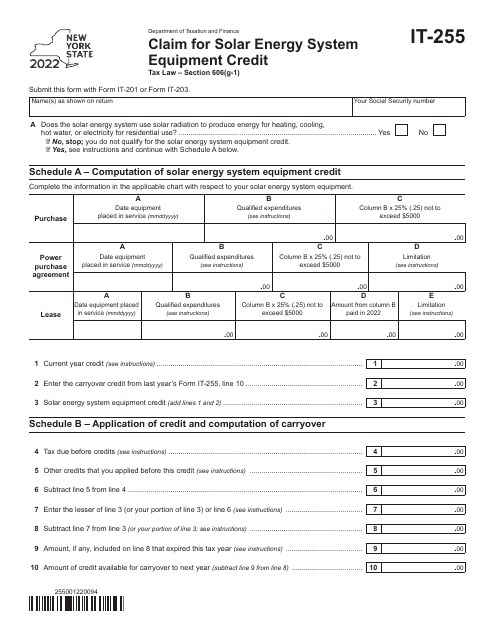

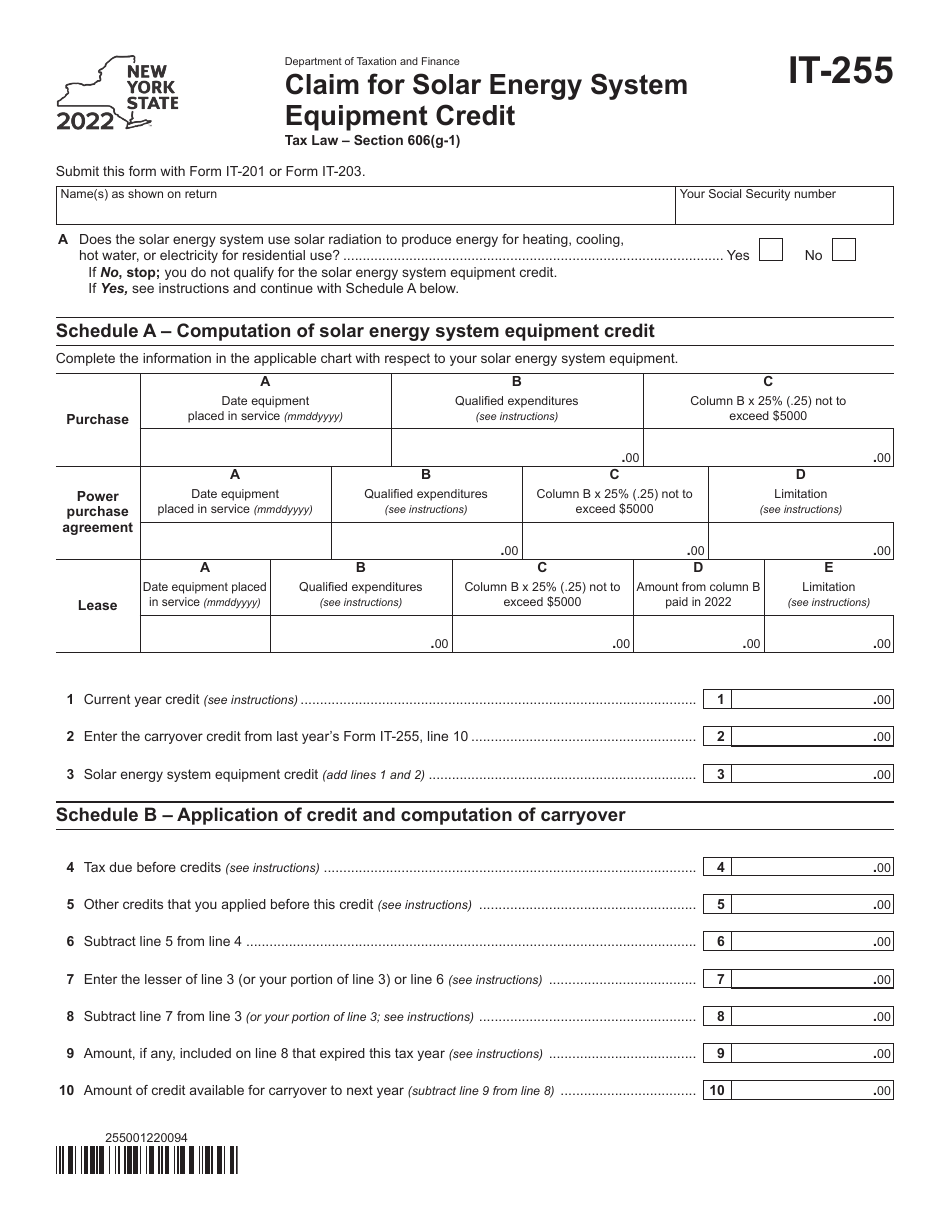

This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-255

for the current year.

Form IT-255 Claim for Solar Energy System Equipment Credit - New York

What Is Form IT-255?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-255?

A: Form IT-255 is a tax form used to claim the Solar Energy System Equipment Credit in New York.

Q: What is the Solar Energy System Equipment Credit?

A: The Solar Energy System Equipment Credit is a tax credit available to individuals and businesses in New York who install qualifying solar energy systems.

Q: Who is eligible to claim the Solar Energy System Equipment Credit?

A: Individuals and businesses in New York who install qualifying solar energy systems are eligible to claim this credit.

Q: What type of solar energy systems qualify for the credit?

A: Qualified solar energy systems include solar electric systems and solar thermal systems.

Q: How much is the credit?

A: The credit is equal to 25% of the eligible expenditures made to install the solar energy system, up to a maximum credit of $5,000 per system.

Q: How do I claim the credit?

A: To claim the credit, you need to complete and file Form IT-255 with your New York State income tax return.

Q: Are there any limitations or restrictions on the credit?

A: Yes, there are certain limitations and restrictions, such as a cap on the total amount of credits that can be claimed in a single year and a requirement to reduce other allowable credits before claiming this credit.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-255 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.