This version of the form is not currently in use and is provided for reference only. Download this version of

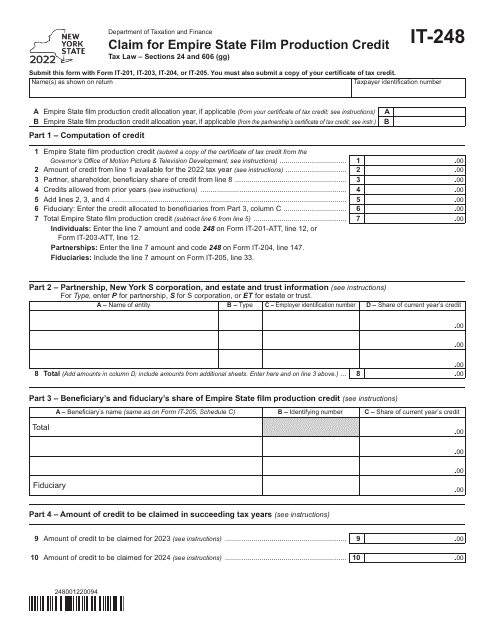

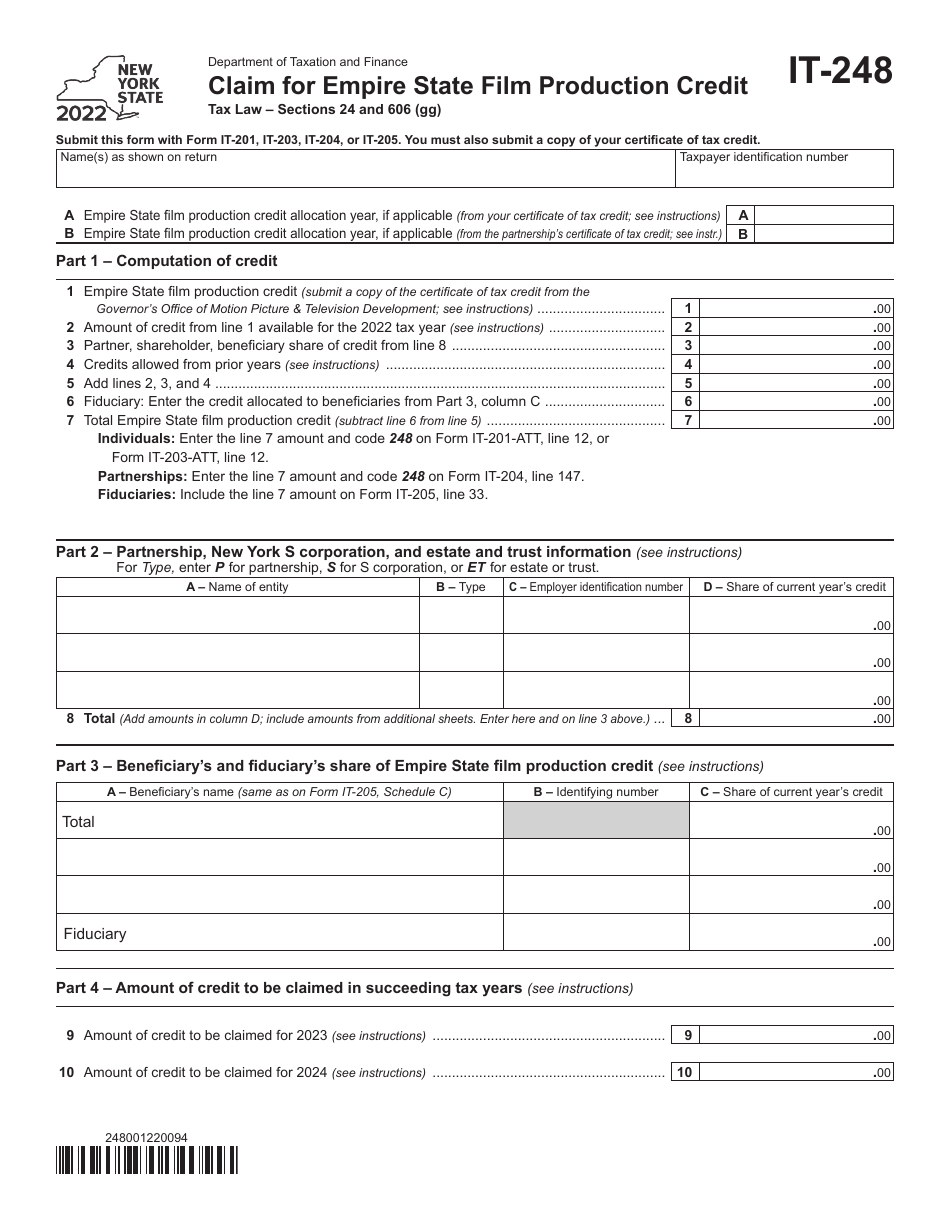

Form IT-248

for the current year.

Form IT-248 Claim for Empire State Film Production Credit - New York

What Is Form IT-248?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-248?

A: Form IT-248 is the Claim for Empire State FilmProduction Credit in New York.

Q: What is the purpose of Form IT-248?

A: The purpose of Form IT-248 is to claim the Empire State Film Production Credit in New York.

Q: Who is eligible to use Form IT-248?

A: Film production companies that qualify for the Empire State Film Production Credit in New York are eligible to use Form IT-248.

Q: What is the Empire State Film Production Credit?

A: The Empire State Film Production Credit is a tax credit available to eligible film production companies in New York.

Q: How do I file Form IT-248?

A: Form IT-248 can be filed electronically or by mail to the New York State Department of Taxation and Finance.

Q: What documents are required to be submitted with Form IT-248?

A: The required documents may include copies of contracts, budgets, and schedules, as well as documentation related to qualified New York State production costs.

Q: What is the deadline for filing Form IT-248?

A: Form IT-248 must be filed within one year from the end of the tax year in which the qualified production costs were incurred.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-248 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.