This version of the form is not currently in use and is provided for reference only. Download this version of

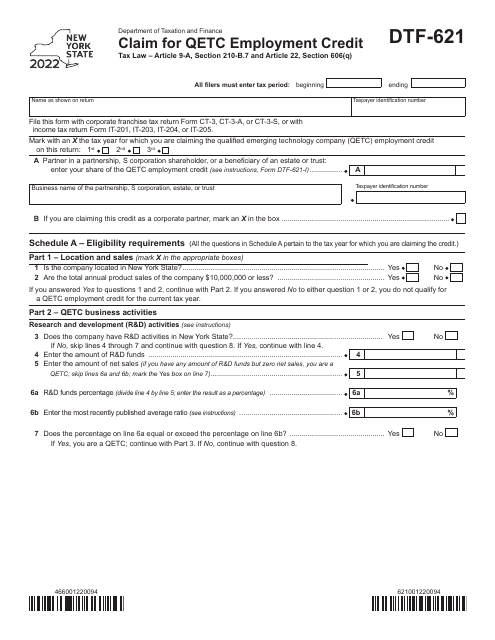

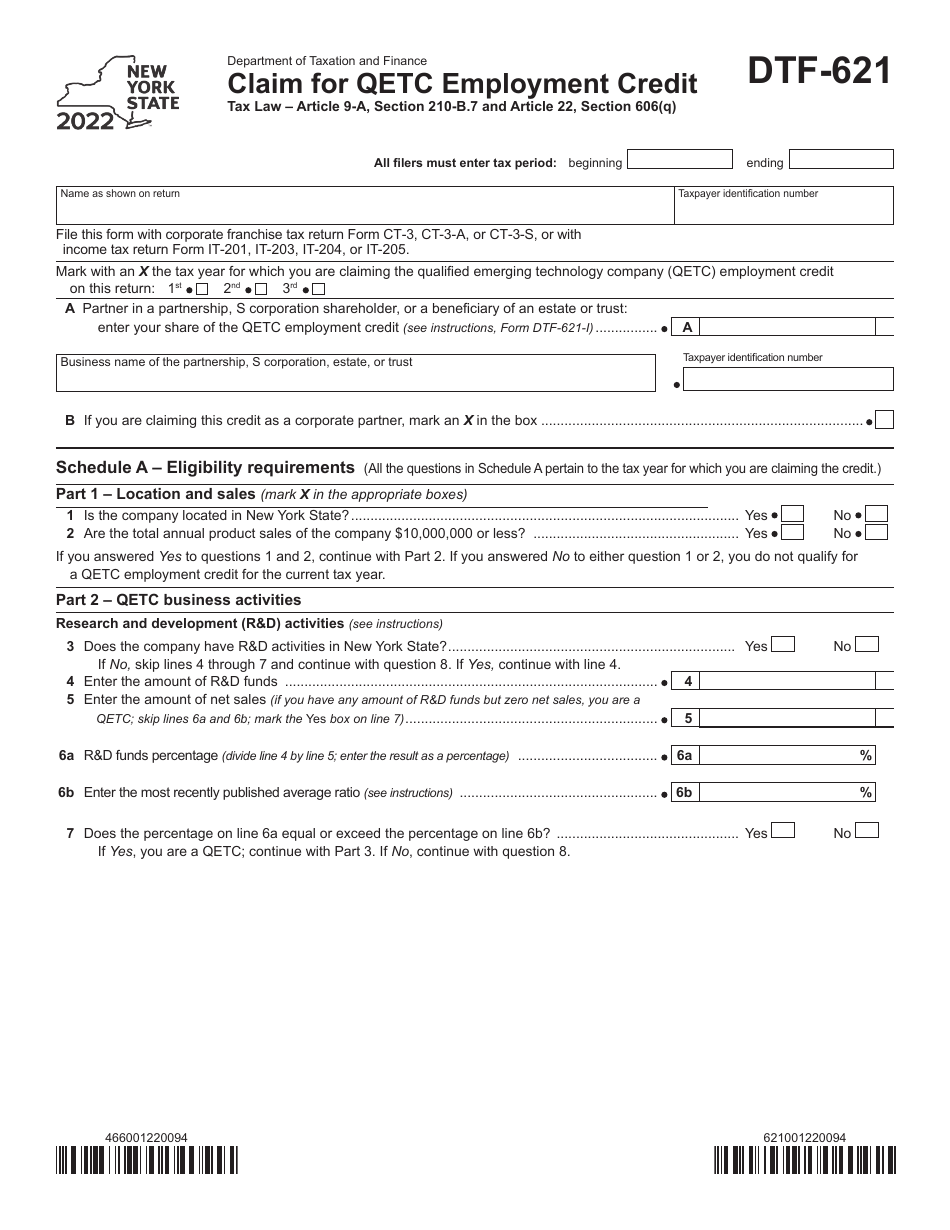

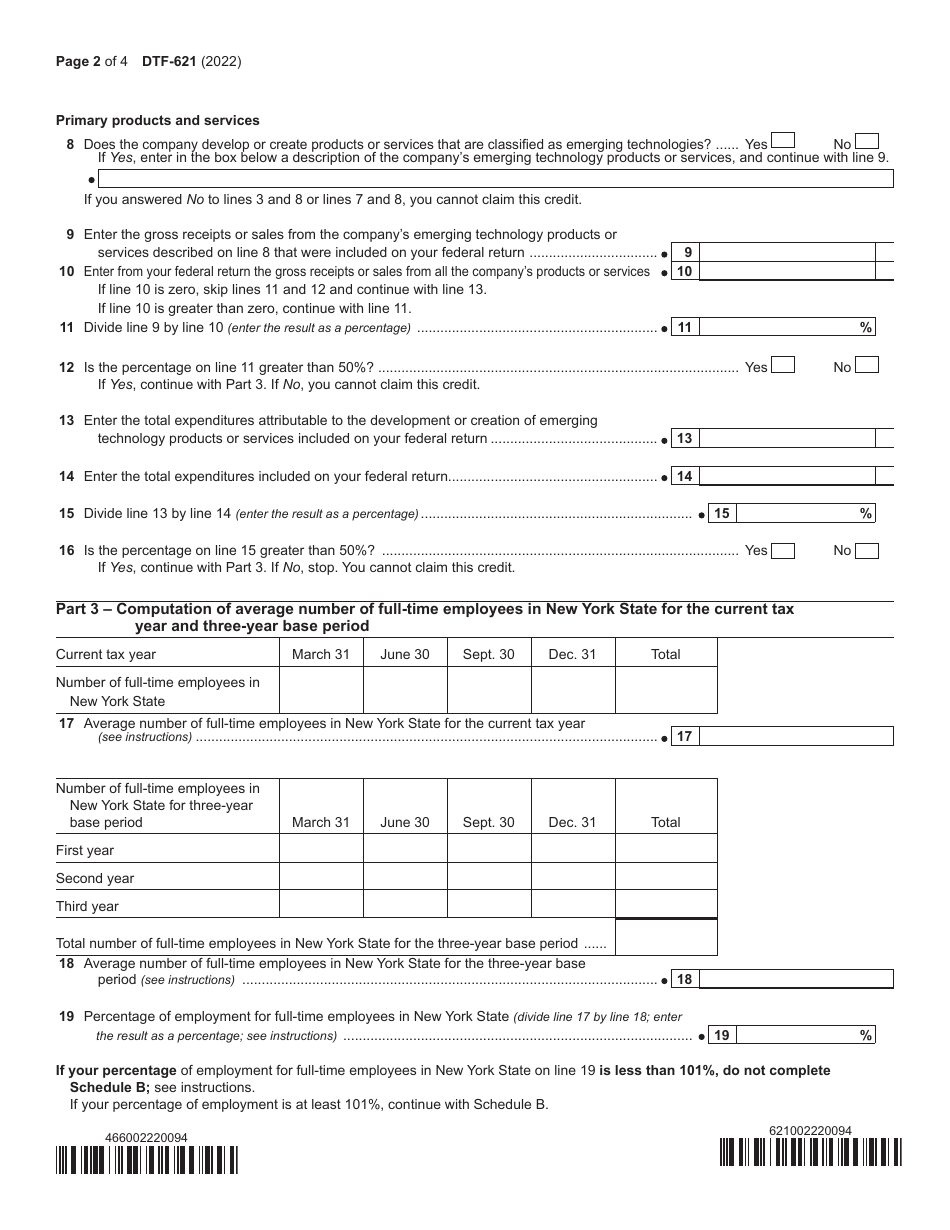

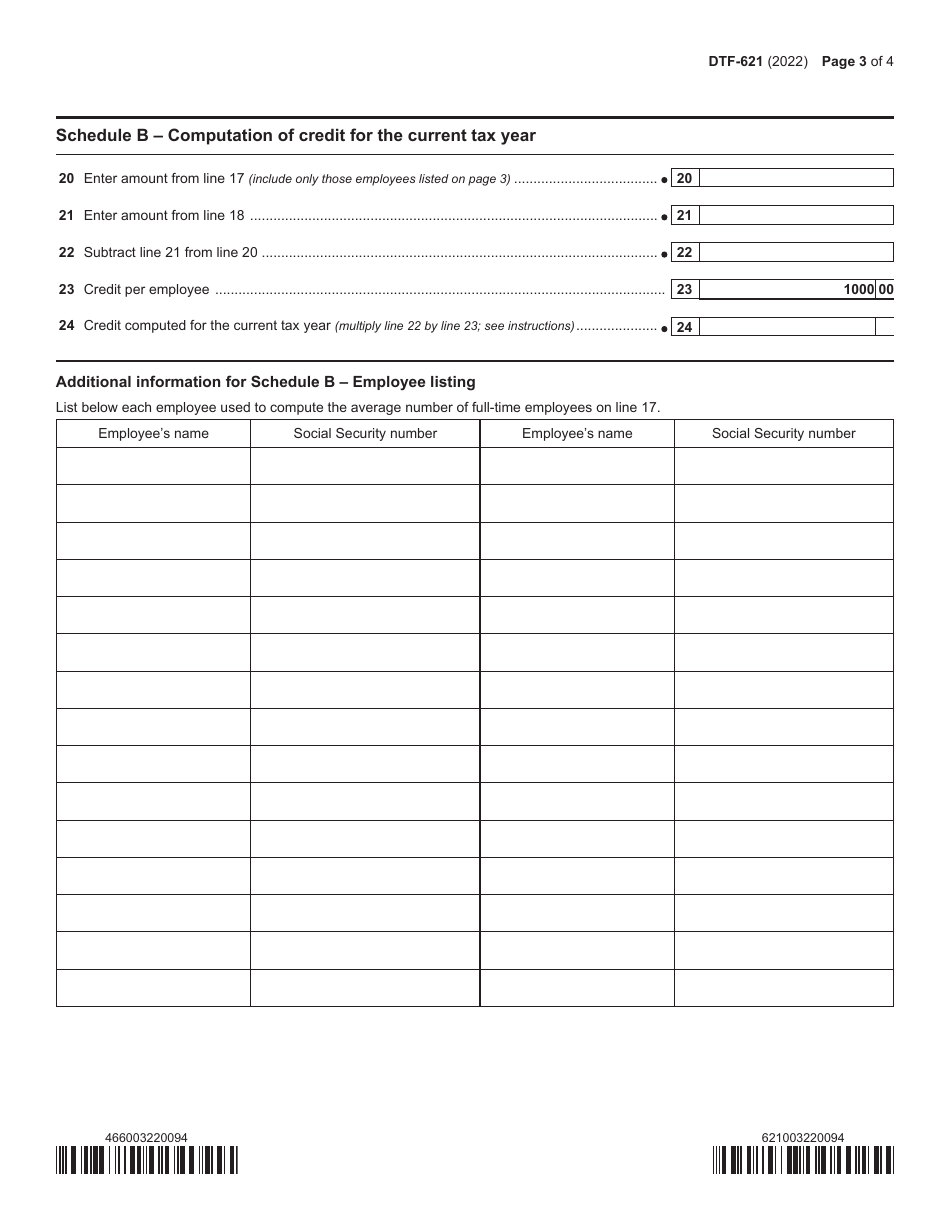

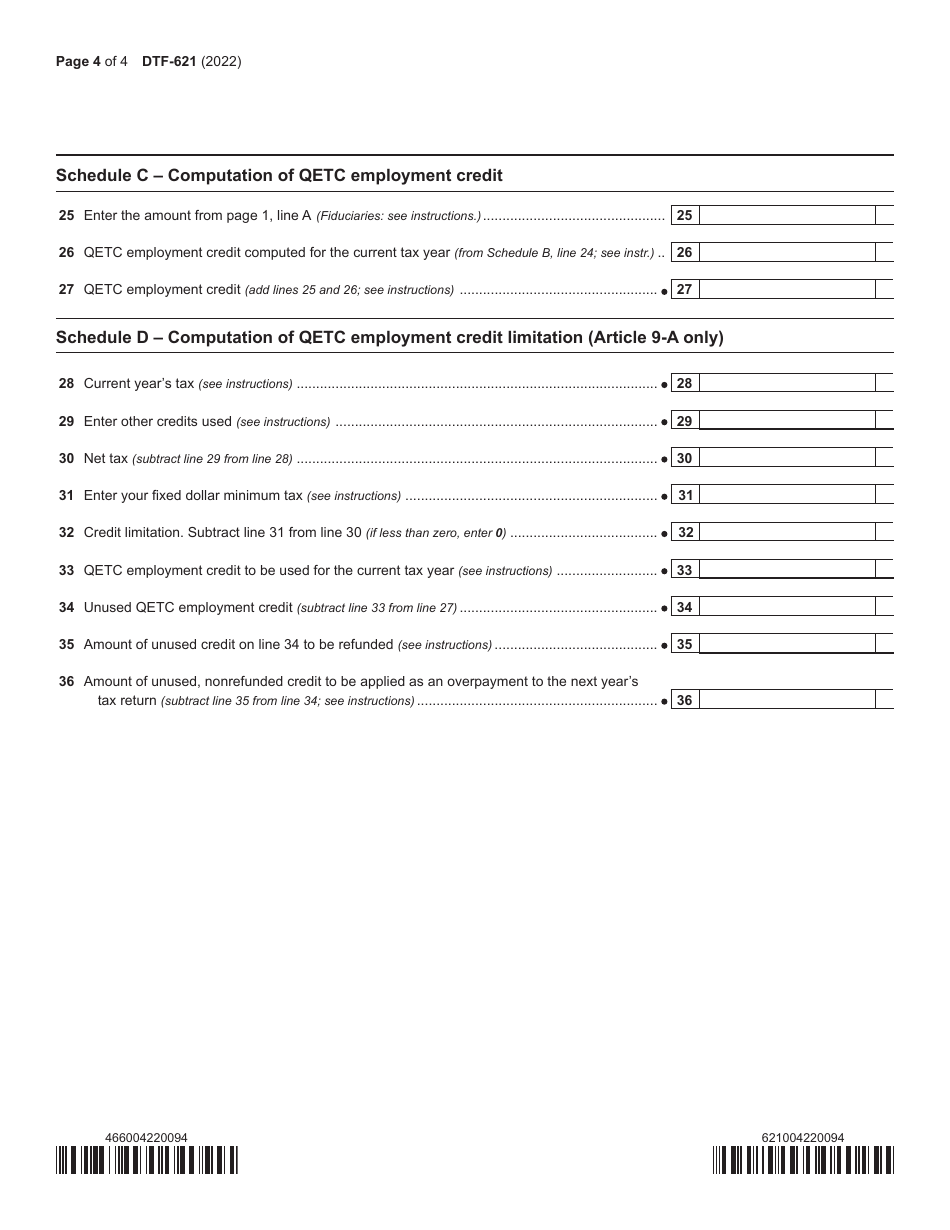

Form DTF-621

for the current year.

Form DTF-621 Claim for Qetc Employment Credit - New York

What Is Form DTF-621?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTF-621?

A: Form DTF-621 is the Claim for Qualified Emerging Technology Company ("QETC") Employment Credit in New York.

Q: What is the QETC Employment Credit?

A: The QETC Employment Credit is a tax credit available to eligible businesses in New York that hire qualified employees engaged in emerging technology activities.

Q: Who can file Form DTF-621?

A: Businesses that are eligible for the QETC Employment Credit in New York can file Form DTF-621.

Q: How do I qualify for the QETC Employment Credit?

A: To qualify for the QETC Employment Credit, your business must be certified as a qualified emerging technology company by the New York State Department of Taxation and Finance.

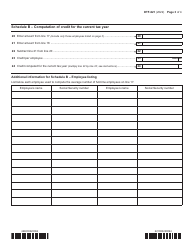

Q: What information do I need to provide on Form DTF-621?

A: You will need to provide information about your business, the qualified employees hired, and the amount of credit claimed on Form DTF-621.

Q: When is the deadline to file Form DTF-621?

A: The deadline to file Form DTF-621 is the same as the due date for your business tax return in New York.

Q: Is there a fee to file Form DTF-621?

A: No, there is no fee to file Form DTF-621.

Q: Can I claim the QETC Employment Credit for previous years?

A: No, the QETC Employment Credit can only be claimed for the current tax year.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTF-621 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.