This version of the form is not currently in use and is provided for reference only. Download this version of

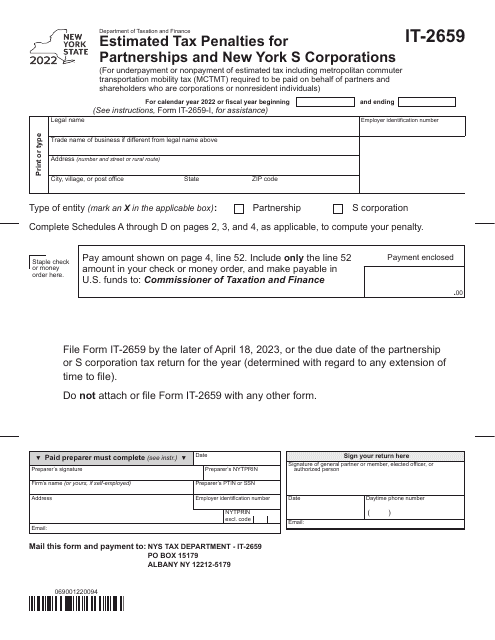

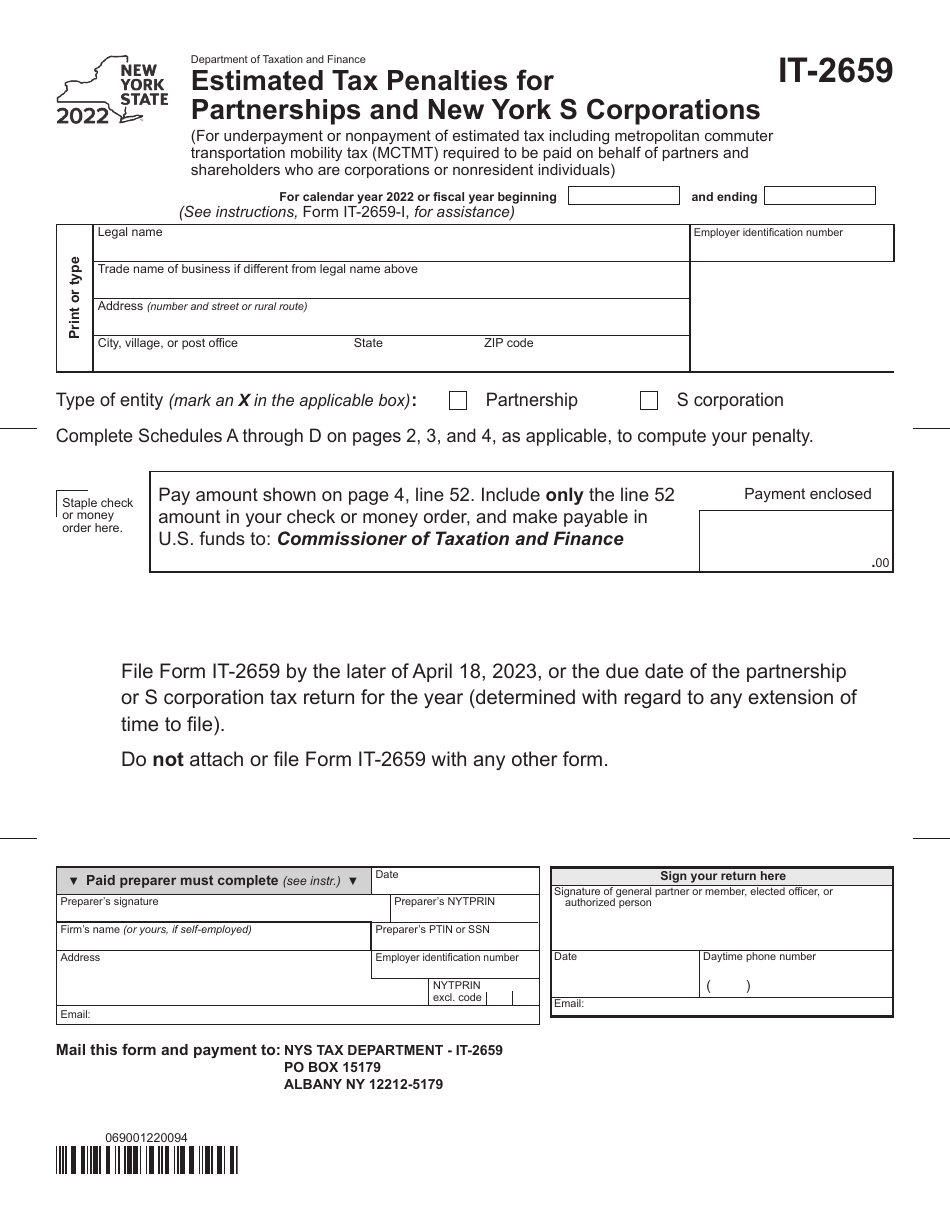

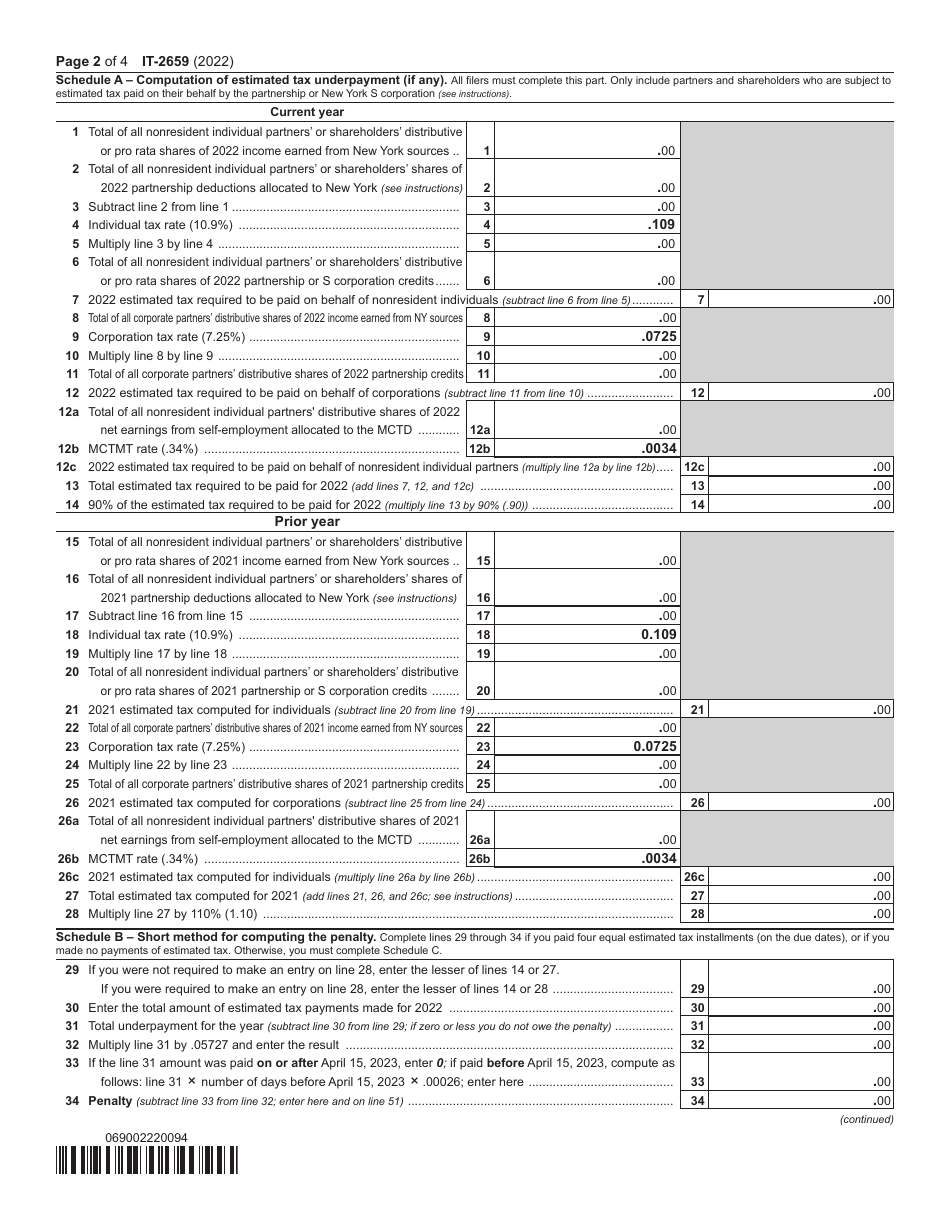

Form IT-2659

for the current year.

Form IT-2659 Estimated Tax Penalties for Partnerships and New York S Corporations - New York

What Is Form IT-2659?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: Who needs to file Form IT-2659?

A: Partnerships and New York S Corporations in New York.

Q: What is the purpose of Form IT-2659?

A: To calculate and pay estimated tax penalties for partnerships and New York S Corporations in New York.

Q: When is Form IT-2659 due?

A: It is due on or before the 15th day of the fourth month following the end of the tax year.

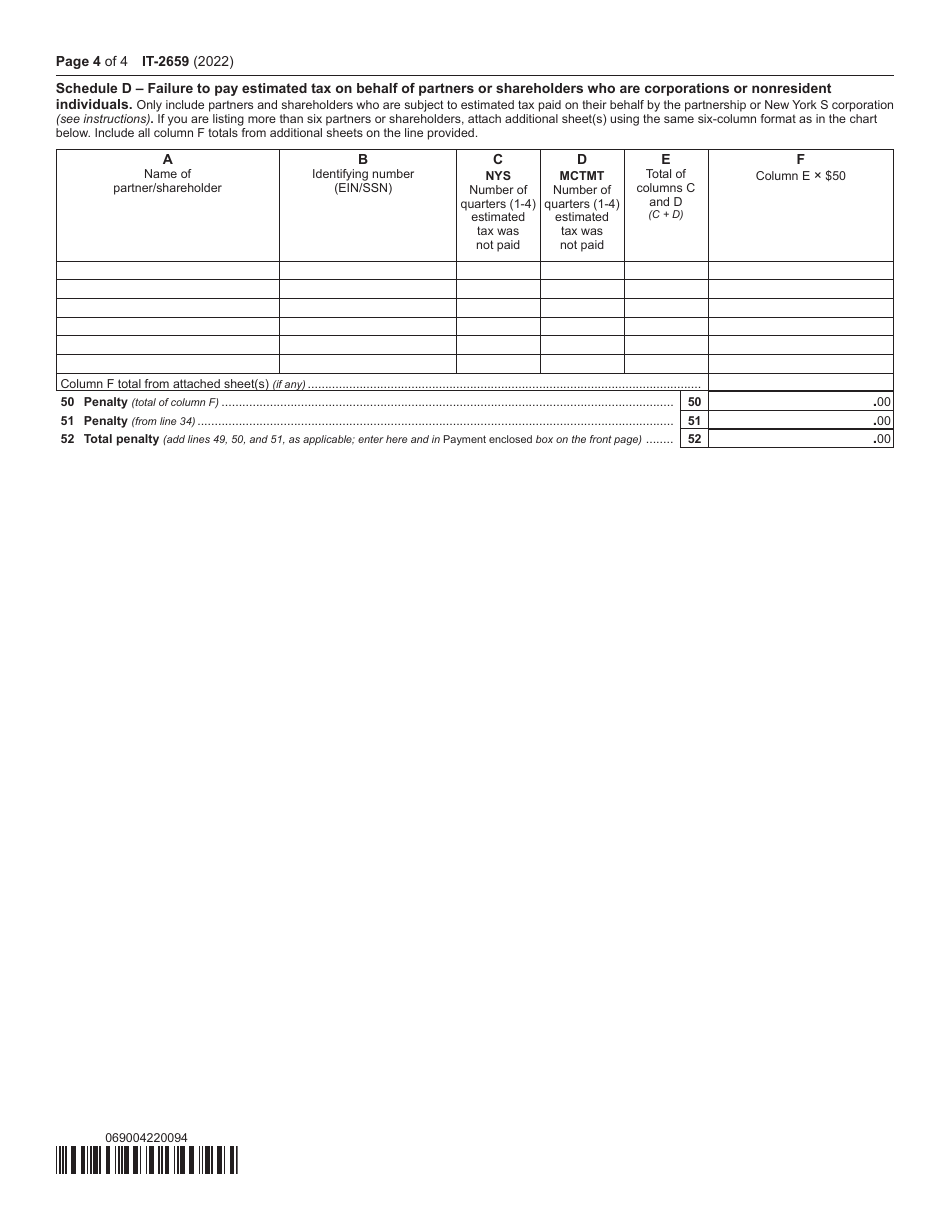

Q: What are estimated tax penalties?

A: They are penalties imposed when a partnership or New York S Corporation fails to pay its estimated tax by the due date.

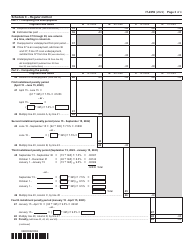

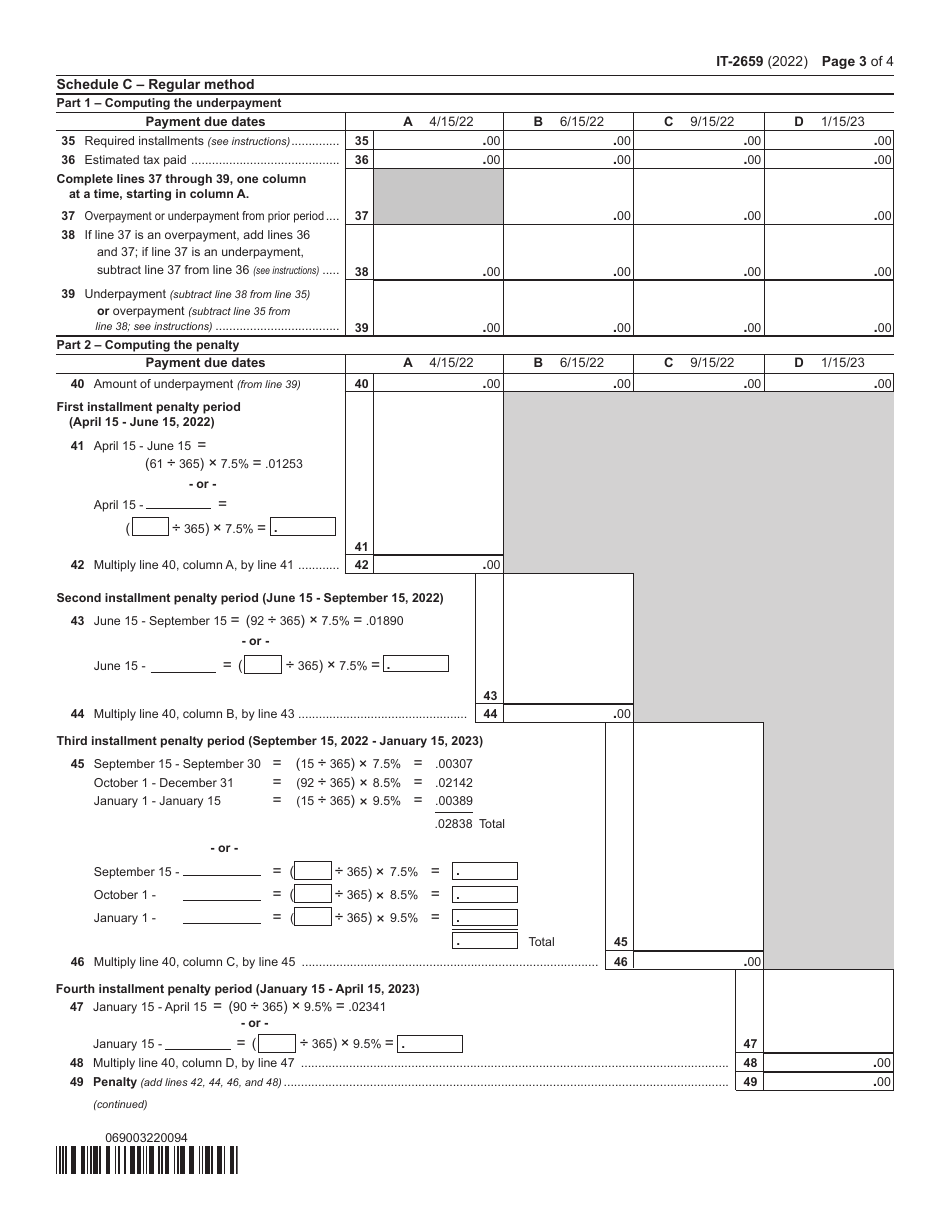

Q: How are estimated tax penalties calculated?

A: The penalties are calculated based on the underpayment of estimated tax and the applicable interest rate.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-2659 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.