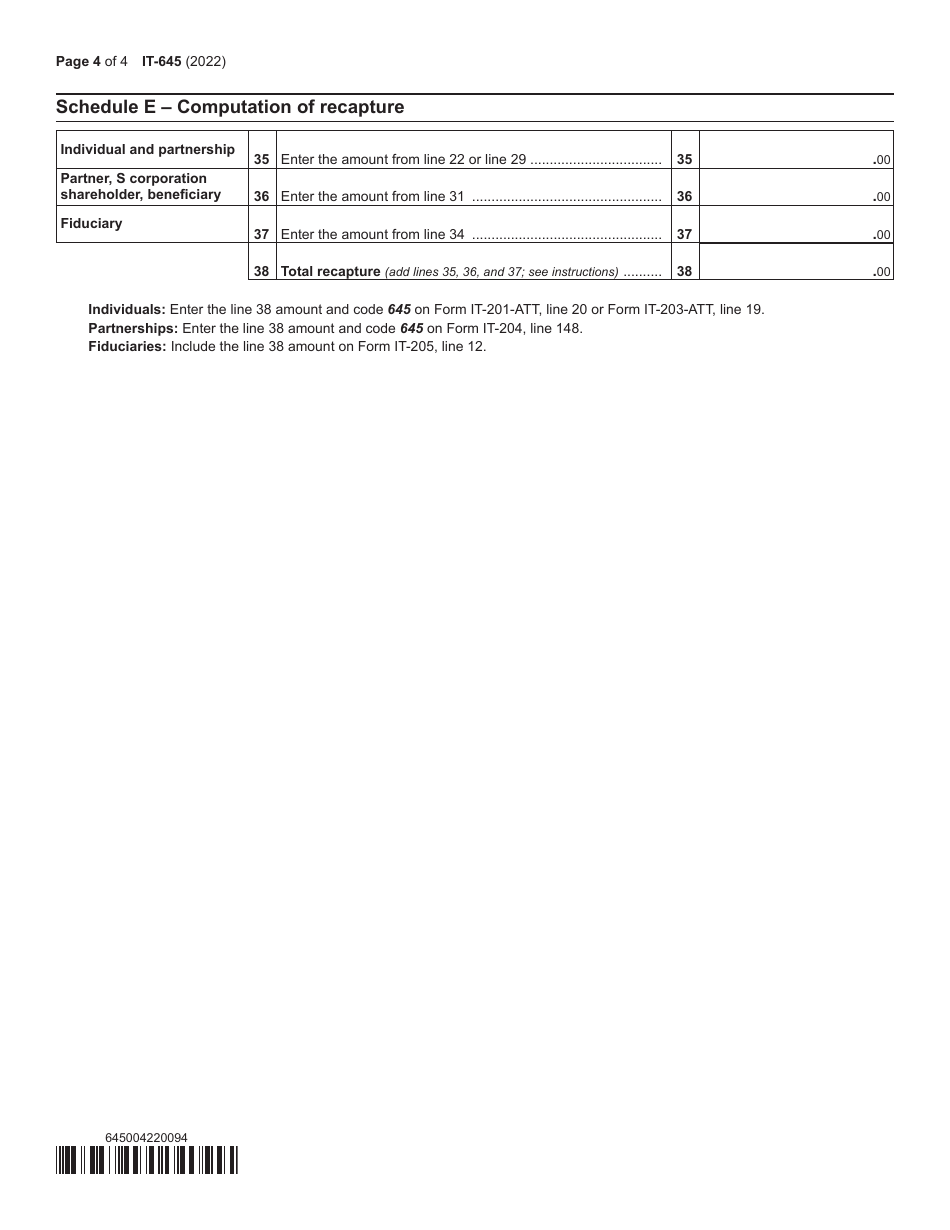

Form IT-645

for the current year.

Form IT-645 Recapture of Start-Up Ny Tax Benefits - New York

What Is Form IT-645?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-645?

A: Form IT-645 is a form used for recapturing Start-Up NY tax benefits in New York.

Q: What are Start-Up NY tax benefits?

A: Start-Up NY tax benefits are incentives offered by the state of New York to encourage the establishment and expansion of new businesses.

Q: Who needs to file Form IT-645?

A: Businesses that have received Start-Up NY tax benefits and no longer meet the eligibility requirements must file Form IT-645 to recapture the benefits.

Q: When should Form IT-645 be filed?

A: Form IT-645 should be filed within 90 days after the end of the taxable year in which the taxpayer becomes ineligible for the Start-Up NY tax benefits.

Q: What information is required on Form IT-645?

A: Form IT-645 requires information such as the taxpayer's identification number, the taxable year for which the recapture is being claimed, and details about the recapture amount.

Q: Are there any penalties for failure to file Form IT-645?

A: Yes, failure to file Form IT-645 within the specified timeframe may result in penalties and interest being assessed by the New York State Department of Taxation and Finance.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-645 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.