This version of the form is not currently in use and is provided for reference only. Download this version of

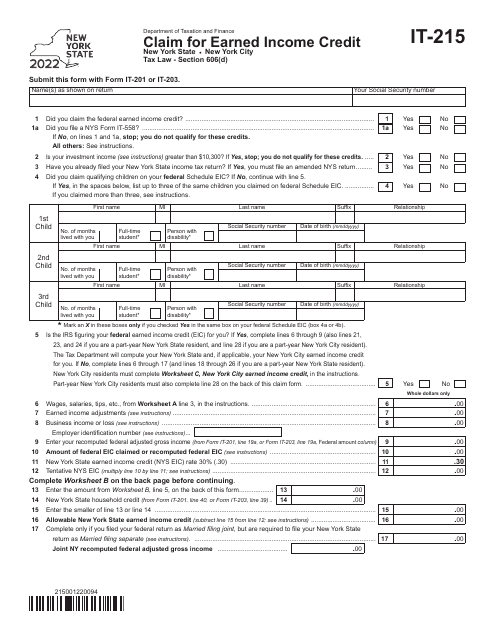

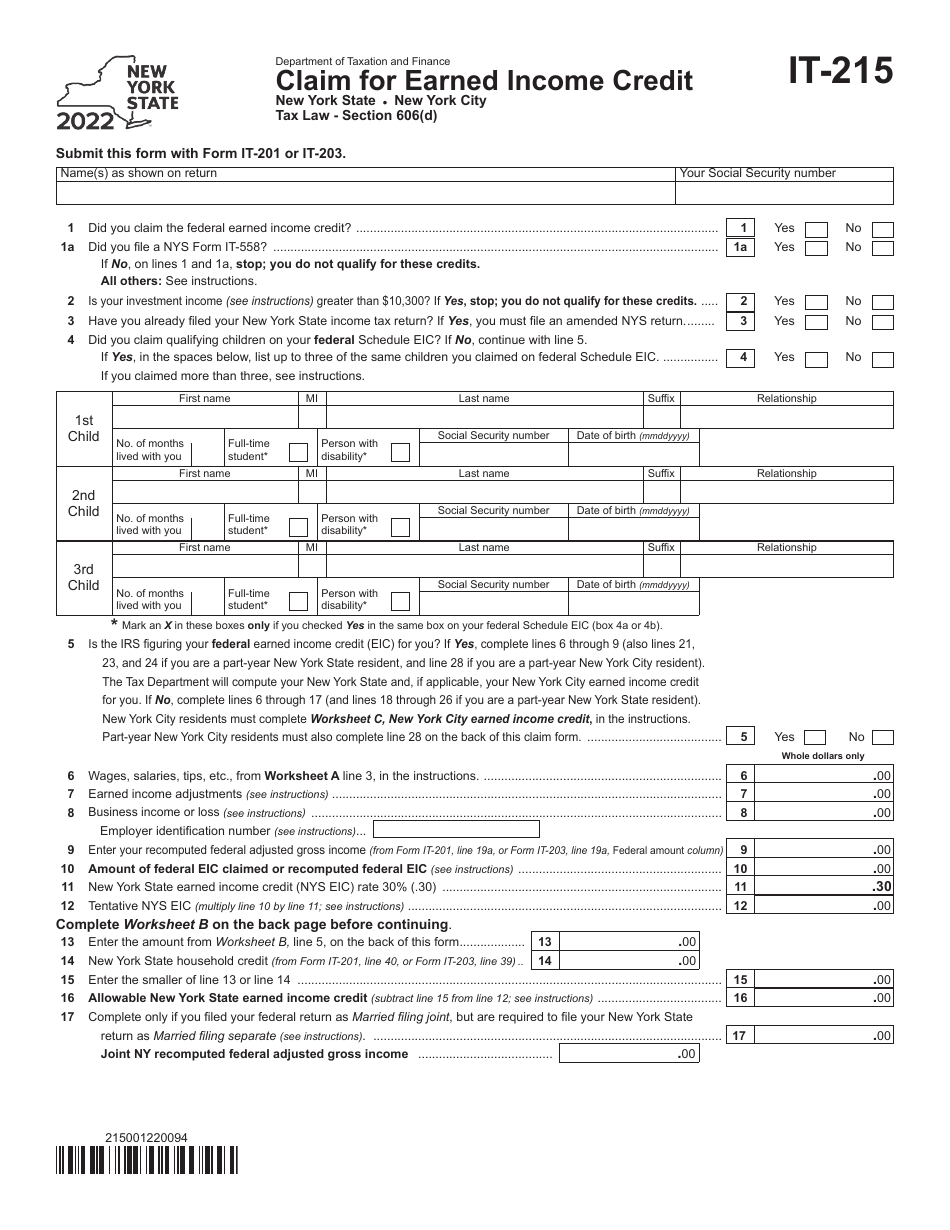

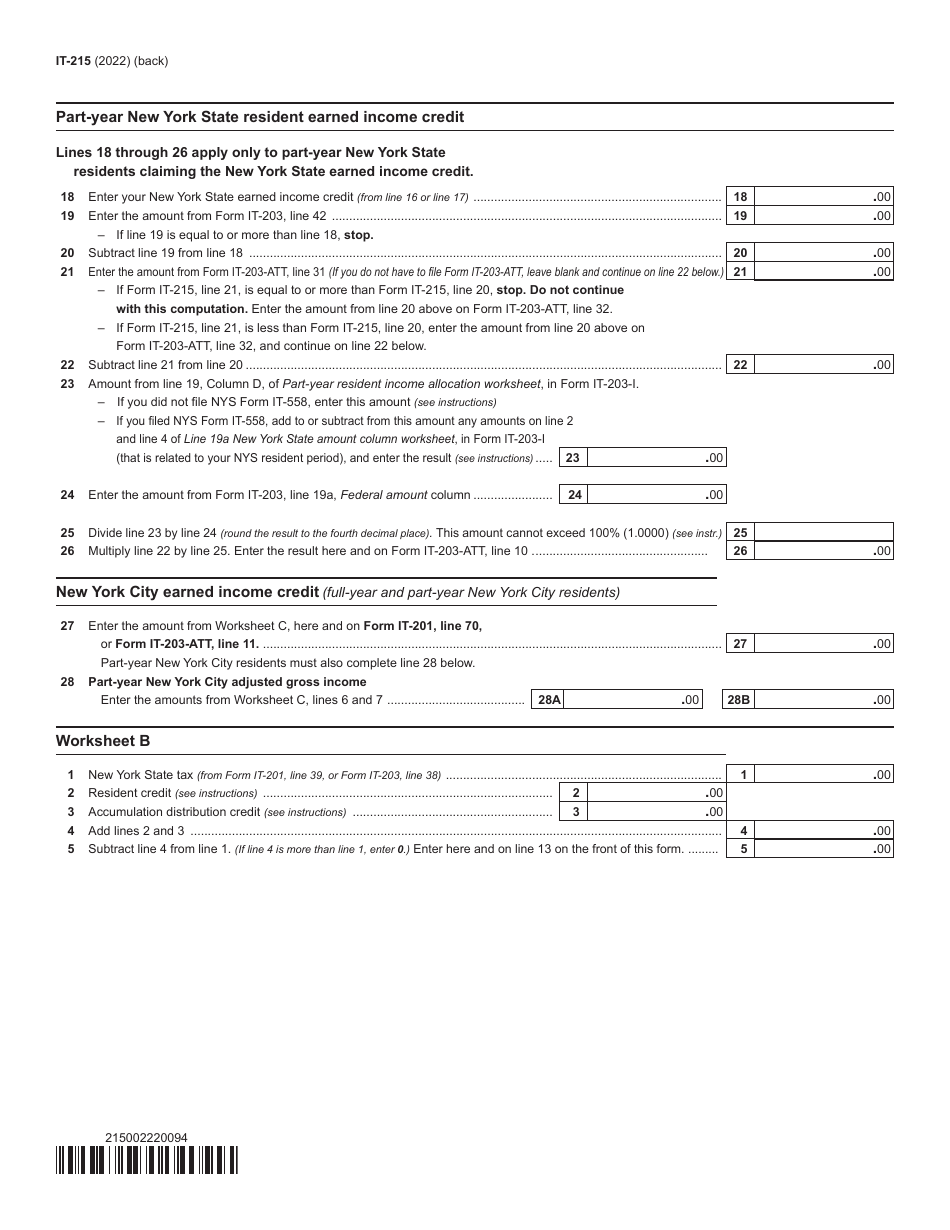

Form IT-215

for the current year.

Form IT-215 Claim for Earned Income Credit - New York

What Is Form IT-215?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-215?

A: Form IT-215 is the Claim for Earned Income Credit specifically for residents of New York.

Q: What is the Earned Income Credit?

A: The Earned Income Credit is a tax credit designed to provide financial assistance to low to moderate-income workers.

Q: Who is eligible to claim the Earned Income Credit?

A: Individuals who meet certain income requirements and have earned income from employment may be eligible to claim the Earned Income Credit.

Q: Why do I need to fill out Form IT-215?

A: You need to fill out Form IT-215 to claim the Earned Income Credit if you are a resident of New York.

Q: What information do I need to complete Form IT-215?

A: You will need to provide personal information, income details, and any eligible expenses to complete Form IT-215.

Q: When is Form IT-215 due?

A: Form IT-215 is typically due on the same date as your New York State income tax return, which is generally April 15th.

Q: Can I file Form IT-215 electronically?

A: Yes, you can file Form IT-215 electronically if you are filing your New York State income tax return electronically.

Q: Is the Earned Income Credit refundable?

A: Yes, the Earned Income Credit is refundable, meaning that if the credit exceeds your tax liability, you may receive a refund.

Q: Is Form IT-215 only for residents of New York?

A: Yes, Form IT-215 is specifically for residents of New York who are claiming the Earned Income Credit.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-215 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.