This version of the form is not currently in use and is provided for reference only. Download this version of

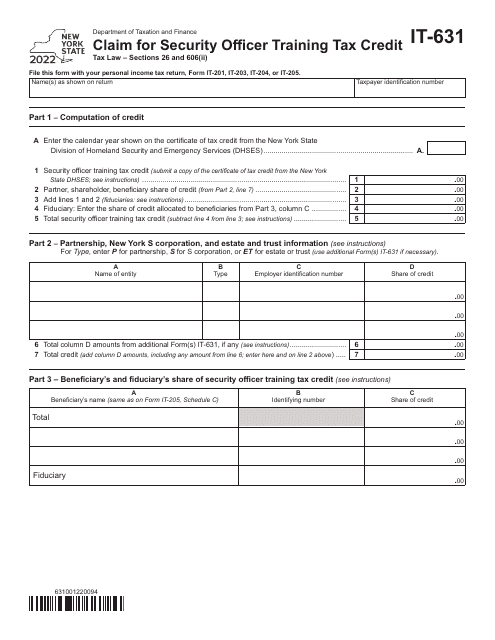

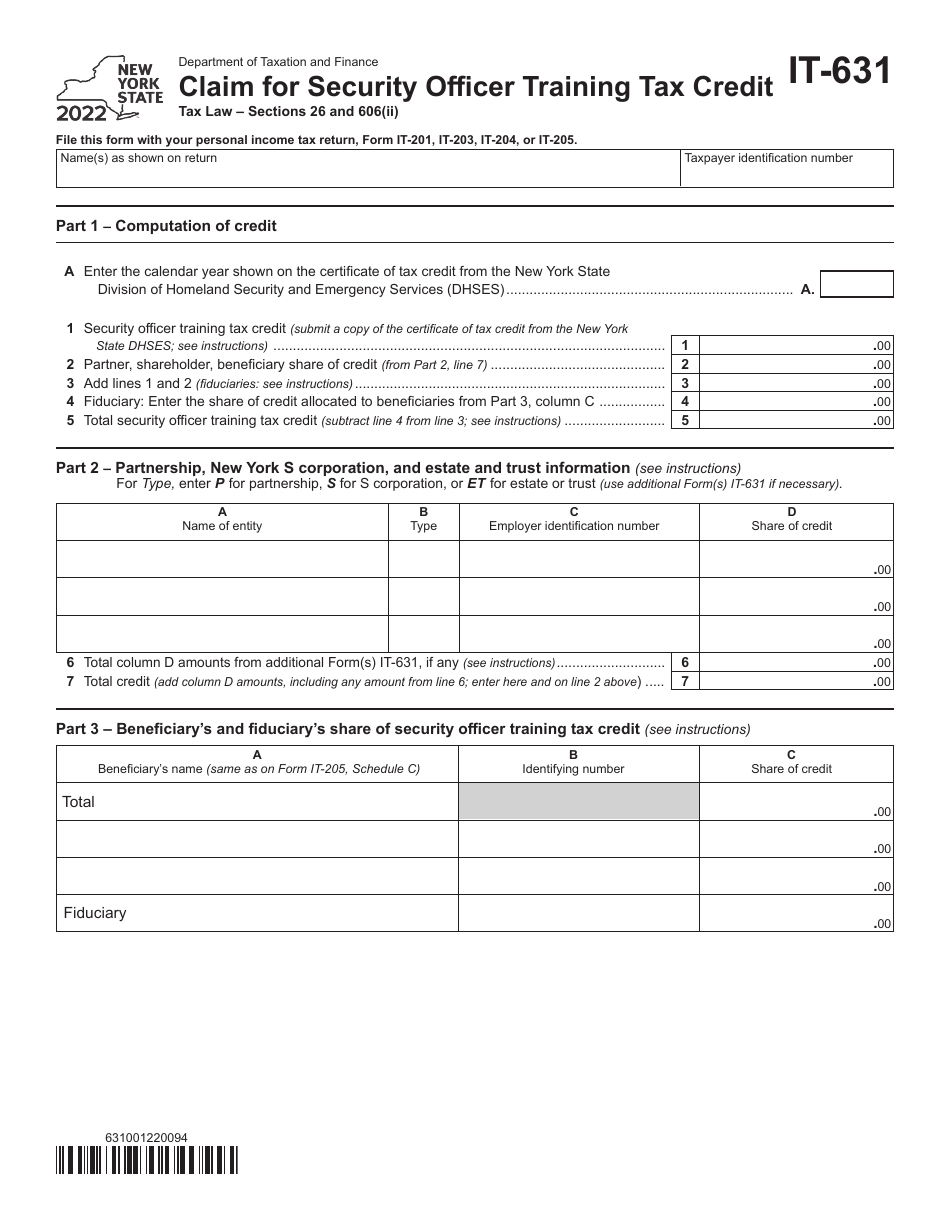

Form IT-631

for the current year.

Form IT-631 Claim for Security Officer Training Tax Credit - New York

What Is Form IT-631?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-631?

A: Form IT-631 is a document used to claim the Security Officer Training Tax Credit in New York.

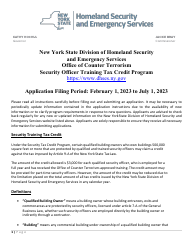

Q: What is the Security Officer Training Tax Credit?

A: The Security Officer Training Tax Credit is a tax credit available to businesses in New York that provide certain security officer training to their employees.

Q: Who can claim the Security Officer Training Tax Credit?

A: Businesses in New York that provide security officer training to their employees can claim the Security Officer Training Tax Credit.

Q: What expenses are eligible for the Security Officer Training Tax Credit?

A: Expenses related to security officer training, including instructors' fees, training materials, and certain equipment, may be eligible for the Tax Credit.

Q: How much is the Security Officer Training Tax Credit?

A: The amount of the Security Officer Training Tax Credit is 10% of eligible expenses, up to a maximum of $350 per employee per year.

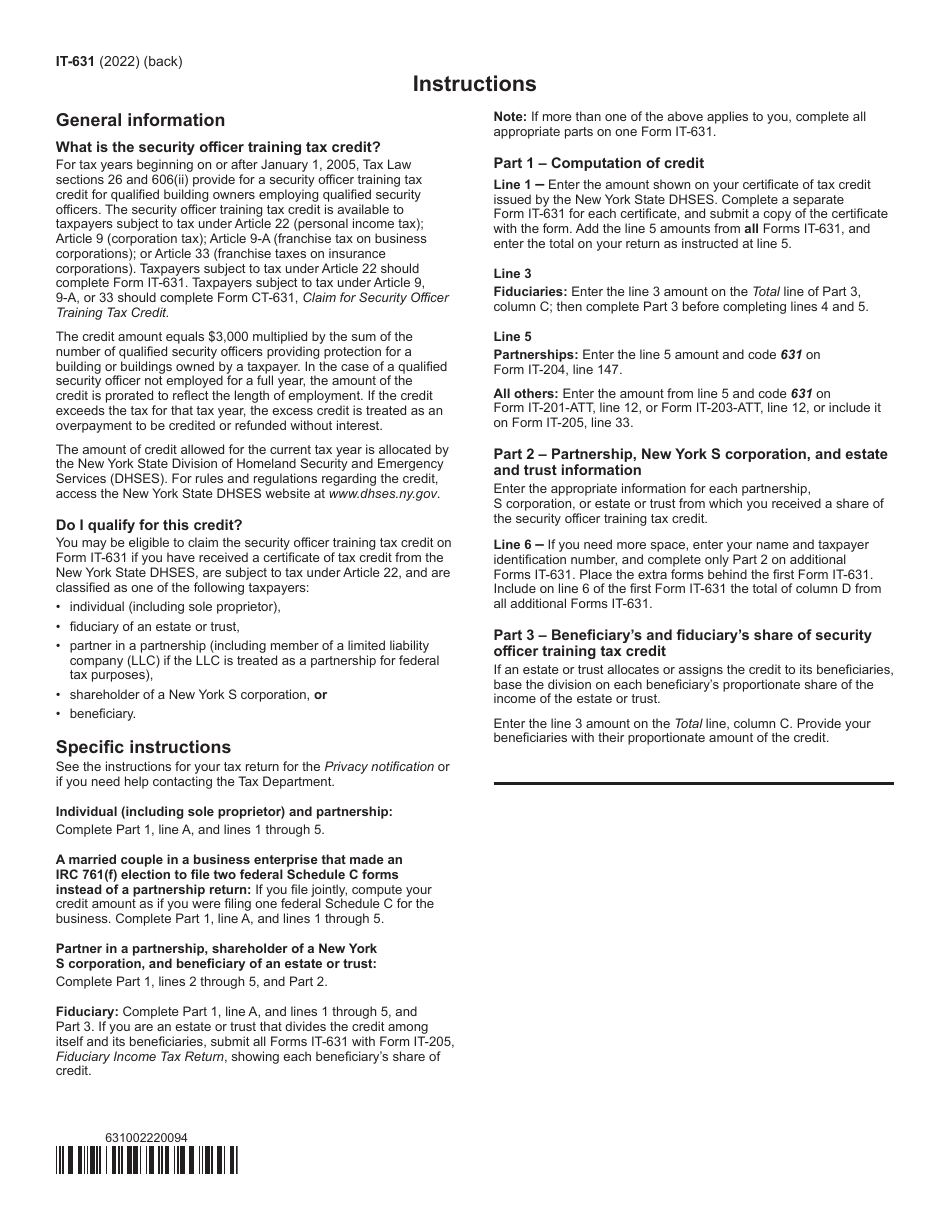

Q: How do I complete Form IT-631?

A: To complete Form IT-631, you will need to provide information about your business, the number of employees trained, and the eligible expenses incurred. Make sure to carefully review the instructions provided with the form.

Q: Is there a deadline for filing Form IT-631?

A: Yes, Form IT-631 must be filed with your New York State income tax return by the due date of the return, including extensions if applicable.

Q: Are there any other requirements for claiming the Security Officer Training Tax Credit?

A: Yes, there are certain eligibility requirements and documentation that must be provided along with Form IT-631. It is recommended to review the instructions and guidelines provided by the New York State Department of Taxation and Finance.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-631 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.