This version of the form is not currently in use and is provided for reference only. Download this version of

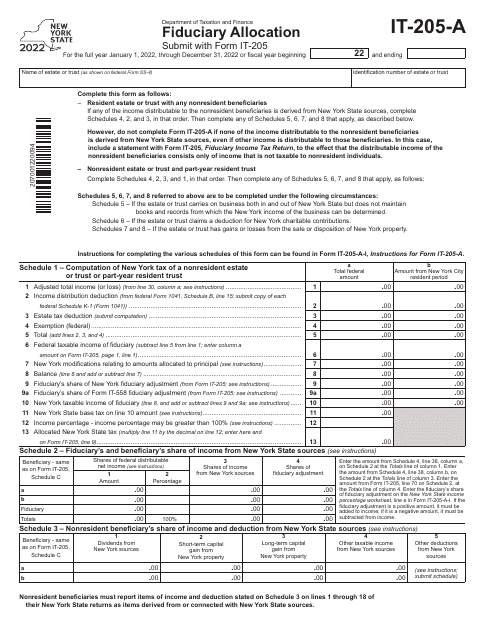

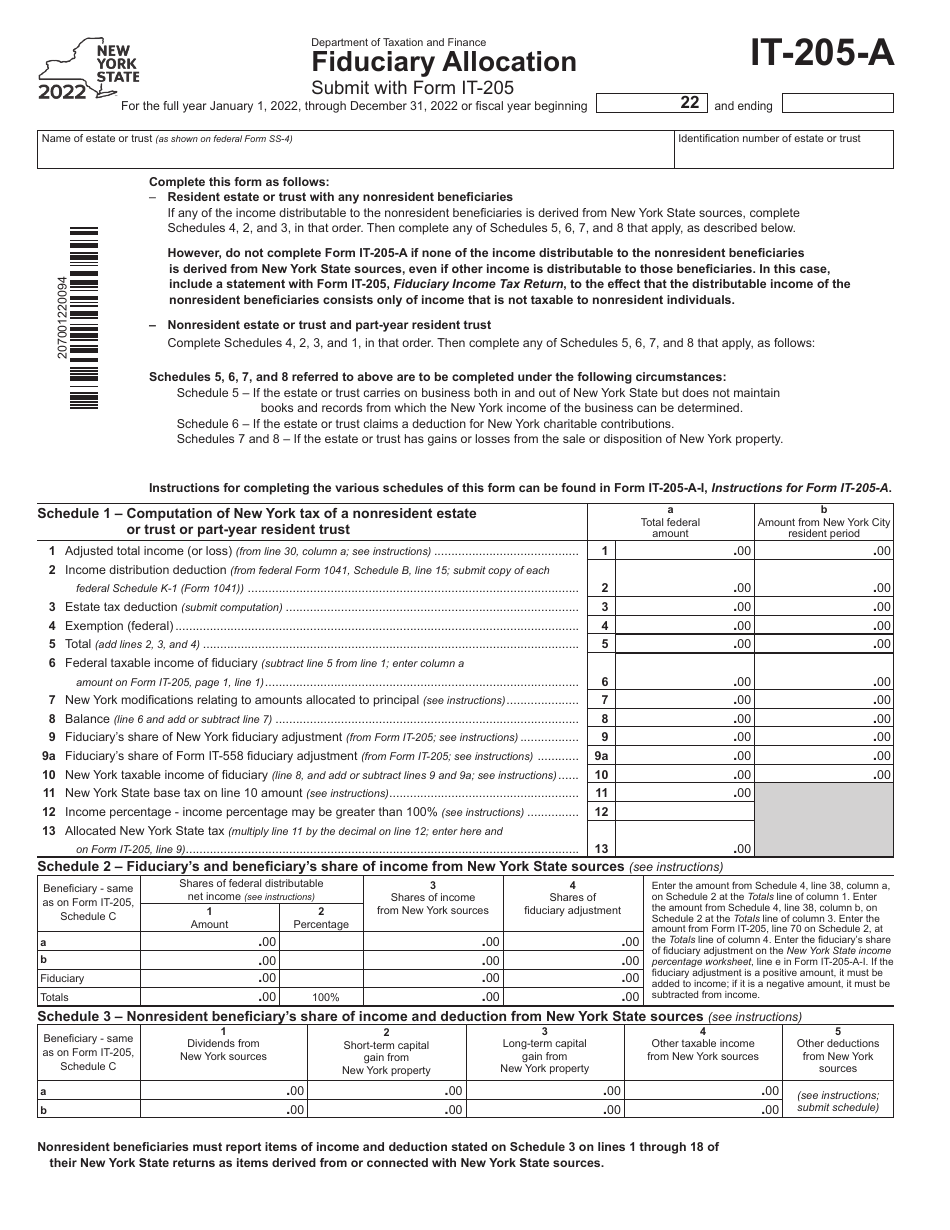

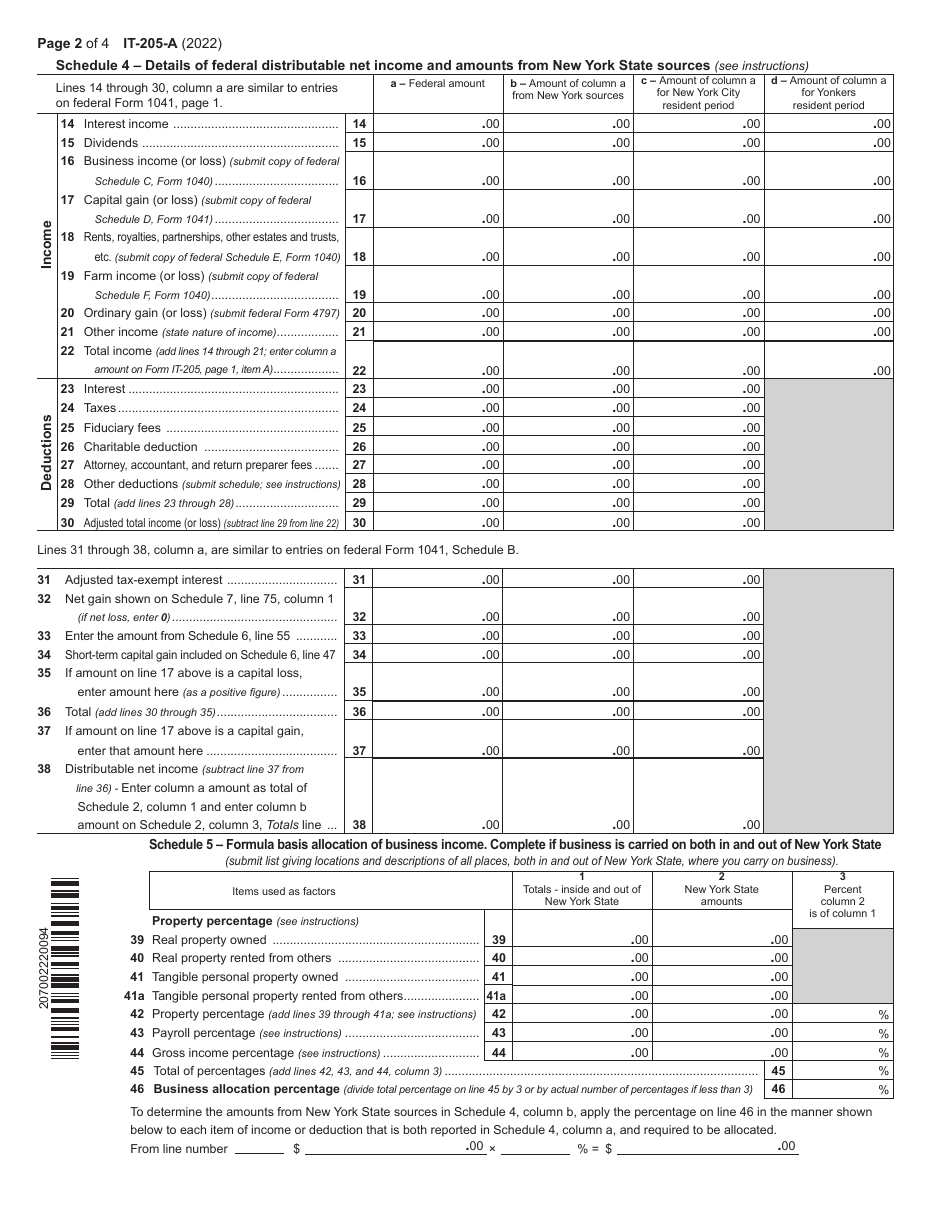

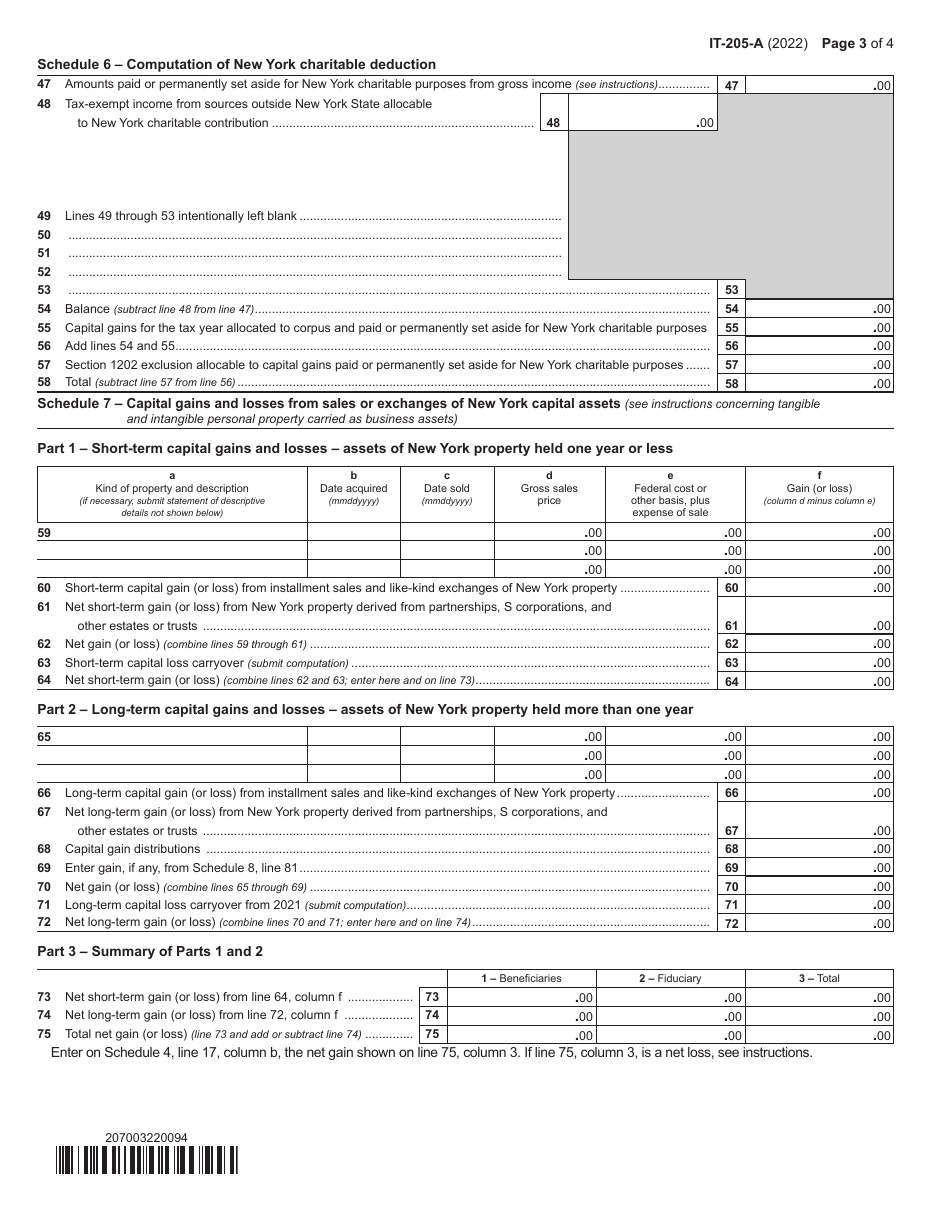

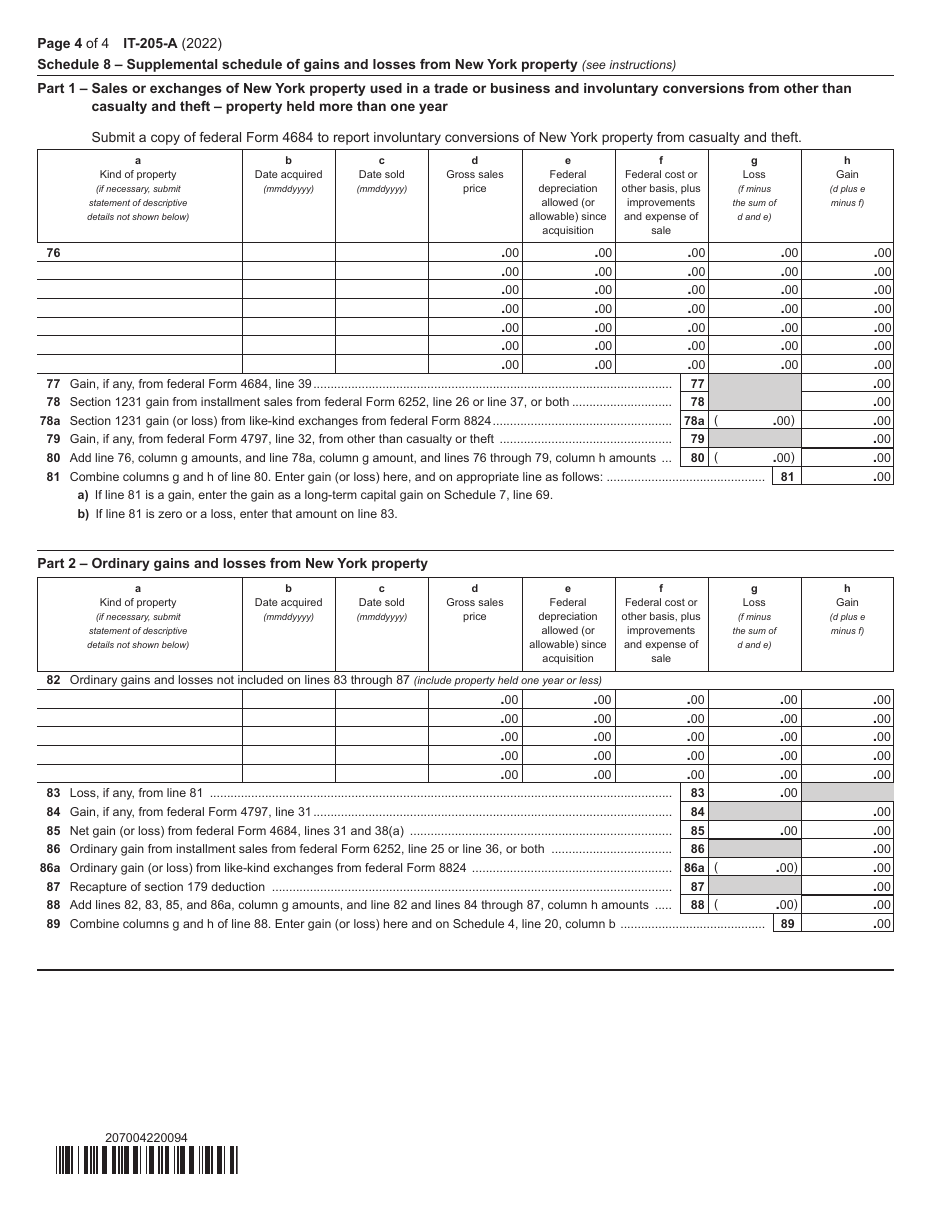

Form IT-205-A

for the current year.

Form IT-205-A Fiduciary Allocation - New York

What Is Form IT-205-A?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-205-A Fiduciary Allocation?

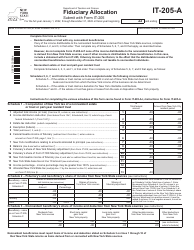

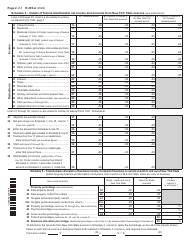

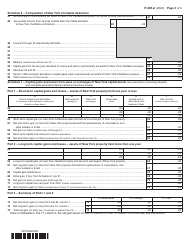

A: Form IT-205-A Fiduciary Allocation is a tax form used by fiduciaries in New York to allocate and report income, deductions, and credits among multiple beneficiaries.

Q: Who needs to file Form IT-205-A Fiduciary Allocation?

A: Fiduciaries in New York who have multiple beneficiaries and need to allocate and report income, deductions, and credits must file Form IT-205-A.

Q: What information is required on Form IT-205-A Fiduciary Allocation?

A: Form IT-205-A requires the fiduciary to provide detailed information about the beneficiaries, their share of income, deductions, and credits, and any special allocation or adjustment.

Q: When is the deadline to file Form IT-205-A Fiduciary Allocation?

A: Form IT-205-A must be filed by the fiduciary no later than the fifteenth day of the fourth month following the close of the taxable year.

Q: Are there any other forms associated with Form IT-205-A Fiduciary Allocation?

A: Yes, fiduciaries may need to file other tax forms such as Form IT-205, Form IT-205-ATT, and Form IT-205-C.

Q: What are the consequences of not filing Form IT-205-A Fiduciary Allocation?

A: Failure to file Form IT-205-A or providing false or incomplete information may result in penalties or other enforcement actions by the New York State Department of Taxation and Finance.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-205-A by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.