This version of the form is not currently in use and is provided for reference only. Download this version of

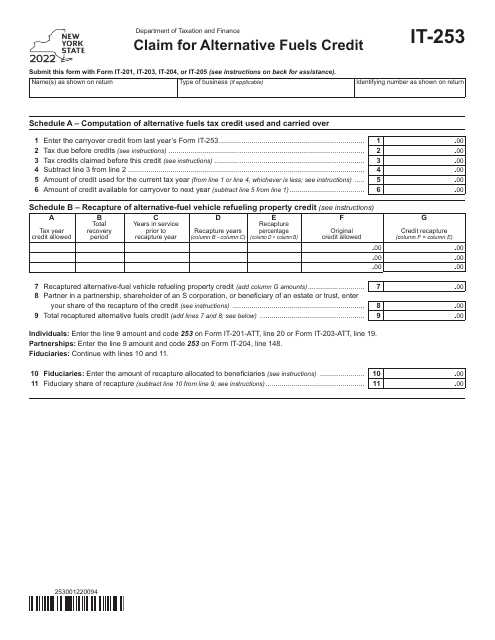

Form IT-253

for the current year.

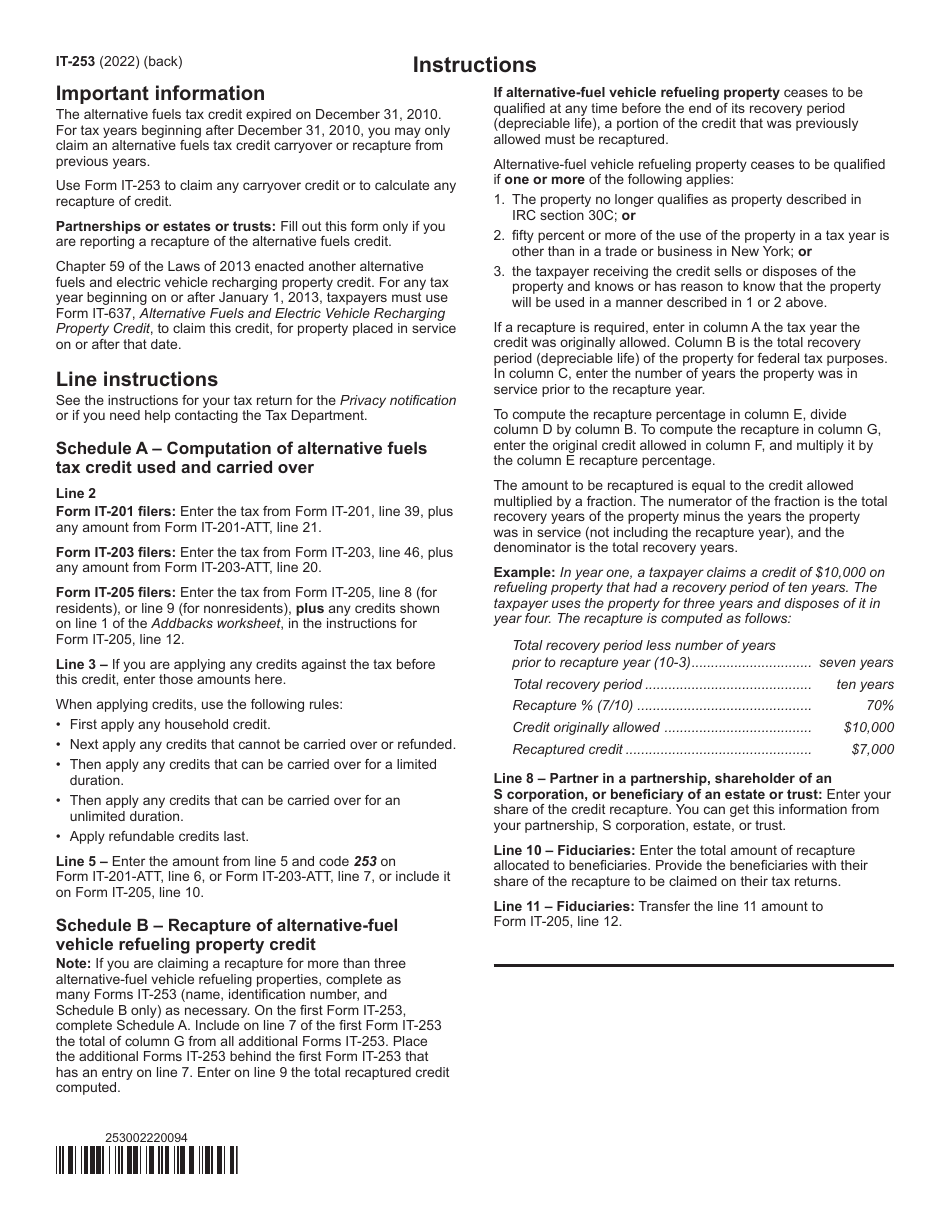

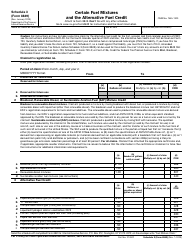

Form IT-253 Claim for Alternative Fuels Credit - New York

What Is Form IT-253?

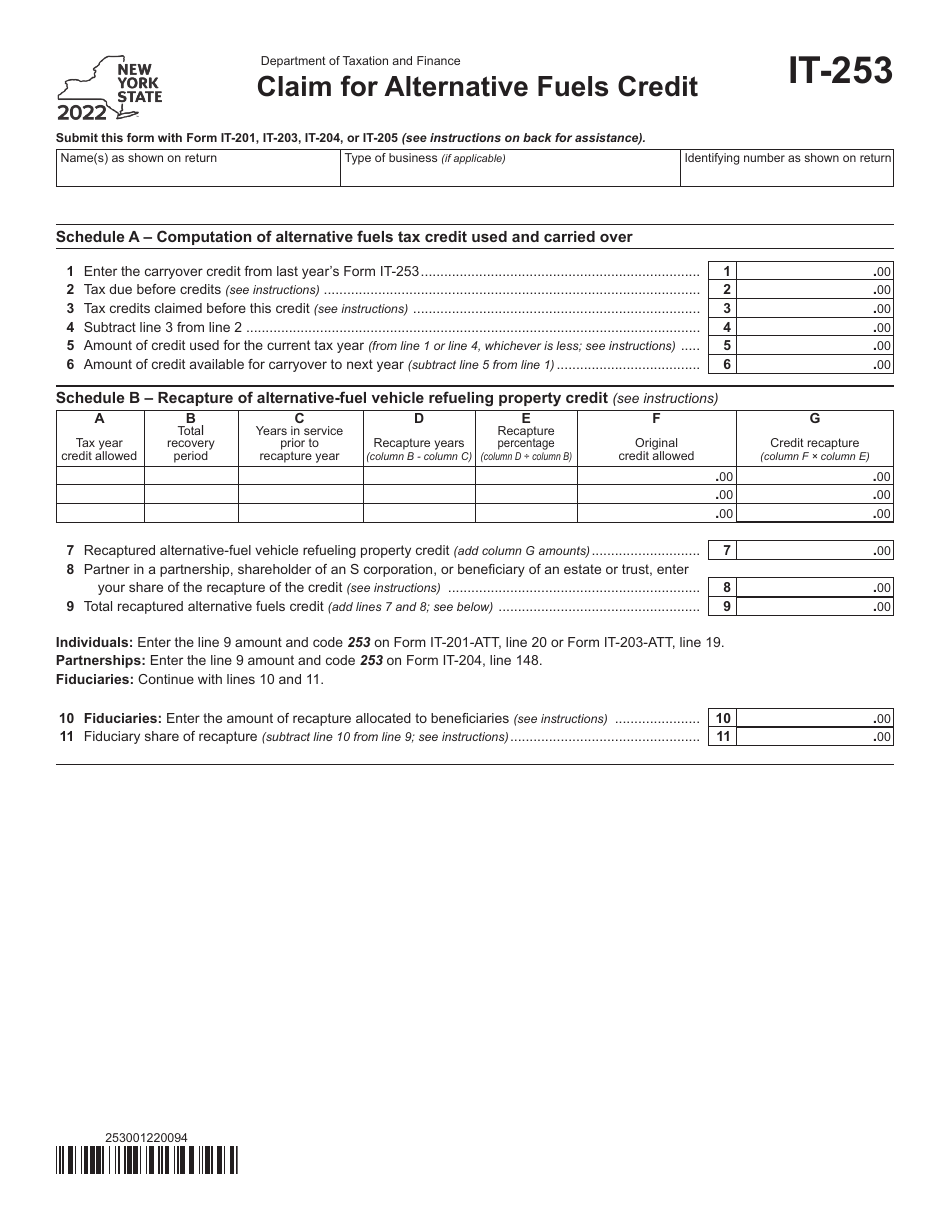

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-253?

A: Form IT-253 is the Claim for Alternative Fuels Credit form in New York.

Q: What is the Alternative Fuels Credit?

A: The Alternative Fuels Credit is a tax credit available to individuals or businesses in New York that used alternative fuels in their vehicles or equipment.

Q: Who can file Form IT-253?

A: Individuals or businesses who used alternative fuels in New York can file Form IT-253 to claim the Alternative Fuels Credit.

Q: What types of alternative fuels are eligible for the credit?

A: Alternative fuels such as compressed natural gas, liquefied natural gas, and hydrogen are eligible for the Alternative Fuels Credit.

Q: What information is required on Form IT-253?

A: Form IT-253 requires information about the taxpayer's alternative fuel usage, including the type and amount of fuel used.

Q: Is there a deadline for filing Form IT-253?

A: Yes, Form IT-253 must be filed by the due date of the taxpayer's New York State income tax return.

Q: Can I claim the Alternative Fuels Credit if I used alternative fuels in a vehicle that I leased?

A: No, only the owner of the vehicle can claim the Alternative Fuels Credit.

Q: Is the Alternative Fuels Credit refundable?

A: No, the Alternative Fuels Credit is not refundable, but it can be carried forward for up to 15 years to offset future tax liabilities.

Q: Are there any other requirements or limitations for claiming the Alternative Fuels Credit?

A: Yes, there may be additional requirements or limitations depending on the specific circumstances of the taxpayer. It is recommended to consult with a tax professional or refer to the instructions for Form IT-253.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-253 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.