This version of the form is not currently in use and is provided for reference only. Download this version of

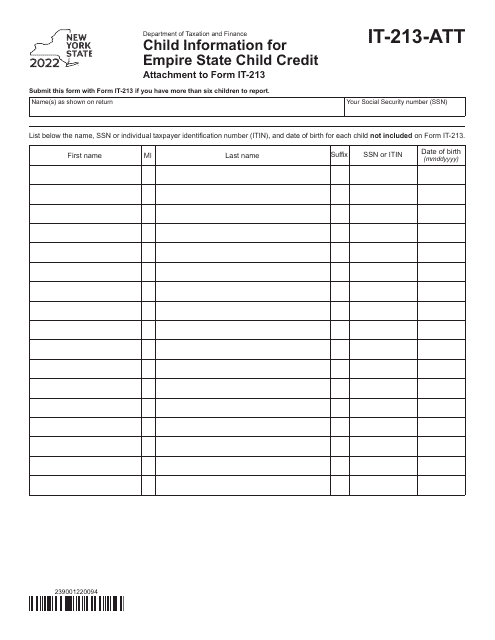

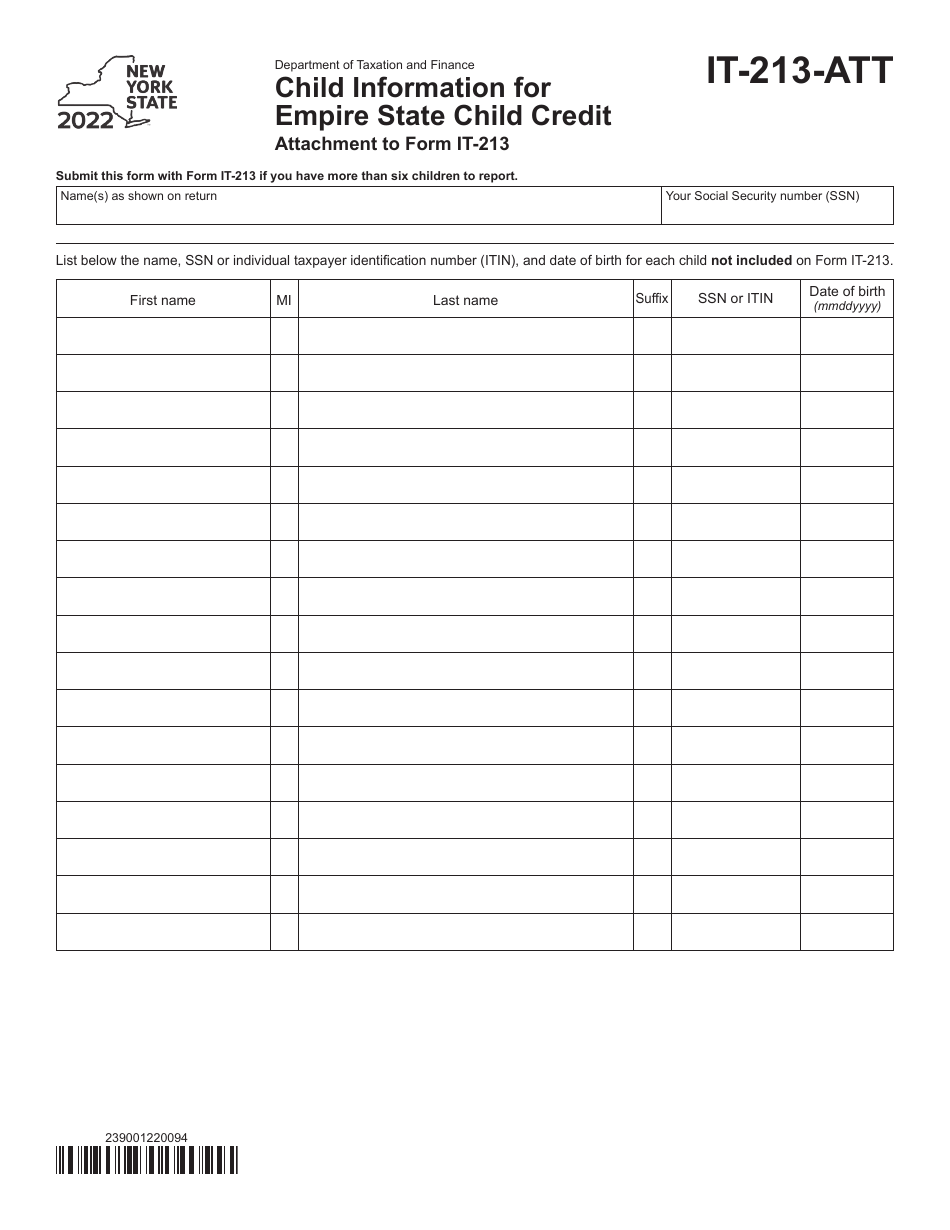

Form IT-213-ATT

for the current year.

Form IT-213-ATT Child Information for Empire State Child Credit - New York

What Is Form IT-213-ATT?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-213-ATT?

A: Form IT-213-ATT is a supplementary form used in New York to provide child information for the Empire State Child Credit.

Q: What is the Empire State Child Credit?

A: The Empire State Child Credit is a tax credit available to residents of New York State who have qualified children.

Q: What information is required on Form IT-213-ATT?

A: Form IT-213-ATT requires details about your qualified children, including their names, Social Security numbers, and relationship to you.

Q: Who is eligible for the Empire State Child Credit?

A: Residents of New York State who have qualified children and meet the income requirements may be eligible for the Empire State Child Credit.

Q: Can I claim the Empire State Child Credit if I have children in college?

A: Yes, you may be able to claim the Empire State Child Credit for children attending college if they meet the eligibility criteria.

Q: When is the deadline to file Form IT-213-ATT?

A: Form IT-213-ATT is typically filed along with your New York State income tax return, which is due on April 15th of each year.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-213-ATT by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.