This version of the form is not currently in use and is provided for reference only. Download this version of

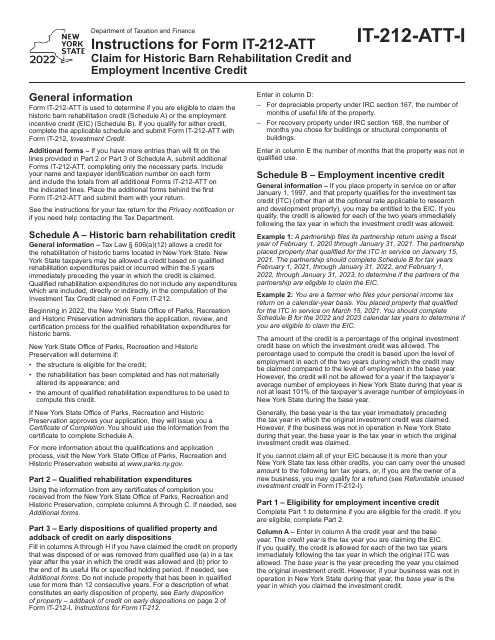

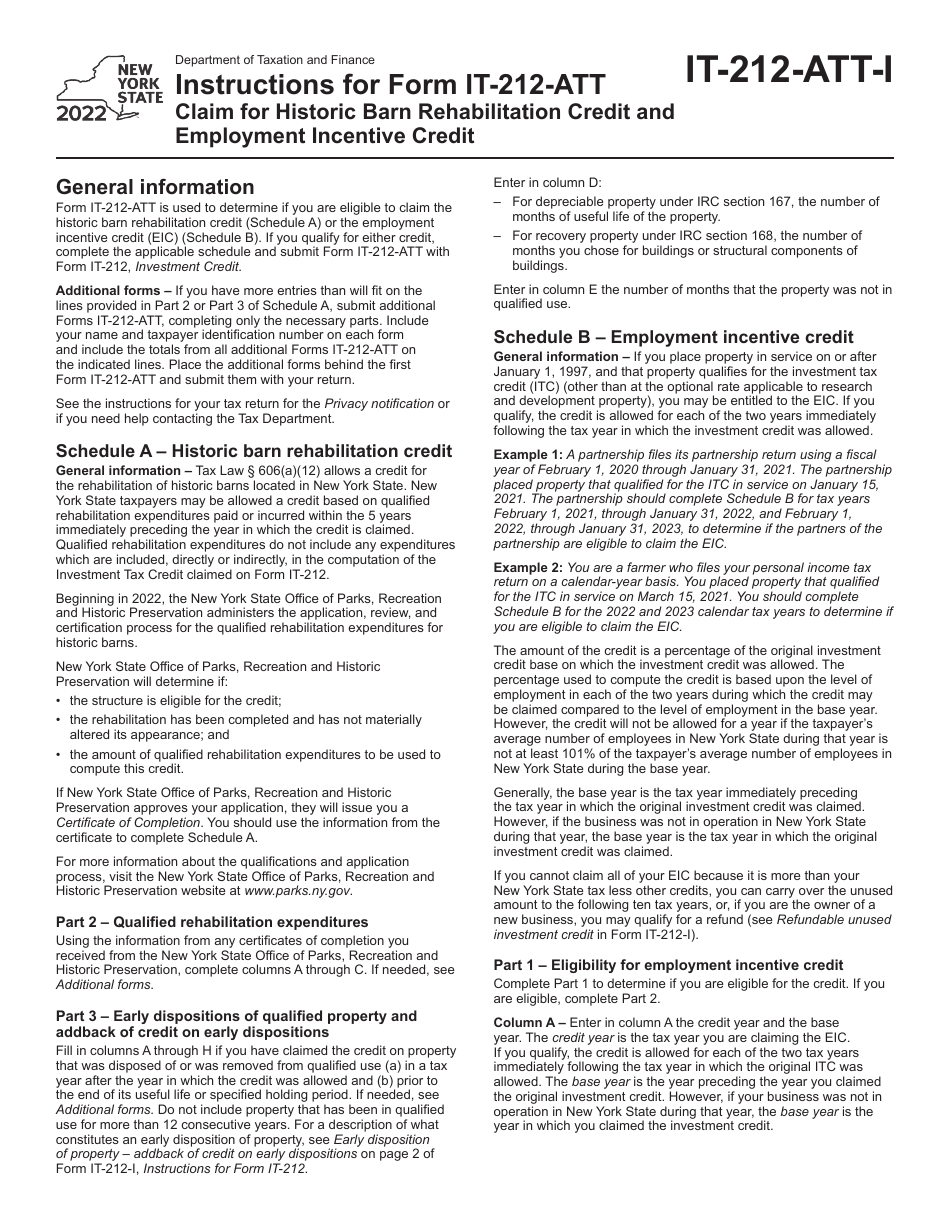

Instructions for Form IT-212-ATT

for the current year.

Instructions for Form IT-212-ATT Claim for Historic Barn Rehabilitation Credit and Employment Incentive Credit - New York

This document contains official instructions for Form IT-212-ATT , Claim for Historic Barn Rehabilitation Credit and Employment Incentive Credit - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form IT-212-ATT is available for download through this link.

FAQ

Q: What is Form IT-212-ATT?

A: Form IT-212-ATT is a form used to claim the Historic Barn Rehabilitation Credit and Employment Incentive Credit in New York.

Q: What are the Historic Barn Rehabilitation Credit and Employment Incentive Credit?

A: These credits are incentives provided by New York for the rehabilitation of historic barns and for creating employment opportunities.

Q: Who can claim these credits?

A: Individuals, estates, and trusts that meet the qualifications can claim these credits.

Q: What is the purpose of the Historic Barn Rehabilitation Credit?

A: The purpose of this credit is to encourage the rehabilitation and preservation of historic barns in New York.

Q: What is the purpose of the Employment Incentive Credit?

A: The purpose of this credit is to provide an incentive for businesses to create new employment opportunities in certain areas of New York.

Q: What documentation is required to claim these credits?

A: You must submit documentation showing the cost of the barn rehabilitation or the number of new employees hired.

Q: Are there any limitations to these credits?

A: Yes, there are certain limitations and restrictions on these credits. Please refer to the instructions for more details.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.