This version of the form is not currently in use and is provided for reference only. Download this version of

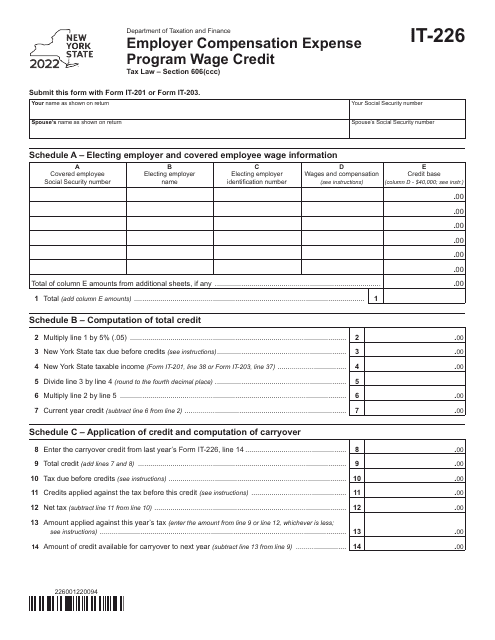

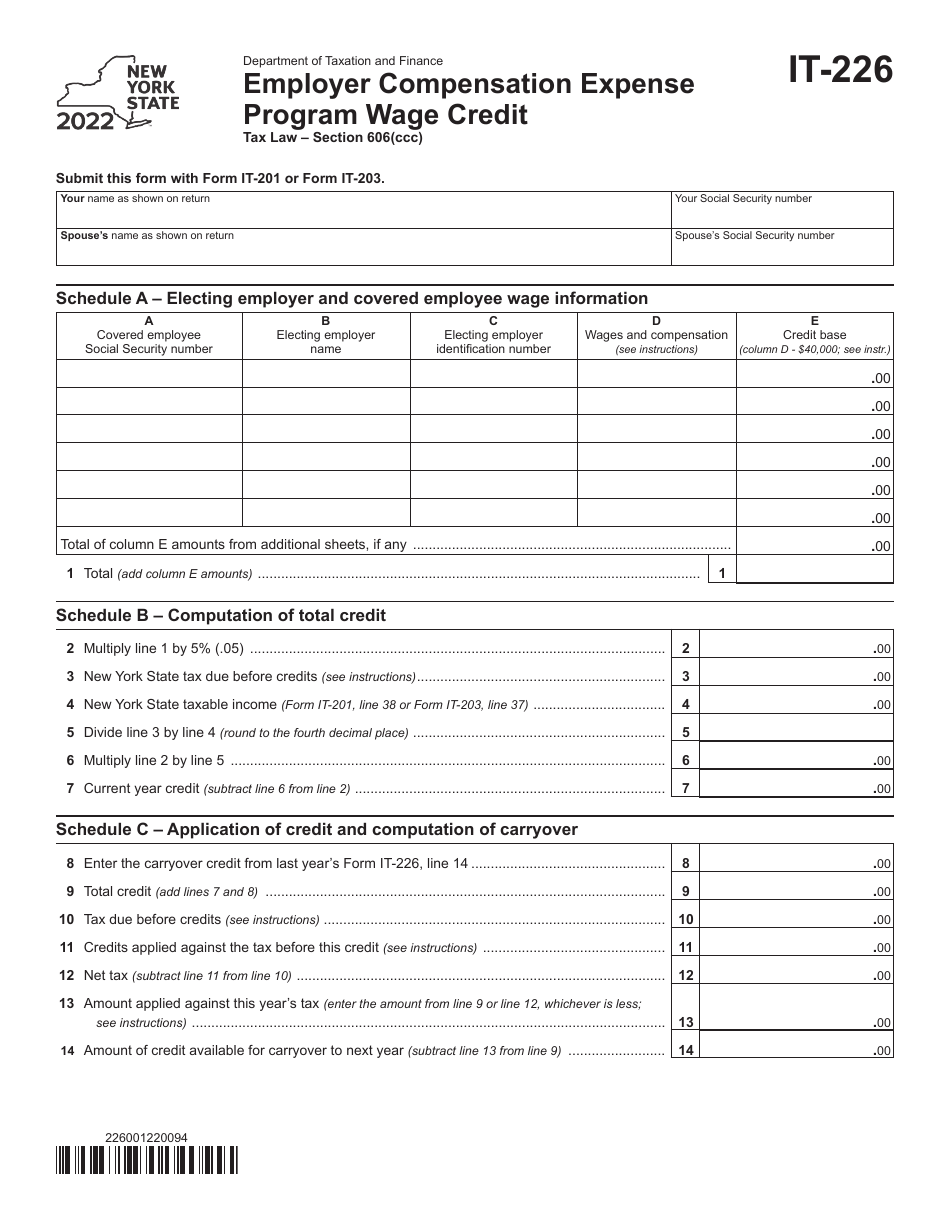

Form IT-226

for the current year.

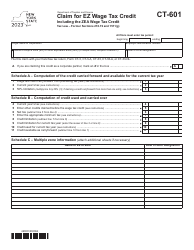

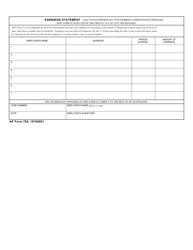

Form IT-226 Employer Compensation Expense Program Wage Credit - New York

What Is Form IT-226?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-226?

A: Form IT-226 is a tax form used in New York for the Employer Compensation Expense Program Wage Credit.

Q: What is the Employer Compensation Expense Program Wage Credit?

A: The Employer Compensation Expense Program Wage Credit is a credit available to qualified employers in New York.

Q: Who is eligible for the Employer Compensation Expense Program Wage Credit?

A: Qualified employers in New York are eligible for the Employer Compensation Expense Program Wage Credit.

Q: How do you claim the Employer Compensation Expense Program Wage Credit?

A: To claim the credit, employers must file Form IT-226 with their New York state tax return.

Q: What is the purpose of the Employer Compensation Expense Program Wage Credit?

A: The credit is designed to help offset the cost of the Employer Compensation Expense Program in New York.

Q: Can self-employed individuals claim the Employer Compensation Expense Program Wage Credit?

A: No, the credit is only available to qualified employers, not self-employed individuals.

Q: Is the Employer Compensation Expense Program Wage Credit refundable?

A: No, the credit is nonrefundable, meaning it can only be used to offset taxes owed.

Q: Are there any limitations on the Employer Compensation Expense Program Wage Credit?

A: Yes, the credit is subject to certain limitations based on the employer's number of employees and qualified wages.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-226 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.