This version of the form is not currently in use and is provided for reference only. Download this version of

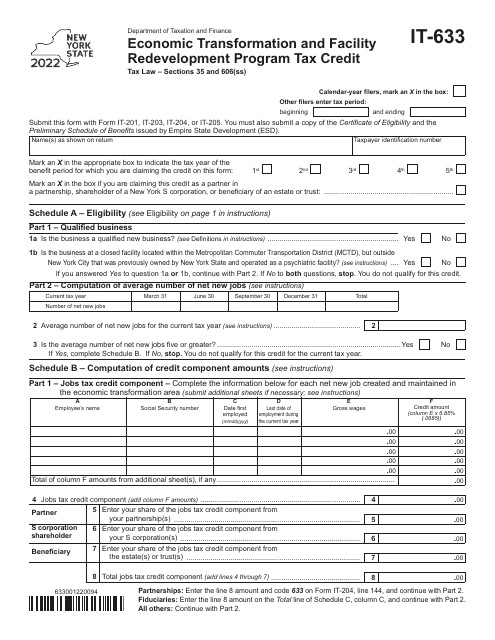

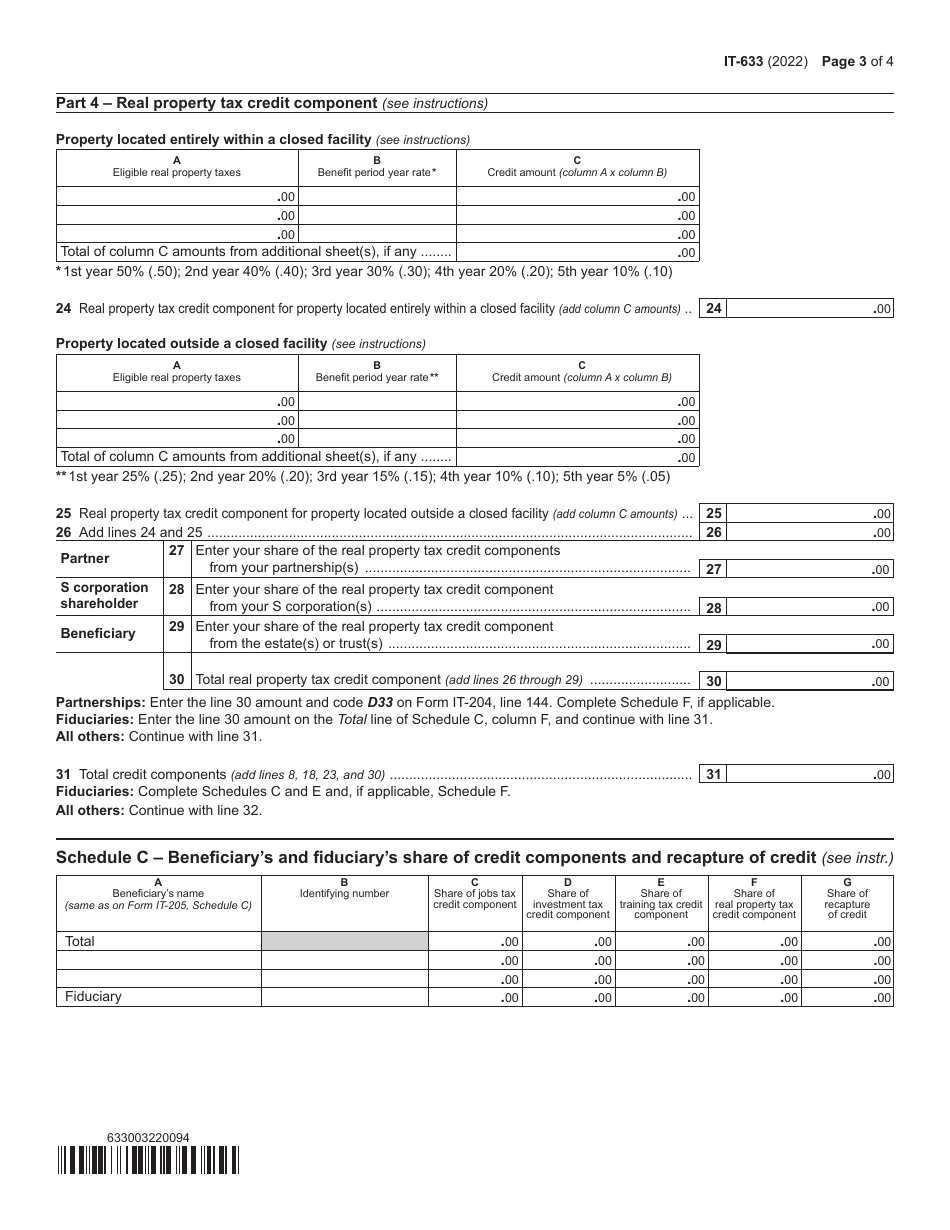

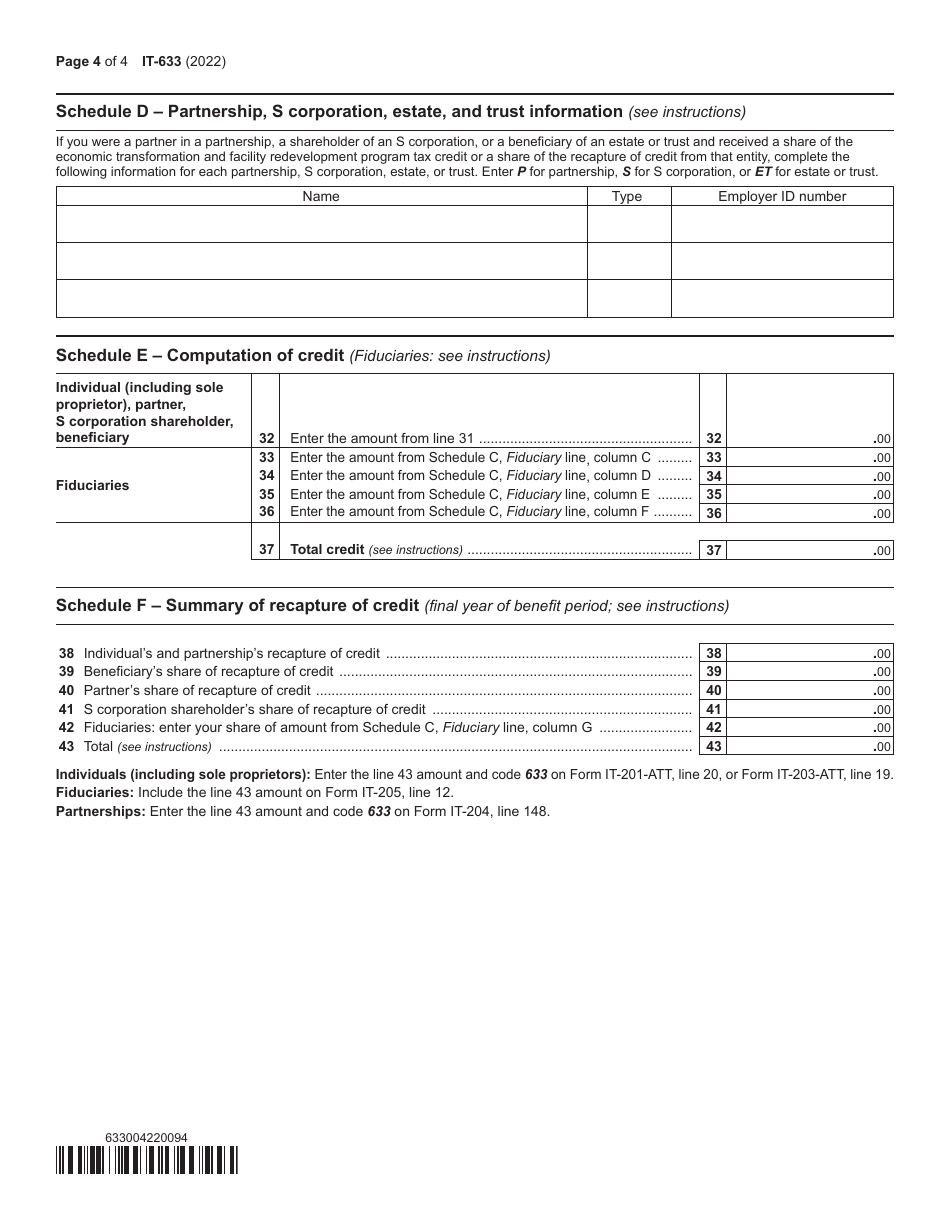

Form IT-633

for the current year.

Form IT-633 Economic Transformation and Facility Redevelopment Program Tax Credit - New York

What Is Form IT-633?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-633?

A: Form IT-633 is a tax form used in New York for claiming the Economic Transformation and Facility Redevelopment Program Tax Credit.

Q: What is the Economic Transformation and Facility Redevelopment Program Tax Credit?

A: The Economic Transformation and Facility Redevelopment Program Tax Credit is a credit available in New York to incentivize businesses to invest in economically distressed areas and redevelop underutilized properties.

Q: Who can claim the tax credit?

A: Businesses that meet the eligibility criteria specified by the New York State Department of Taxation and Finance can claim the tax credit.

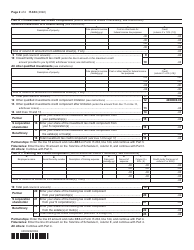

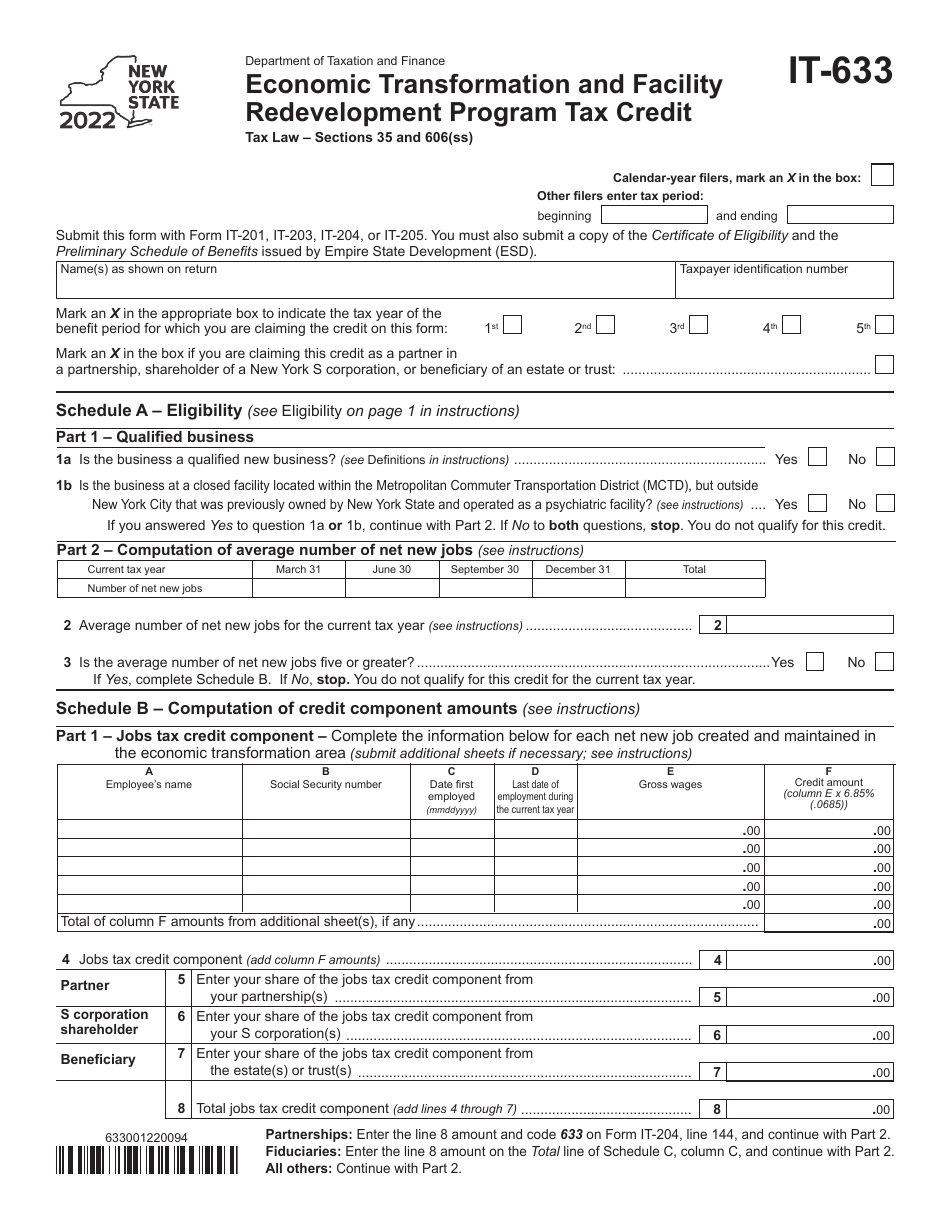

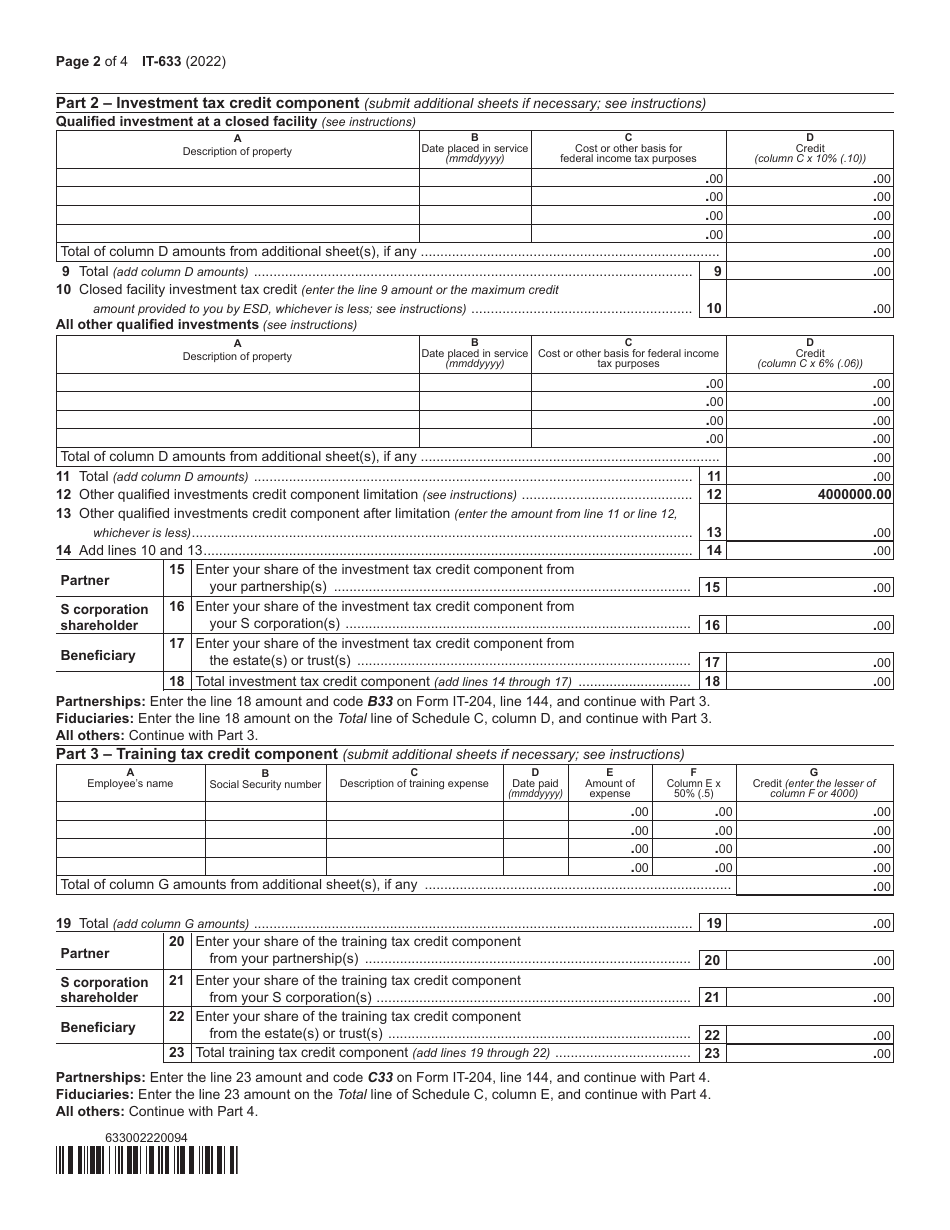

Q: What information is required on Form IT-633?

A: Form IT-633 requires information such as the taxpayer's identification, details of the economic transformation project, and calculations related to the tax credit.

Q: What should I do after completing Form IT-633?

A: Once you have completed Form IT-633, you should attach it to your New York state tax return and submit it according to the instructions provided.

Q: Is there a deadline for filing Form IT-633?

A: Yes, the deadline for filing Form IT-633 is the same as the deadline for filing your New York state tax return, which is usually April 15th.

Q: What are the benefits of claiming the tax credit?

A: By claiming the Economic Transformation and Facility Redevelopment Program Tax Credit, businesses can receive a credit against their New York state tax liability, which can help reduce their overall tax burden.

Q: Are there any limitations or restrictions on the tax credit?

A: Yes, there are certain limitations and restrictions on the tax credit, which are outlined in the instructions provided with Form IT-633 and the relevant New York state tax regulations.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-633 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.