This version of the form is not currently in use and is provided for reference only. Download this version of

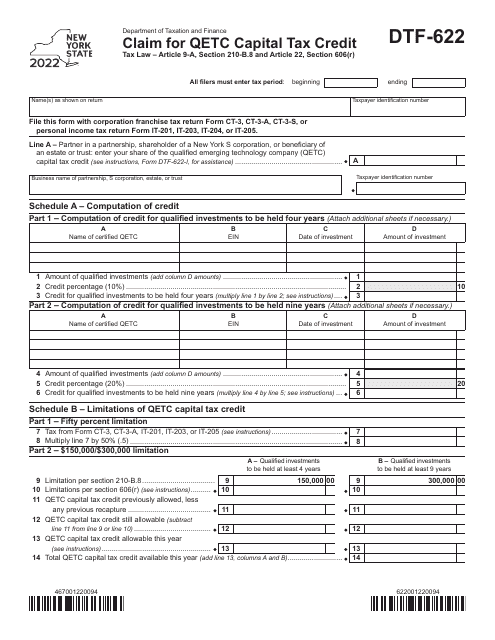

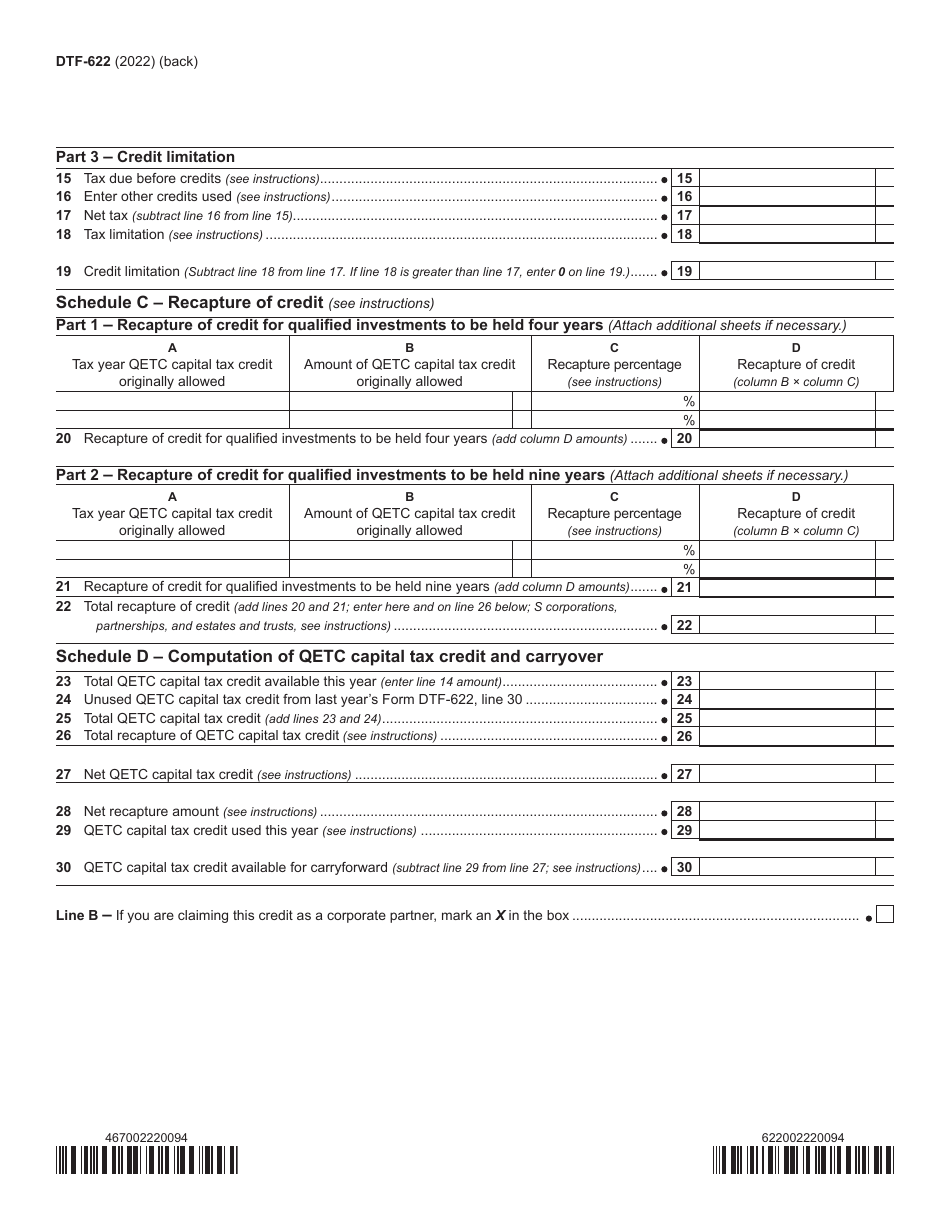

Form DTF-622

for the current year.

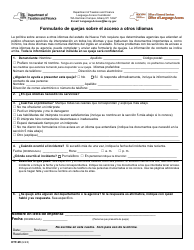

Form DTF-622 Claim for Qetc Capital Tax Credit - New York

What Is Form DTF-622?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form DTF-622?

A: Form DTF-622 is a tax form used in the state of New York to claim the QETC (Qualified Emerging Technology Company) Capital Tax Credit.

Q: Who can use Form DTF-622?

A: Form DTF-622 can be used by businesses that qualify as Qualified Emerging Technology Companies in the state of New York.

Q: What is the QETC Capital Tax Credit?

A: The QETC Capital Tax Credit is a tax credit available to qualifying businesses in New York that invest in qualified emerging technology companies.

Q: How do I qualify as a Qualified Emerging Technology Company?

A: To qualify as a Qualified Emerging Technology Company, you must meet certain criteria set by the state of New York, including being engaged in certain high-tech industries and meeting specified employment and revenue requirements.

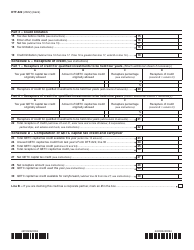

Q: What expenses or investments are eligible for the QETC Capital Tax Credit?

A: Eligible expenses or investments include capital investments made by the business in qualified emerging technology companies, as well as certain research and development expenses.

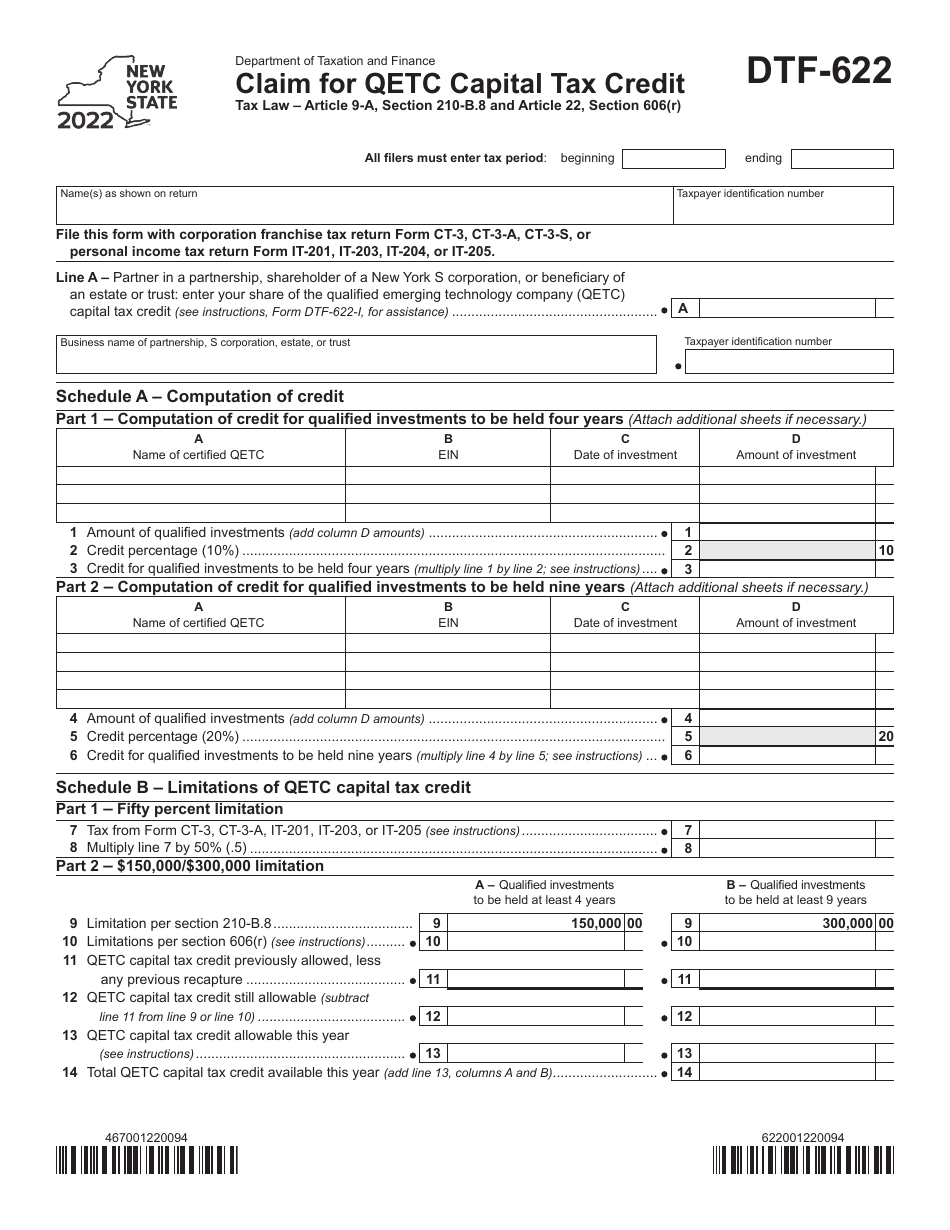

Q: How do I file Form DTF-622?

A: Form DTF-622 can be filed electronically or by mail with the New York State Department of Taxation and Finance. The instructions on the form provide detailed guidance on how to complete and submit the form.

Q: What documentation do I need to include with Form DTF-622?

A: You may be required to provide supporting documentation, such as investment agreements, proof of capital investments, or other relevant documents. The instructions on the form will specify the required documentation.

Q: When is the deadline to file Form DTF-622?

A: The deadline to file Form DTF-622 varies depending on the tax year for which you are claiming the tax credit. The specific deadlines can be found in the instructions for the form.

Q: What happens after I submit Form DTF-622?

A: After you submit Form DTF-622, the New York State Department of Taxation and Finance will review your claim and determine if you qualify for the QETC Capital Tax Credit. If approved, the tax credit will be applied to your tax liability.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTF-622 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.