This version of the form is not currently in use and is provided for reference only. Download this version of

Form DTF-630

for the current year.

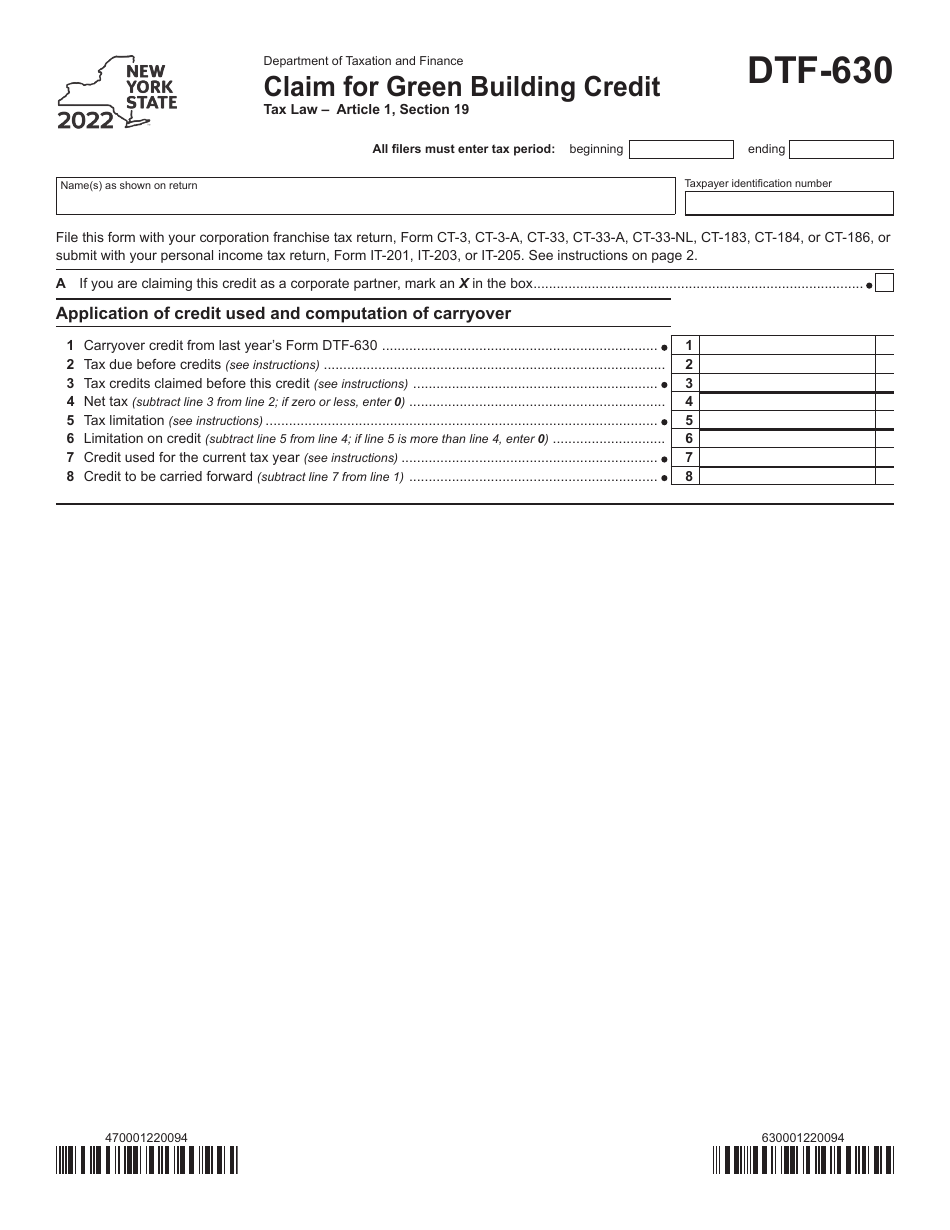

Form DTF-630 Claim for Green Building Credit - New York

What Is Form DTF-630?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTF-630?

A: Form DTF-630 is a claim for Green Building Credit in New York.

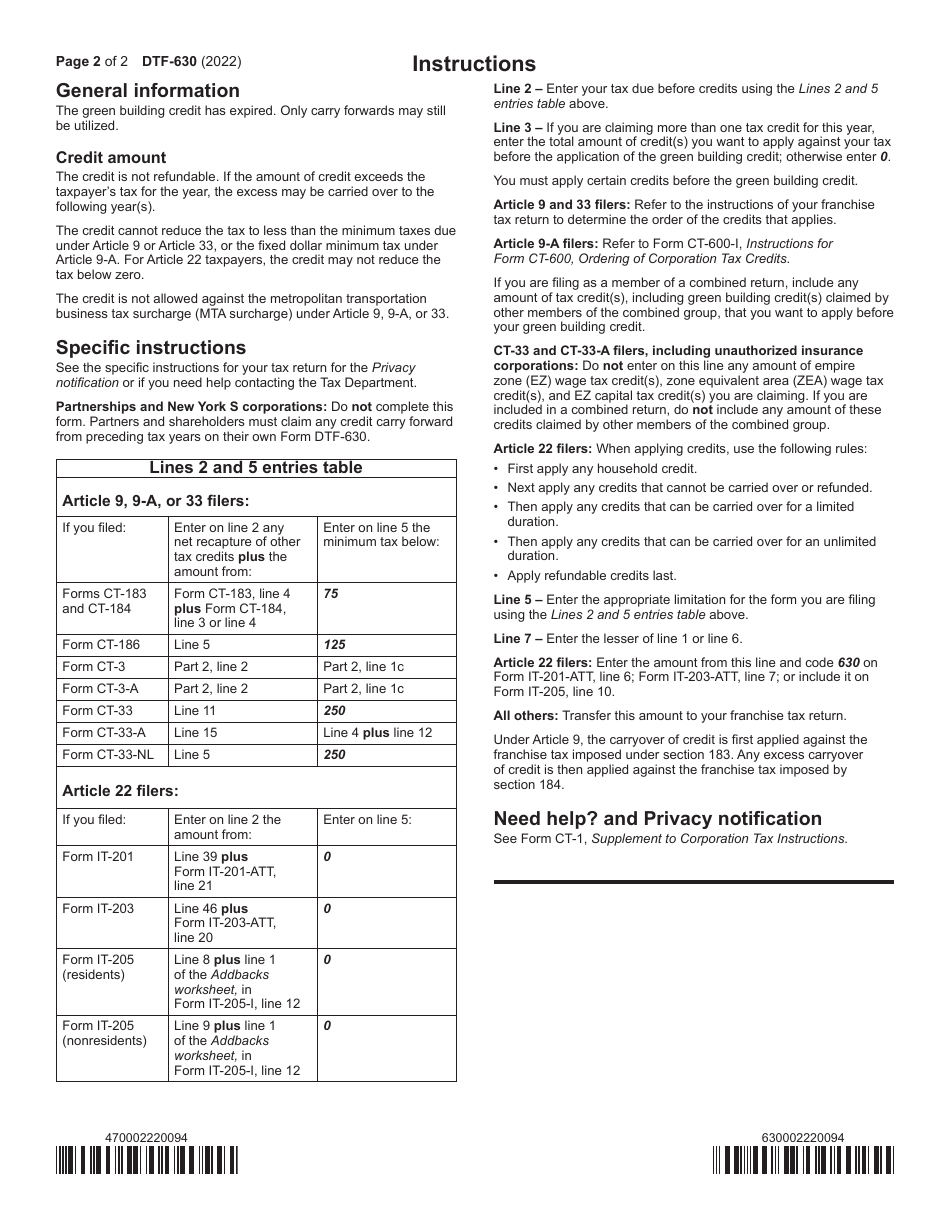

Q: What is the Green Building Credit?

A: The Green Building Credit is a tax credit provided by New York State for certain energy-efficient construction projects.

Q: How do I qualify for the Green Building Credit?

A: To qualify for the Green Building Credit, you must meet the eligibility requirements outlined by New York State.

Q: What information do I need to provide on Form DTF-630?

A: You will need to provide information about the energy-efficient construction project, including project details, costs, and certifications.

Q: Is there a deadline for submitting Form DTF-630?

A: Yes, the deadline for submitting Form DTF-630 is typically the same as the deadline for filing your tax return.

Q: Are there any other credits available for energy-efficient construction projects in New York?

A: Yes, in addition to the Green Building Credit, there may be other tax credits or incentives available. It is recommended to consult with a tax professional or the New York State Department of Taxation and Finance for more information.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTF-630 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.