This version of the form is not currently in use and is provided for reference only. Download this version of

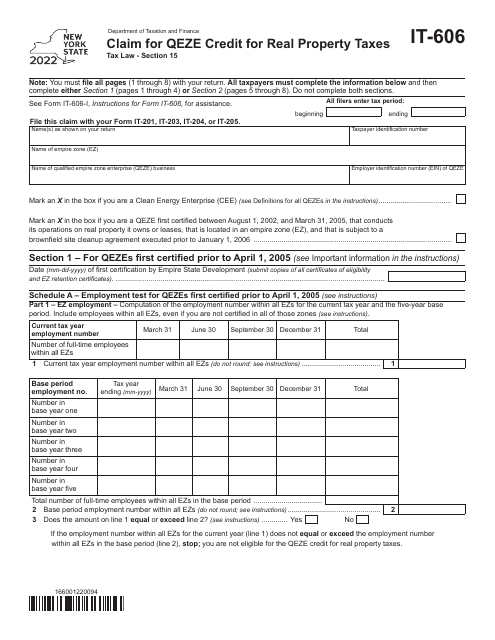

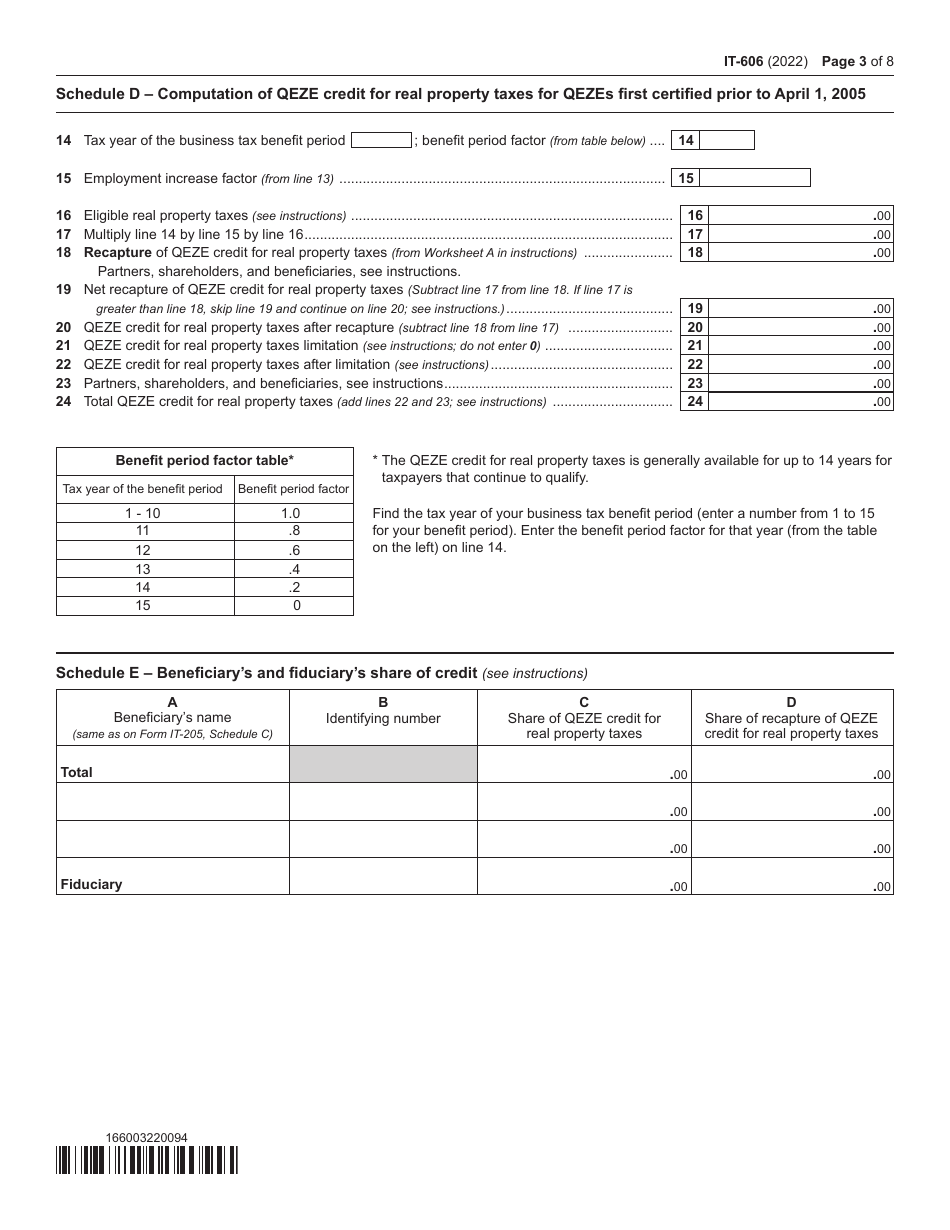

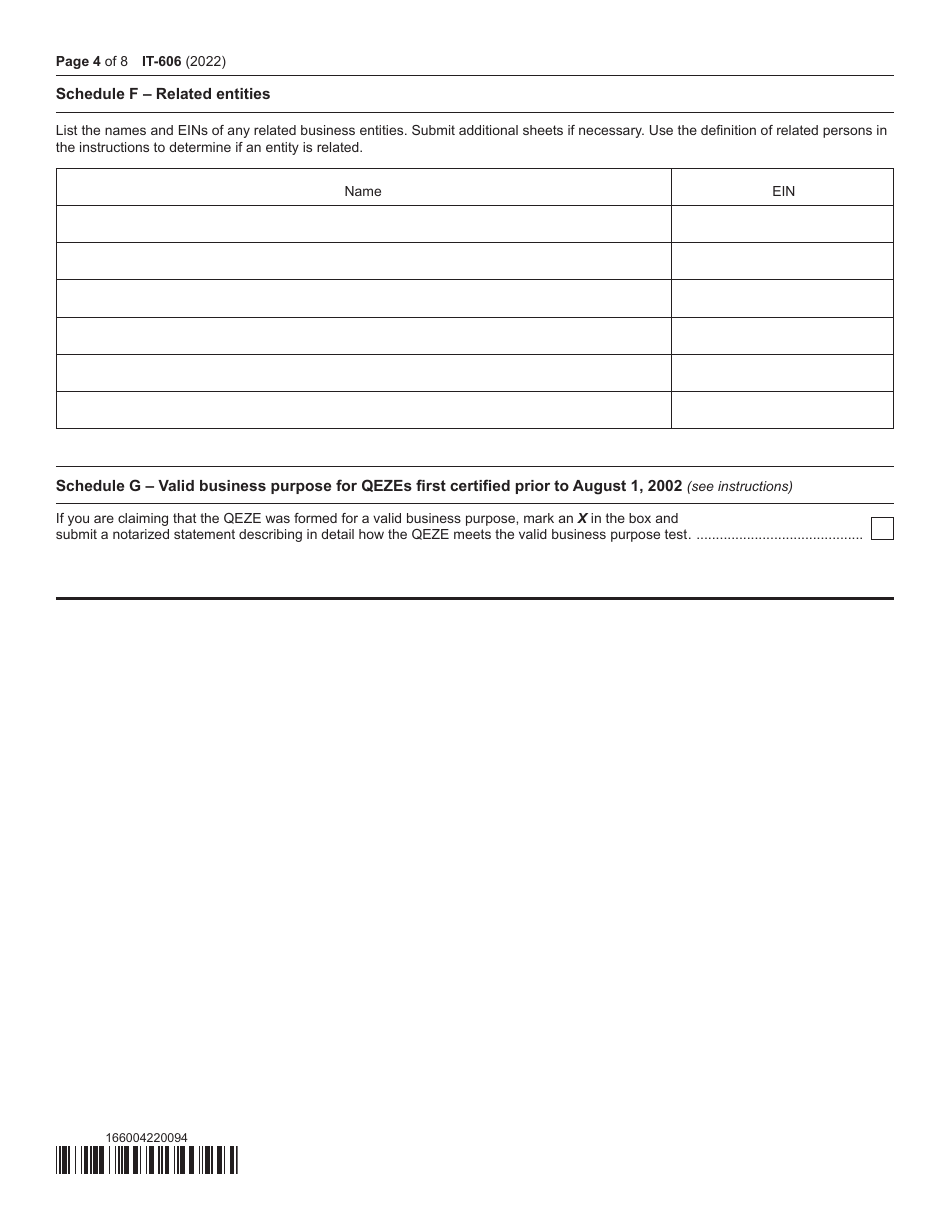

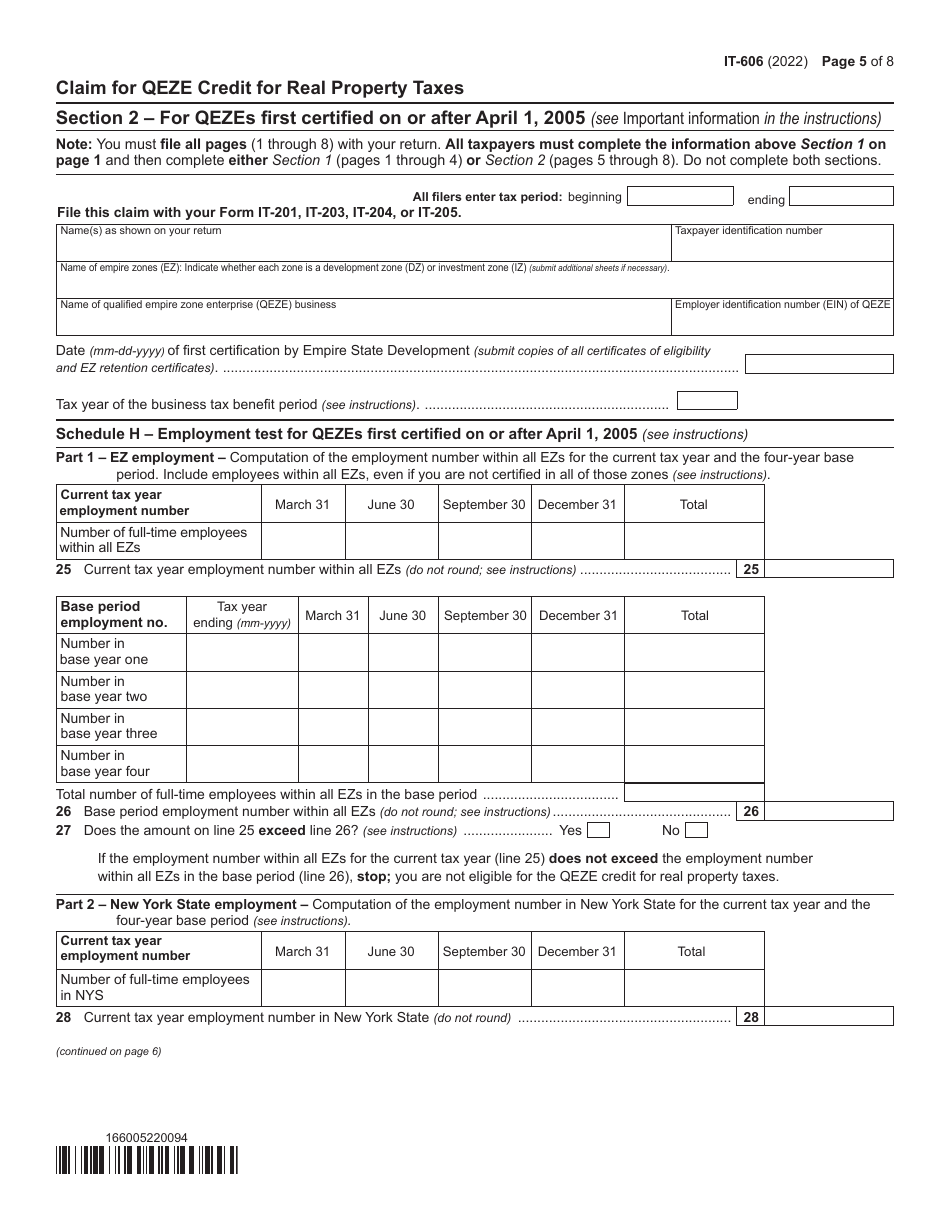

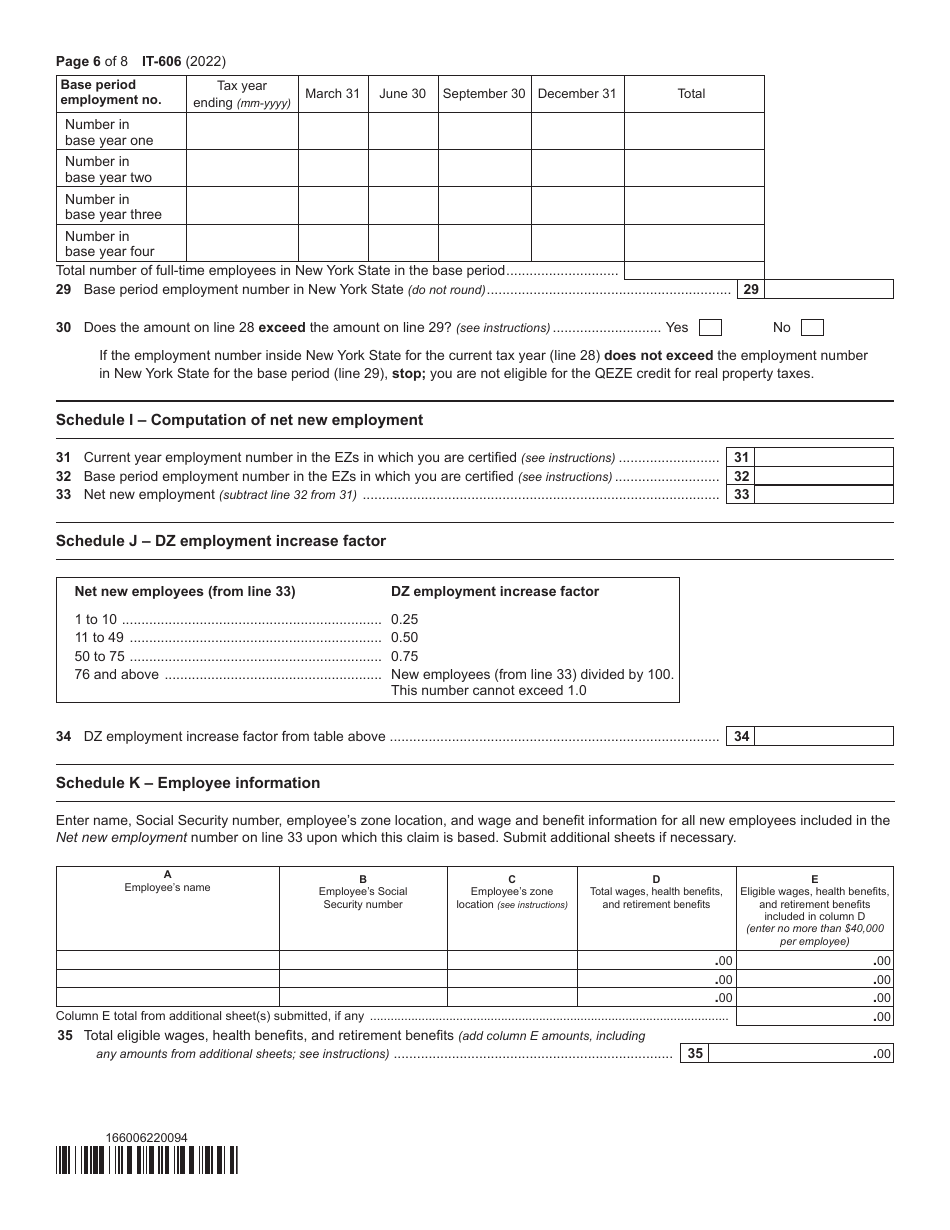

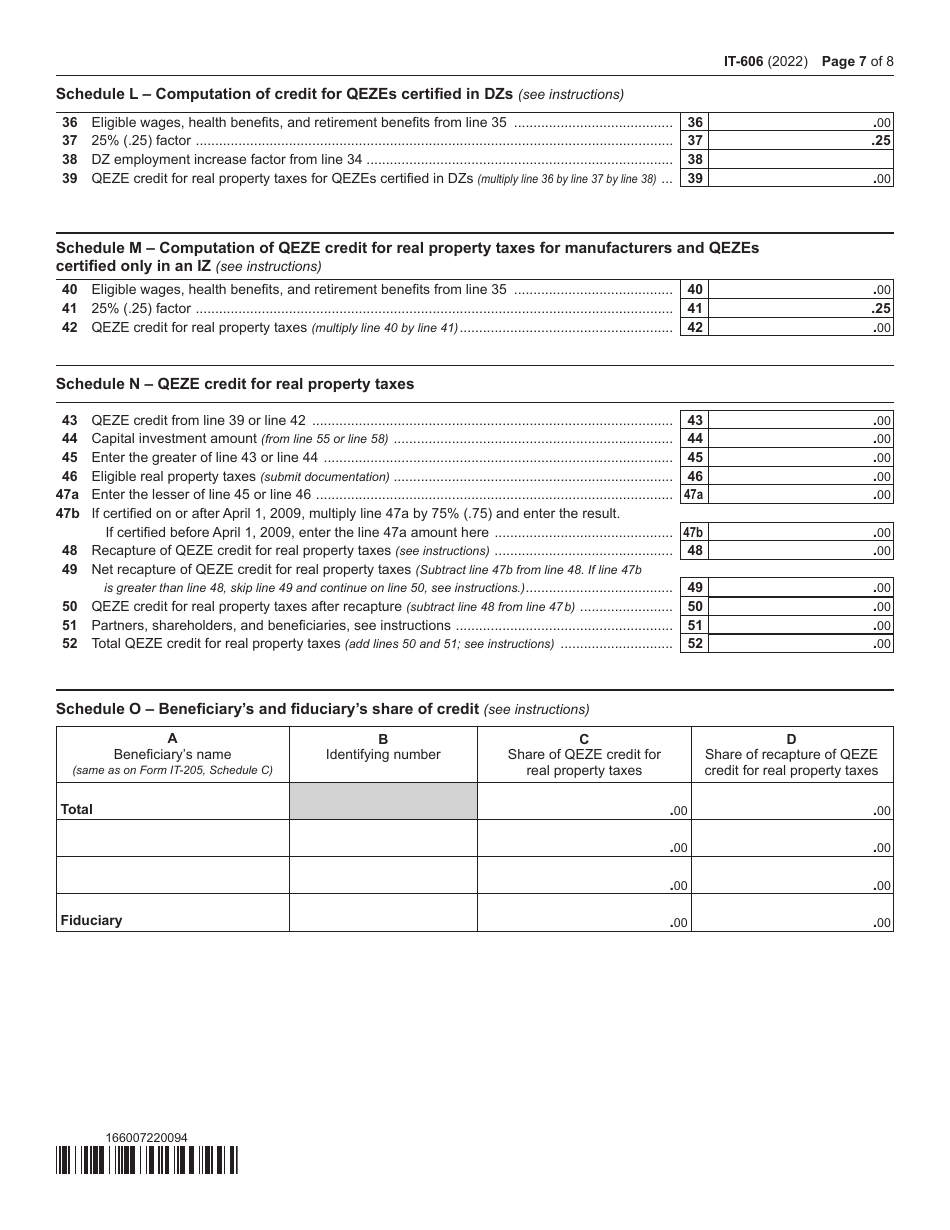

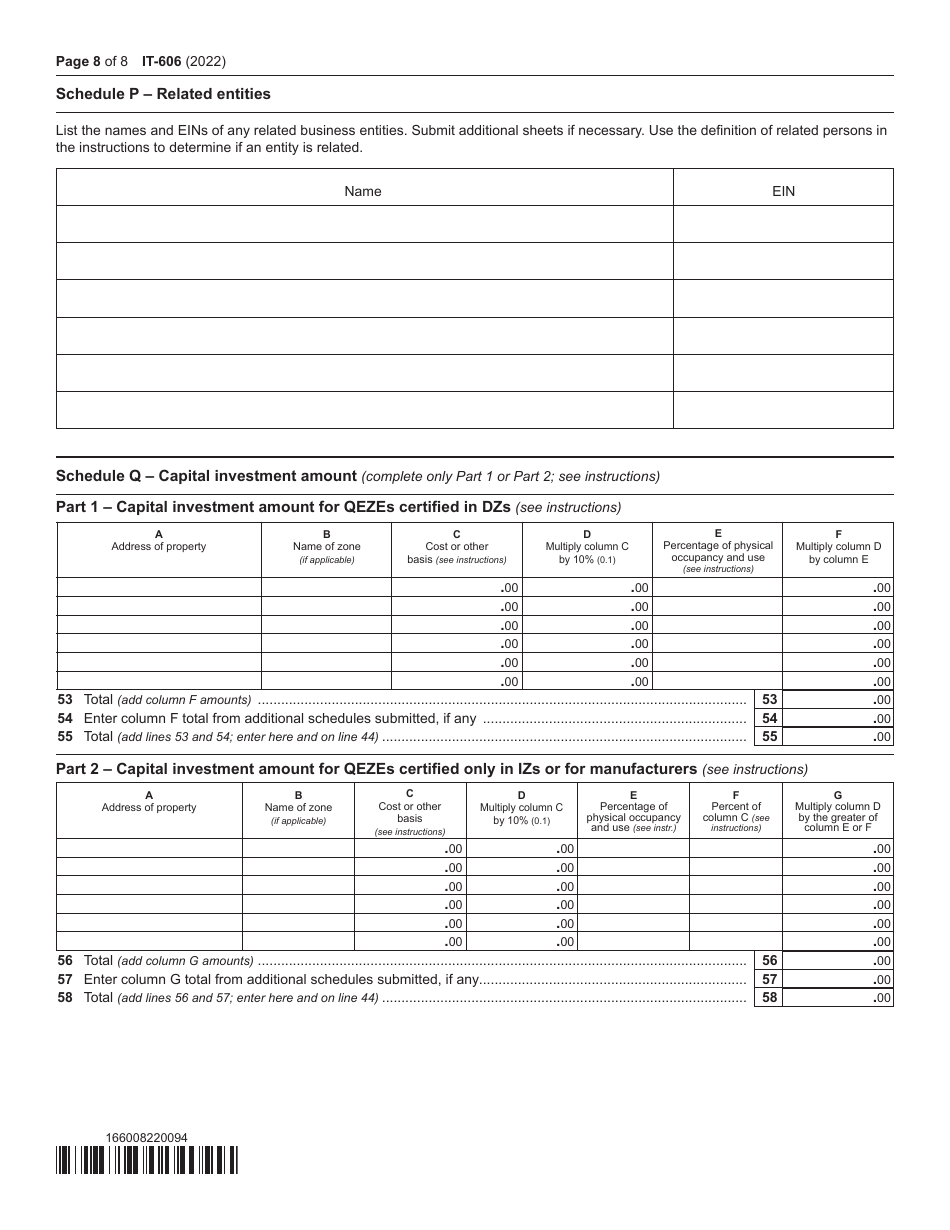

Form IT-606

for the current year.

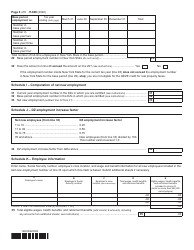

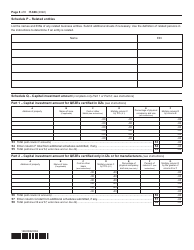

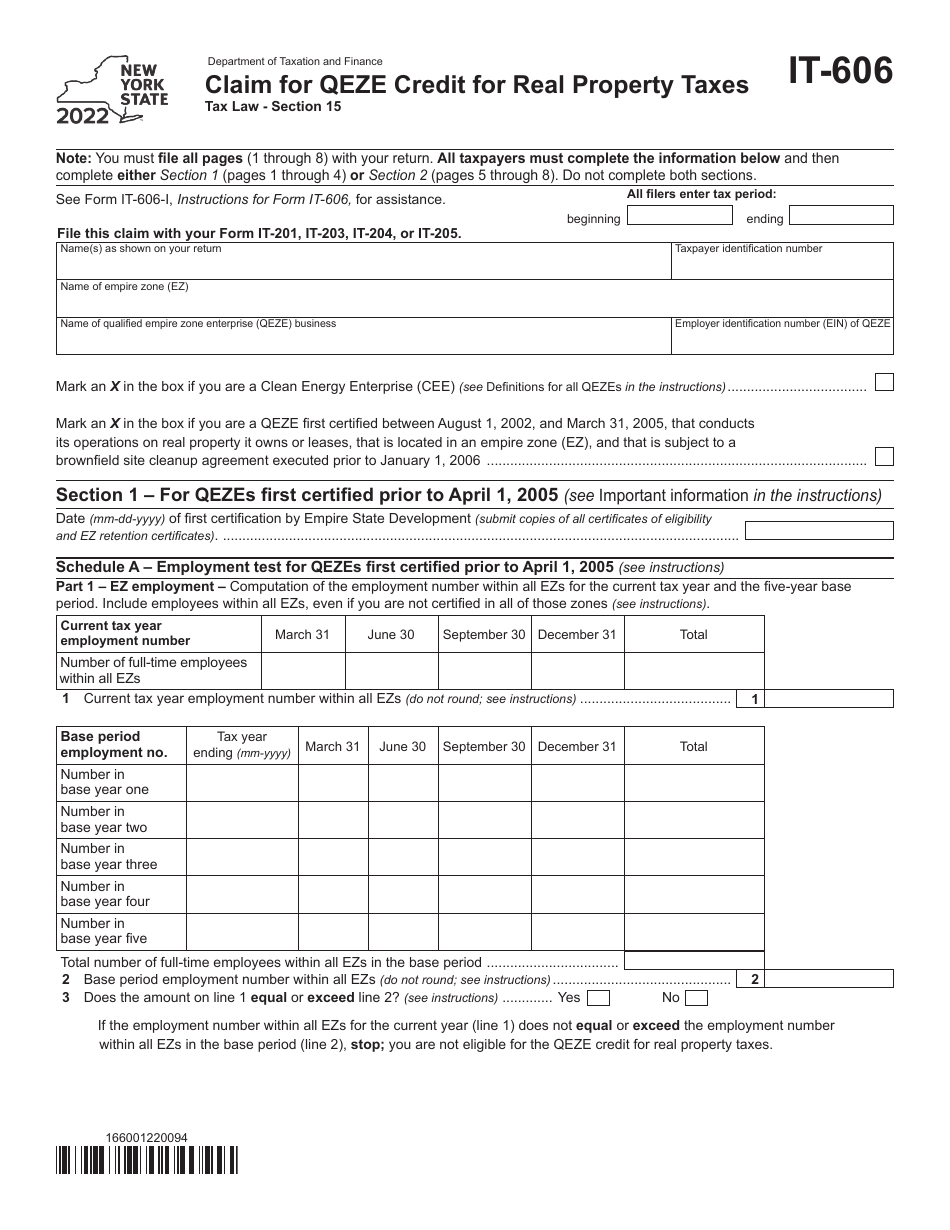

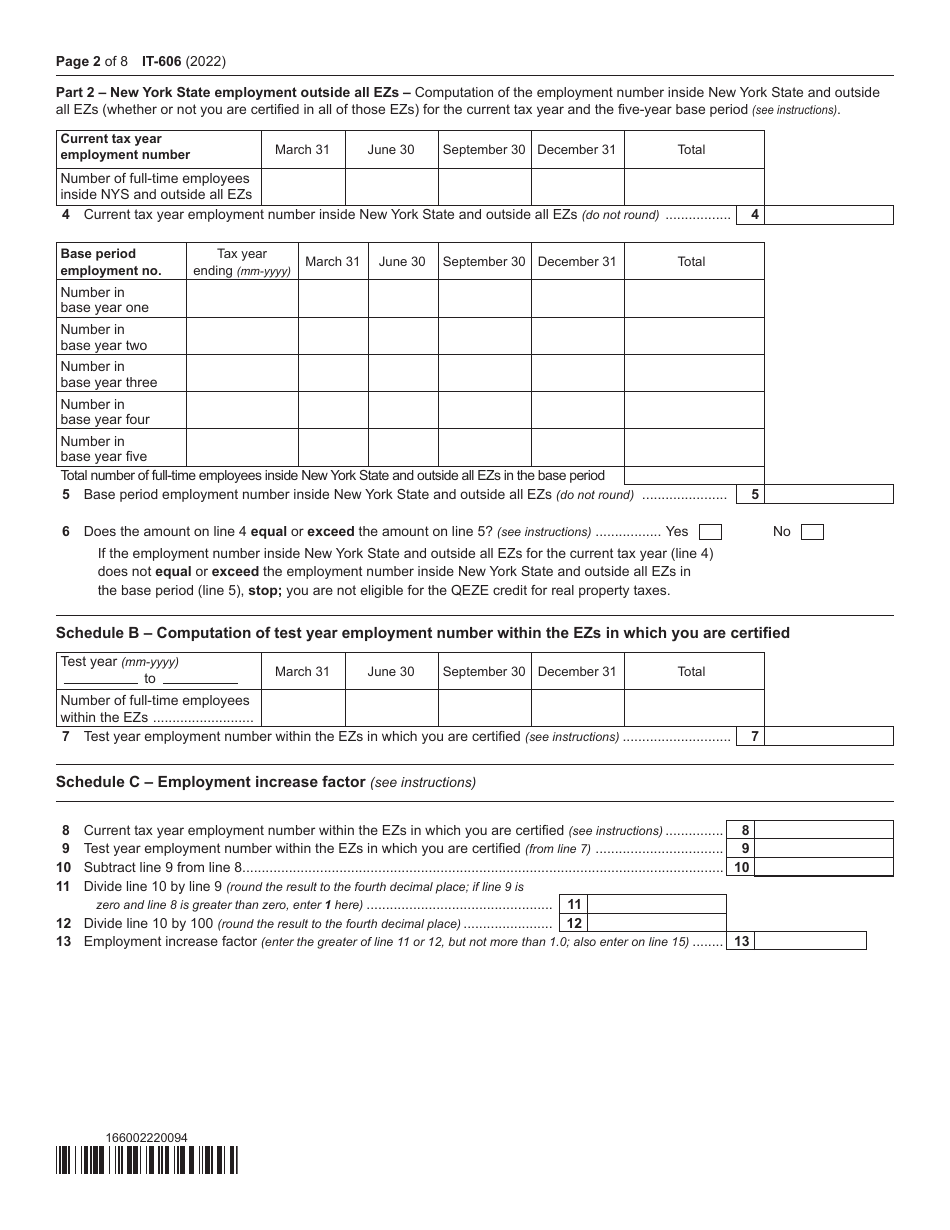

Form IT-606 Claim for Qeze Credit for Real Property Taxes - New York

What Is Form IT-606?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-606?

A: Form IT-606 is the Claim for QEZE Credit for Real Property Taxes form in New York.

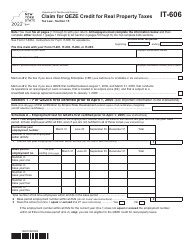

Q: What is the QEZE credit?

A: The QEZE credit is a tax credit available to businesses that occupy or own qualified empire zones.

Q: Who can claim the QEZE credit?

A: Businesses that are located or own property in a qualified empire zone in New York can claim the QEZE credit.

Q: What is the purpose of Form IT-606?

A: Form IT-606 is used to claim the QEZE credit for real propertytaxes paid by businesses in qualified empire zones.

Q: What information is required on Form IT-606?

A: Form IT-606 requires information about the business, the qualified empire zone, and the real property taxes paid.

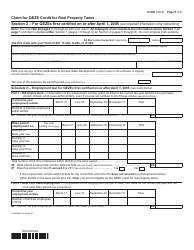

Q: When is the deadline to file Form IT-606?

A: The deadline to file Form IT-606 is generally the same as the deadline to file the business's tax return, which is March 15th for most businesses.

Q: Are there any limitations or restrictions on the QEZE credit?

A: Yes, there are certain limitations and restrictions on the QEZE credit, including limitations on the amount of credit that can be claimed and eligibility requirements.

Q: Can the QEZE credit be carried forward or backward?

A: Yes, any unused QEZE credit can be carried forward for up to 15 years or carried back for up to 3 years.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-606 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.