This version of the form is not currently in use and is provided for reference only. Download this version of

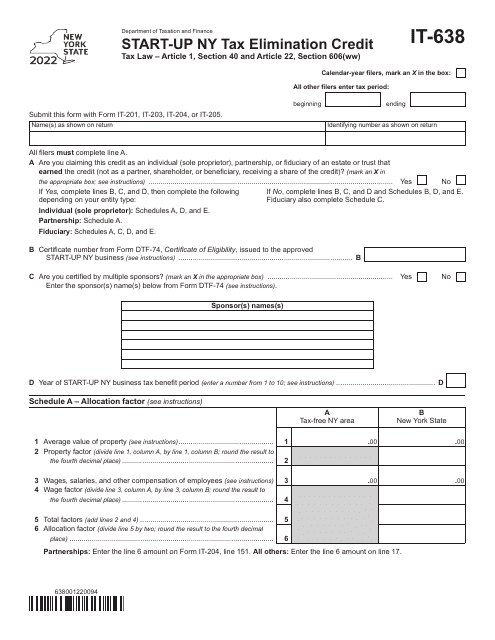

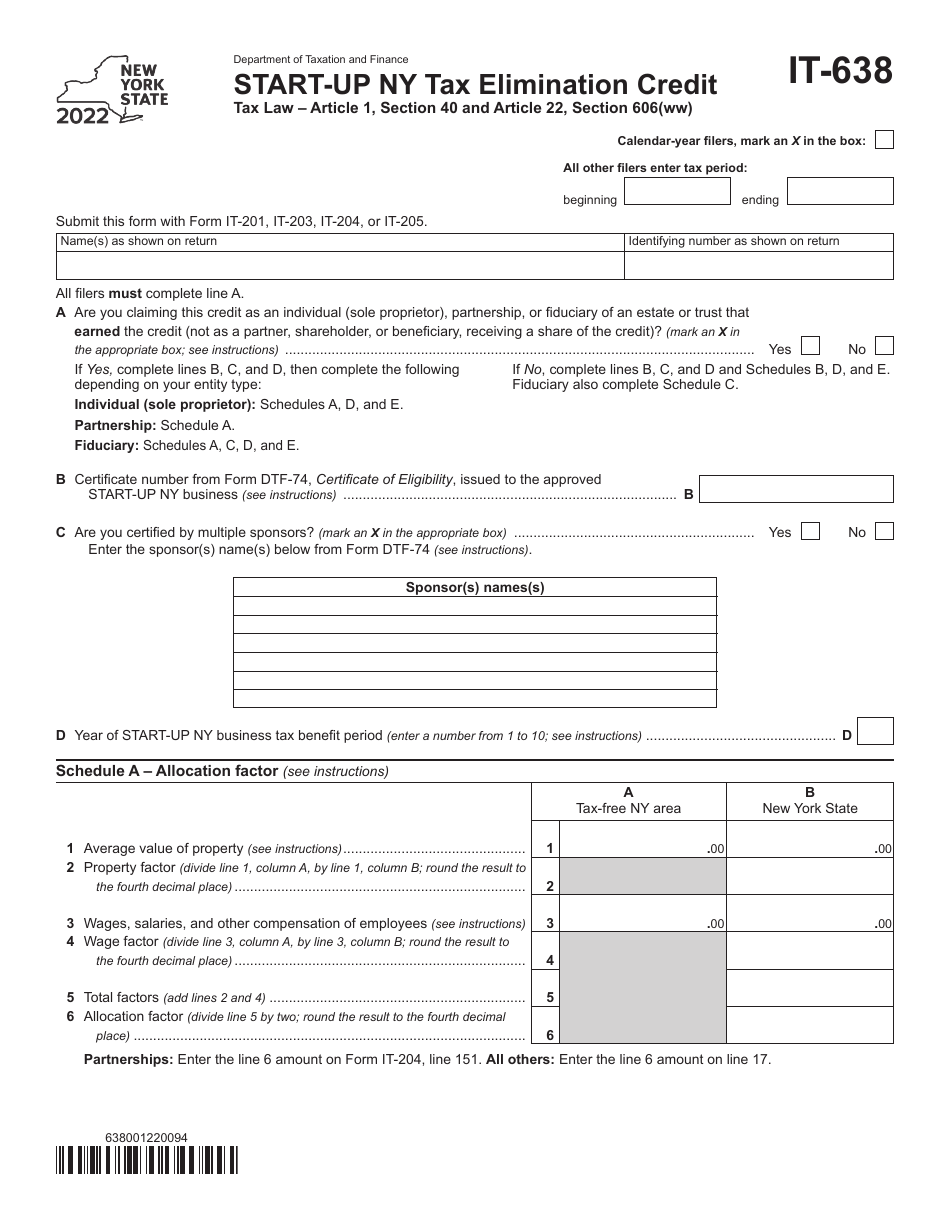

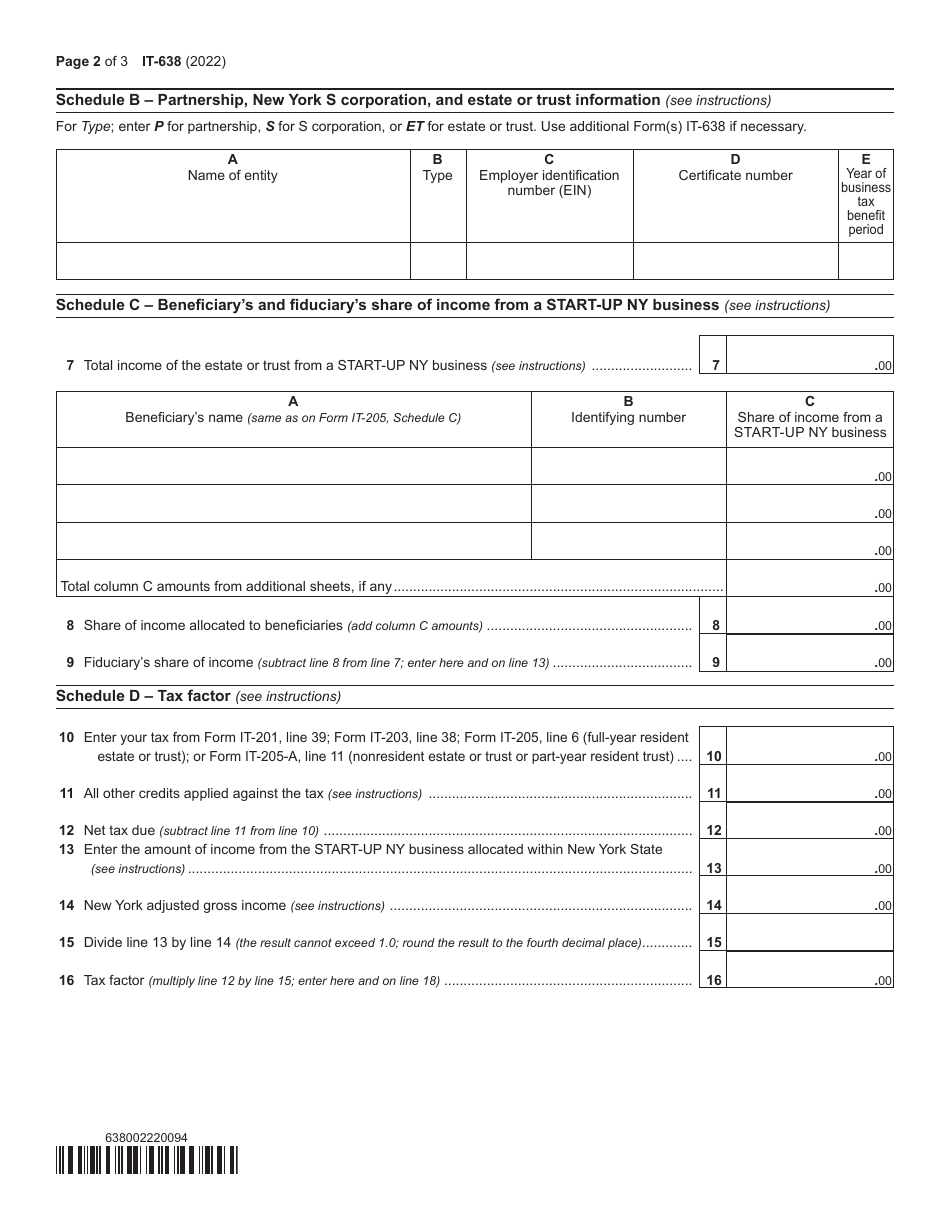

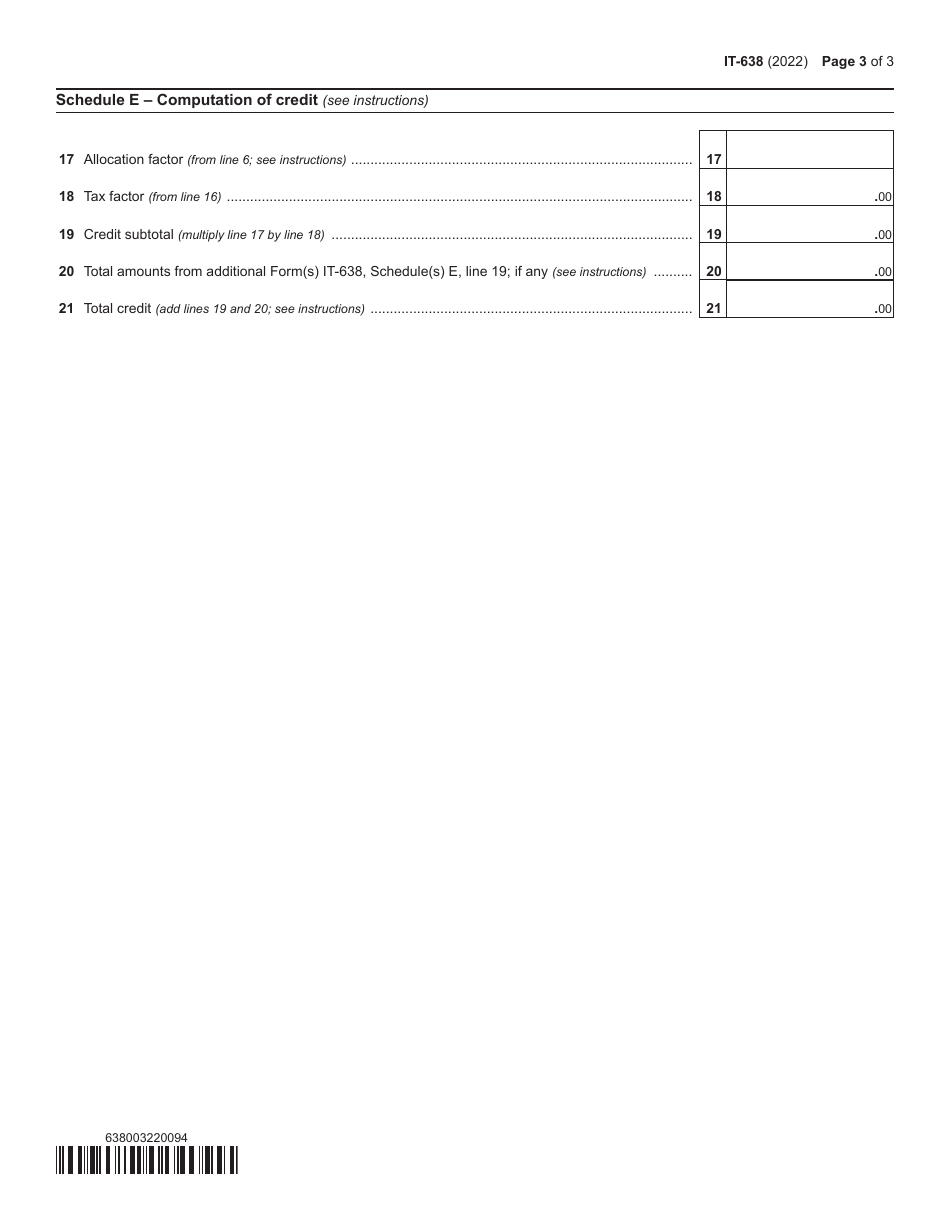

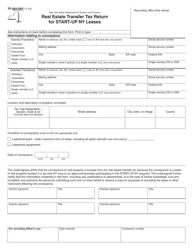

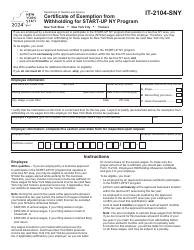

Form IT-638

for the current year.

Form IT-638 Start-Up Ny Tax Elimination Credit - New York

What Is Form IT-638?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the Form IT-638?

A: The Form IT-638 is the official tax form used in New York to claim the Start-Up NY Tax Elimination Credit.

Q: What is the Start-Up NY Tax Elimination Credit?

A: The Start-Up NY Tax Elimination Credit is a tax credit in New York that allows eligible businesses to eliminate state taxes for a specified period.

Q: Who is eligible for the Start-Up NY Tax Elimination Credit?

A: Eligible businesses must be approved and participating in the Start-Up NY program and meet certain criteria to qualify for the tax credit.

Q: How long does the Start-Up NY Tax Elimination Credit last?

A: The tax credit can be claimed for up to 10 years, depending on the specific terms of the agreement with the Start-Up NY program.

Q: How do I claim the Start-Up NY Tax Elimination Credit?

A: To claim the tax credit, businesses must complete and file Form IT-638 with the New York State Department of Taxation and Finance.

Q: Are there any limitations on the Start-Up NY Tax Elimination Credit?

A: Yes, there are certain limitations on the tax credit, such as limitations on the type of taxes that can be eliminated and the amount of credits that can be claimed in a given year.

Q: Is there a deadline for filing Form IT-638?

A: Yes, the form must be filed by the due date of the business's tax return for the applicable tax year.

Q: Can I amend my tax return to claim the Start-Up NY Tax Elimination Credit?

A: Yes, if you did not claim the tax credit on your original tax return, you can file an amended return using Form IT-638 to claim the credit.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-638 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.