This version of the form is not currently in use and is provided for reference only. Download this version of

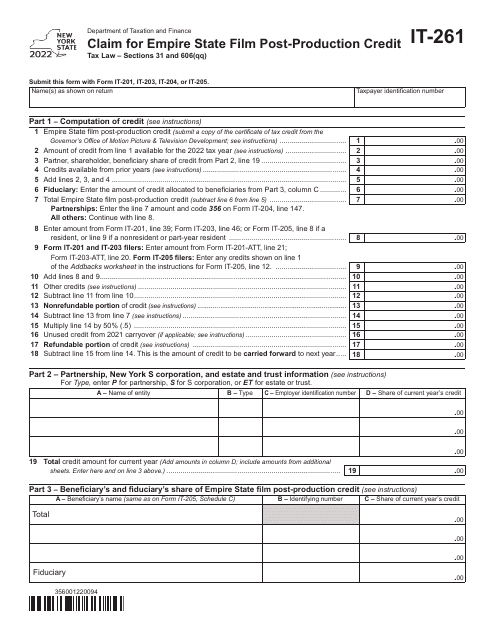

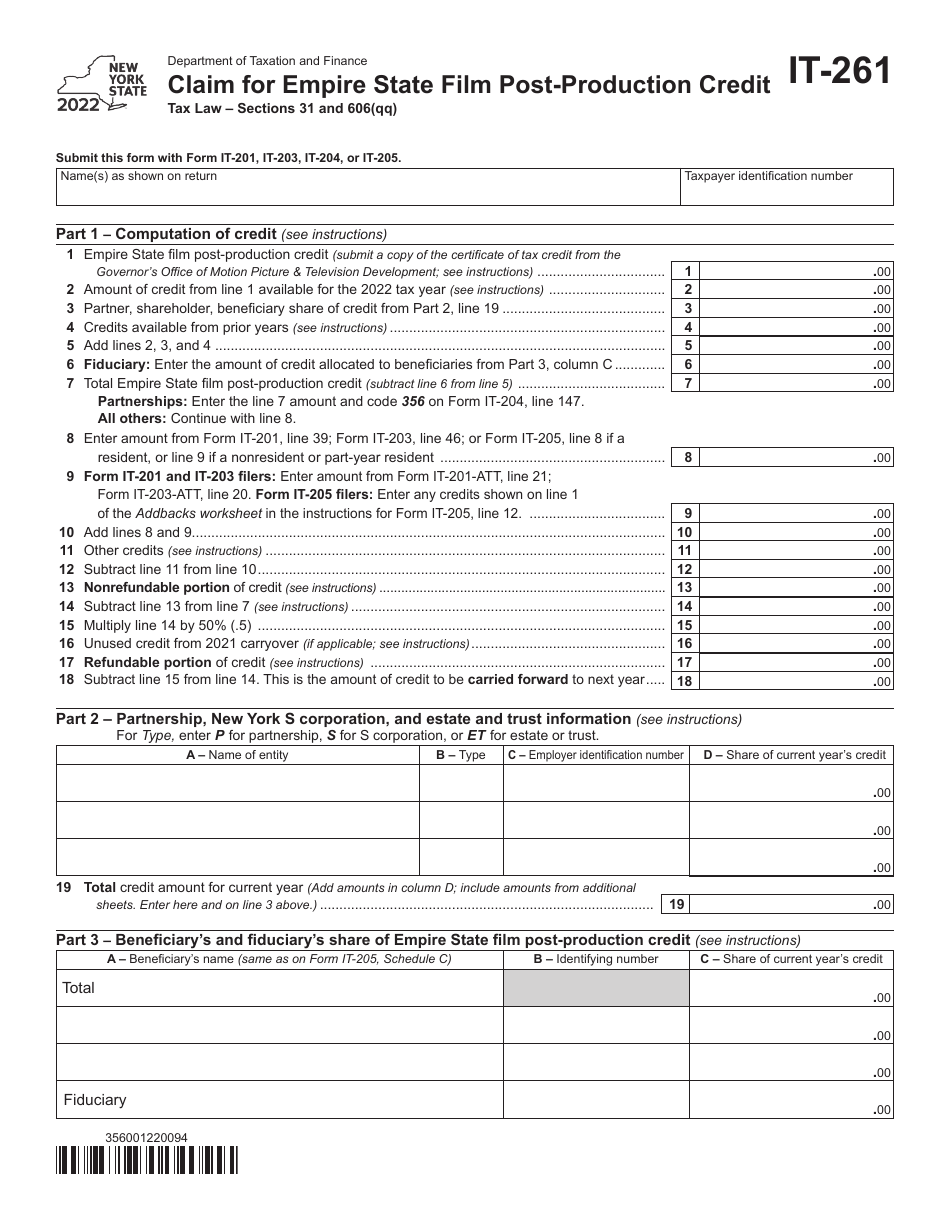

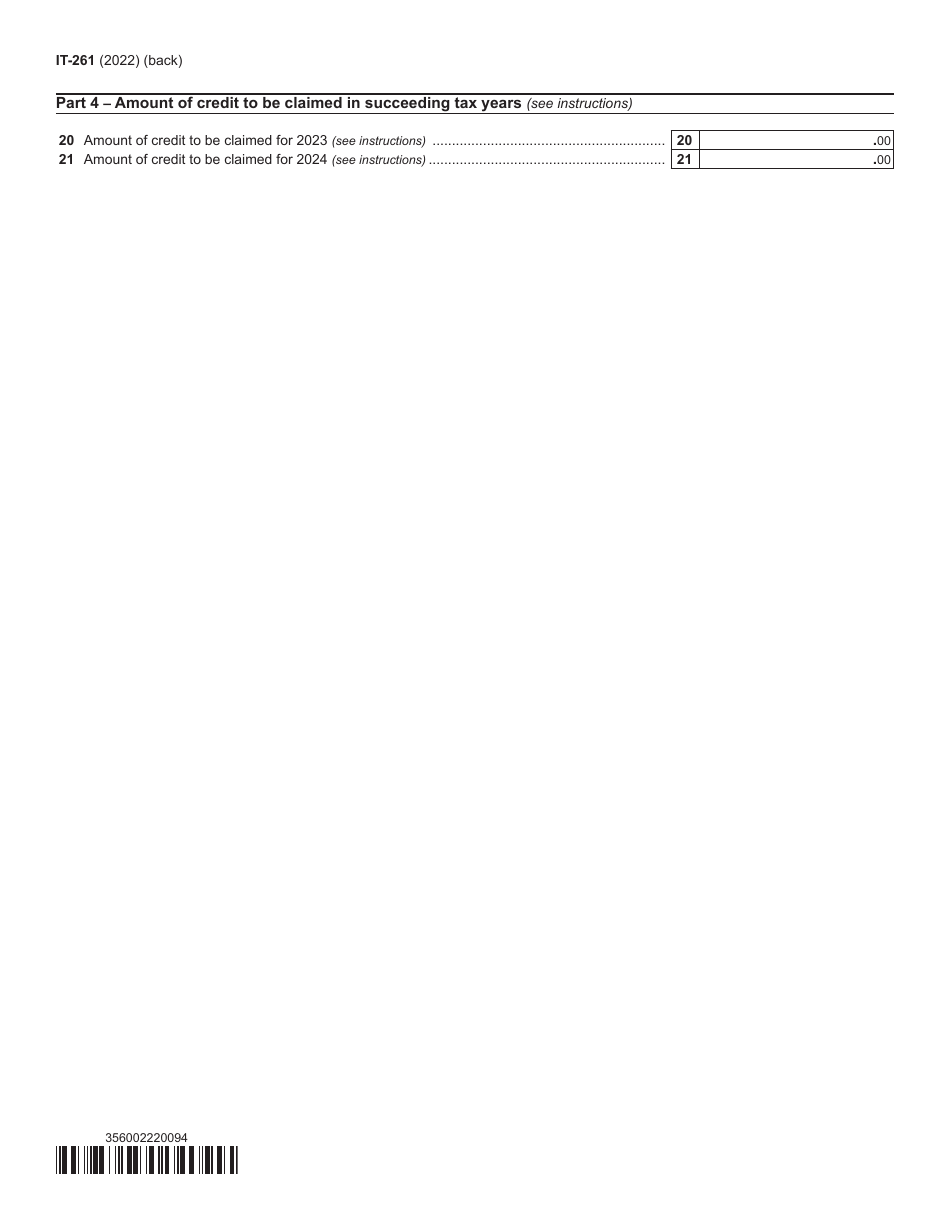

Form IT-261

for the current year.

Form IT-261 Claim for Empire State Film Post-production Credit - New York

What Is Form IT-261?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-261?

A: Form IT-261 is the claim form for the Empire State Film Post-production Credit in New York.

Q: What is the Empire State Film Post-production Credit?

A: The Empire State Film Post-production Credit is a tax credit available for qualified post-production expenditures made in New York.

Q: Who can claim the Empire State Film Post-production Credit?

A: Any production company that meets the eligibility criteria can claim the Empire State Film Post-production Credit.

Q: What are the eligibility criteria for claiming the Empire State Film Post-production Credit?

A: To be eligible for the credit, the production company must have a film production certificate and meet certain requirements related to the amount of post-production expenditures and the employment of New York residents.

Q: What expenses qualify for the Empire State Film Post-production Credit?

A: Qualified post-production expenditures include costs incurred for editing, sound mixing, visual effects, and other post-production activities.

Q: How much is the Empire State Film Post-production Credit?

A: The credit is equal to 30% of qualified post-production expenditures made in New York.

Q: How do I claim the Empire State Film Post-production Credit?

A: To claim the credit, you must complete and file Form IT-261, along with the required supporting documentation, with the New York State Department of Taxation and Finance.

Q: Is there a deadline for claiming the Empire State Film Post-production Credit?

A: Yes, the claim must be filed within three years from the date the return was due or filed, whichever is later.

Q: Are there any limitations or restrictions on the Empire State Film Post-production Credit?

A: Yes, there are certain limitations and restrictions, such as a cap on the total amount of credits that can be claimed in a year and a requirement to maintain records and make them available for audit purposes.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-261 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.