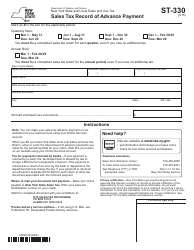

This version of the form is not currently in use and is provided for reference only. Download this version of

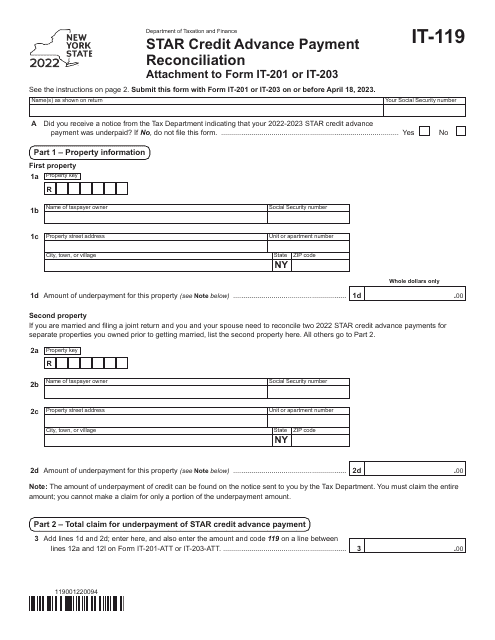

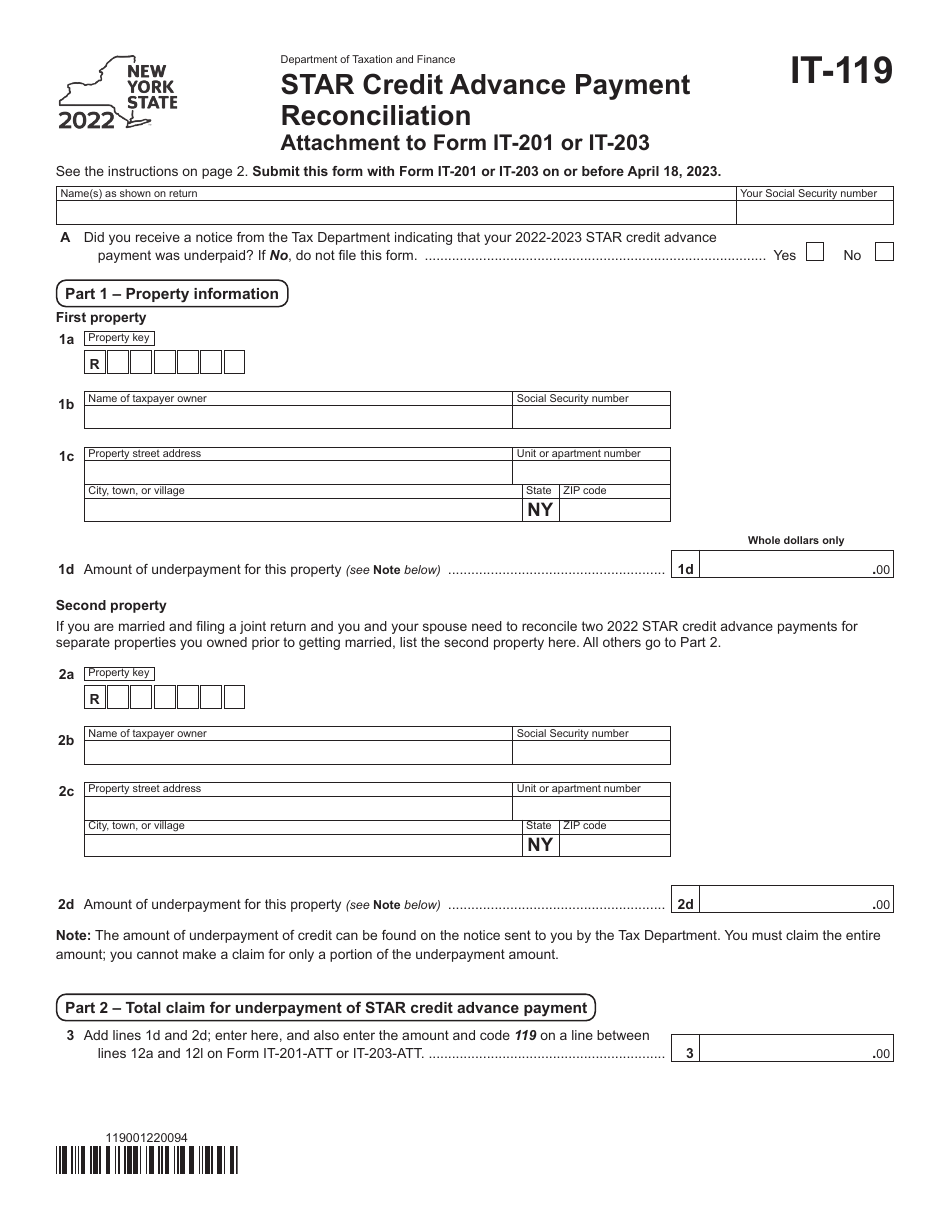

Form IT-119

for the current year.

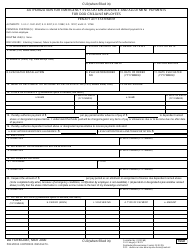

Form IT-119 Star Credit Advance Payment Reconciliation - New York

What Is Form IT-119?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-119?

A: Form IT-119 is a tax form used for reconciling Star Credit advance payments in New York.

Q: What is the Star Credit program?

A: The Star Credit program is a tax relief program in New York that provides a reduction in property taxes for eligible homeowners.

Q: Who is eligible for the Star Credit?

A: To be eligible for the Star Credit, you must own and live in your primary residence in New York State and meet certain income requirements.

Q: What are Star Credit advance payments?

A: Star Credit advance payments are payments made to eligible homeowners in advance of the reduction in their property taxes.

Q: Why do I need to reconcile Star Credit advance payments?

A: Reconciliation of Star Credit advance payments is required to ensure that you receive the correct amount of tax relief based on your eligibility and actual property taxes.

Q: How do I reconcile Star Credit advance payments?

A: You can reconcile Star Credit advance payments by completing Form IT-119 and providing accurate information about your property taxes paid and your eligibility for the program.

Q: When is the deadline for reconciling Star Credit advance payments?

A: The deadline for reconciling Star Credit advance payments is generally April 15th of the year following the tax year in which the advance payments were received.

Q: Is there a penalty for failing to reconcile Star Credit advance payments?

A: Yes, if you fail to reconcile Star Credit advance payments, you may lose your eligibility for the program and be required to repay the advance payments.

Q: Can I claim the Star Credit on my federal tax return?

A: No, the Star Credit is a state-specific tax relief program and cannot be claimed on your federal tax return.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-119 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.