This version of the form is not currently in use and is provided for reference only. Download this version of

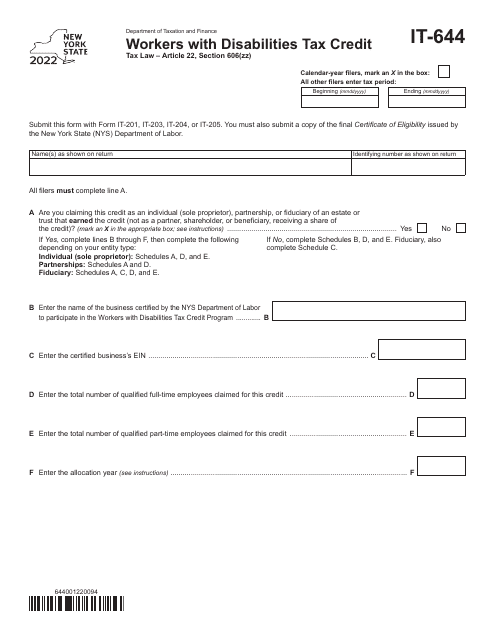

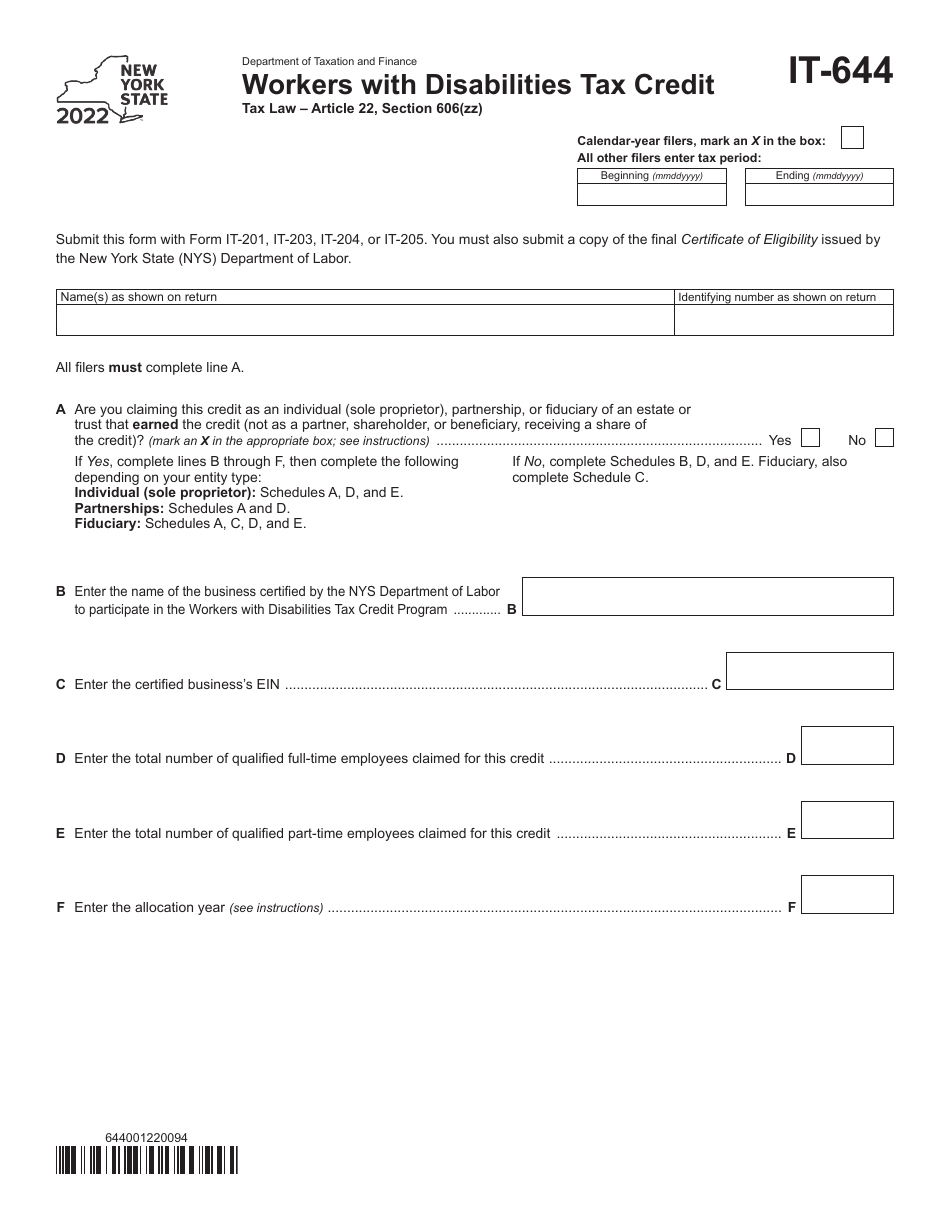

Form IT-644

for the current year.

Form IT-644 Workers With Disabilities Tax Credit - New York

What Is Form IT-644?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-644?

A: Form IT-644 is a tax form used in New York to claim the Workers With Disabilities Tax Credit.

Q: What is the Workers With Disabilities Tax Credit?

A: The Workers With Disabilities Tax Credit is a tax credit available to employers who hire individuals with disabilities in New York.

Q: Who is eligible for the Workers With Disabilities Tax Credit?

A: Employers who hire individuals with disabilities in New York are eligible for the Workers With Disabilities Tax Credit.

Q: What is the purpose of Form IT-644?

A: The purpose of Form IT-644 is to claim the Workers With Disabilities Tax Credit.

Q: How do I file Form IT-644?

A: You can file Form IT-644 with the New York Department of Taxation and Finance.

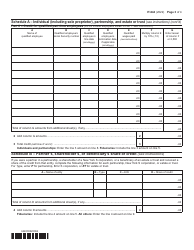

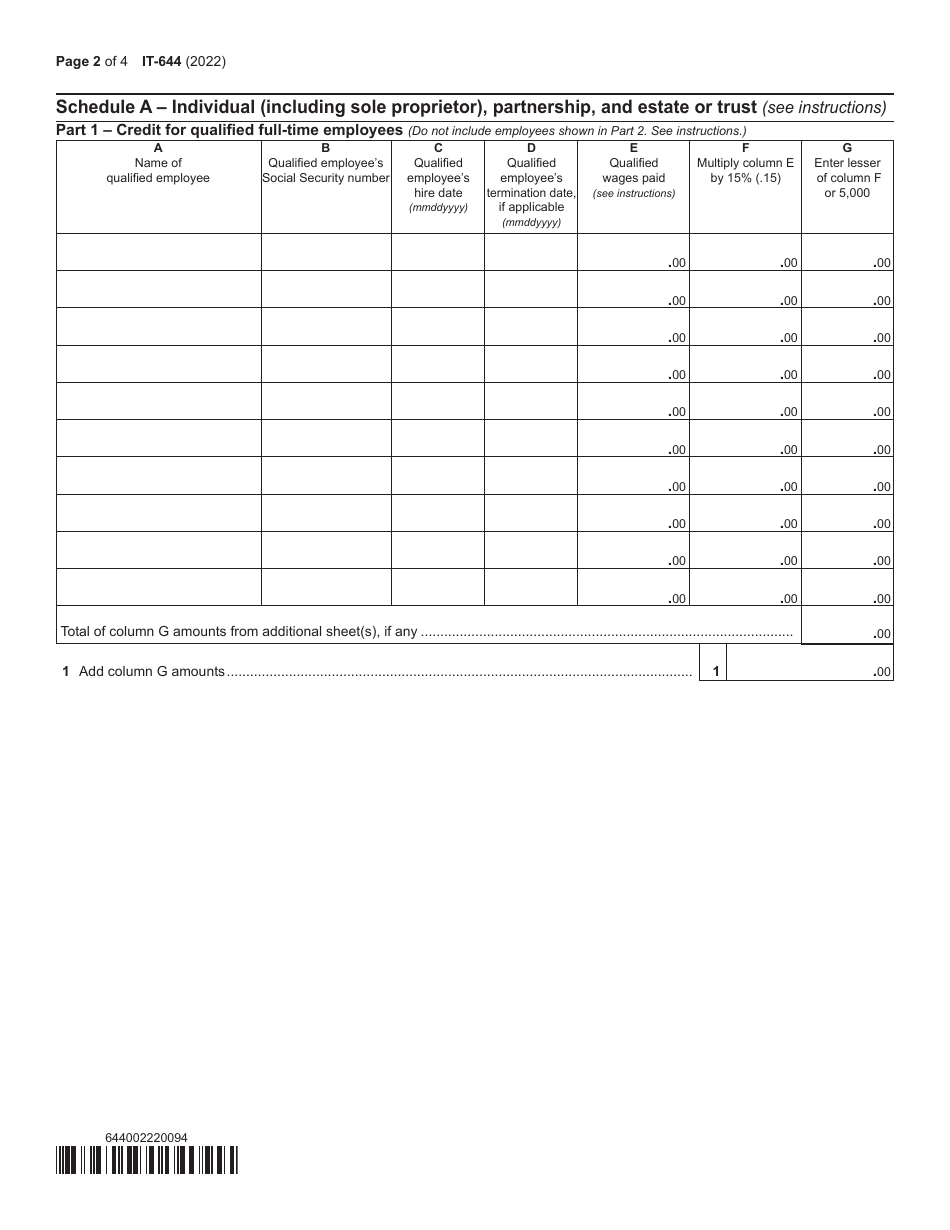

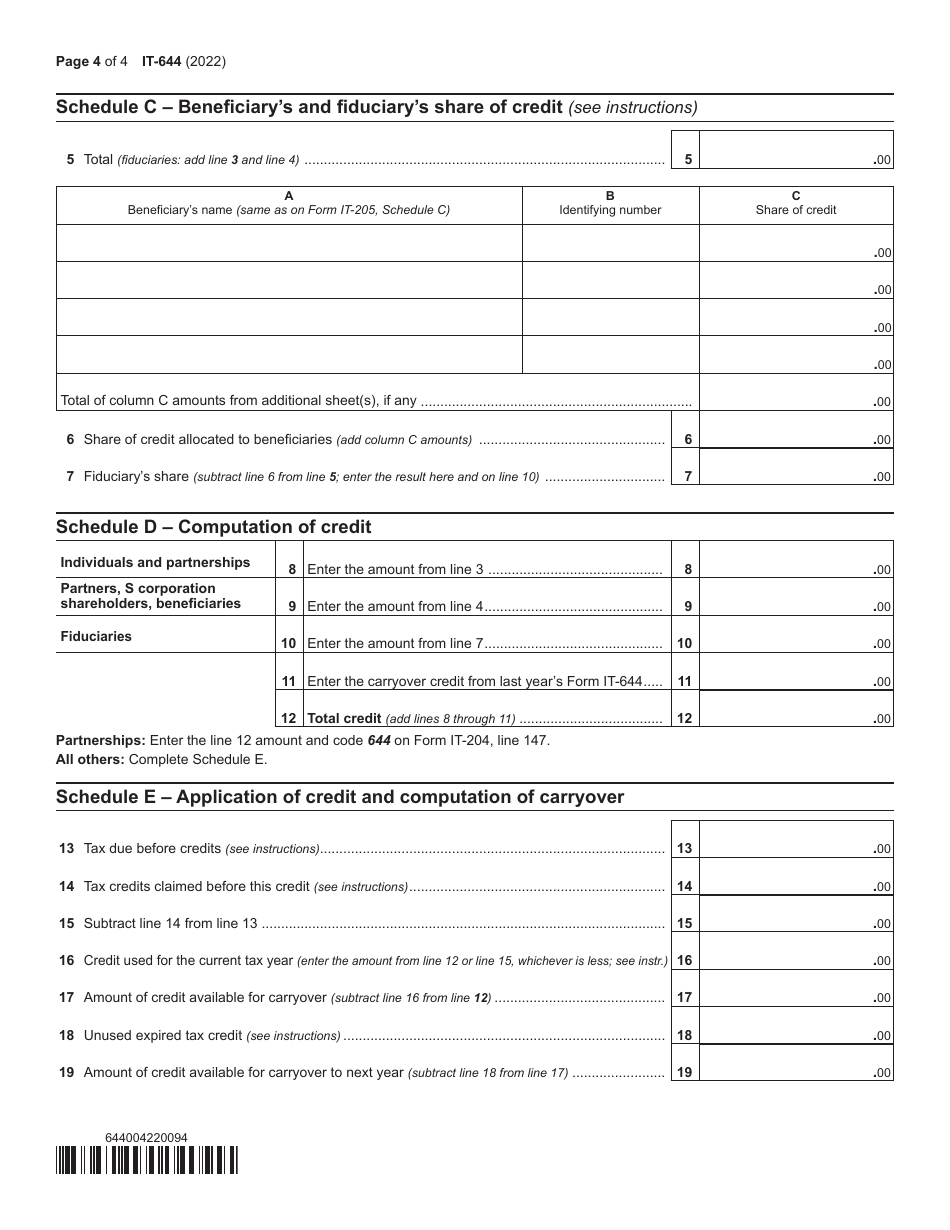

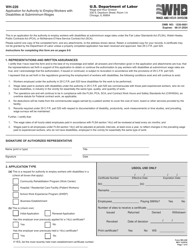

Q: What information is required on Form IT-644?

A: Form IT-644 requires information about the employer, the employee with disabilities, and the wages paid to the employee.

Q: What is the deadline for filing Form IT-644?

A: Form IT-644 must be filed by the due date of the employer's New York state tax return.

Q: Can I claim the Workers With Disabilities Tax Credit if I am self-employed?

A: No, the Workers With Disabilities Tax Credit is only available to employers.

Q: What is the benefit of claiming the Workers With Disabilities Tax Credit?

A: The benefit of claiming the Workers With Disabilities Tax Credit is a reduction in the employer's tax liability.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-644 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.