This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-634

for the current year.

Form IT-634 Empire State Jobs Retention Program Credit - New York

What Is Form IT-634?

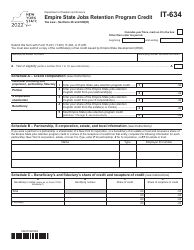

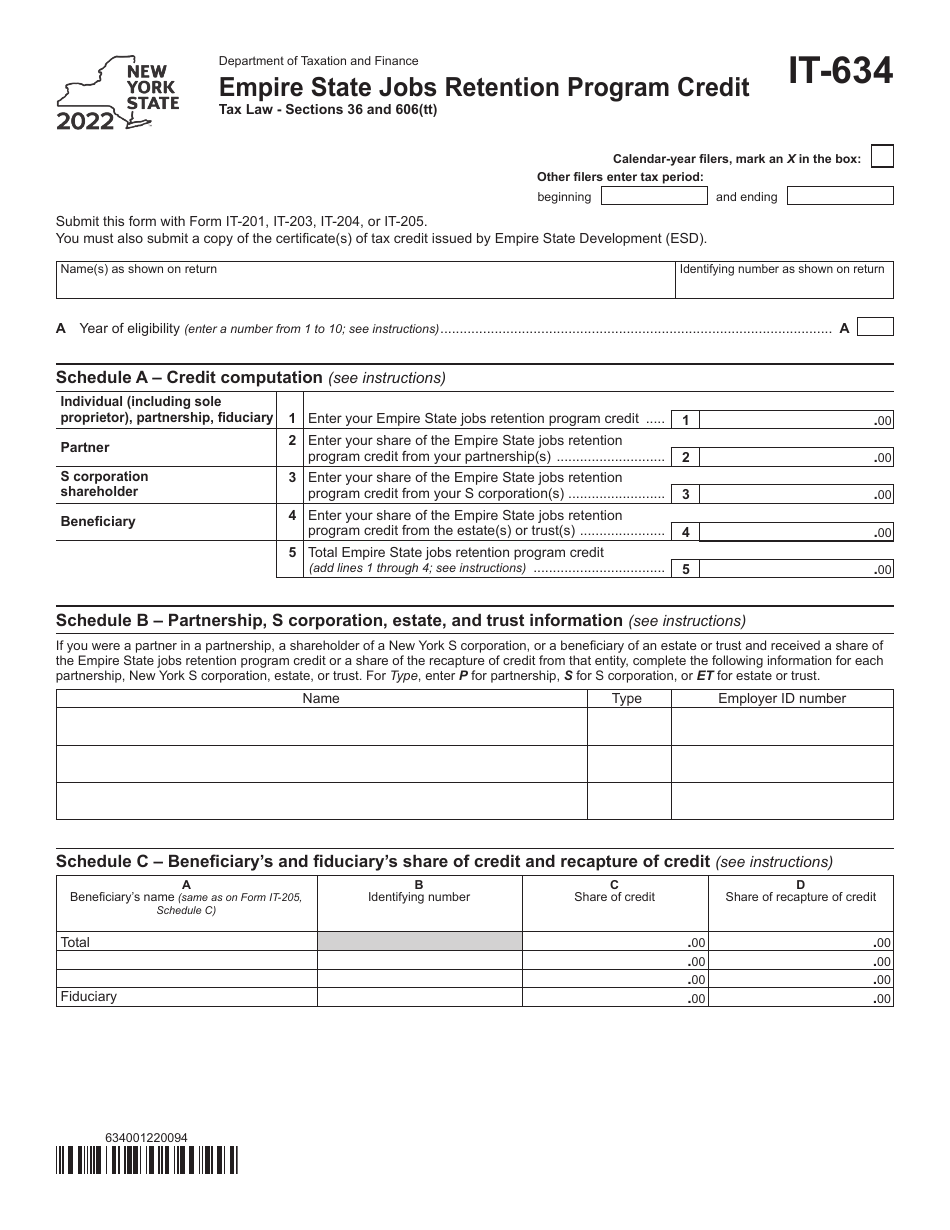

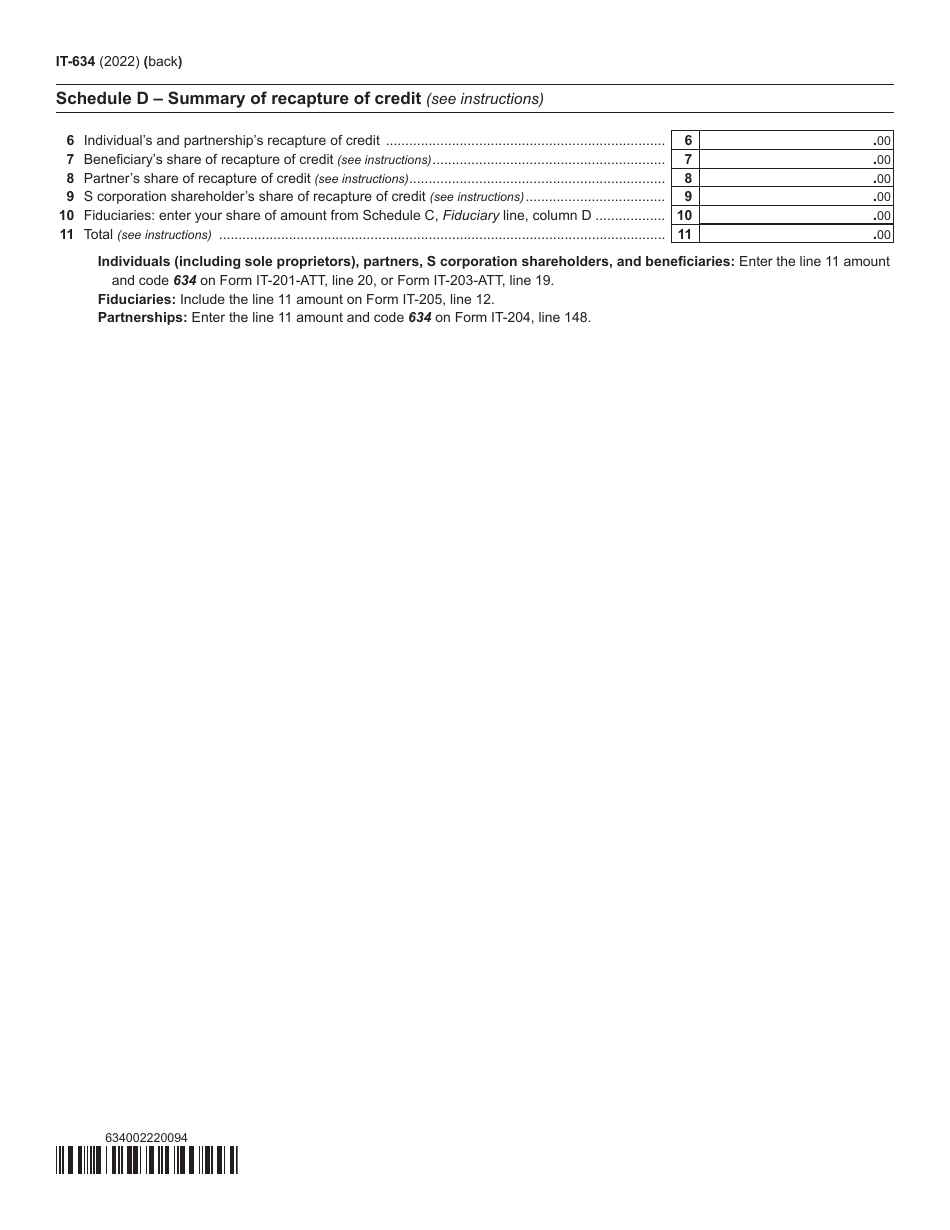

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the IT-634 Empire StateJobs Retention Program Credit?

A: The IT-634 Empire State Jobs Retention Program Credit is a credit available in the state of New York.

Q: Who is eligible for the IT-634 Empire State Jobs Retention Program Credit?

A: Eligibility for the IT-634 Empire State Jobs Retention Program Credit is determined by meeting certain criteria set by the state of New York.

Q: What is the purpose of the IT-634 Empire State Jobs Retention Program Credit?

A: The purpose of the IT-634 Empire State Jobs Retention Program Credit is to encourage job retention and economic growth in New York.

Q: How can I apply for the IT-634 Empire State Jobs Retention Program Credit?

A: To apply for the IT-634 Empire State Jobs Retention Program Credit, you need to complete the relevant forms and submit them to the appropriate state agency.

Q: Are there any restrictions or limitations for claiming the IT-634 Empire State Jobs Retention Program Credit?

A: Yes, there may be restrictions and limitations for claiming the IT-634 Empire State Jobs Retention Program Credit. It is important to review the specific requirements and guidelines set by the state of New York.

Q: What documents do I need to include when applying for the IT-634 Empire State Jobs Retention Program Credit?

A: The specific documents required when applying for the IT-634 Empire State Jobs Retention Program Credit may vary. It is recommended to consult the guidelines provided by the state of New York.

Q: Is the IT-634 Empire State Jobs Retention Program Credit taxable?

A: The taxability of the IT-634 Empire State Jobs Retention Program Credit depends on the specific tax laws and regulations of the state of New York. It is advisable to consult a tax professional or refer to the relevant tax guidelines for more information.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-634 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.