This version of the form is not currently in use and is provided for reference only. Download this version of

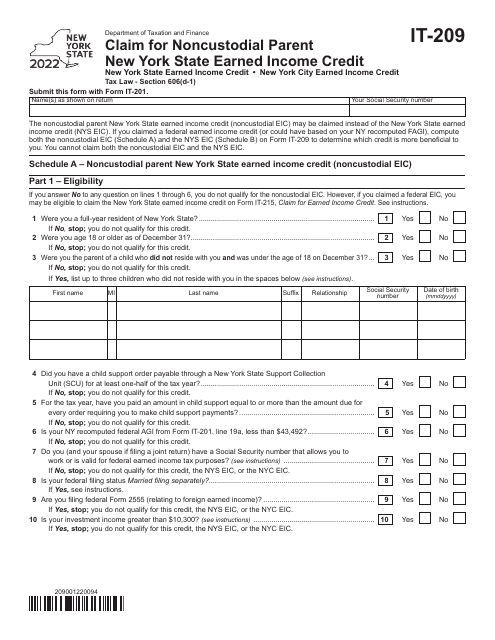

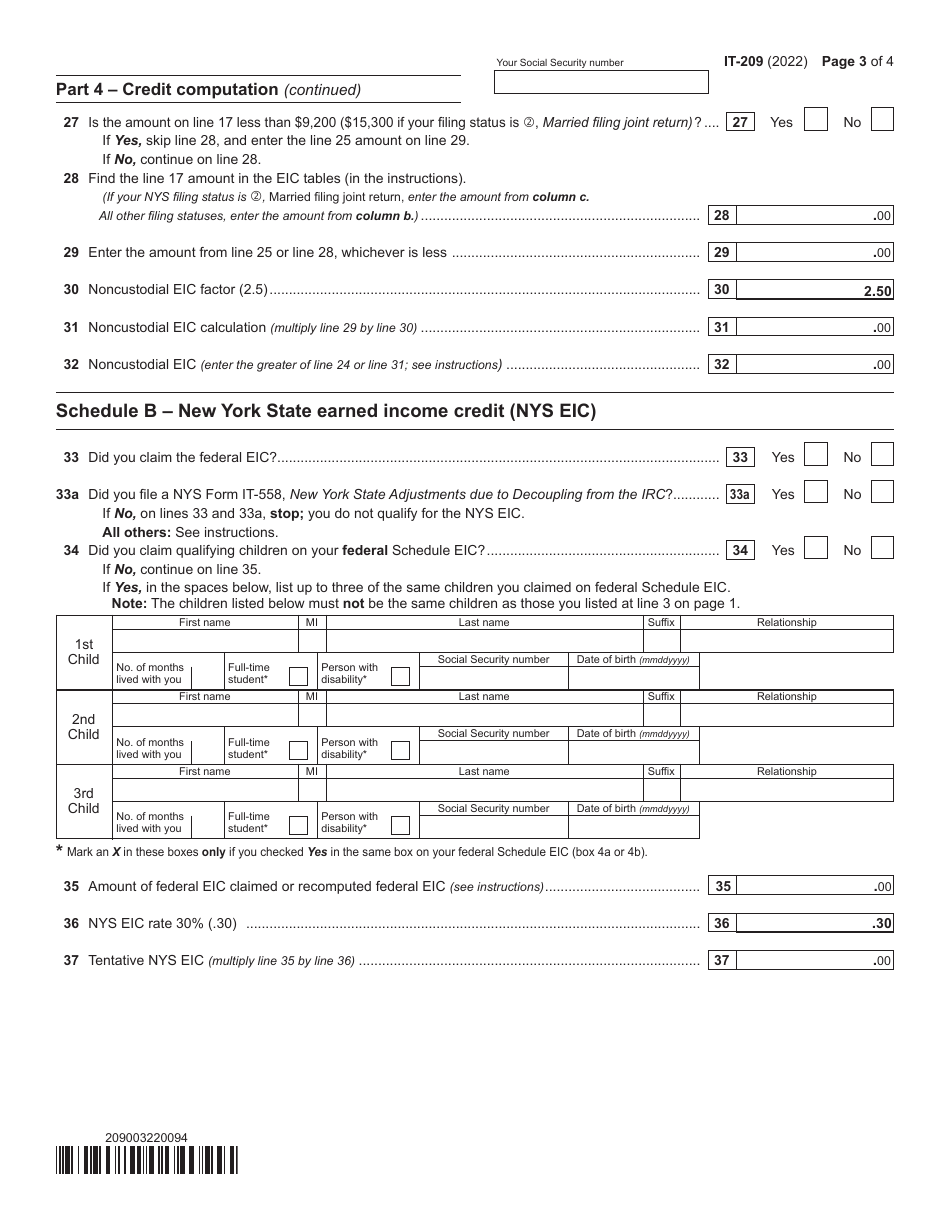

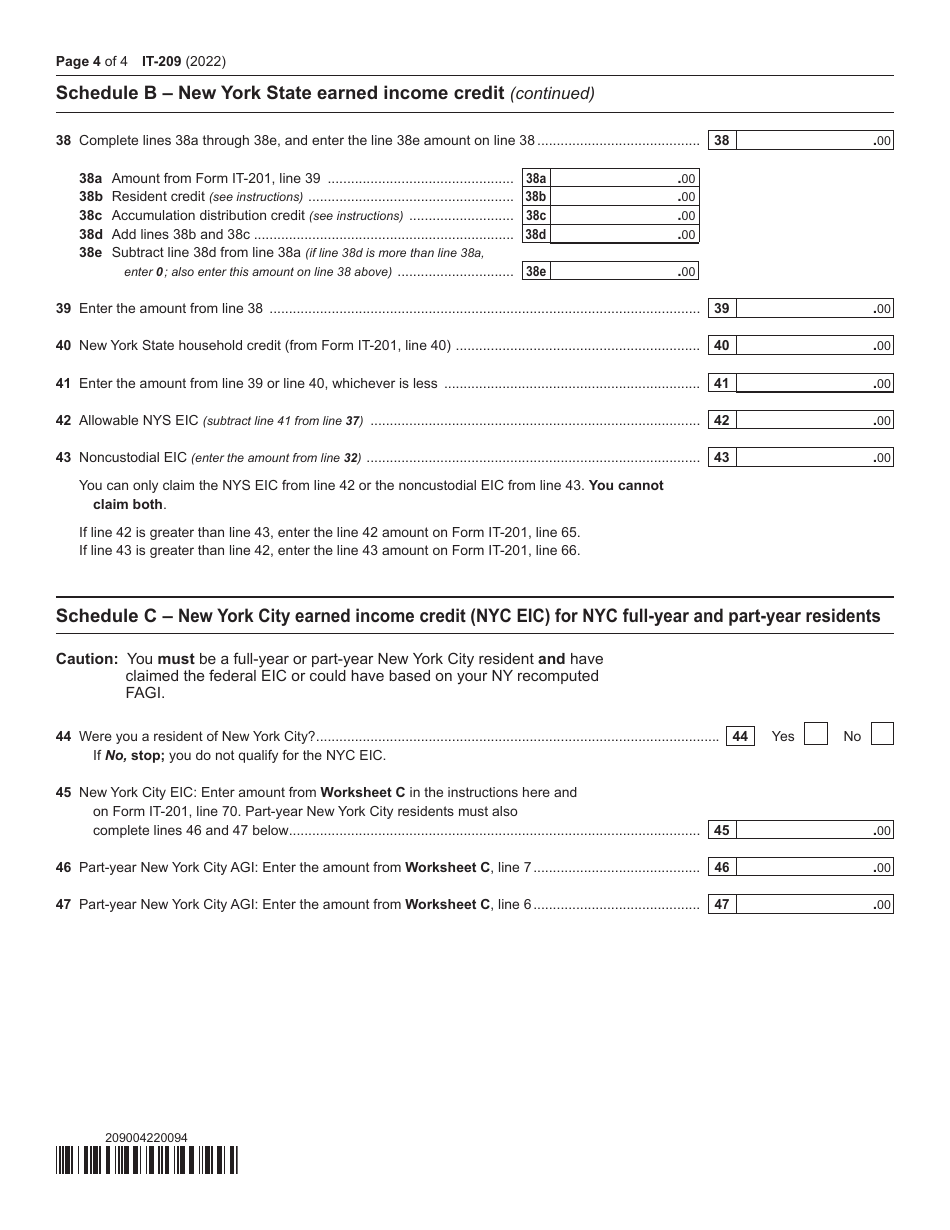

Form IT-209

for the current year.

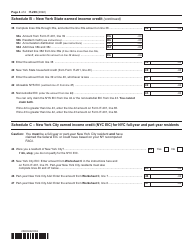

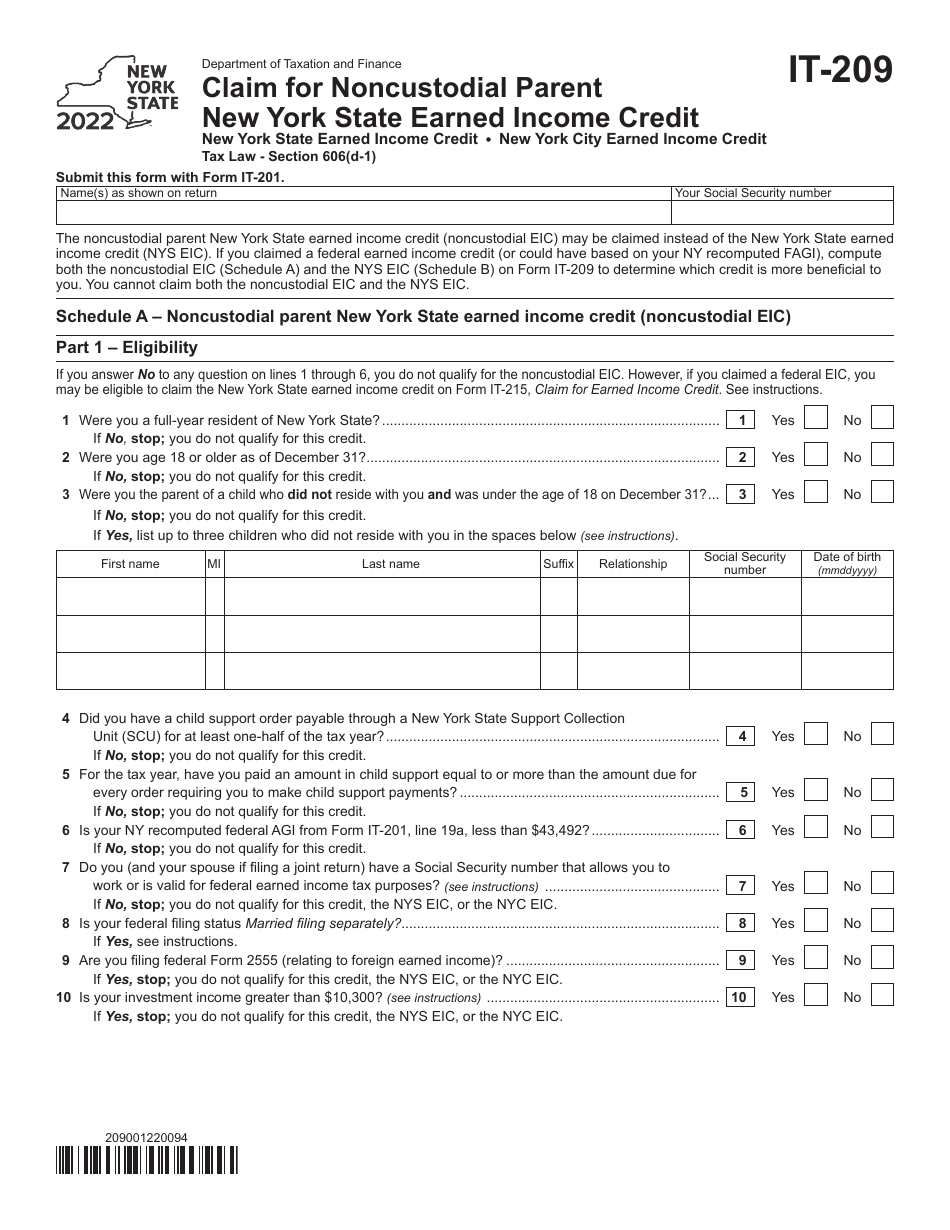

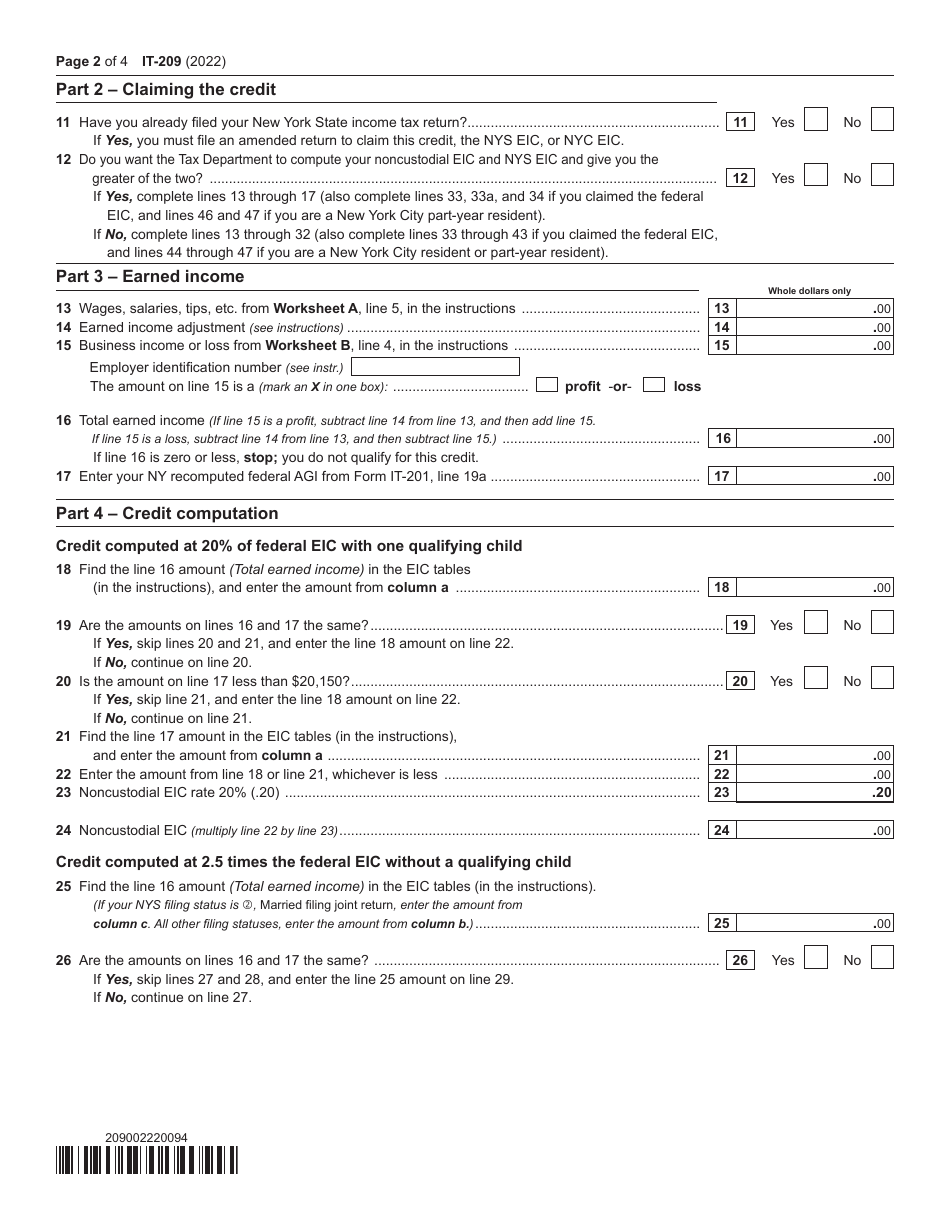

Form IT-209 Claim for Noncustodial Parent New York State Earned Income Credit - New York

What Is Form IT-209?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-209?

A: Form IT-209 is the Claim for Noncustodial Parent New York State Earned Income Credit form.

Q: Who should file Form IT-209?

A: Noncustodial parents in New York State who wish to claim the earned income credit should file Form IT-209.

Q: What is the New York State Earned Income Credit?

A: The New York State Earned Income Credit is a refundable credit designed to help working families with low to moderate incomes.

Q: What expenses can be claimed on Form IT-209?

A: Form IT-209 allows noncustodial parents to claim certain qualifying expenses related to their children.

Q: When is the deadline to file Form IT-209?

A: The deadline to file Form IT-209 is the same as the deadline for filing your New York State income tax return.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-209 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.