This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-223

for the current year.

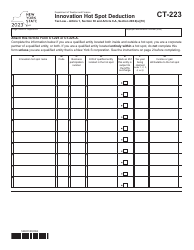

Form IT-223 Innovation Hot Spot Deduction - New York

What Is Form IT-223?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

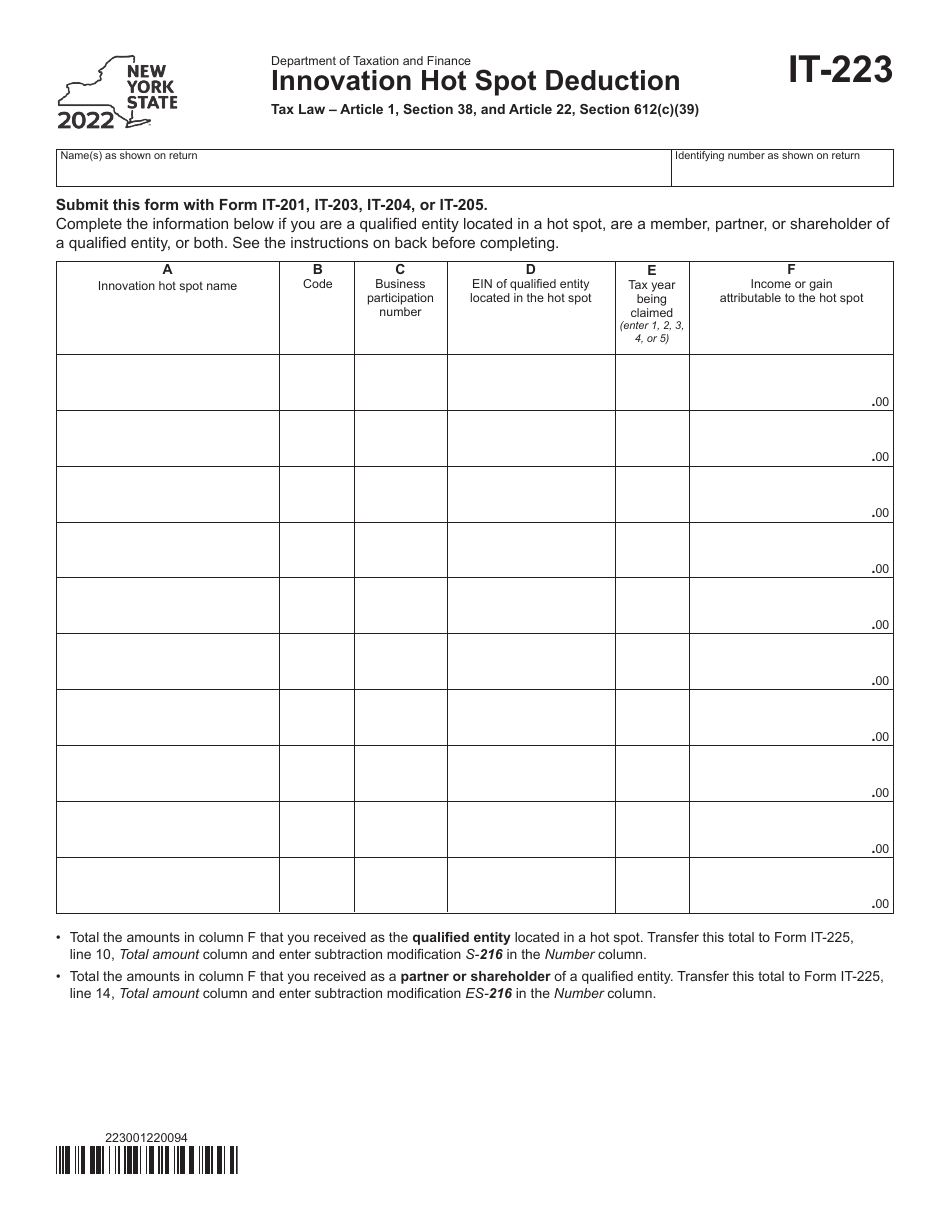

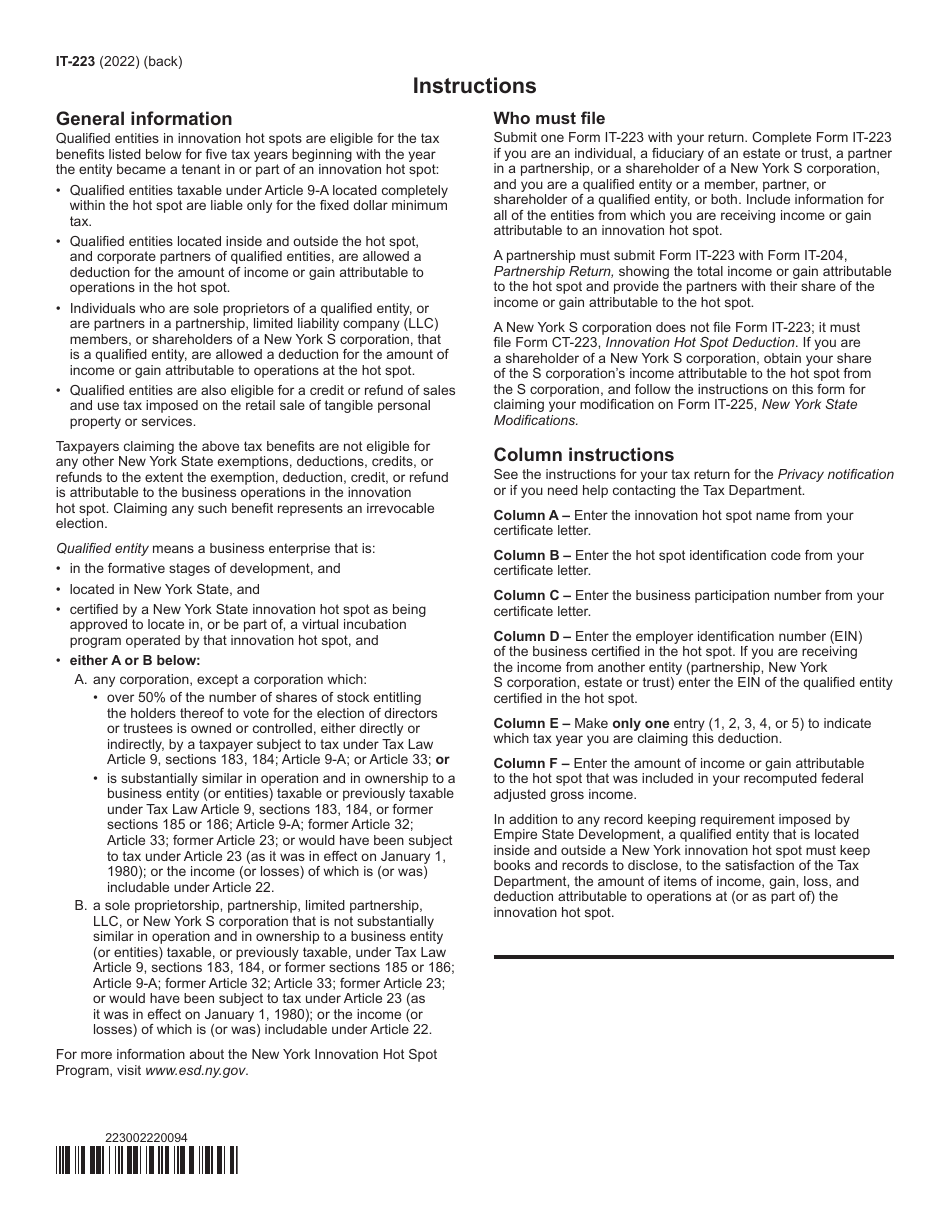

Q: What is the IT-223 Innovation Hot Spot Deduction?

A: The IT-223 Innovation Hot Spot Deduction is a tax deduction available to businesses that operate in designated innovation hot spots in New York.

Q: What is considered an innovation hot spot?

A: An innovation hot spot is a designated area in New York that promotes the growth of innovative businesses and technology startups.

Q: How can I qualify for the IT-223 Innovation Hot Spot Deduction?

A: To qualify for the deduction, your business must be located in a designated innovation hot spot and meet certain criteria specified by the New York State Department of Taxation and Finance.

Q: What expenses can be deducted under the IT-223 Innovation Hot Spot Deduction?

A: Eligible expenses for the deduction may include research and development costs, employee training expenses, and certain capital expenditures related to qualifying business activities.

Q: How much can I deduct with the IT-223 Innovation Hot Spot Deduction?

A: The deduction amount may vary based on the specific rules and regulations set by the New York State Department of Taxation and Finance. It is advisable to consult with a tax professional for accurate information.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-223 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.