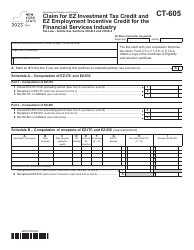

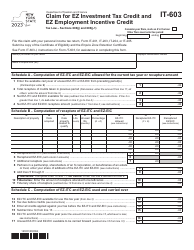

This version of the form is not currently in use and is provided for reference only. Download this version of

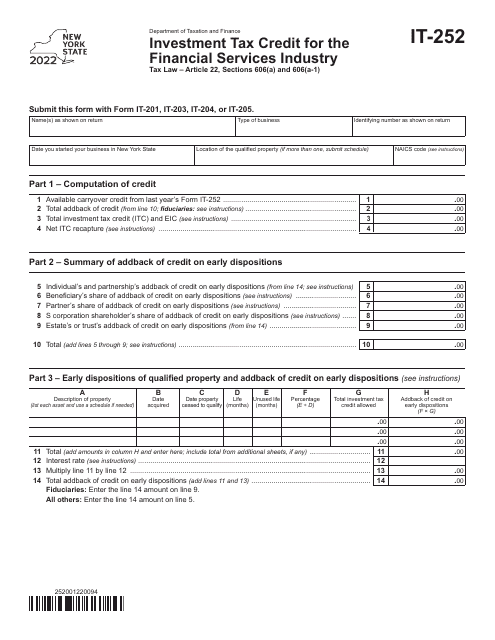

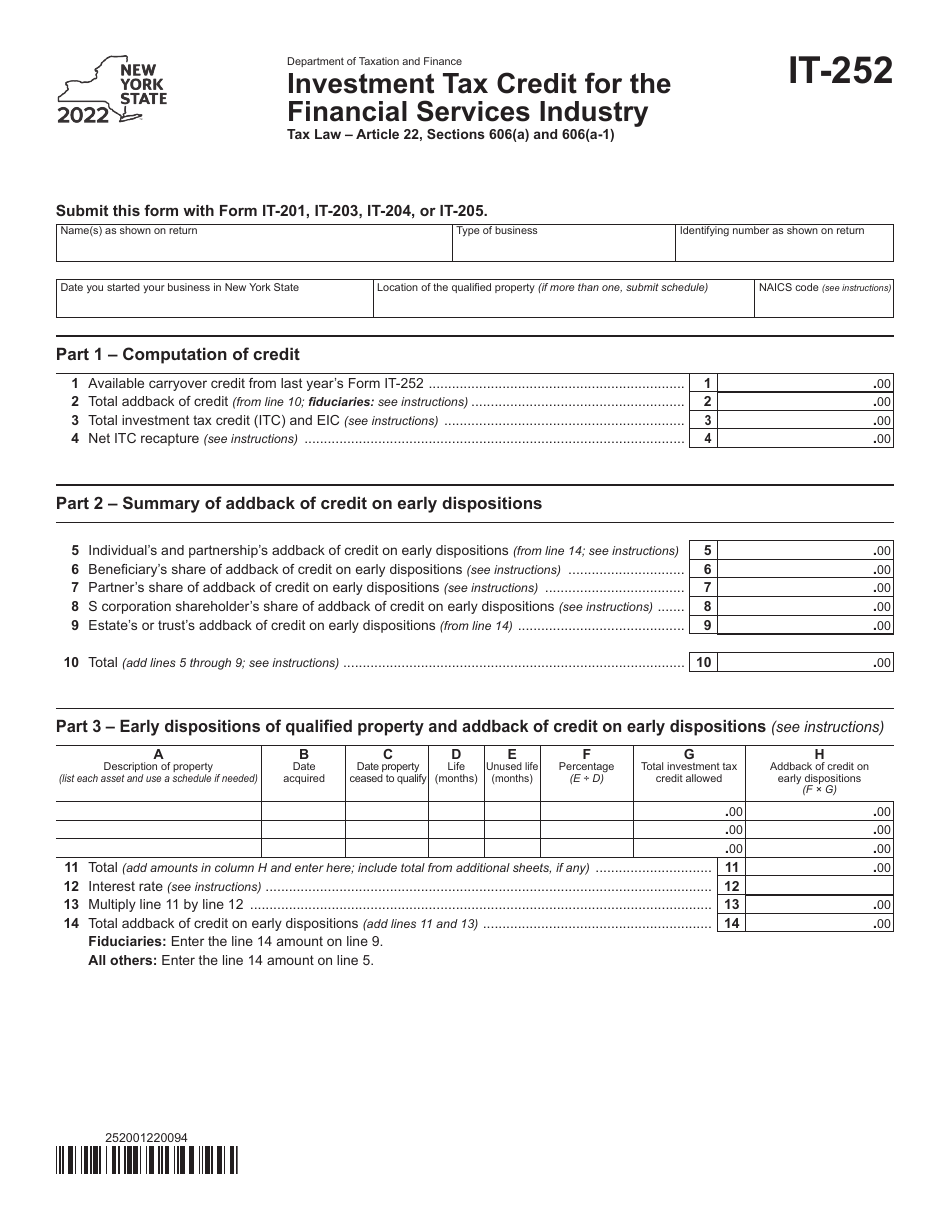

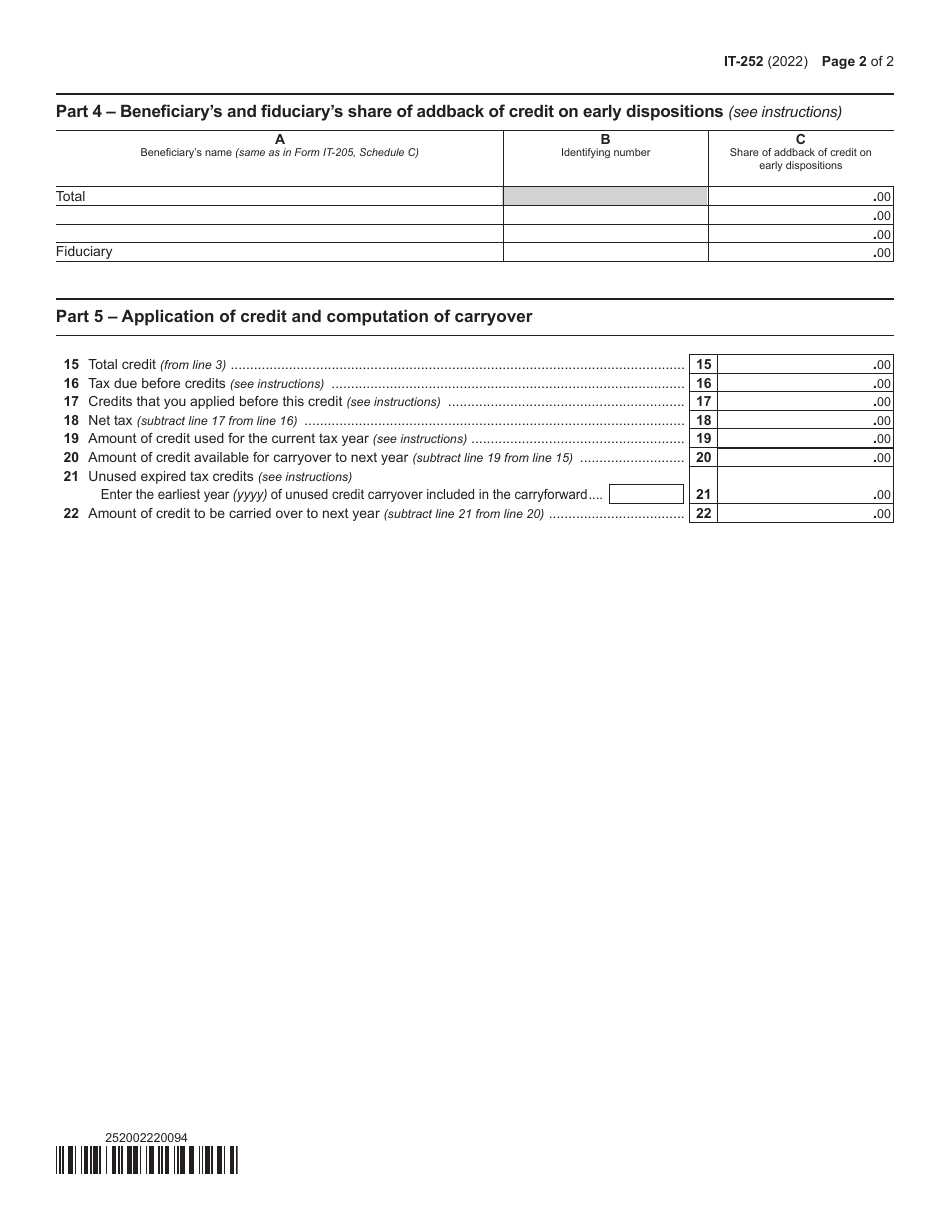

Form IT-252

for the current year.

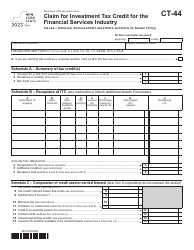

Form IT-252 Investment Tax Credit for the Financial Services Industry - New York

What Is Form IT-252?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-252?

A: Form IT-252 is the Investment Tax Credit form specifically designed for the Financial Services Industry in New York.

Q: What is the Investment Tax Credit?

A: The Investment Tax Credit is a tax credit that allows businesses to offset a portion of the cost of qualifying investments in qualified property.

Q: Who is eligible to use Form IT-252?

A: Financial services businesses operating in New York may be eligible to use Form IT-252 if they have made qualifying investments in qualified property.

Q: What is qualified property?

A: Qualified property refers to tangible property used predominantly in the operation of a qualified financial services business.

Q: What expenses can be claimed on Form IT-252?

A: Qualifying expenses that can be claimed on Form IT-252 include the cost of acquiring, constructing, or improving qualified property.

Q: What is the benefit of using Form IT-252?

A: By using Form IT-252, financial services businesses in New York can claim tax credits and reduce their tax liability.

Q: Are there any deadlines for filing Form IT-252?

A: Yes, financial services businesses must file Form IT-252 along with their New York State income tax return by the prescribed deadline.

Q: Can I claim the Investment Tax Credit for expenses incurred in a previous year?

A: Yes, financial services businesses can carry forward any unused Investment Tax Credit to future tax years.

Q: Are there any limitations on the amount of Investment Tax Credit that can be claimed?

A: Yes, there are limitations on the amount of Investment Tax Credit that can be claimed, including a maximum credit amount and a limit based on the taxpayer's alternative minimum tax liability.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-252 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.