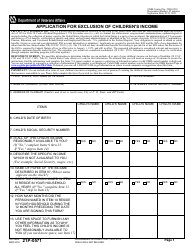

This version of the form is not currently in use and is provided for reference only. Download this version of

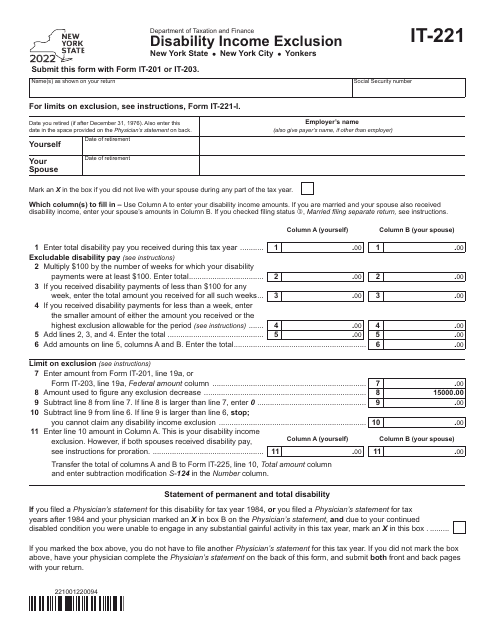

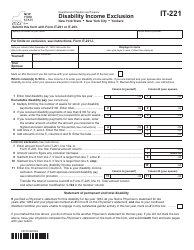

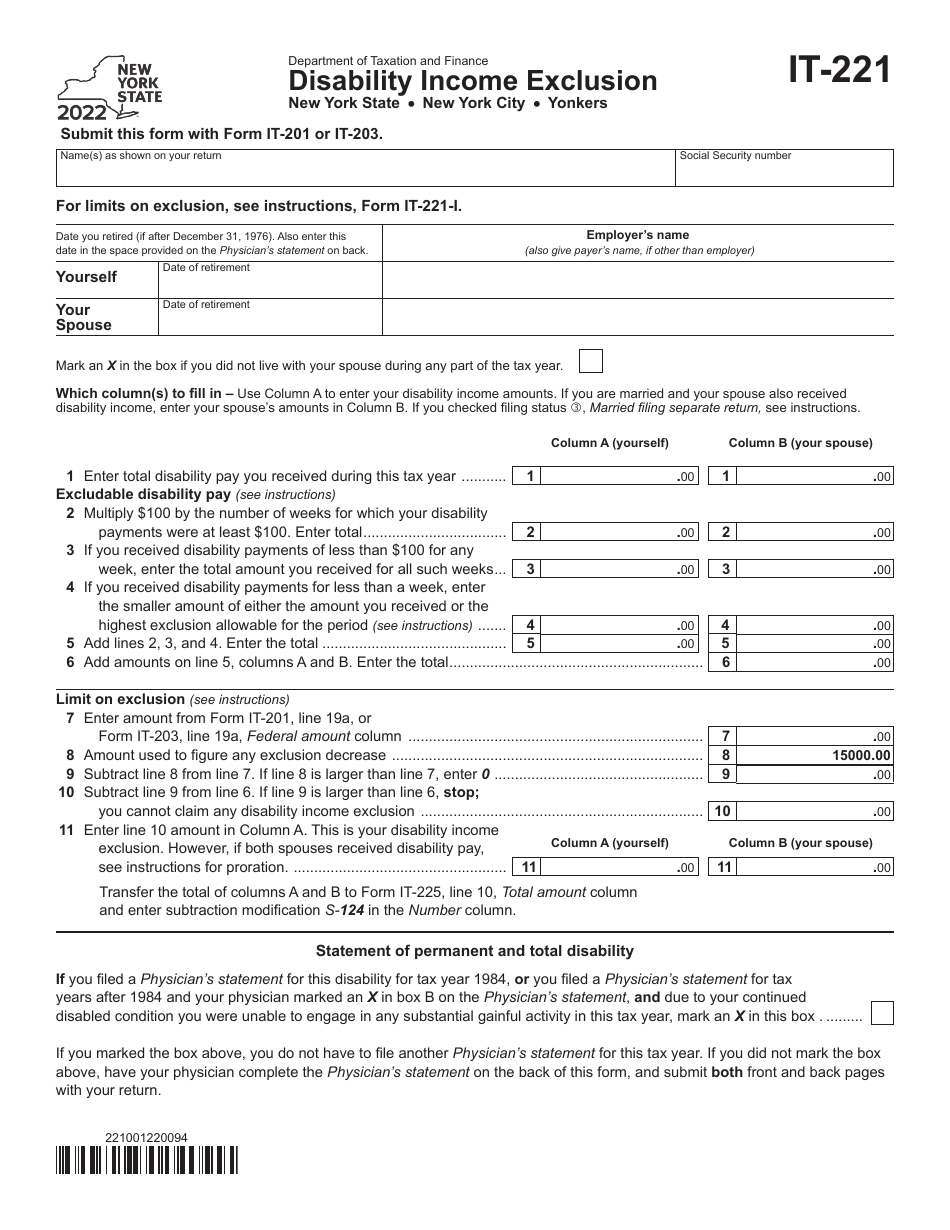

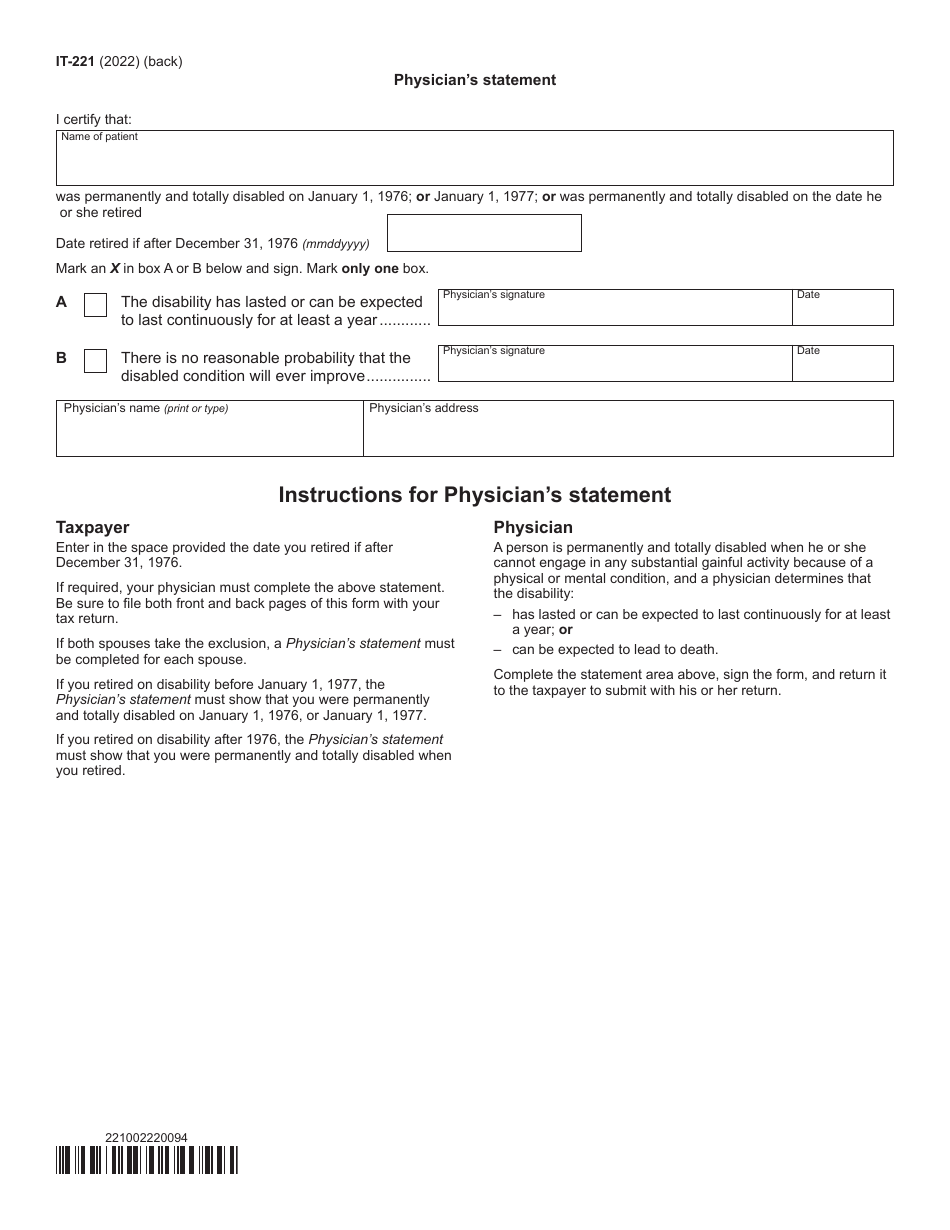

Form IT-221

for the current year.

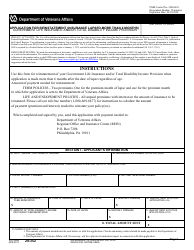

Form IT-221 Disability Income Exclusion - New York

What Is Form IT-221?

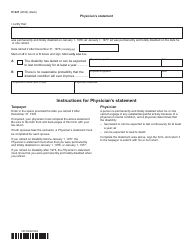

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-221?

A: Form IT-221 is a tax form specific to the state of New York that allows individuals to claim a disability income exclusion.

Q: Who is eligible to use Form IT-221?

A: New York residents who have received disability income and meet certain requirements may be eligible to use Form IT-221.

Q: What is the purpose of Form IT-221?

A: The purpose of Form IT-221 is to exclude a portion of disability income from taxable income, reducing the overall tax liability for eligible individuals.

Q: What type of disability income can be excluded using Form IT-221?

A: Form IT-221 allows for the exclusion of certain disability income, including payments from disability insurance policies or certain retirement plans.

Q: What are the requirements for using Form IT-221?

A: To be eligible to use Form IT-221, you must be a New York resident, have received disability income, and meet certain income limitations and other criteria as outlined in the form's instructions.

Q: How do I file Form IT-221?

A: Form IT-221 can be filed along with your New York state income tax return. The completed form should be attached to your return and submitted to the appropriate tax authority.

Q: Is Form IT-221 only for residents of New York?

A: Yes, Form IT-221 is specifically for residents of New York who have received disability income and meet the eligibility requirements.

Q: What is the deadline for filing Form IT-221?

A: The deadline for filing Form IT-221 is typically the same as the deadline for filing your New York state income tax return, which is usually April 15th of each year.

Q: Can I claim both federal and state disability income exclusions?

A: Yes, in certain cases, you may be able to claim both federal and state disability income exclusions. It is recommended to consult with a tax professional for specific guidance.

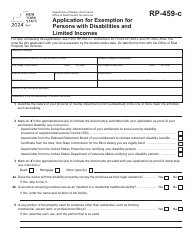

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-221 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.