This version of the form is not currently in use and is provided for reference only. Download this version of

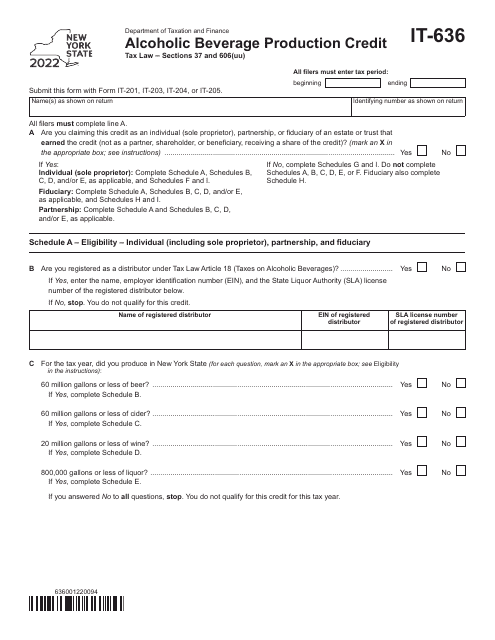

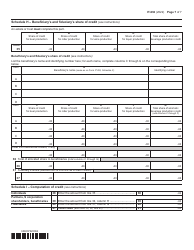

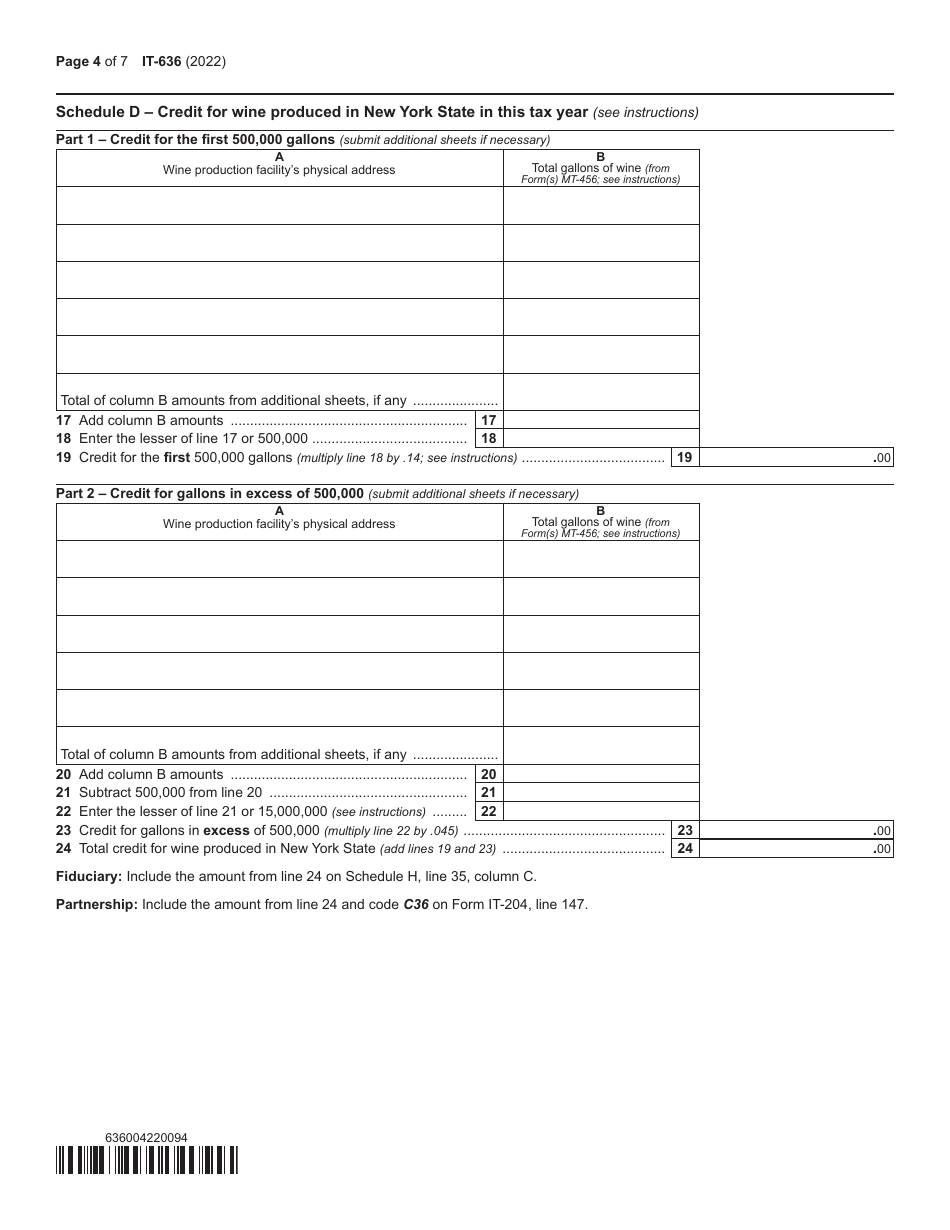

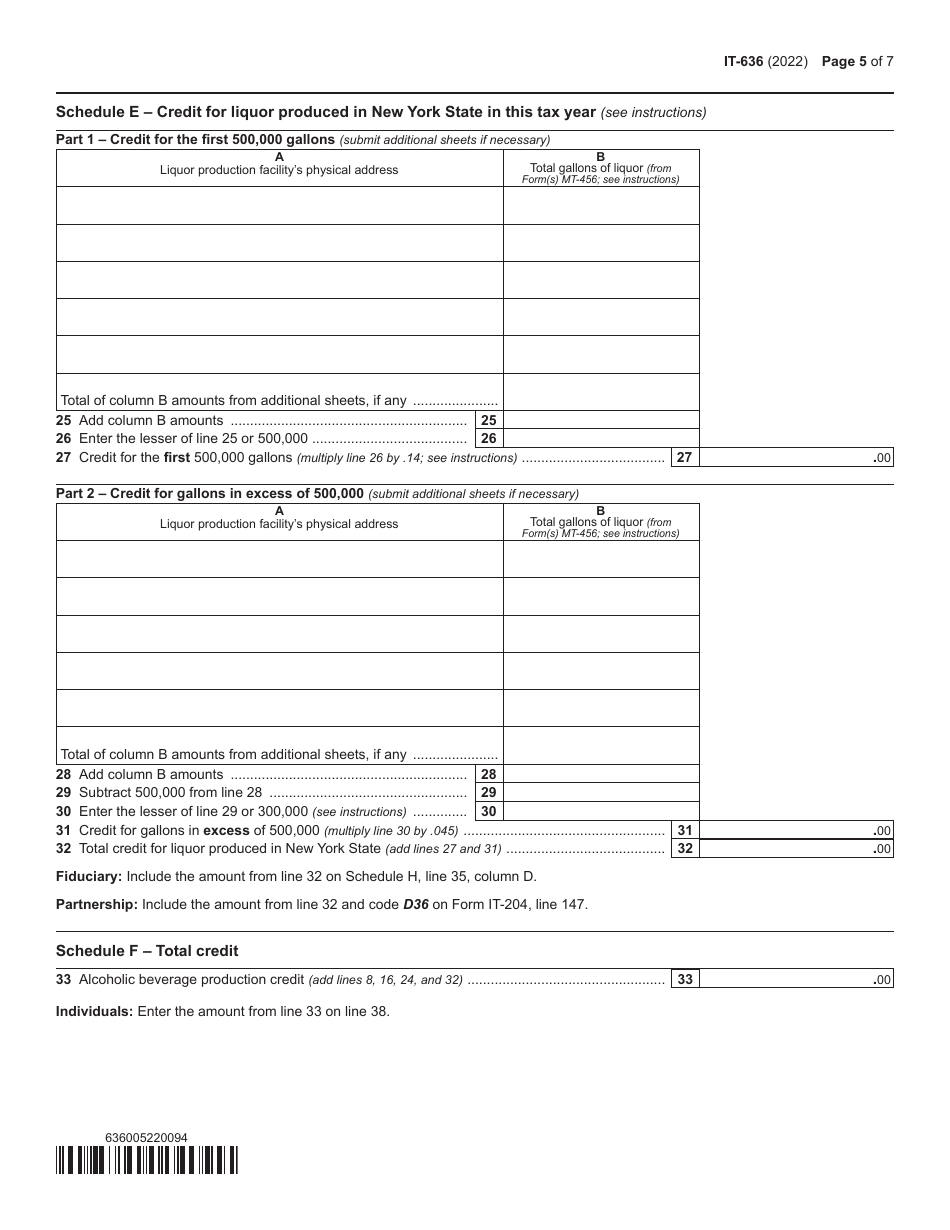

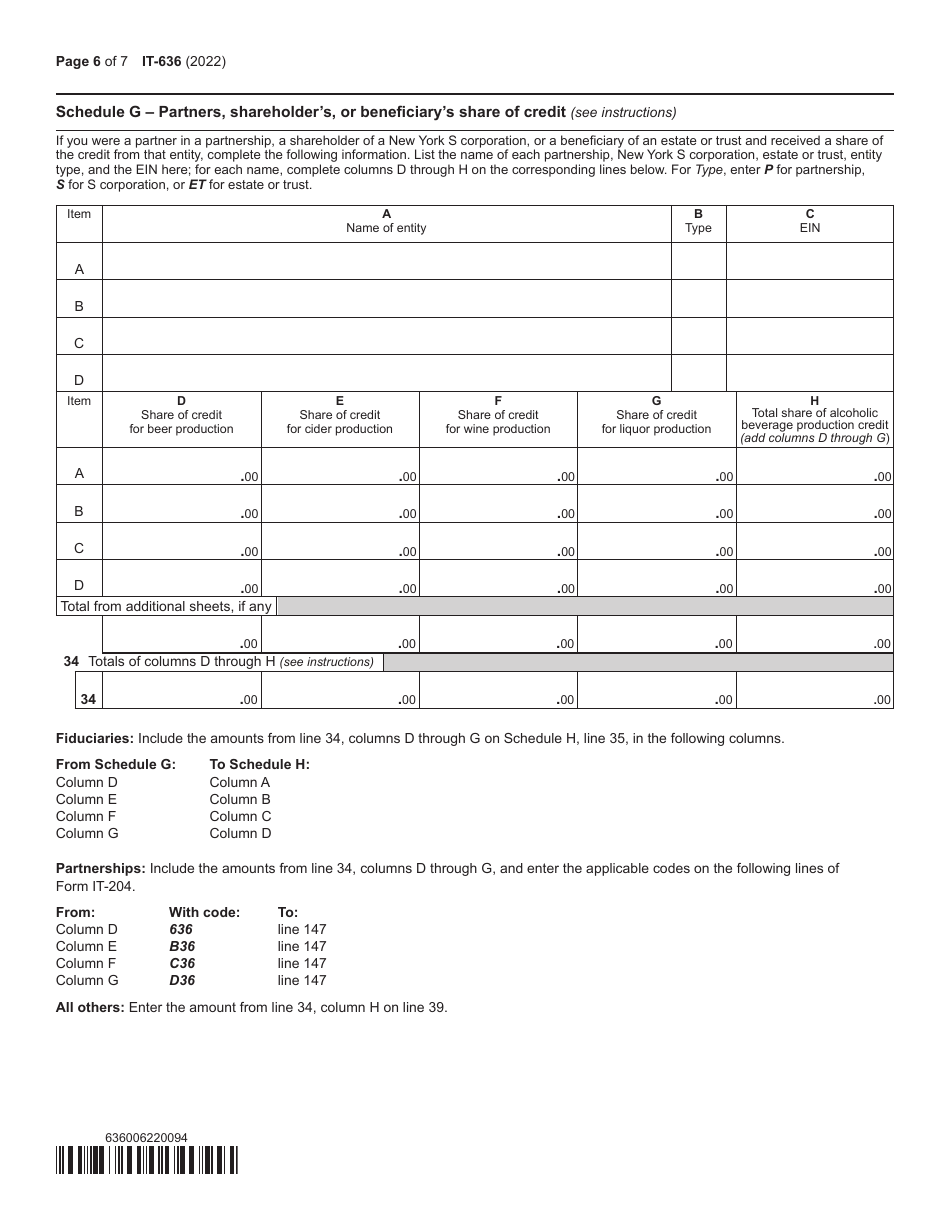

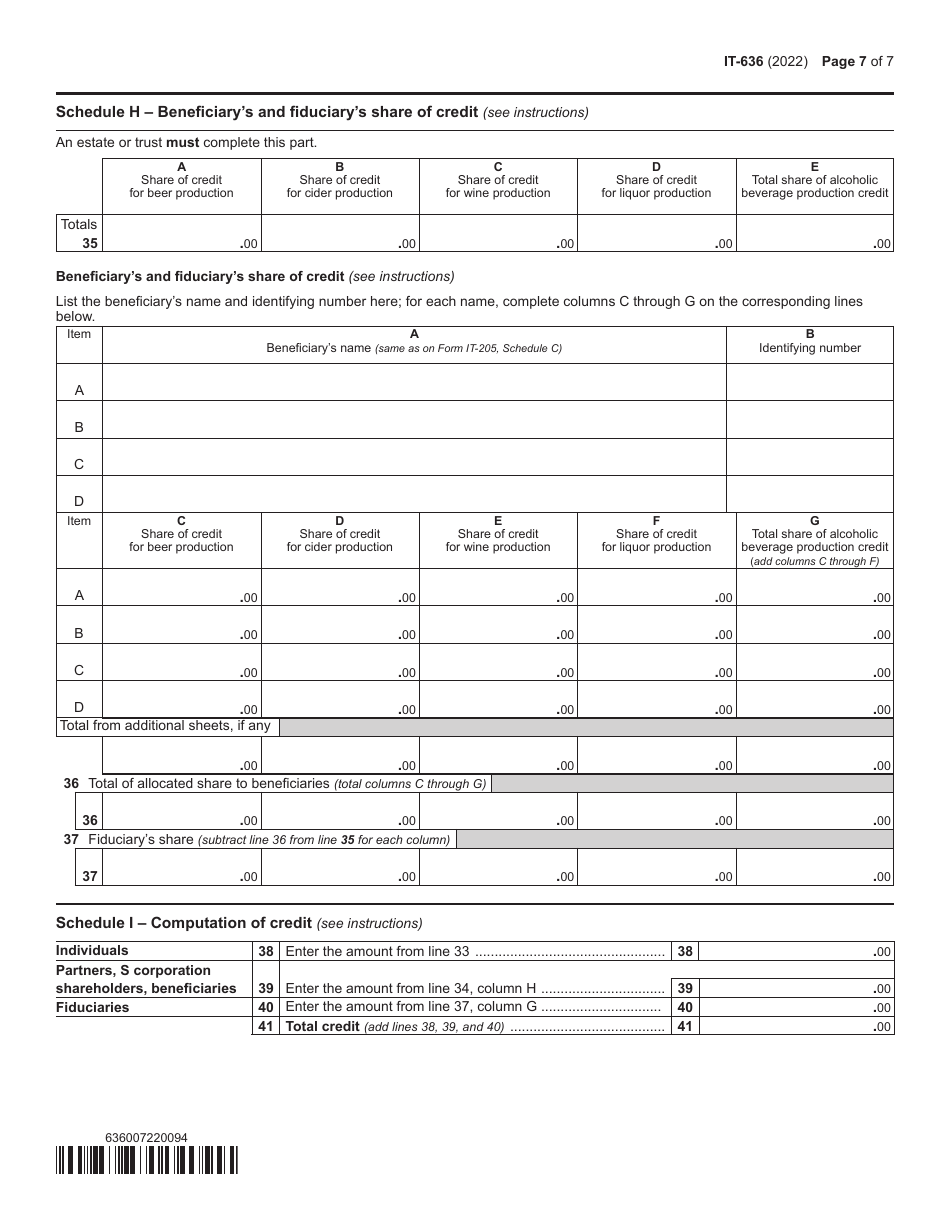

Form IT-636

for the current year.

Form IT-636 Alcoholic Beverage Production Credit - New York

What Is Form IT-636?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-636?

A: Form IT-636 is a tax form used in New York for claiming the Alcoholic Beverage Production Credit.

Q: What is the Alcoholic Beverage Production Credit?

A: The Alcoholic Beverage Production Credit is a tax credit available to eligible businesses in New York engaged in the production of alcoholic beverages.

Q: Who can claim the Alcoholic Beverage Production Credit?

A: Eligible businesses, including wineries, breweries, cideries, and distilleries, can claim the Alcoholic Beverage Production Credit in New York.

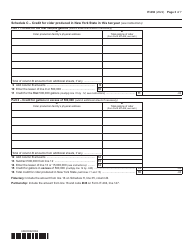

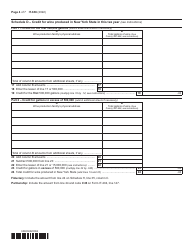

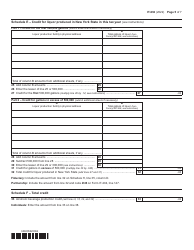

Q: What expenses are eligible for the credit?

A: Expenses related to the production of alcoholic beverages, including raw materials, manufacturing equipment, and certain promotional activities, may be eligible for the credit.

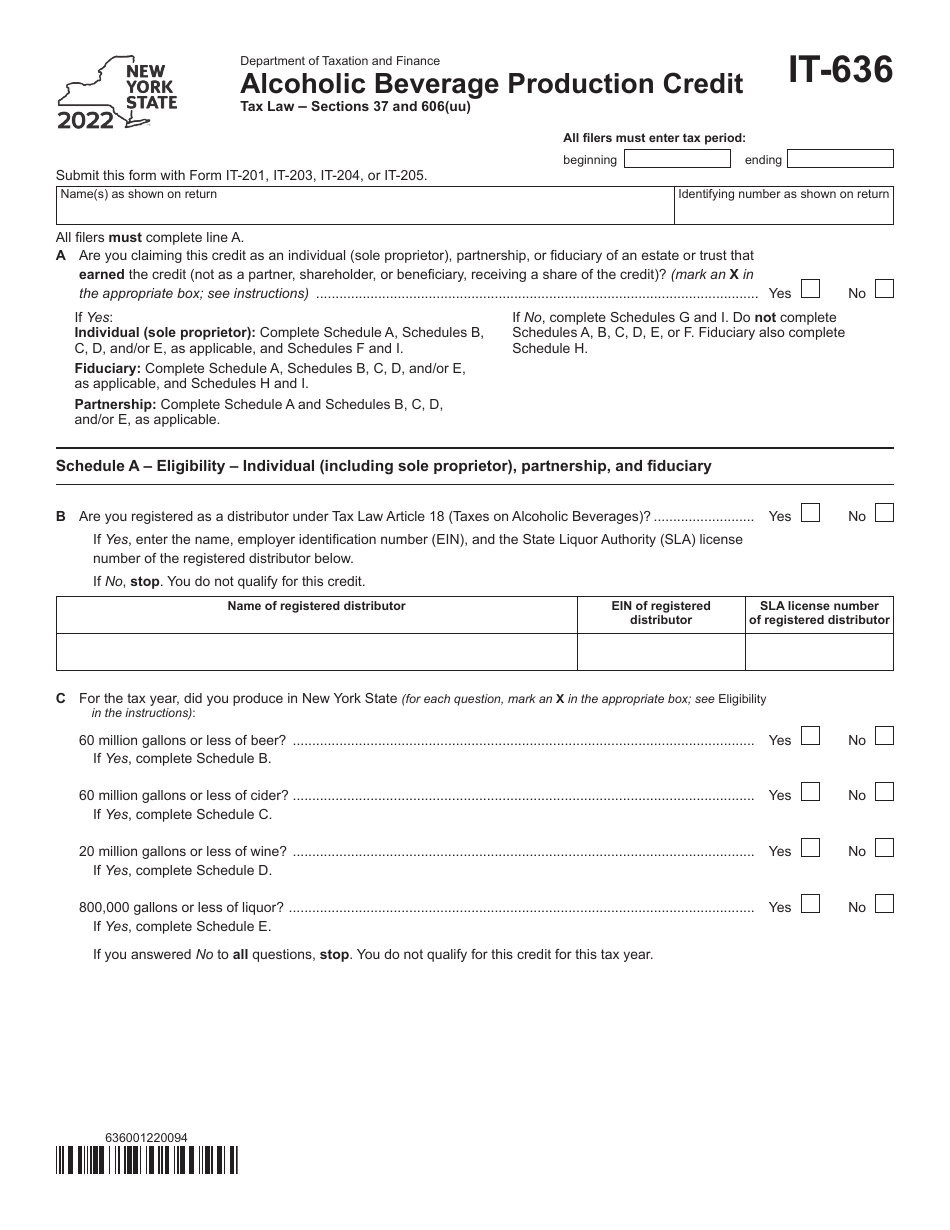

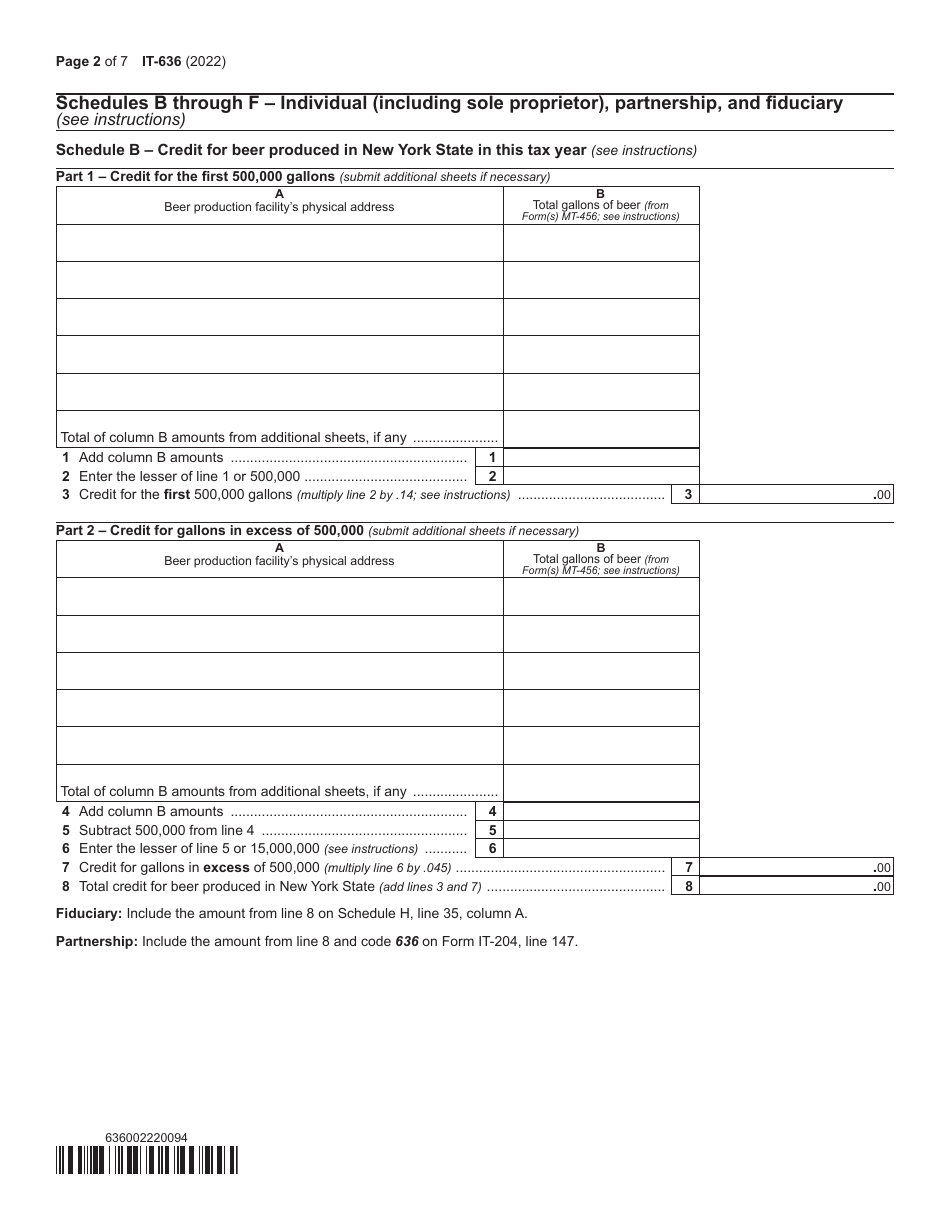

Q: How is the credit calculated?

A: The Alcoholic Beverage Production Credit is calculated as a percentage of eligible expenses incurred by the business during the tax year.

Q: When is the deadline for filing Form IT-636?

A: The deadline for filing Form IT-636 is generally the same as the deadline for filing the business's New York State income tax return.

Q: Can the Alcoholic Beverage Production Credit be carried forward or back?

A: Yes, unused credits can be carried forward for up to 15 years or carried back for up to 3 years in New York.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-636 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.