This version of the form is not currently in use and is provided for reference only. Download this version of

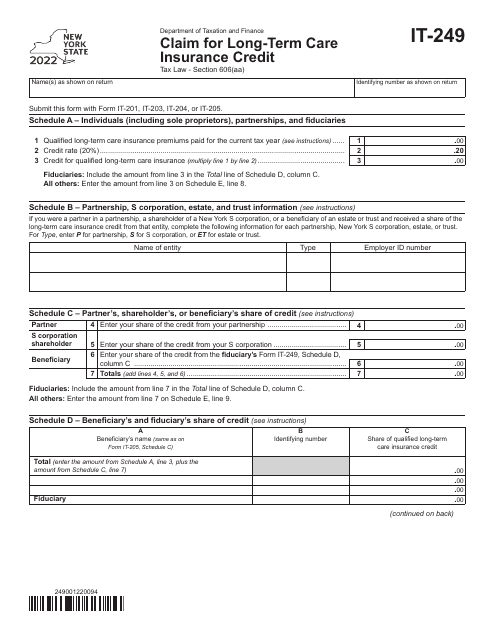

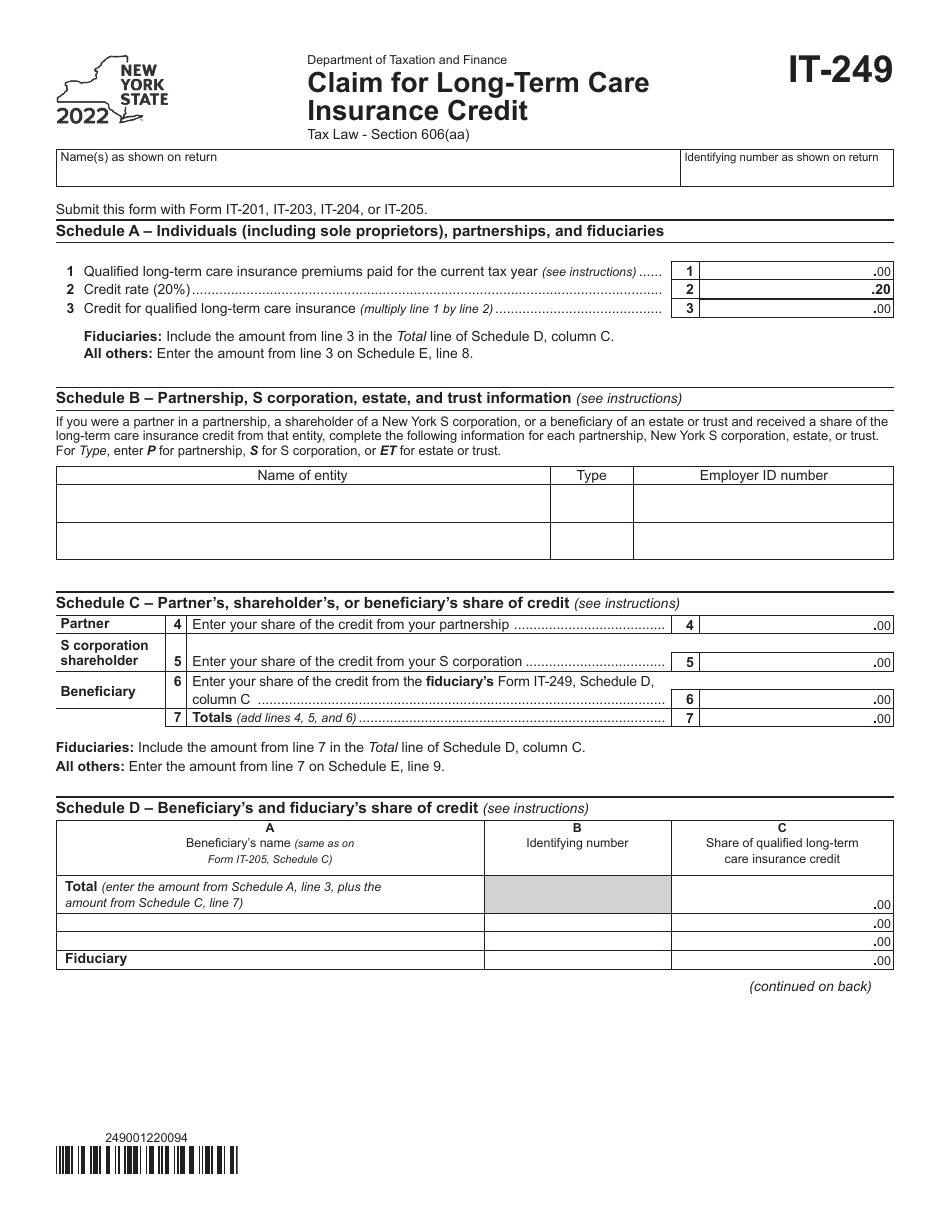

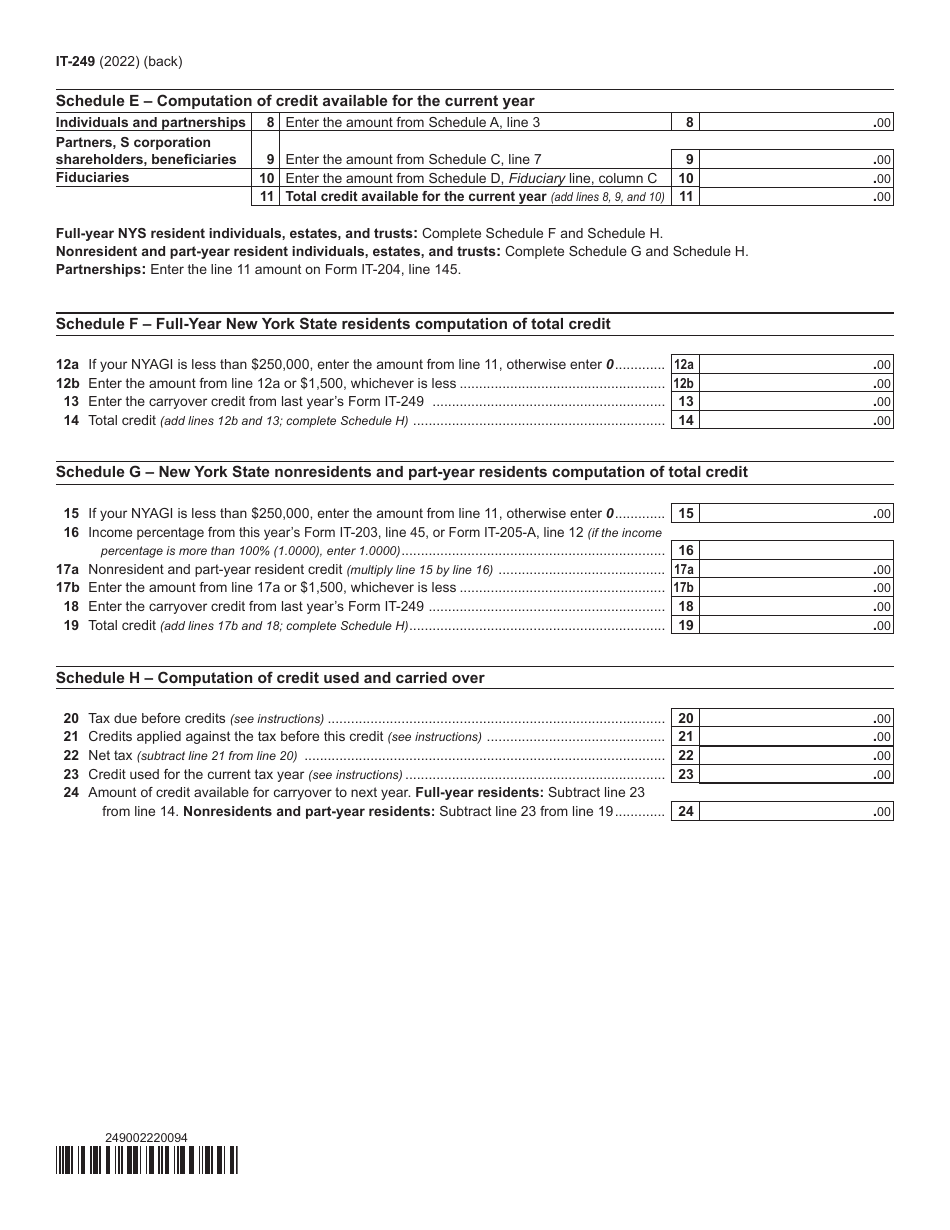

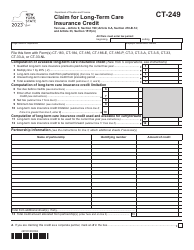

Form IT-249

for the current year.

Form IT-249 Claim for Long-Term Care Insurance Credit - New York

What Is Form IT-249?

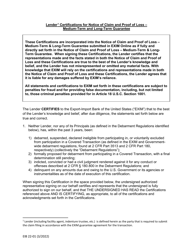

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is IT-249?

A: IT-249 is the form for claiming the Long-Term Care Insurance Credit in New York.

Q: What is the Long-Term Care Insurance Credit?

A: The Long-Term Care Insurance Credit is a tax credit offered in New York for qualifying long-term care insurance premiums.

Q: Who is eligible to claim the Long-Term Care Insurance Credit?

A: New York residents who have qualifying long-term care insurance policies are eligible to claim the credit.

Q: What is considered a qualifying long-term care insurance policy?

A: A qualifying long-term care insurance policy is one that meets the criteria set by the New York State Department of Financial Services.

Q: How do I claim the Long-Term Care Insurance Credit?

A: You can claim the credit by completing Form IT-249 and including it with your New York state income tax return.

Q: Is there a limit to how much credit I can claim?

A: Yes, the credit is limited to $2,050 per taxpayer.

Q: Can I claim the Long-Term Care Insurance Credit if I itemize deductions?

A: Yes, you can claim the credit even if you itemize deductions on your New York state income tax return.

Q: Are there any other requirements to claim the Long-Term Care Insurance Credit?

A: Yes, you must meet certain income requirements to be eligible for the credit. Refer to the instructions for Form IT-249 for more details.

Q: When is the deadline for filing Form IT-249?

A: The deadline for filing Form IT-249 is the same as the deadline for filing your New York state income tax return, which is usually April 15th.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-249 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.