This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form IT-216

for the current year.

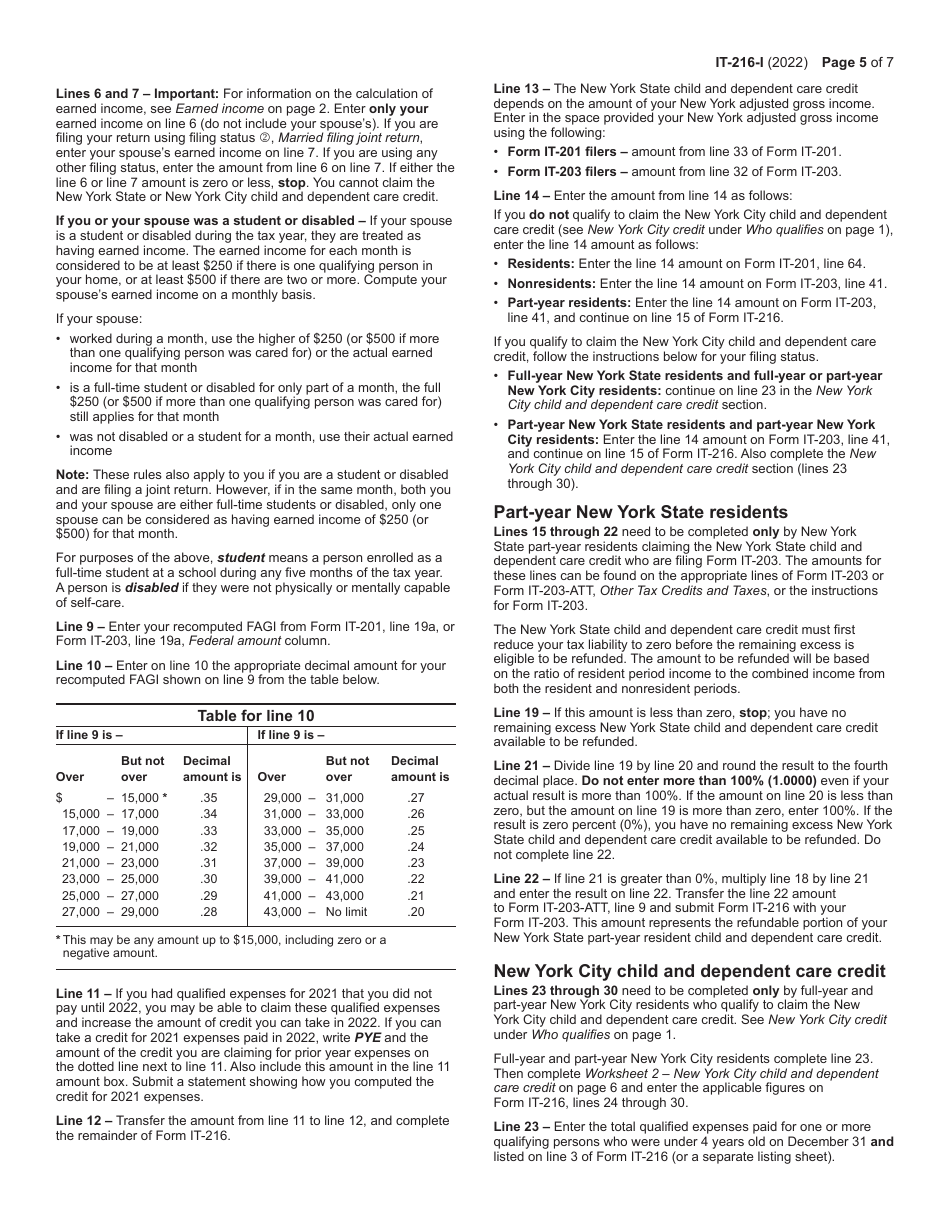

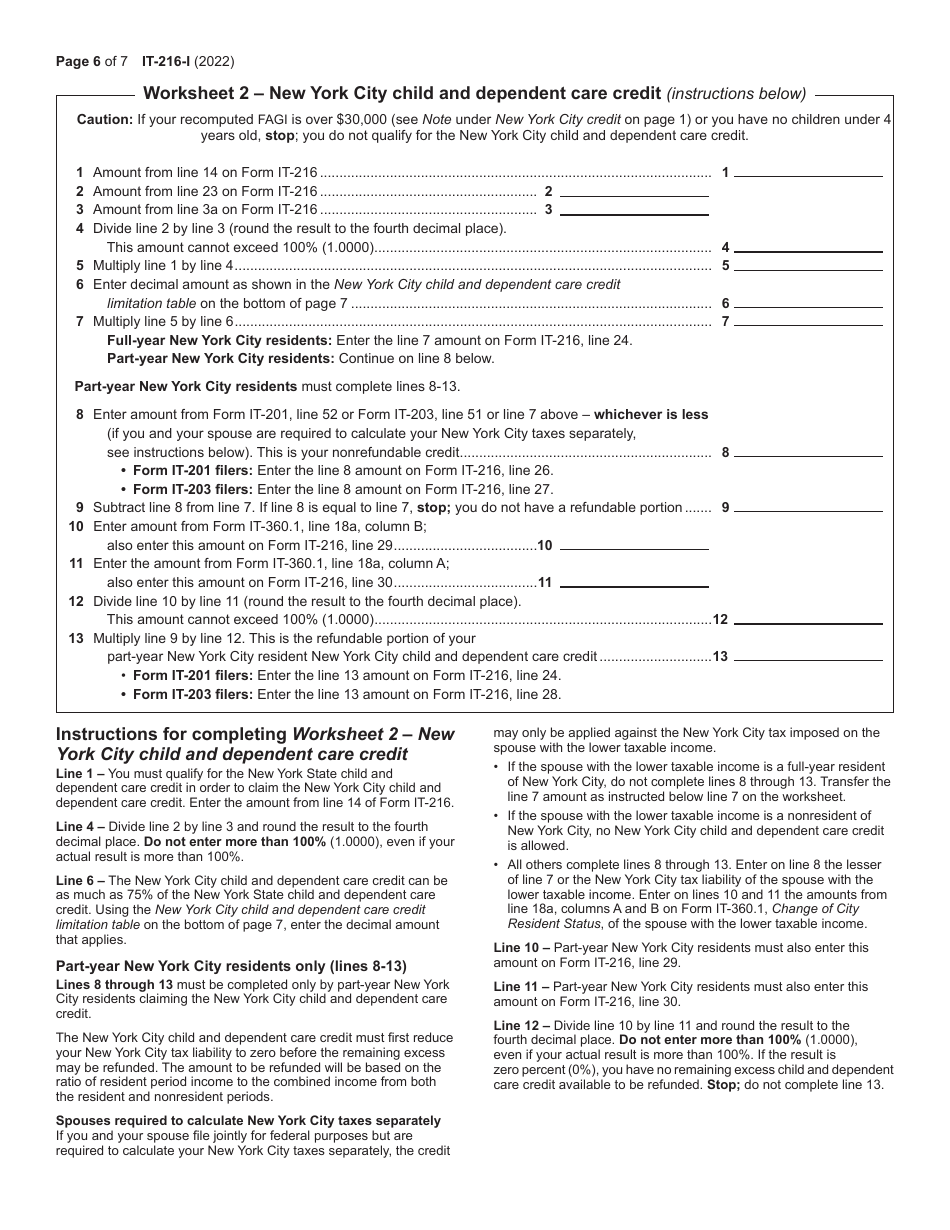

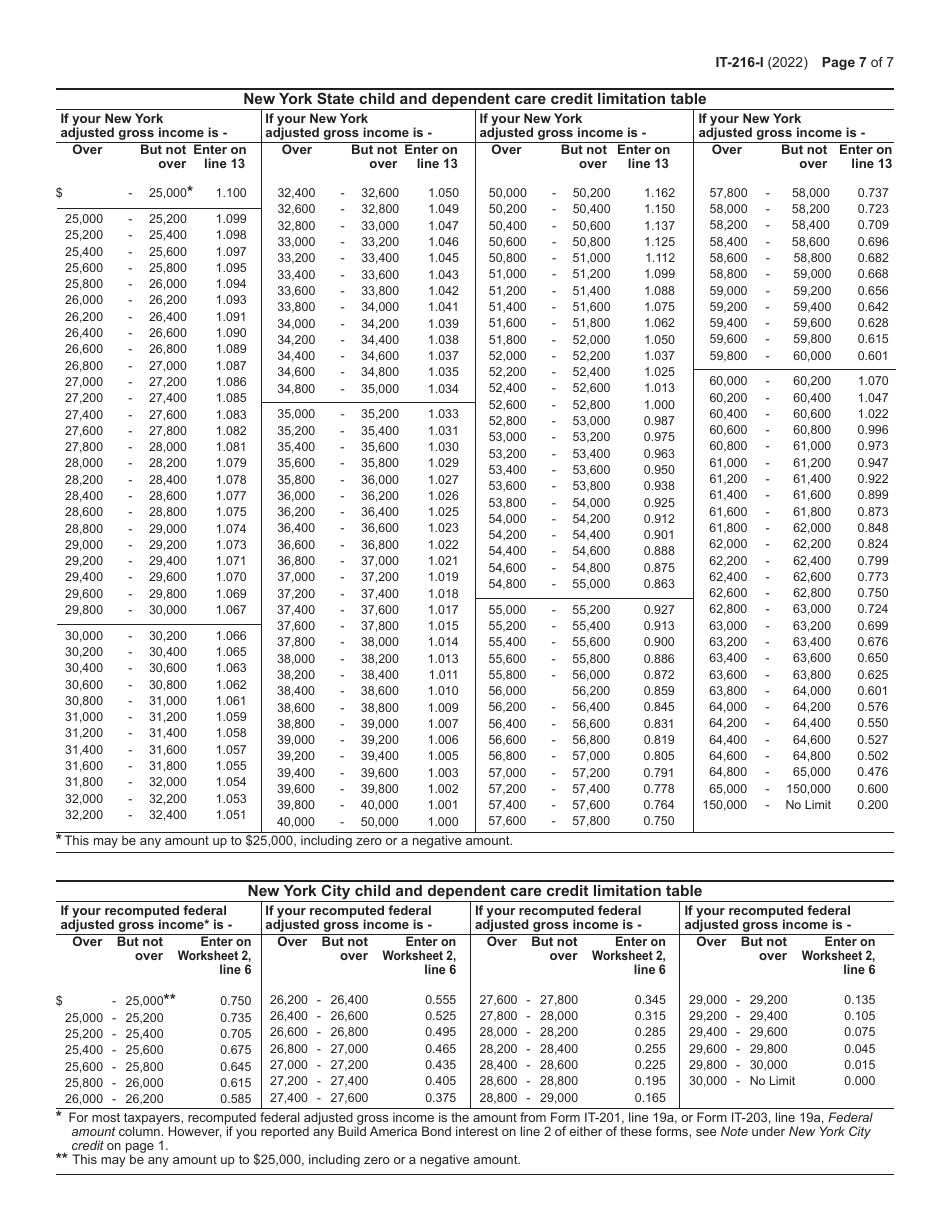

Instructions for Form IT-216 Claim for Child and Dependent Care Credit - New York

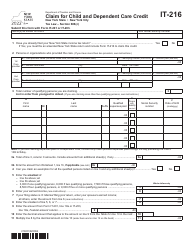

This document contains official instructions for Form IT-216 , Claim for Child and Dependent Care Credit - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form IT-216 is available for download through this link.

FAQ

Q: What is Form IT-216?

A: Form IT-216 is a form used to claim the Child and Dependent Care Credit in New York.

Q: Who can claim the Child and Dependent Care Credit?

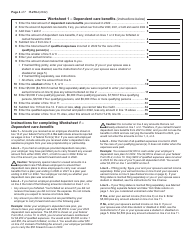

A: Individuals who paid for child or dependent care services in order to work or look for work may be eligible to claim the credit.

Q: What expenses qualify for the Child and Dependent Care Credit?

A: Expenses for child or dependent care services provided while the filer worked or looked for work may qualify, including day care, babysitting, and summer camps.

Q: Is there an income limit to claim the credit?

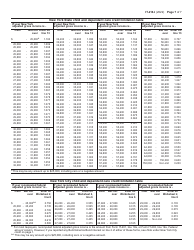

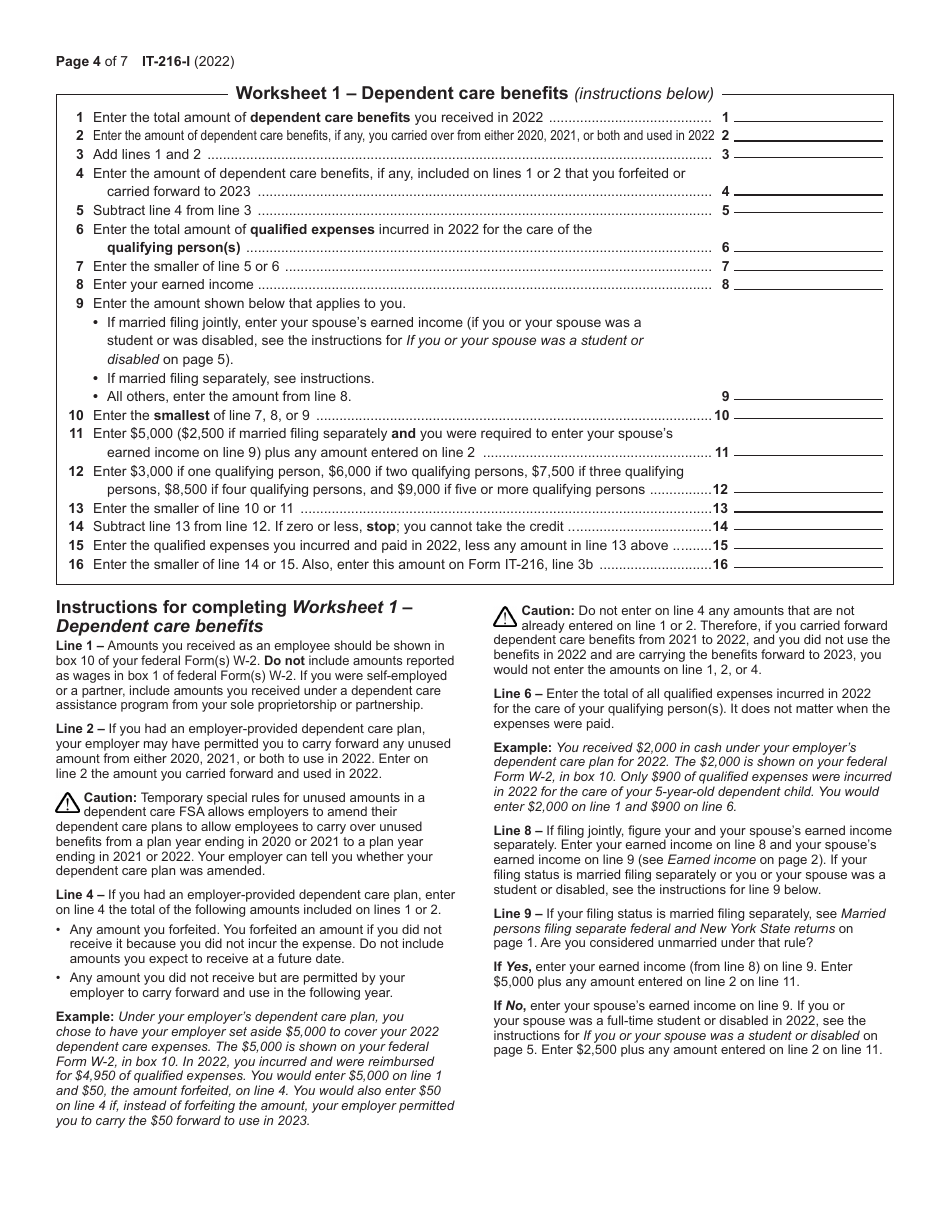

A: Yes, there is an income limit to claim the credit. The limit varies depending on your filing status and number of dependents.

Q: What is the maximum amount that can be claimed for the credit?

A: The maximum amount that can be claimed for the credit is $3,000 for one child/dependent or $6,000 for two or more children/dependents.

Instruction Details:

- This 7-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.