This version of the form is not currently in use and is provided for reference only. Download this version of

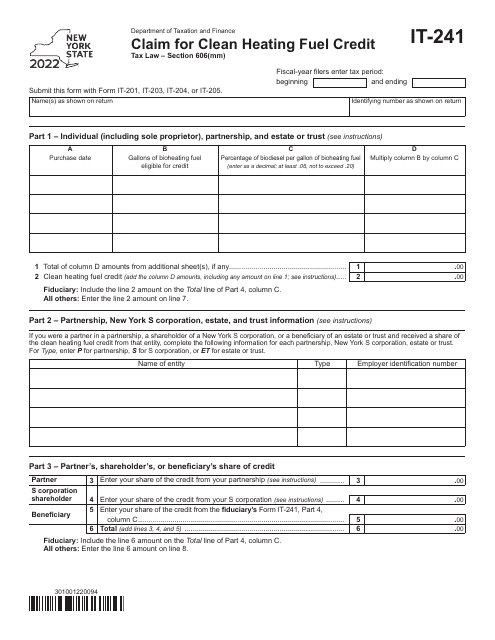

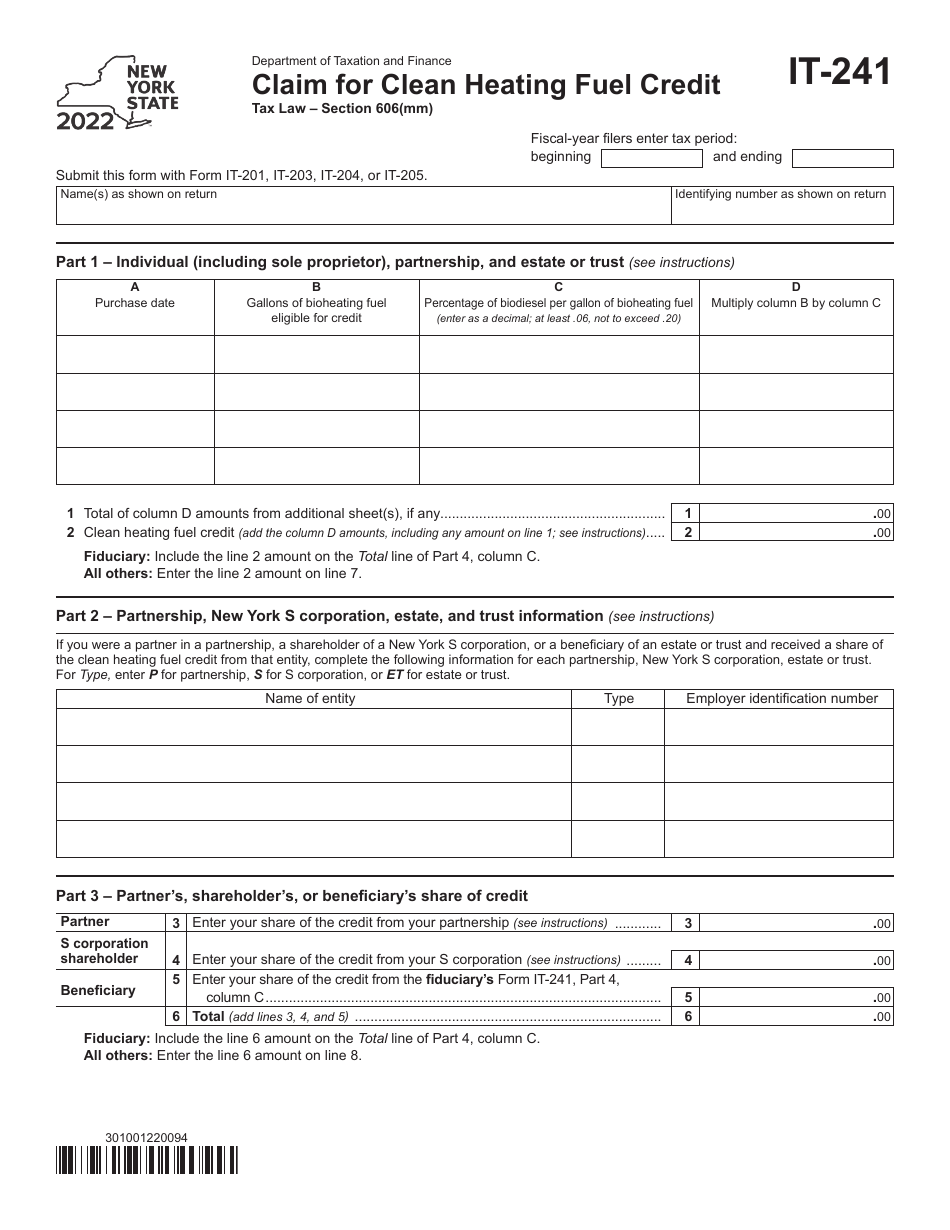

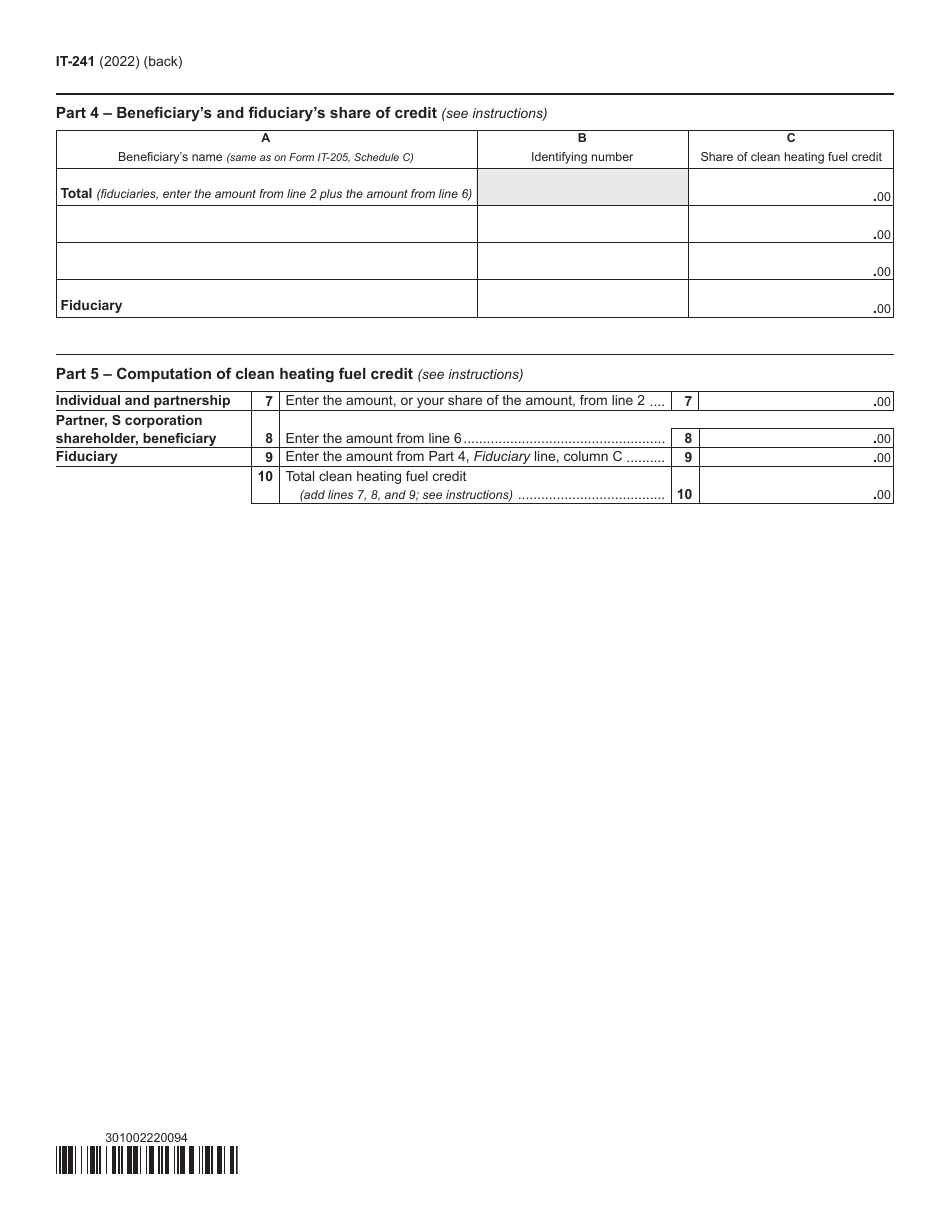

Form IT-241

for the current year.

Form IT-241 Claim for Clean Heating Fuel Credit - New York

What Is Form IT-241?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: Who is eligible to claim the Clean Heating Fuel Credit?

A: New York residents who use eligible clean heating fuels in their primary residences.

Q: What fuels are eligible for the Clean Heating Fuel Credit?

A: Eligible clean heating fuels include biodiesel and natural gas.

Q: How much is the Clean Heating Fuel Credit?

A: The credit is $0.01 per gallon of eligible clean heating fuel used.

Q: How can I claim the Clean Heating Fuel Credit?

A: You can claim the credit by filing Form IT-241 with your New York income tax return.

Q: Is there a maximum credit amount?

A: Yes, the maximum credit amount is $700.

Q: Can I claim the credit for fuel used to heat a rental property?

A: No, the credit is only available for fuels used in your primary residence.

Q: Do I need to keep records of my fuel purchases?

A: Yes, you should keep records of your fuel purchases in case of an audit.

Q: What is the deadline to claim the Clean Heating Fuel Credit?

A: You must claim the credit by the due date of your New York income tax return.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-241 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.