This version of the form is not currently in use and is provided for reference only. Download this version of

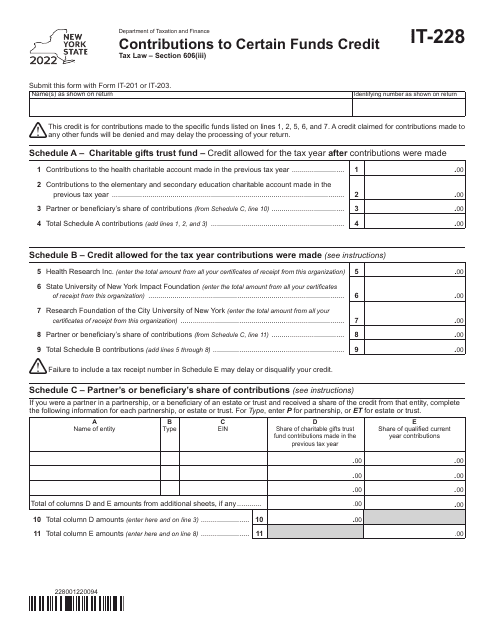

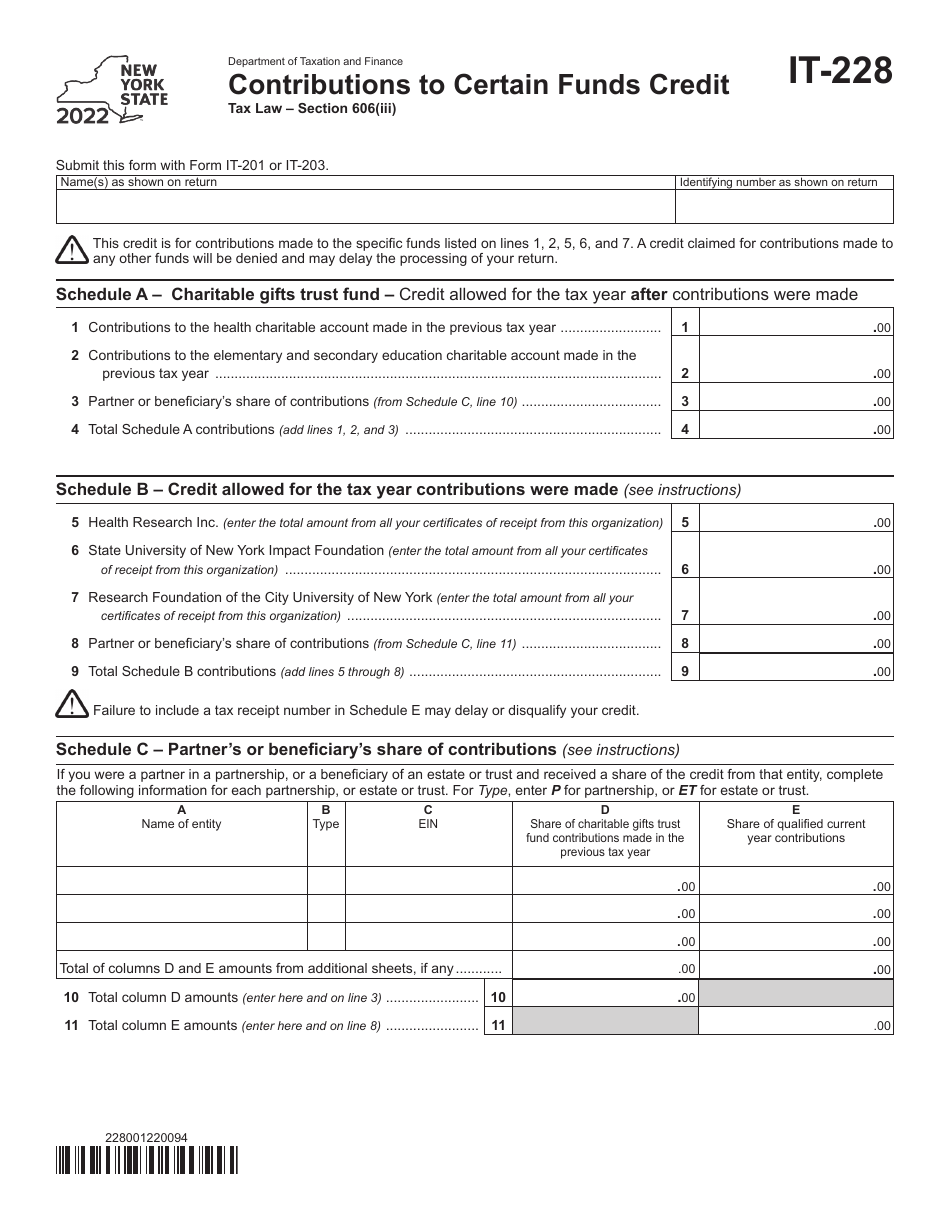

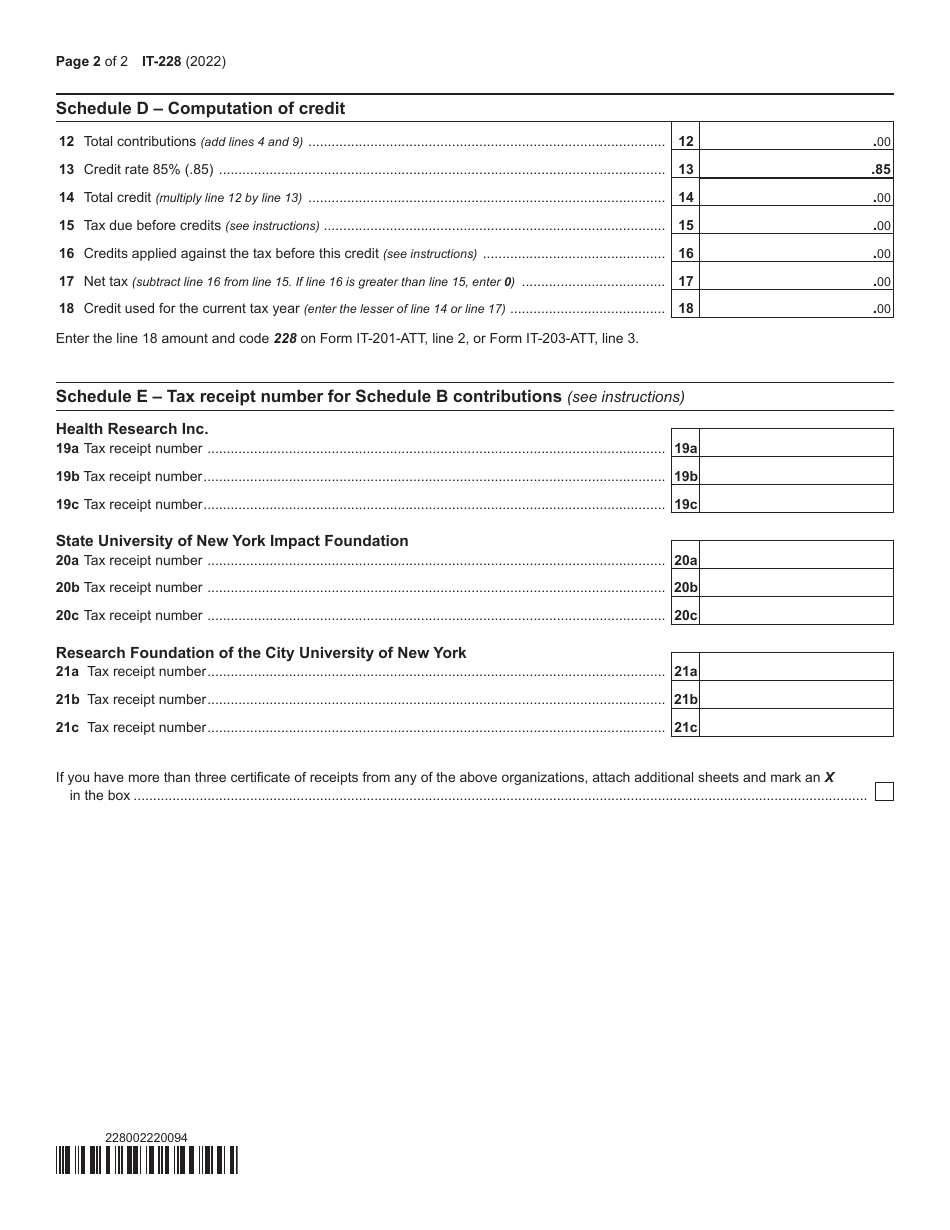

Form IT-228

for the current year.

Form IT-228 Contributions to Certain Funds Credit - New York

What Is Form IT-228?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-228?

A: Form IT-228 is a tax form used in New York to claim the Contributions to Certain Funds Credit.

Q: What is the purpose of Form IT-228?

A: The purpose of Form IT-228 is to allow taxpayers in New York to claim a tax credit for contributions made to certain funds.

Q: Who is eligible to use Form IT-228?

A: Taxpayers in New York who have made contributions to certain funds are eligible to use Form IT-228.

Q: What kinds of contributions are eligible for the Contributions to Certain Funds Credit?

A: Contributions to certain funds, such as the Empire StateDevelopment Fund or the New York State Higher Education Services Corporation, may be eligible for the credit.

Q: How do I fill out Form IT-228?

A: You need to provide information about the contributions you made, including the name of the fund, the amount contributed, and the tax year in which the contribution was made.

Q: When is the deadline to file Form IT-228?

A: The deadline to file Form IT-228 is the same as the deadline for filing your New York state tax return.

Q: What should I do if I have questions about Form IT-228?

A: If you have questions or need assistance with Form IT-228, you can contact the New York State Department of Taxation and Finance for guidance.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-228 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.