This version of the form is not currently in use and is provided for reference only. Download this version of

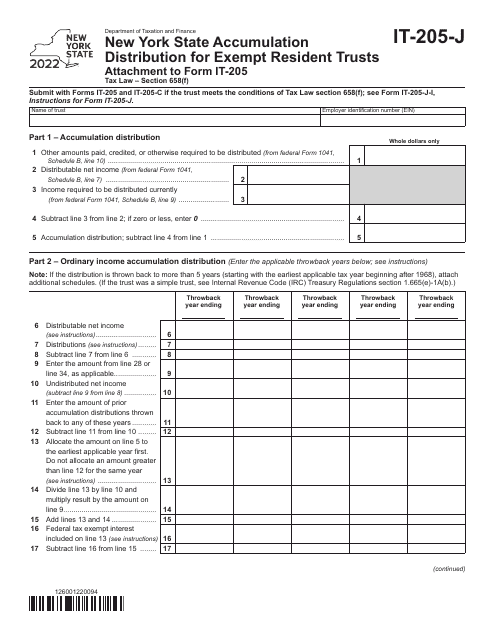

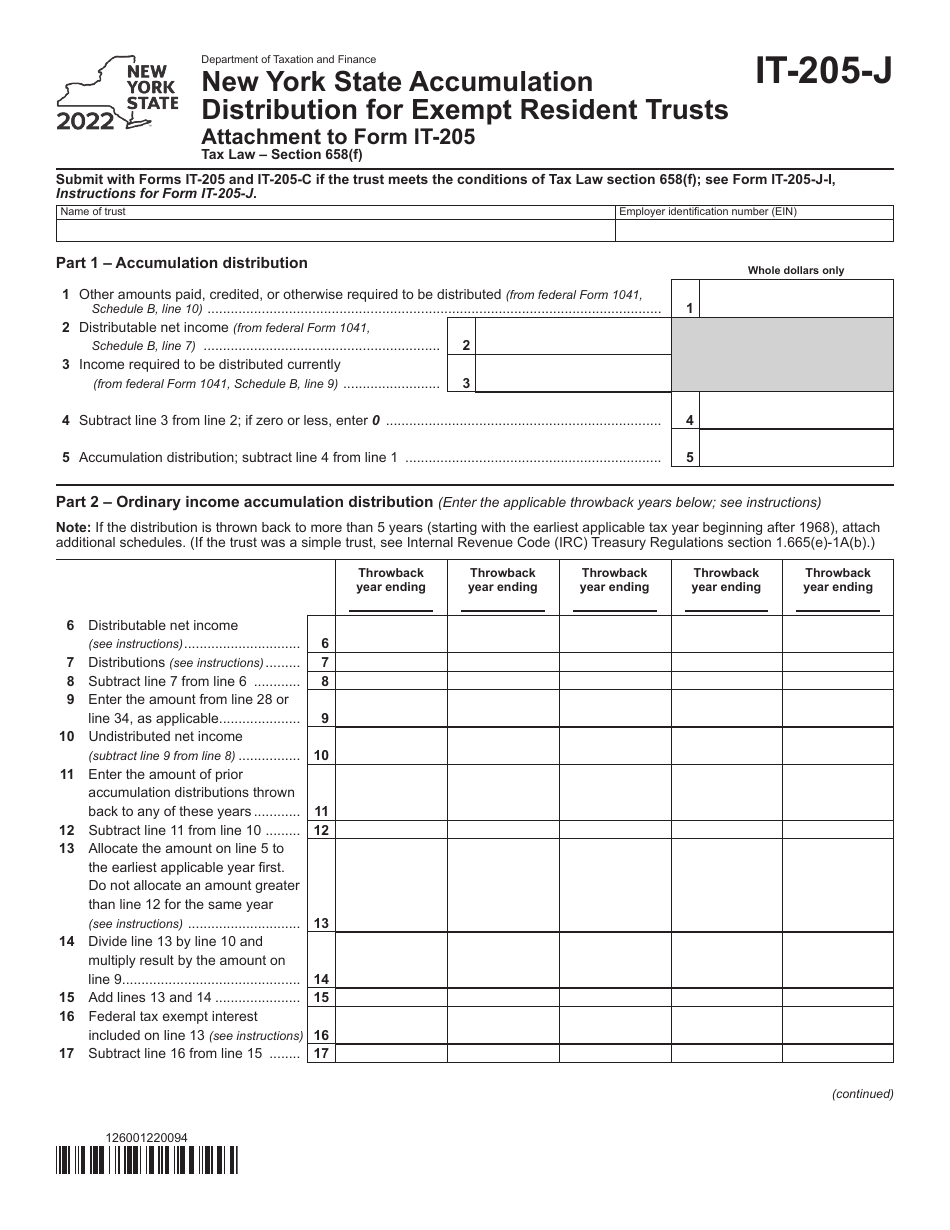

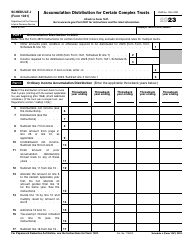

Form IT-205-J

for the current year.

Form IT-205-J New York State Accumulation Distribution for Exempt Resident Trusts - New York

What Is Form IT-205-J?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-205-J?

A: Form IT-205-J is the New York State Accumulation Distribution for Exempt Resident Trusts.

Q: Who needs to fill out Form IT-205-J?

A: Form IT-205-J should be filled out by exempt resident trusts in New York State.

Q: What is an exempt resident trust?

A: An exempt resident trust is a trust that is not subject to New York State income tax.

Q: What is an accumulation distribution?

A: An accumulation distribution is the income that was accumulated in the trust and is distributed to the beneficiaries.

Q: What information is required on Form IT-205-J?

A: Form IT-205-J requires information about the trust, its beneficiaries, and the amount of accumulation distribution.

Q: When is the deadline for filing Form IT-205-J?

A: The deadline for filing Form IT-205-J is generally April 15th, or the fifteenth day of the fourth month following the end of the taxable year.

Q: Are there any penalties for late filing of Form IT-205-J?

A: Yes, there may be penalties for late filing of Form IT-205-J, so it is important to file it on time.

Q: Can I e-file Form IT-205-J?

A: No, Form IT-205-J cannot be e-filed and must be filed by mail.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-205-J by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.