This version of the form is not currently in use and is provided for reference only. Download this version of

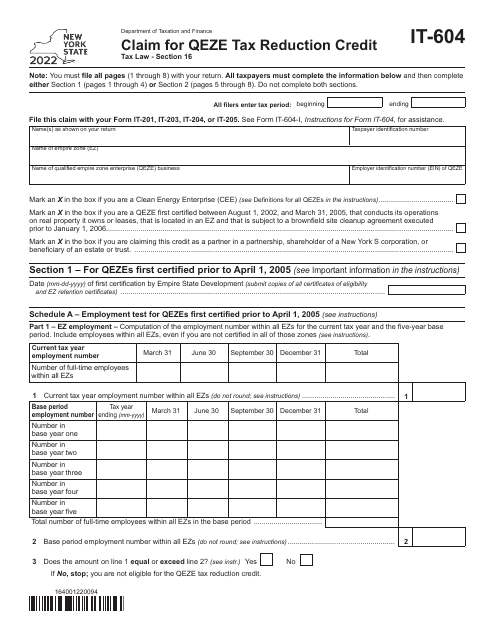

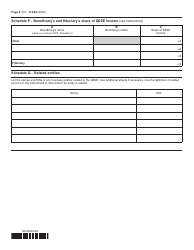

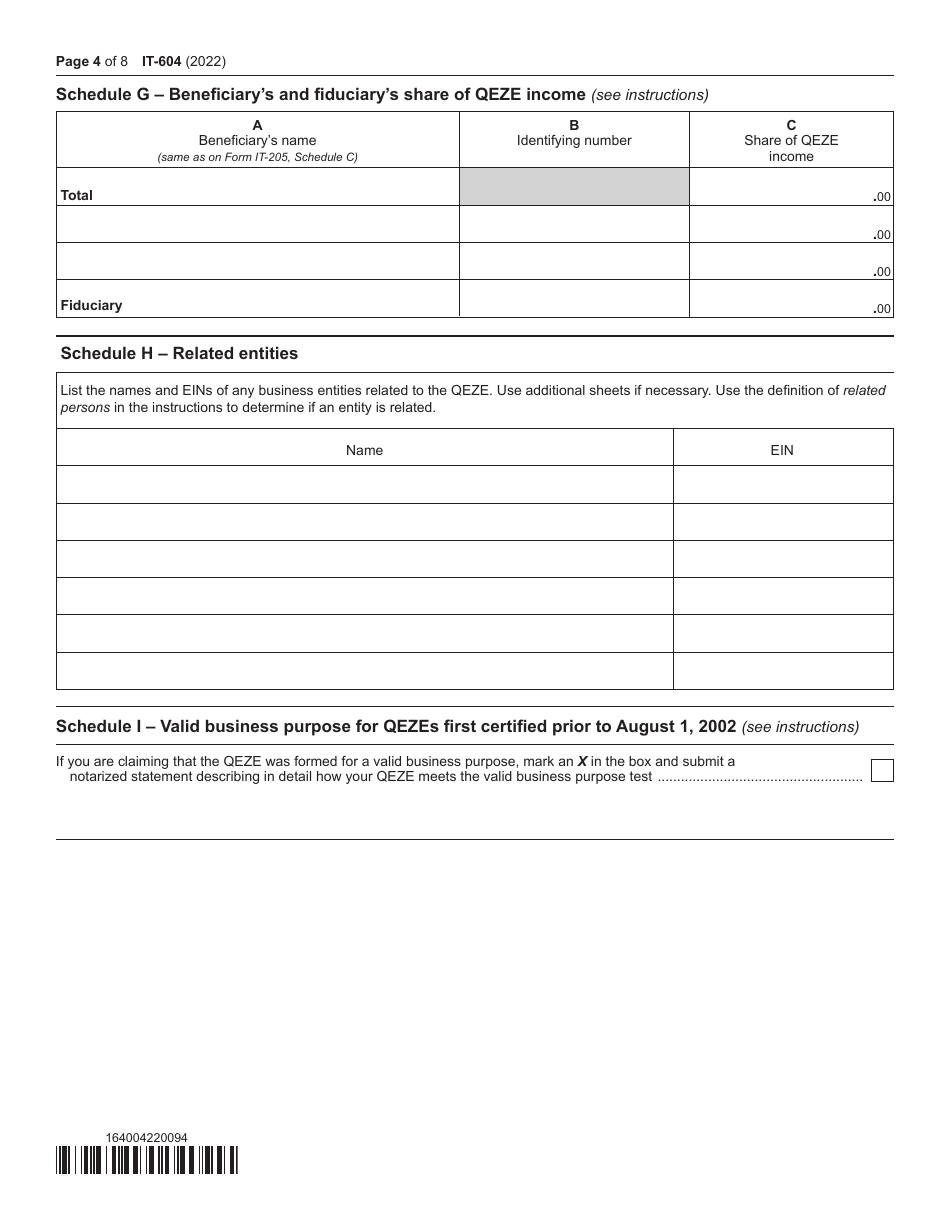

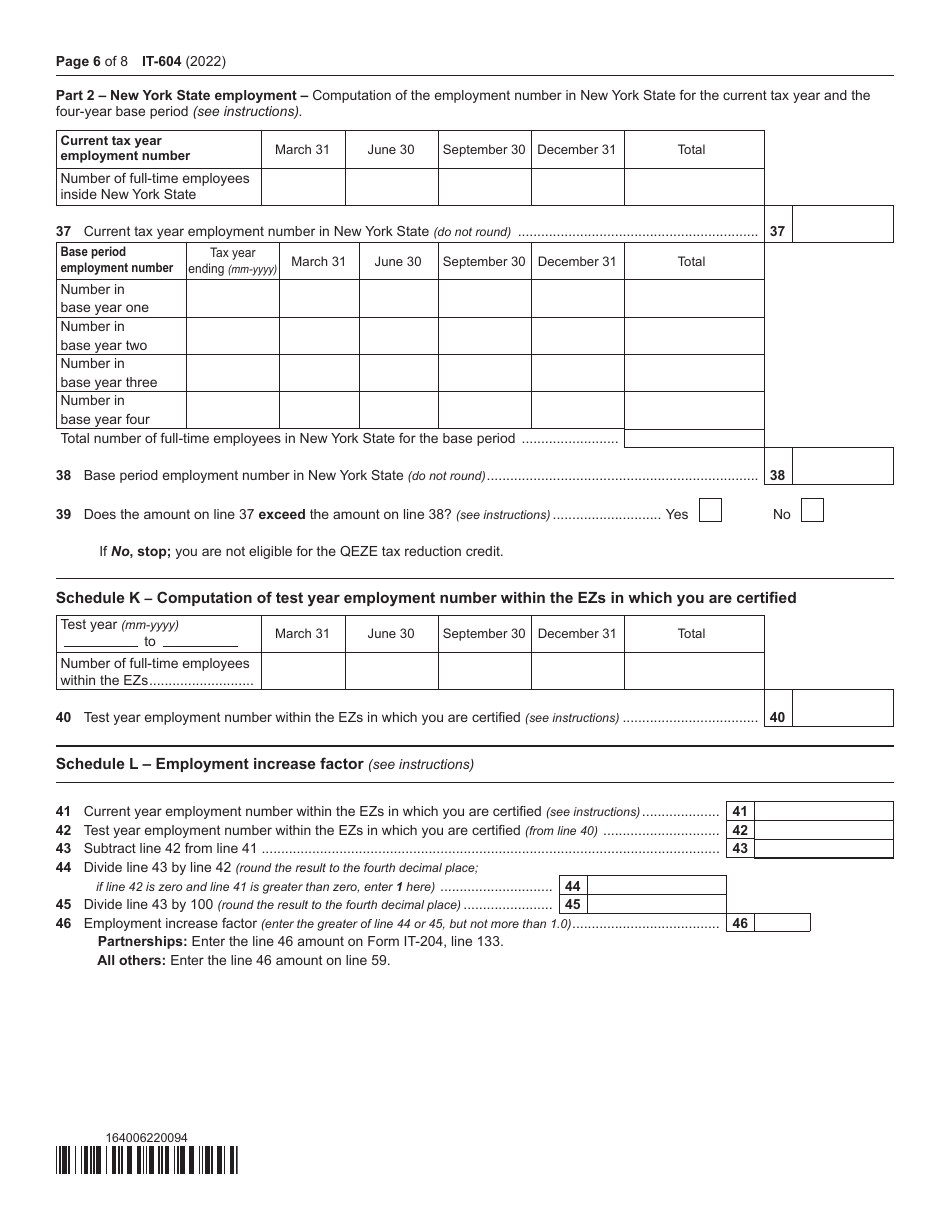

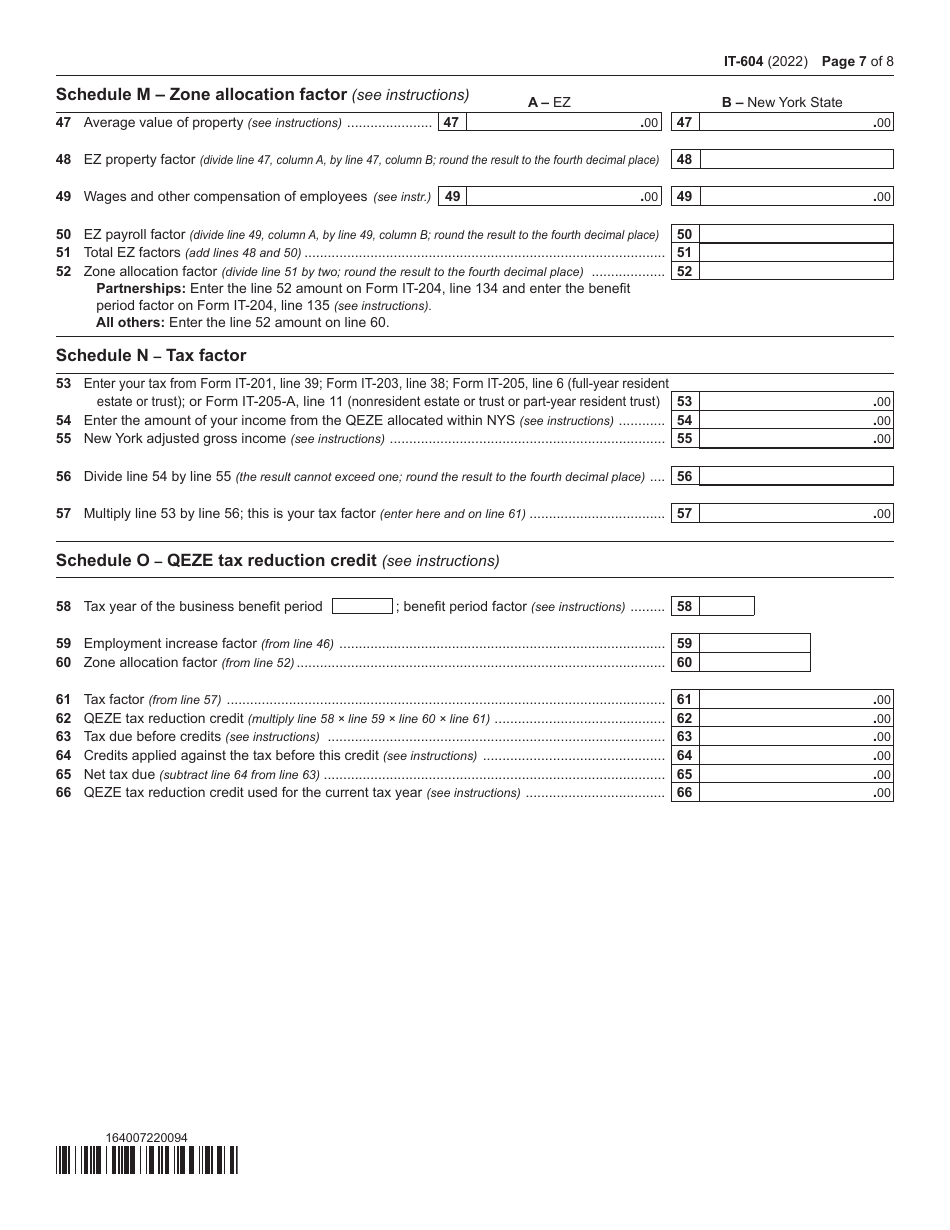

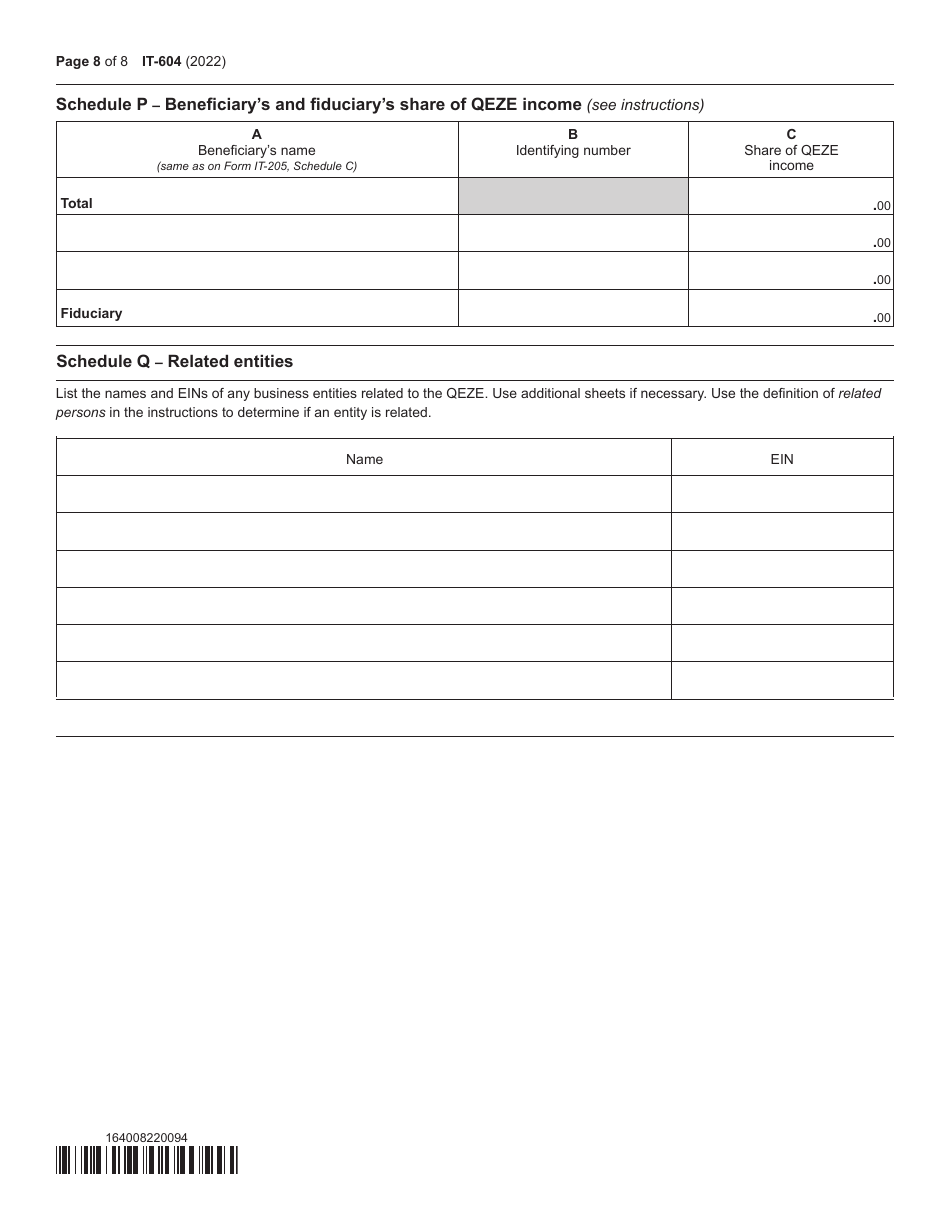

Form IT-604

for the current year.

Form IT-604 Claim for Qeze Tax Reduction Credit - New York

What Is Form IT-604?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-604?

A: Form IT-604 is a tax form used by individuals or businesses in New York to claim the QEZ tax reduction credit.

Q: What is the QEZ tax reduction credit?

A: The QEZ tax reduction credit is a tax credit available to businesses that operate in designated qualified empire zones (QEZs) in New York.

Q: Who can claim the QEZ tax reduction credit?

A: Businesses that operate within designated qualified empire zones (QEZs) in New York can claim the QEZ tax reduction credit.

Q: How do I claim the QEZ tax reduction credit?

A: To claim the QEZ tax reduction credit, you need to complete and file Form IT-604 with the New York State Department of Taxation and Finance.

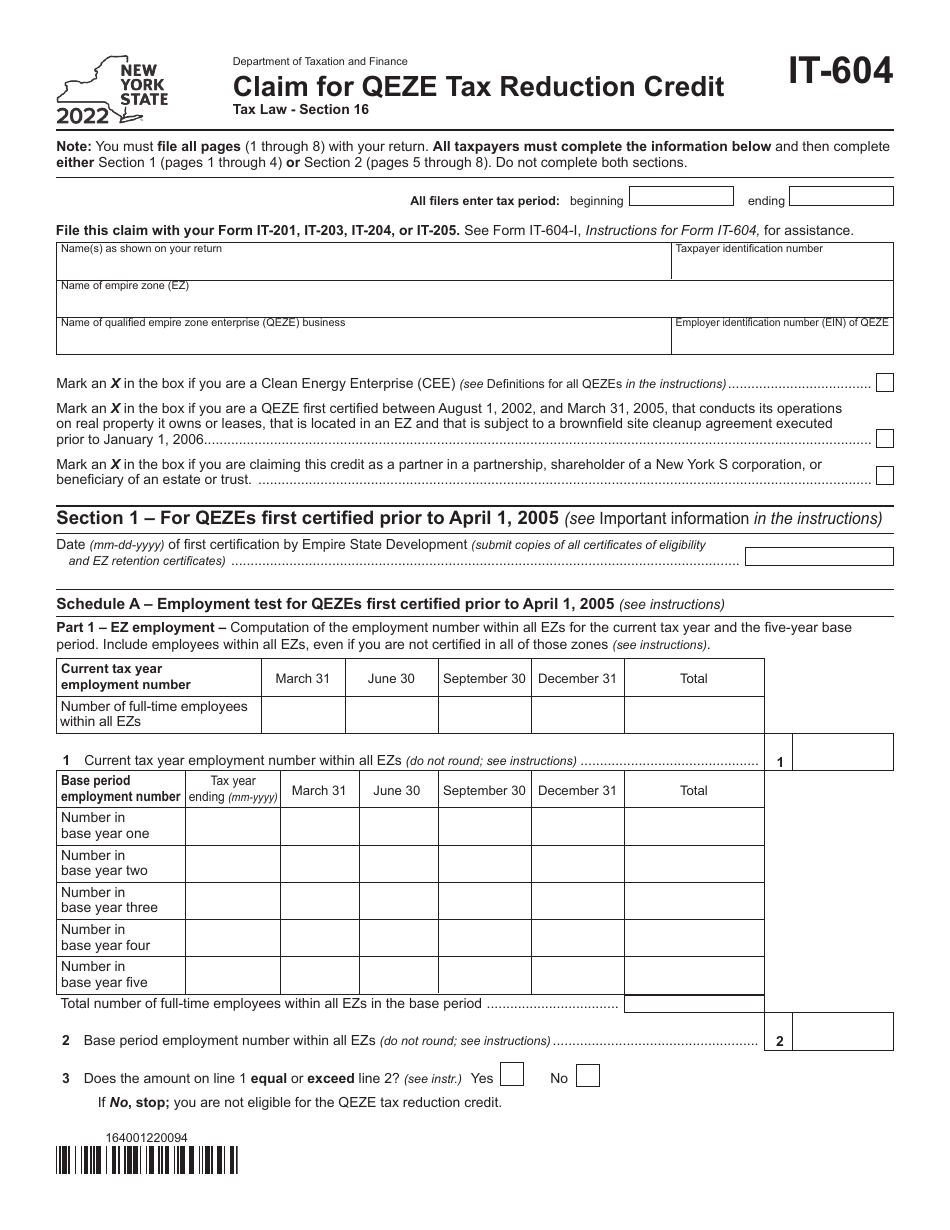

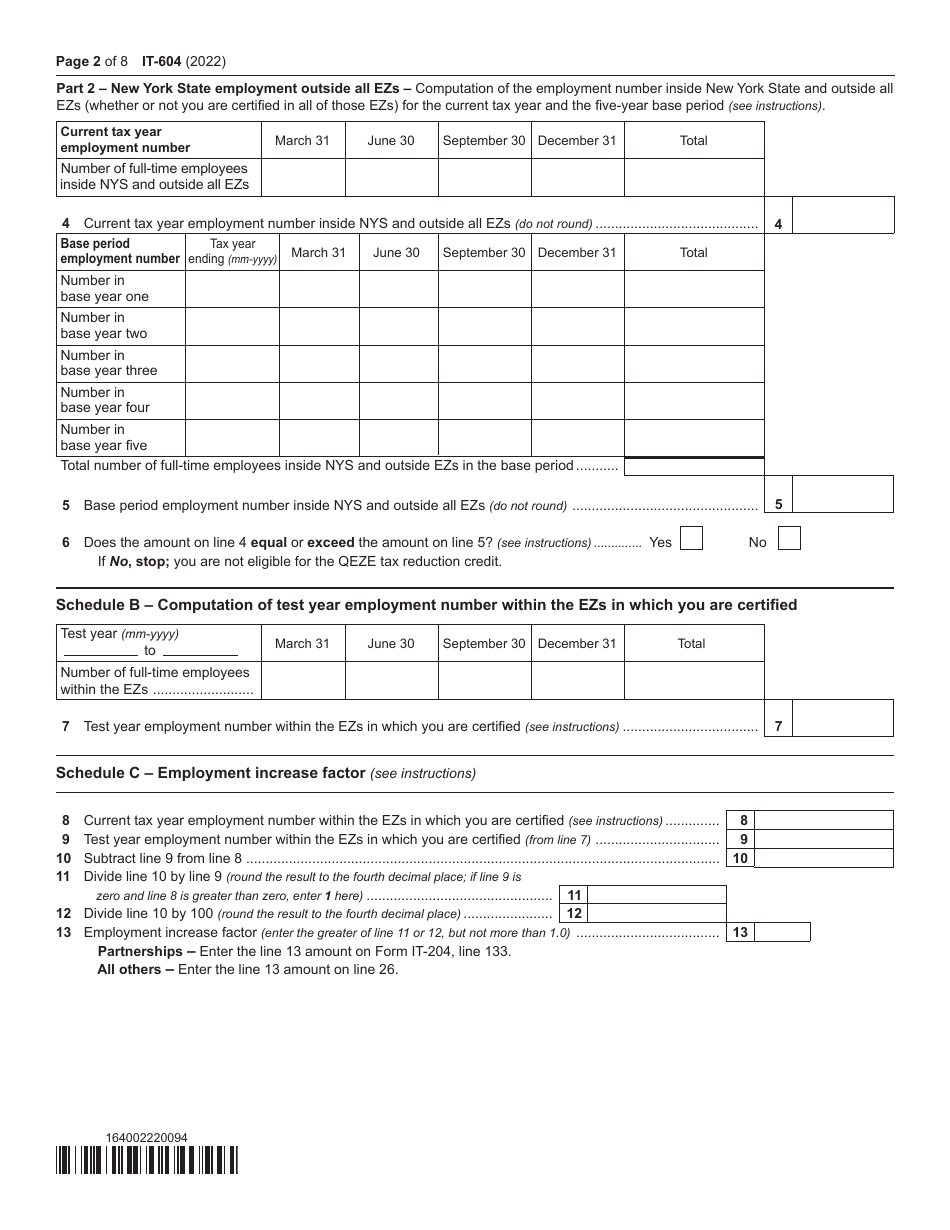

Q: What information do I need to complete Form IT-604?

A: To complete Form IT-604, you will need to provide information about your business and its activities within the qualified empire zone (QEZ).

Q: Is there a deadline for filing Form IT-604?

A: Yes, the deadline for filing Form IT-604 is typically the same as the deadline for filing your New York state tax return, which is usually April 15th.

Q: Are there any restrictions or limitations on the QEZ tax reduction credit?

A: Yes, there are restrictions and limitations on the QEZ tax reduction credit. It is important to review the instructions for Form IT-604 or consult with a tax professional to understand these restrictions and limitations.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-604 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.