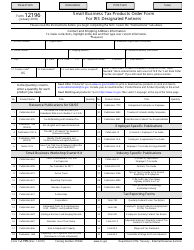

This version of the form is not currently in use and is provided for reference only. Download this version of

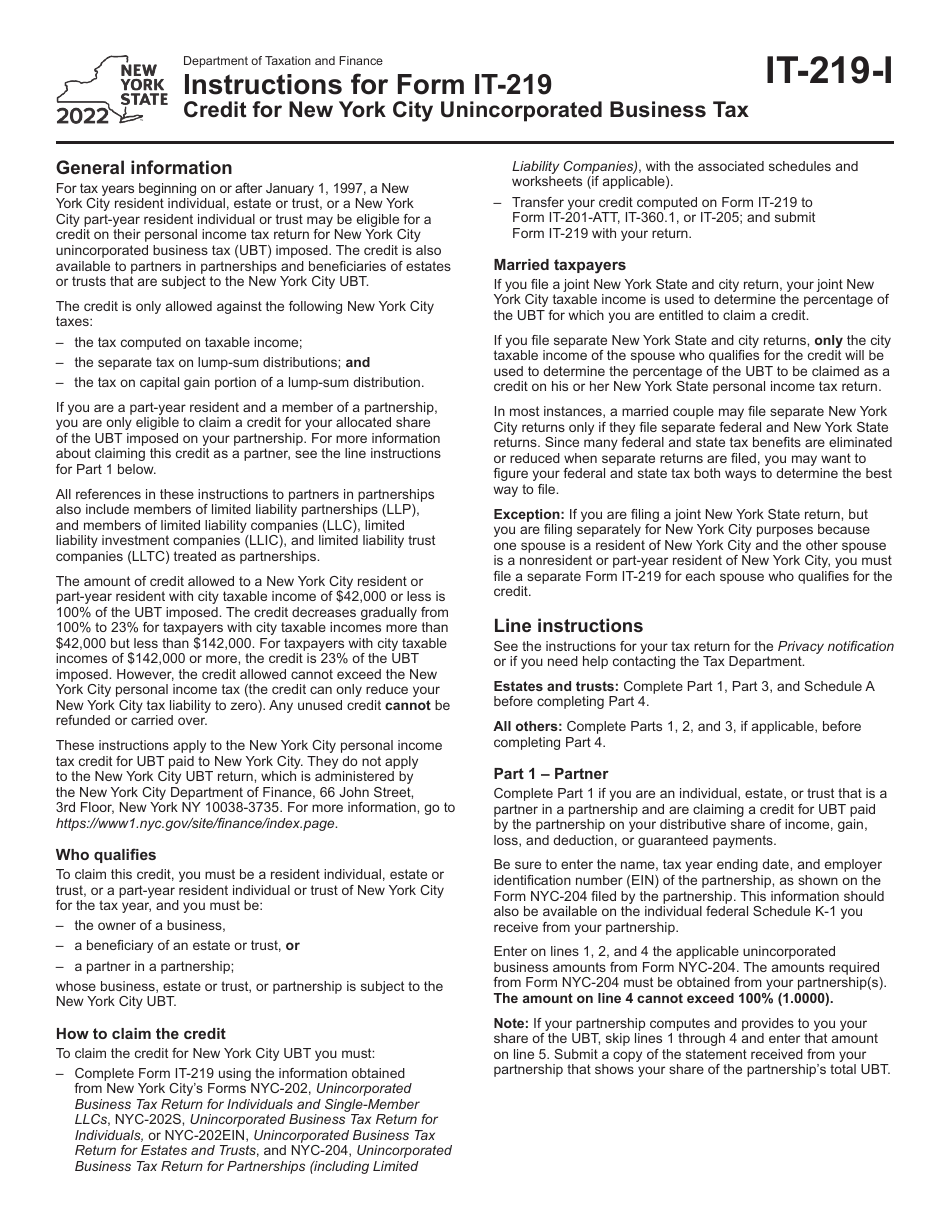

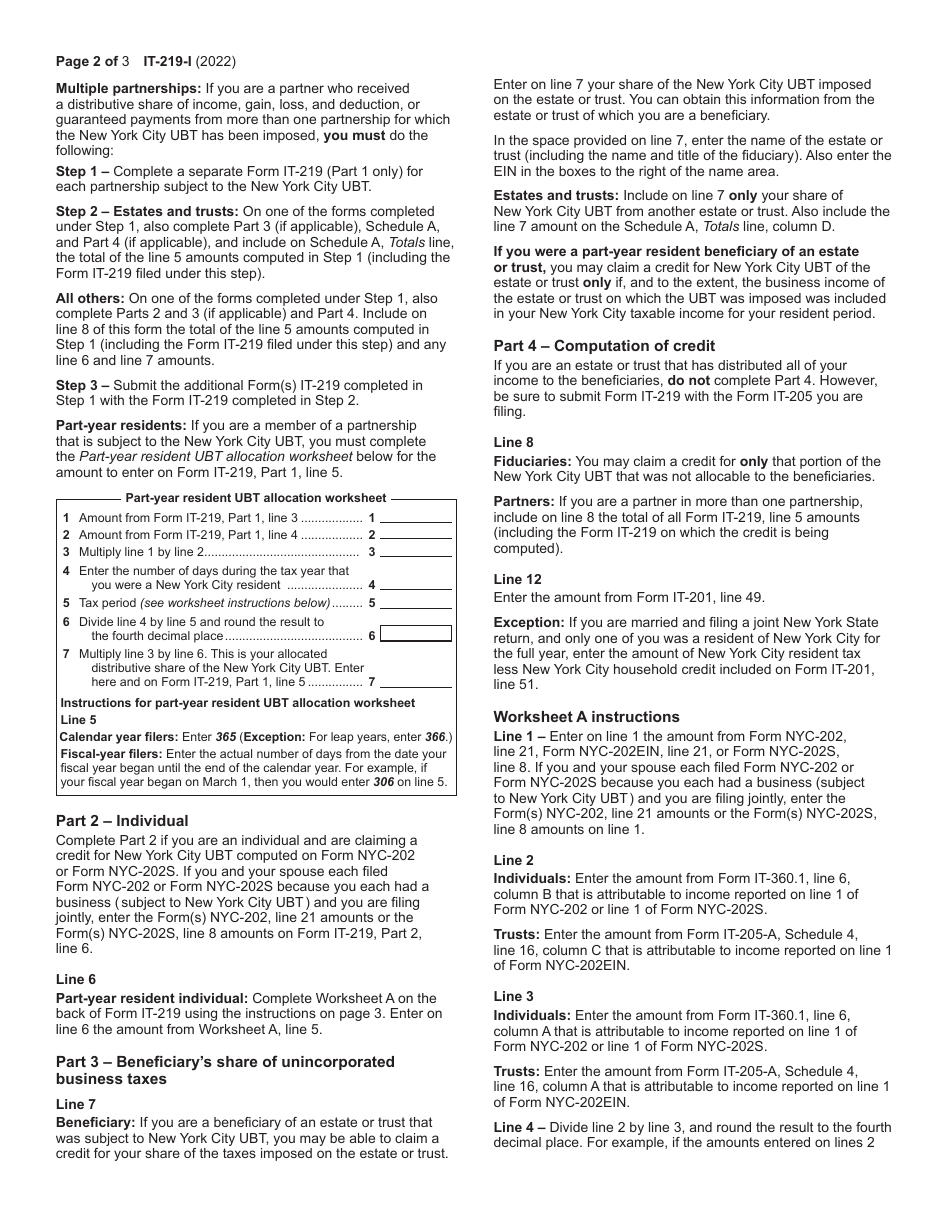

Instructions for Form IT-219

for the current year.

Instructions for Form IT-219 Credit for New York City Unincorporated Business Tax - New York

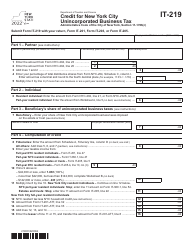

This document contains official instructions for Form IT-219 , Credit for New York City Unincorporated Business Tax - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form IT-219 is available for download through this link.

FAQ

Q: What is Form IT-219?

A: Form IT-219 is a tax form for claiming the Credit for New York City Unincorporated Business Tax.

Q: Who needs to file Form IT-219?

A: Anyone who is eligible and wants to claim the credit for New York City Unincorporated Business Tax should file Form IT-219.

Q: What is the purpose of the Credit for New York City Unincorporated Business Tax?

A: The purpose of the credit is to provide relief to small businesses in New York City.

Q: How can I claim the Credit for New York City Unincorporated Business Tax?

A: You can claim the credit by filling out Form IT-219 and including it with your New York State income tax return.

Q: Are there any requirements to qualify for the credit?

A: Yes, there are several requirements that must be met in order to qualify for the credit. These include having a net income of $250,000 or less, being subject to the New York City unincorporated business tax, and meeting certain business activity and residency requirements.

Q: When is the deadline to file Form IT-219?

A: The deadline to file Form IT-219 is the same as the deadline for filing your New York State income tax return, typically April 15th.

Q: What other documents do I need to include with Form IT-219?

A: You may need to include supporting documents such as copies of your New York City unincorporated business tax returns, profit and loss statements, or other documentation that verifies your eligibility for the credit.

Q: What should I do if I have questions or need help with Form IT-219?

A: If you have questions or need help with Form IT-219, you can contact the New York State Department of Taxation and Finance or consult a tax professional.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.