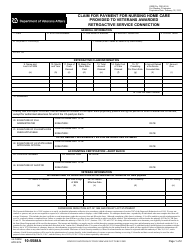

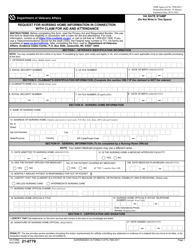

This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-258

for the current year.

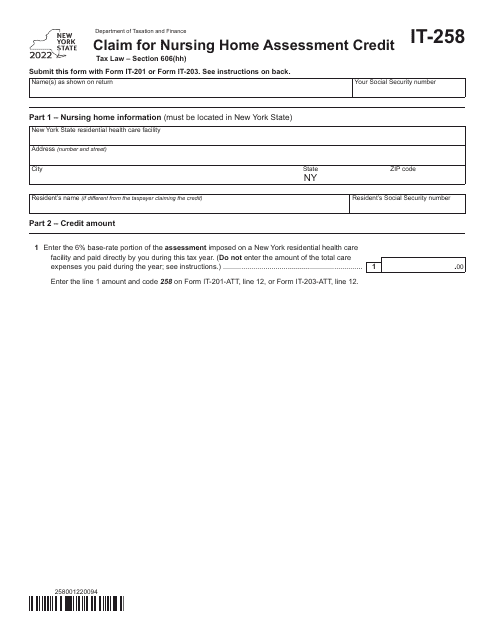

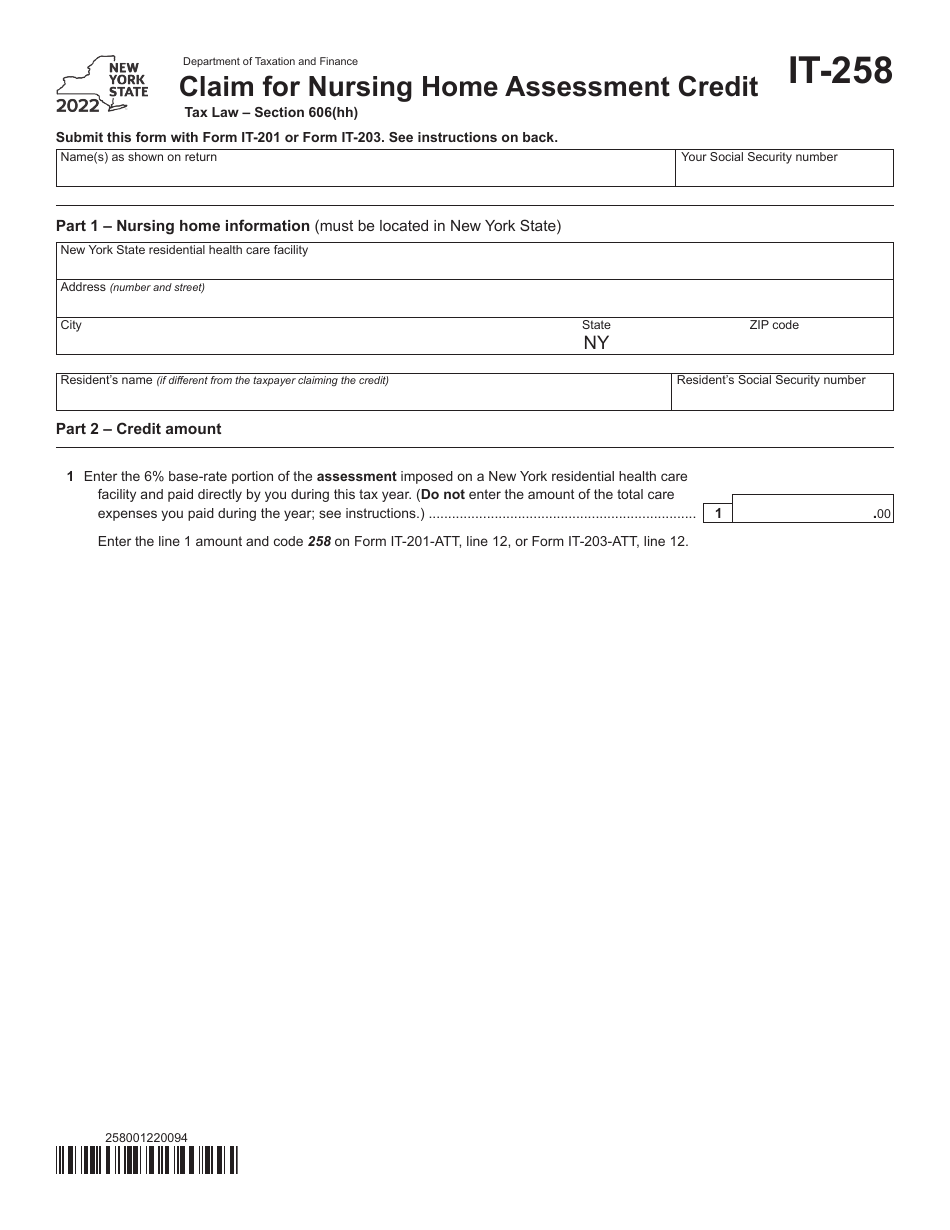

Form IT-258 Claim for Nursing Home Assessment Credit - New York

What Is Form IT-258?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

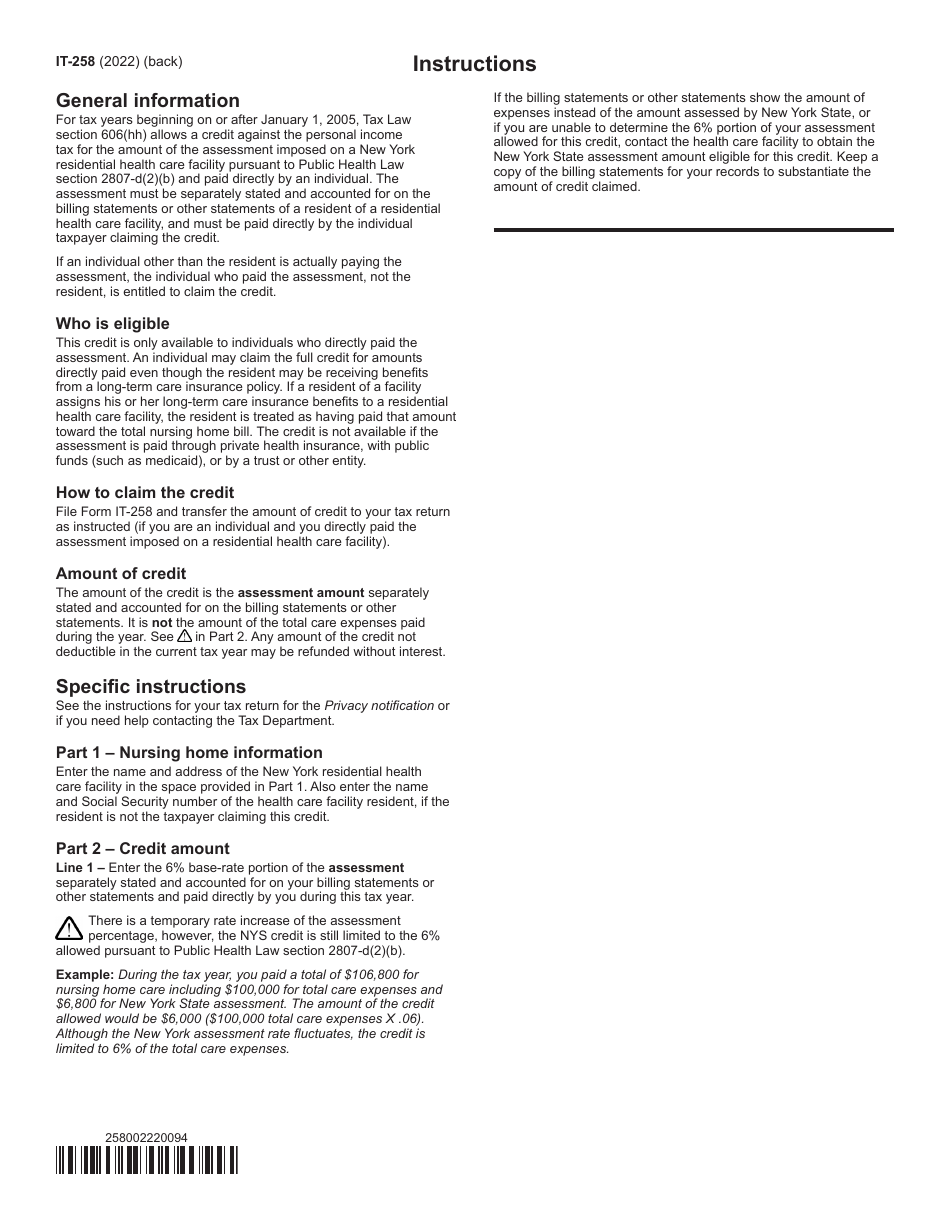

Q: What is Form IT-258?

A: Form IT-258 is the Claim for Nursing HomeAssessment Credit in New York.

Q: Who can claim the Nursing Home Assessment Credit?

A: Individuals who were residents in a nursing home in New York and meet certain criteria can claim the Nursing Home Assessment Credit.

Q: What is the purpose of the Nursing Home Assessment Credit?

A: The Nursing Home Assessment Credit is designed to provide financial relief to individuals who reside in a nursing home in New York.

Q: What are the eligibility requirements for the Nursing Home Assessment Credit?

A: To be eligible for the Nursing Home Assessment Credit, individuals must be residents of a qualified nursing home in New York and meet certain income requirements.

Q: How much is the Nursing Home Assessment Credit?

A: The amount of the Nursing Home Assessment Credit varies depending on the individual's income and the cost of care in the nursing home.

Q: How can I claim the Nursing Home Assessment Credit?

A: To claim the Nursing Home Assessment Credit, you need to complete and file Form IT-258 with the New York State Department of Taxation and Finance.

Q: Are there any deadlines to claim the Nursing Home Assessment Credit?

A: Yes, you must file Form IT-258 within three years from the due date of the original return or within two years from the date the tax was paid, whichever is later.

Q: Is the Nursing Home Assessment Credit refundable?

A: No, the Nursing Home Assessment Credit is not refundable. It can only be used to offset your New York State personal incometax liability.

Q: Can I claim the Nursing Home Assessment Credit if I receive Medicaid benefits?

A: Yes, individuals receiving Medicaid benefits may still be eligible for the Nursing Home Assessment Credit if they meet the other eligibility requirements.

Q: Are there any additional forms or documentation required to claim the Nursing Home Assessment Credit?

A: Depending on your circumstances, you may need to include additional documents, such as proof of residency in a nursing home, with your Form IT-258.

Q: Can I claim the Nursing Home Assessment Credit for multiple tax years?

A: Yes, you can claim the Nursing Home Assessment Credit for multiple tax years if you continue to meet the eligibility requirements.

Q: Can I claim the Nursing Home Assessment Credit if I am claimed as a dependent on someone else's tax return?

A: No, individuals who can be claimed as a dependent on someone else's tax return are not eligible to claim the Nursing Home Assessment Credit.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-258 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.