This version of the form is not currently in use and is provided for reference only. Download this version of

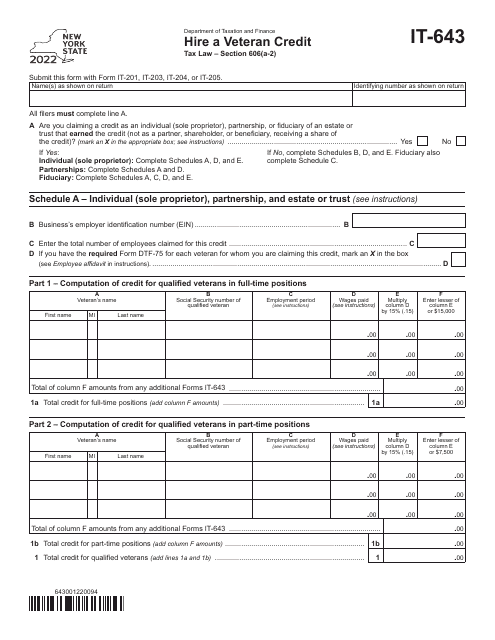

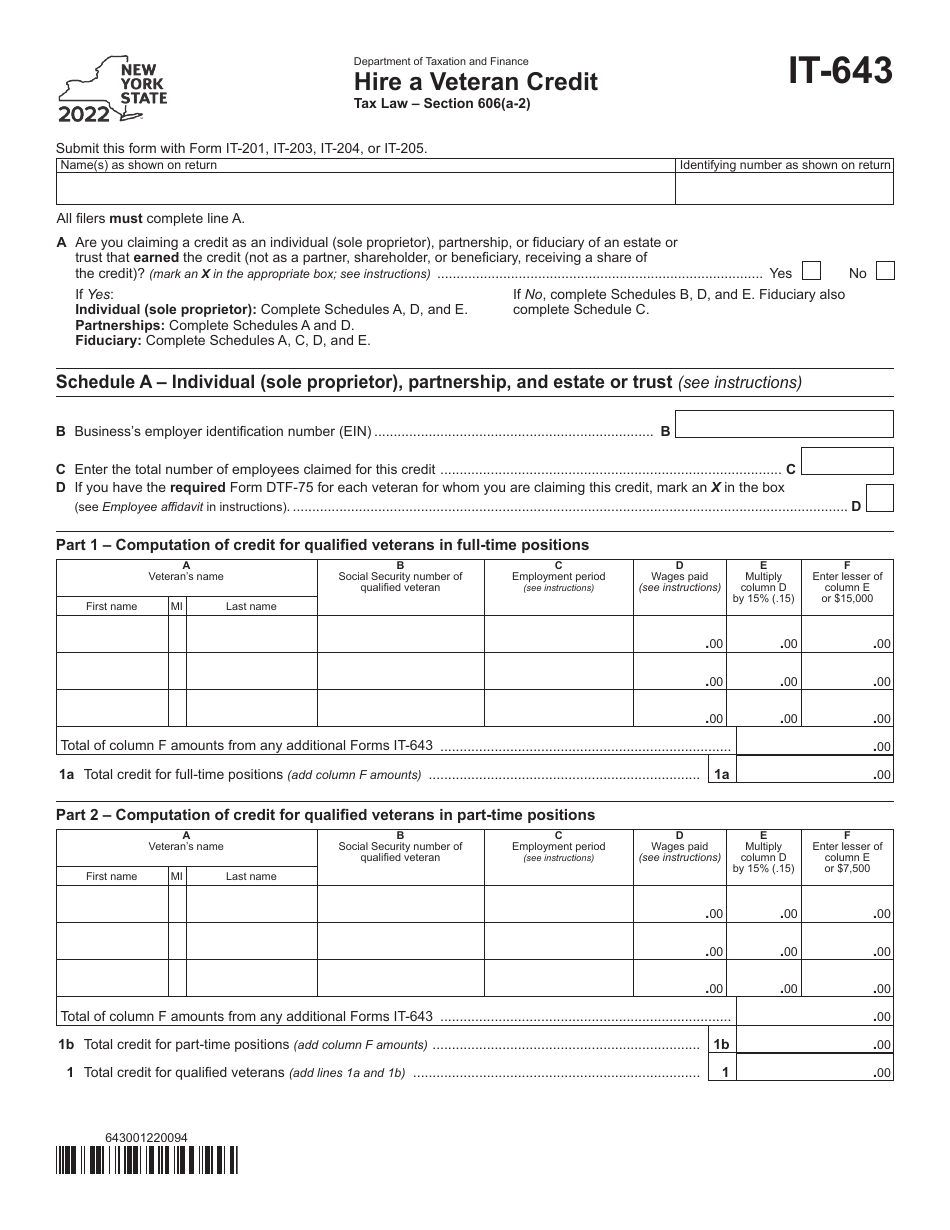

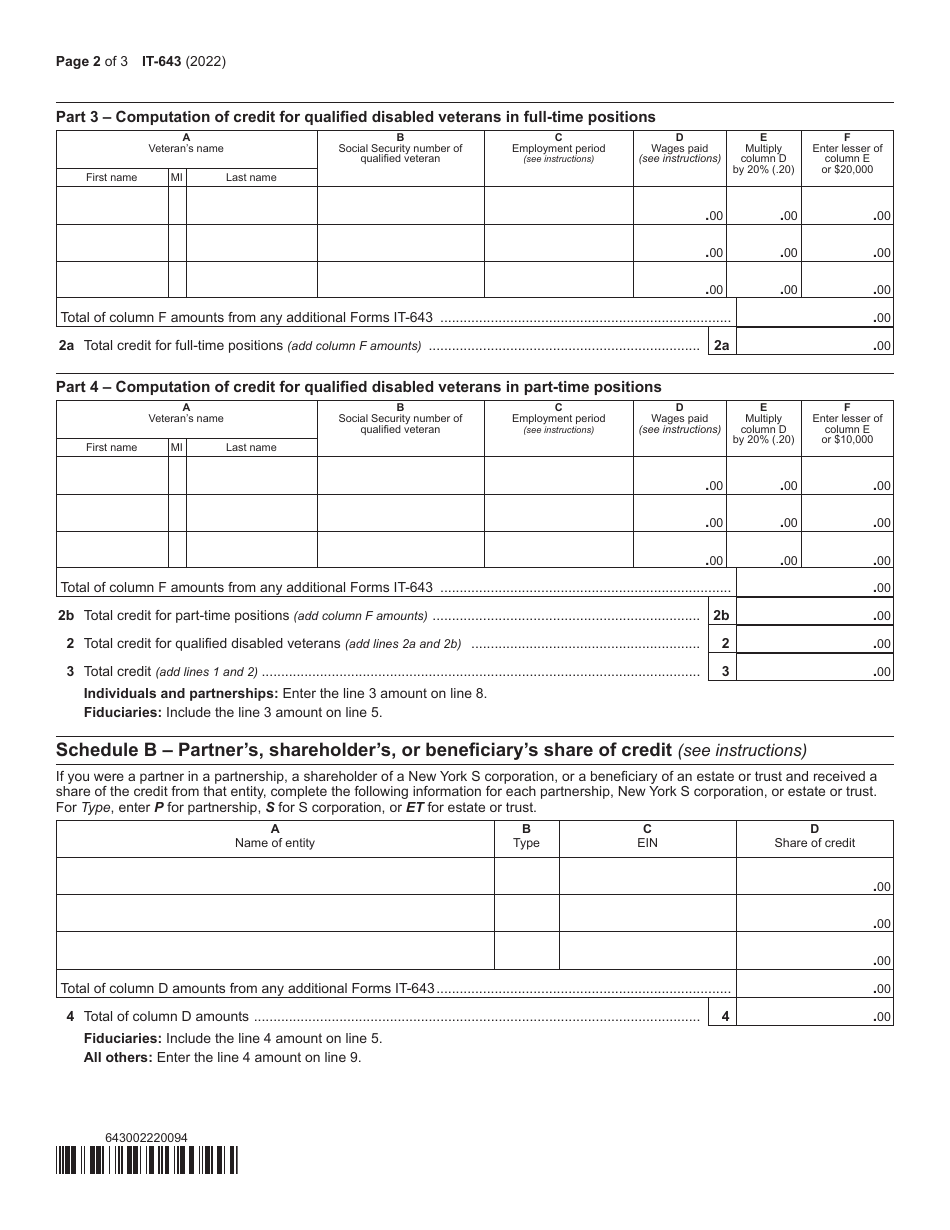

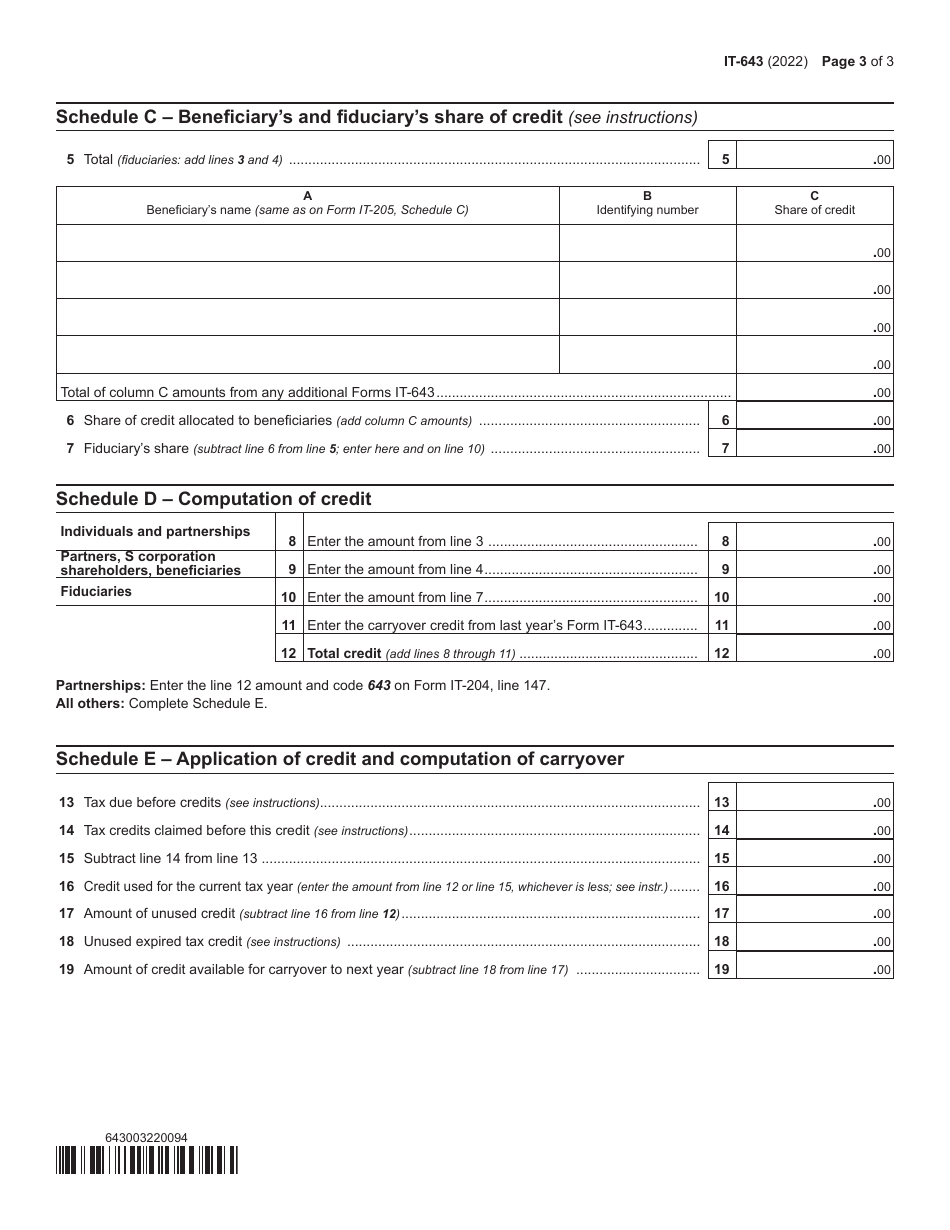

Form IT-643

for the current year.

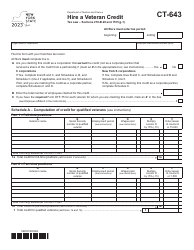

Form IT-643 Hire a Veteran Credit - New York

What Is Form IT-643?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-643?

A: Form IT-643 is a tax form used in New York to claim the Hire a Veteran Credit.

Q: What is the purpose of Form IT-643?

A: The purpose of Form IT-643 is to allow businesses to claim a tax credit for hiring qualified veterans.

Q: Who can use Form IT-643?

A: Businesses in New York that have hired qualified veterans during the tax year can use Form IT-643.

Q: What is the Hire a Veteran Credit?

A: The Hire a Veteran Credit is a tax credit available to businesses that hire qualified veterans in New York.

Q: How much is the Hire a Veteran Credit?

A: The Hire a Veteran Credit can be up to $5,000 per qualified veteran hired by a business.

Q: What are the eligibility requirements for the Hire a Veteran Credit?

A: To be eligible for the Hire a Veteran Credit, businesses must have a valid tax identification number and the hired veteran must meet certain criteria.

Q: When is the deadline to file Form IT-643?

A: Form IT-643 must be filed with the New York State Department of Taxation and Finance by the due date of the business's tax return.

Q: Can the Hire a Veteran Credit be carried forward?

A: Yes, any unused credit can be carried forward for up to 15 years.

Q: Can the Hire a Veteran Credit be transferred?

A: No, the Hire a Veteran Credit cannot be transferred or sold.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-643 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.