This version of the form is not currently in use and is provided for reference only. Download this version of

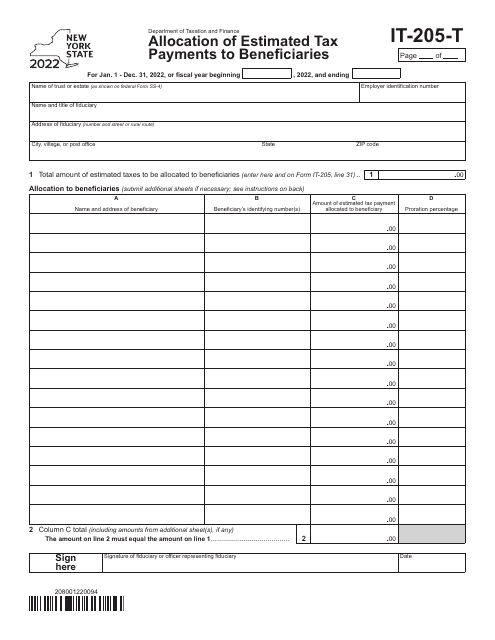

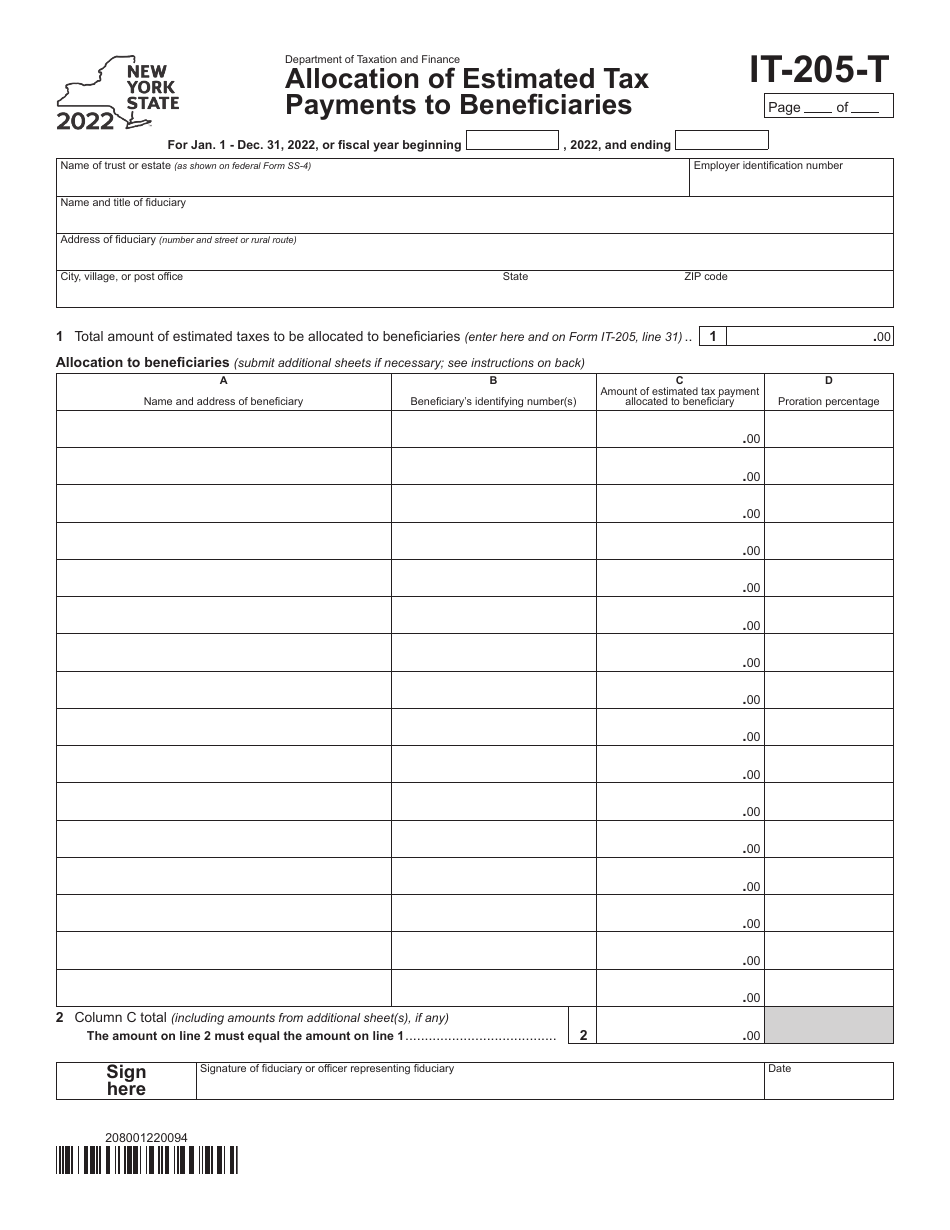

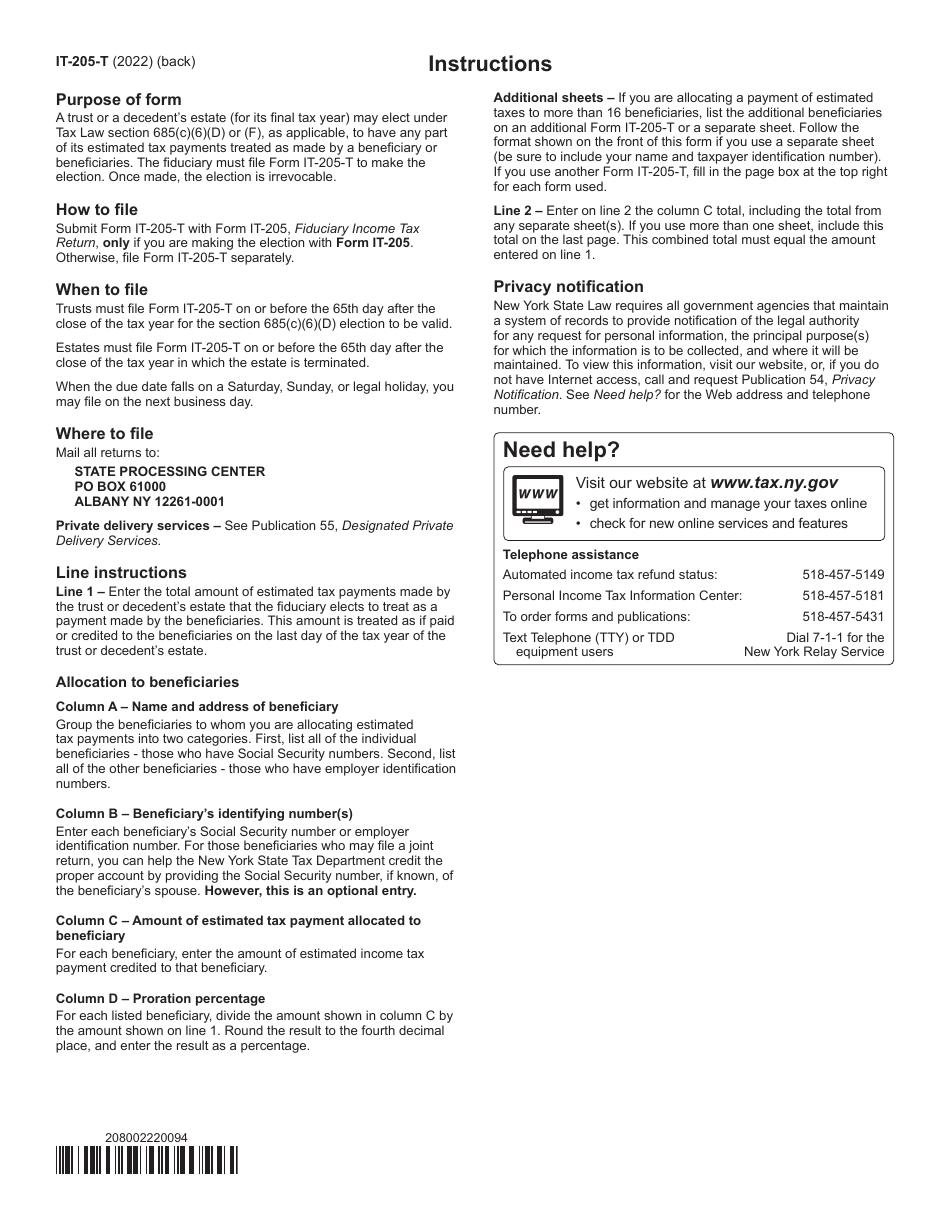

Form IT-205-T

for the current year.

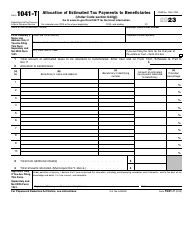

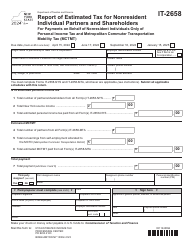

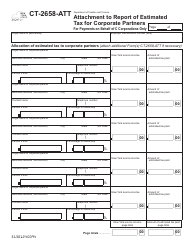

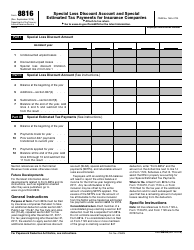

Form IT-205-T Allocation of Estimated Tax Payments to Beneficiaries - New York

What Is Form IT-205-T?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is IT-205-T?

A: IT-205-T is a form used in New York to allocate estimated tax payments to beneficiaries.

Q: Who uses Form IT-205-T?

A: Form IT-205-T is used by fiduciaries in New York to allocate estimated tax payments made on behalf of beneficiaries.

Q: What is the purpose of Form IT-205-T?

A: The purpose of Form IT-205-T is to allocate estimated tax payments to beneficiaries to ensure that the correct amount of tax is attributed to each beneficiary.

Q: When is Form IT-205-T due?

A: Form IT-205-T is typically due on the same date as Form IT-205, which is the fiduciary income tax return due date. This is usually April 15th, unless it falls on a weekend or holiday.

Q: Are there any penalties for not filing Form IT-205-T?

A: Yes, there may be penalties for not filing Form IT-205-T or for filing it late. It is important to meet all tax filing requirements and deadlines to avoid penalties or interest charges.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-205-T by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.