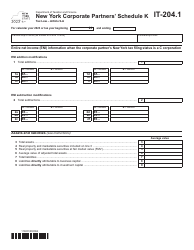

This version of the form is not currently in use and is provided for reference only. Download this version of

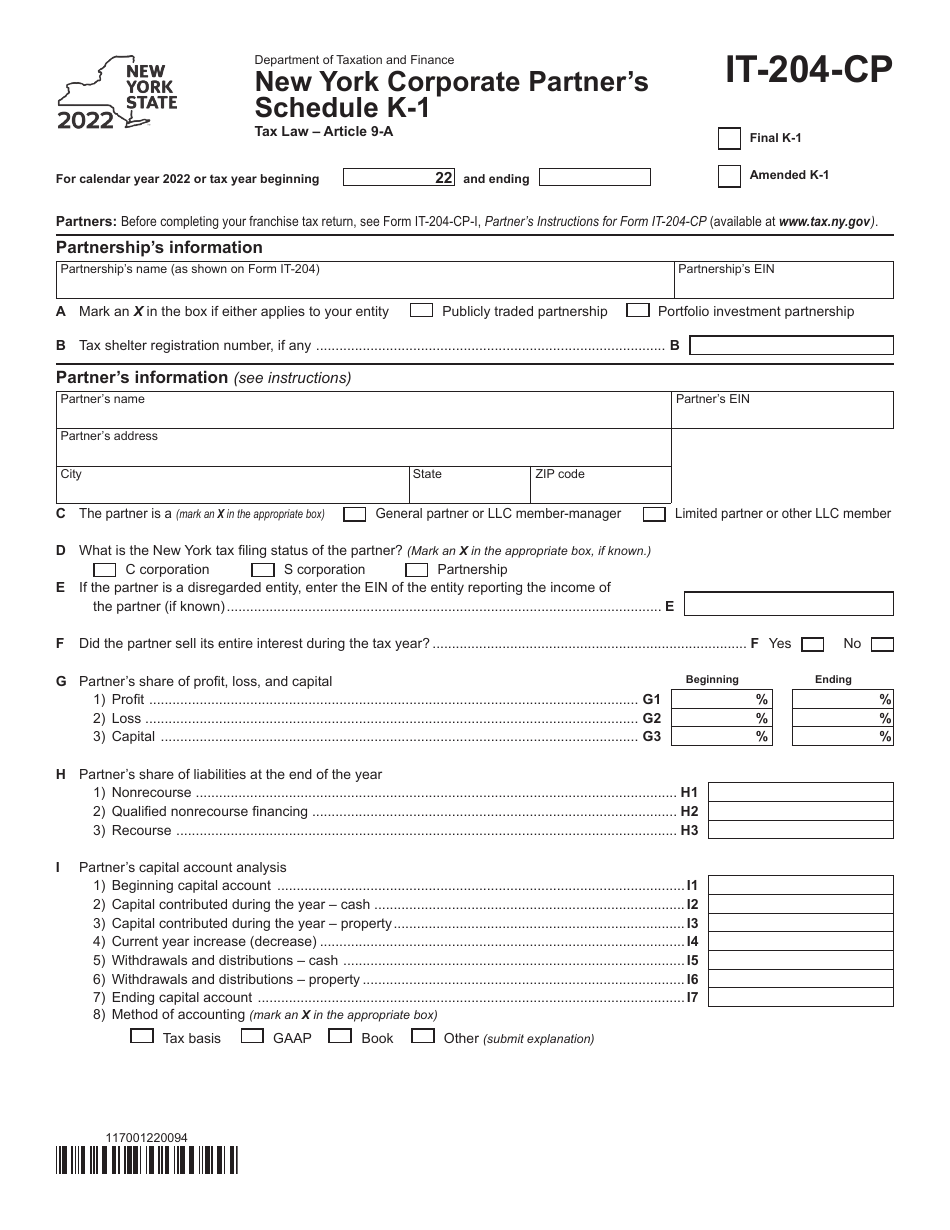

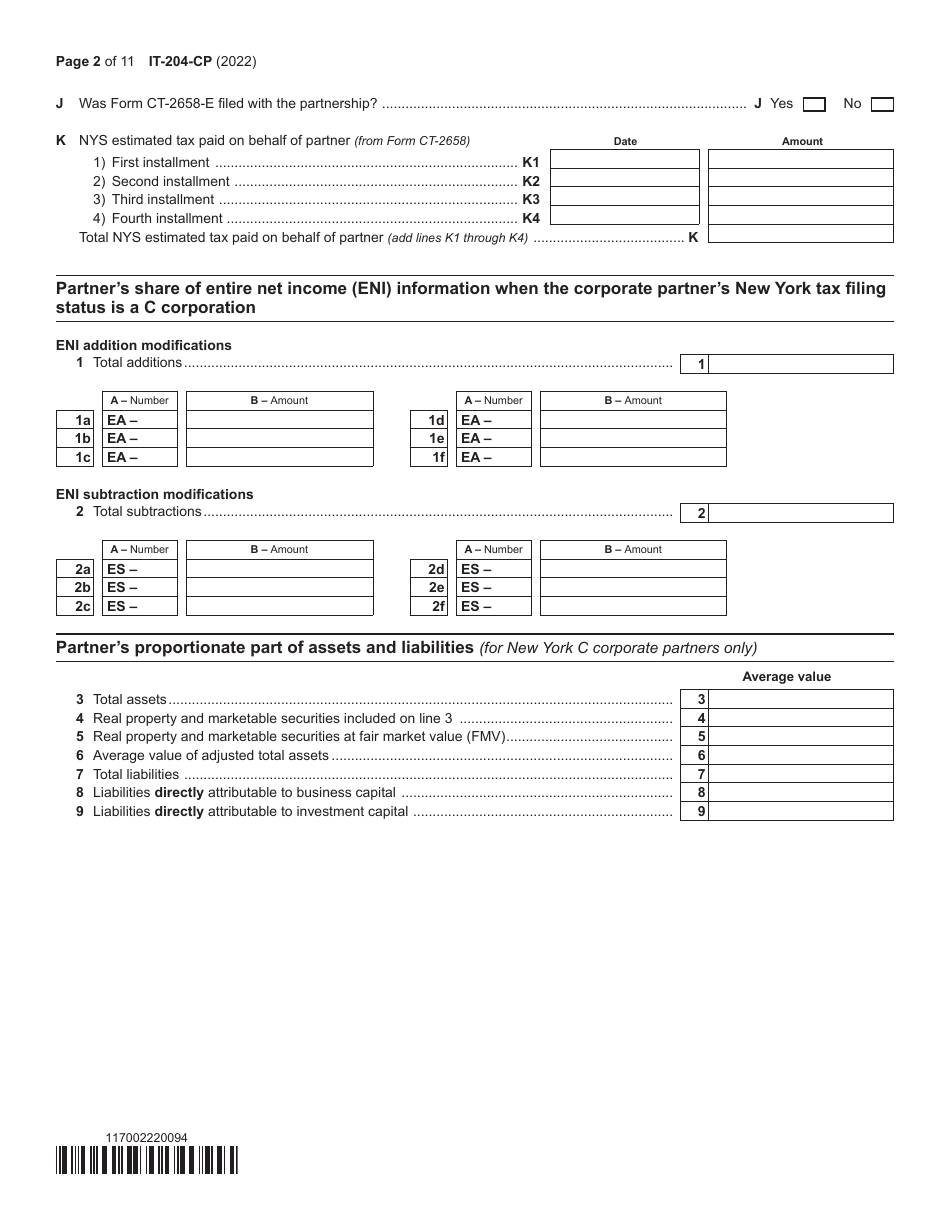

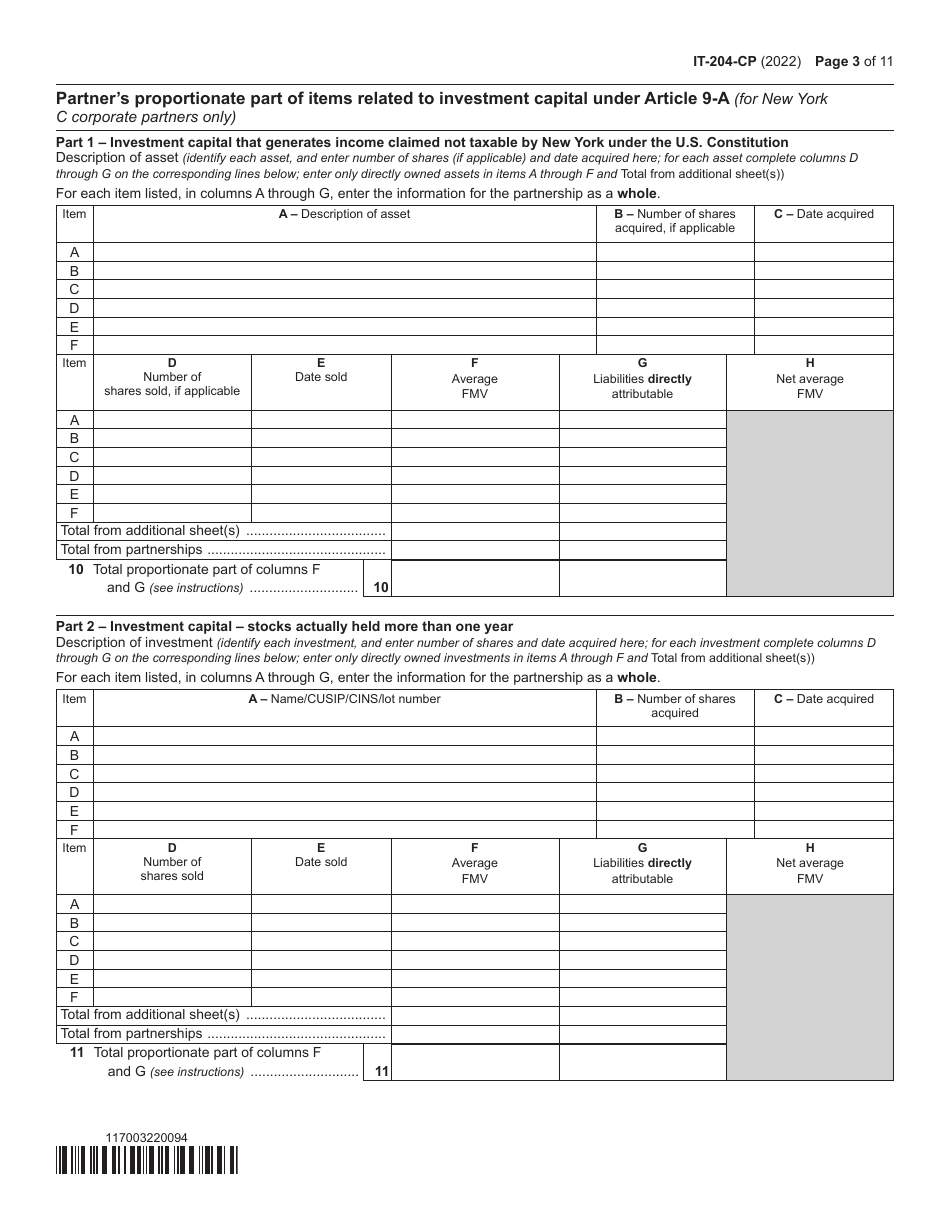

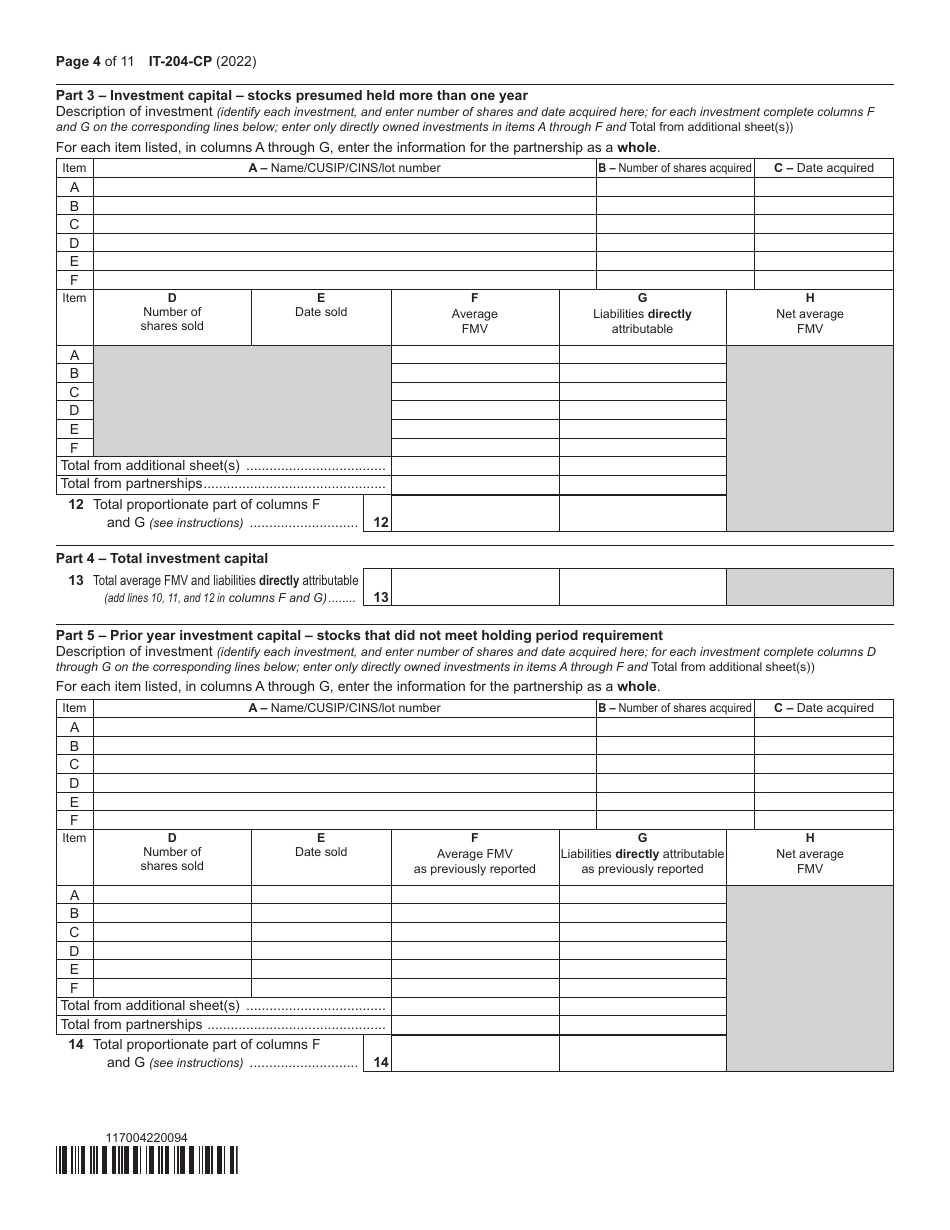

Form IT-204-CP Schedule K-1

for the current year.

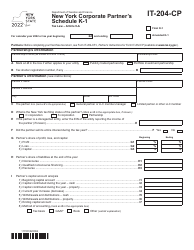

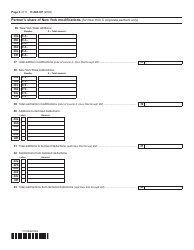

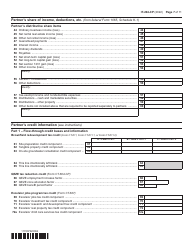

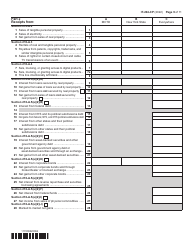

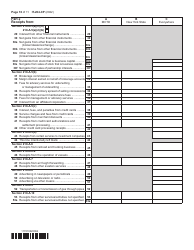

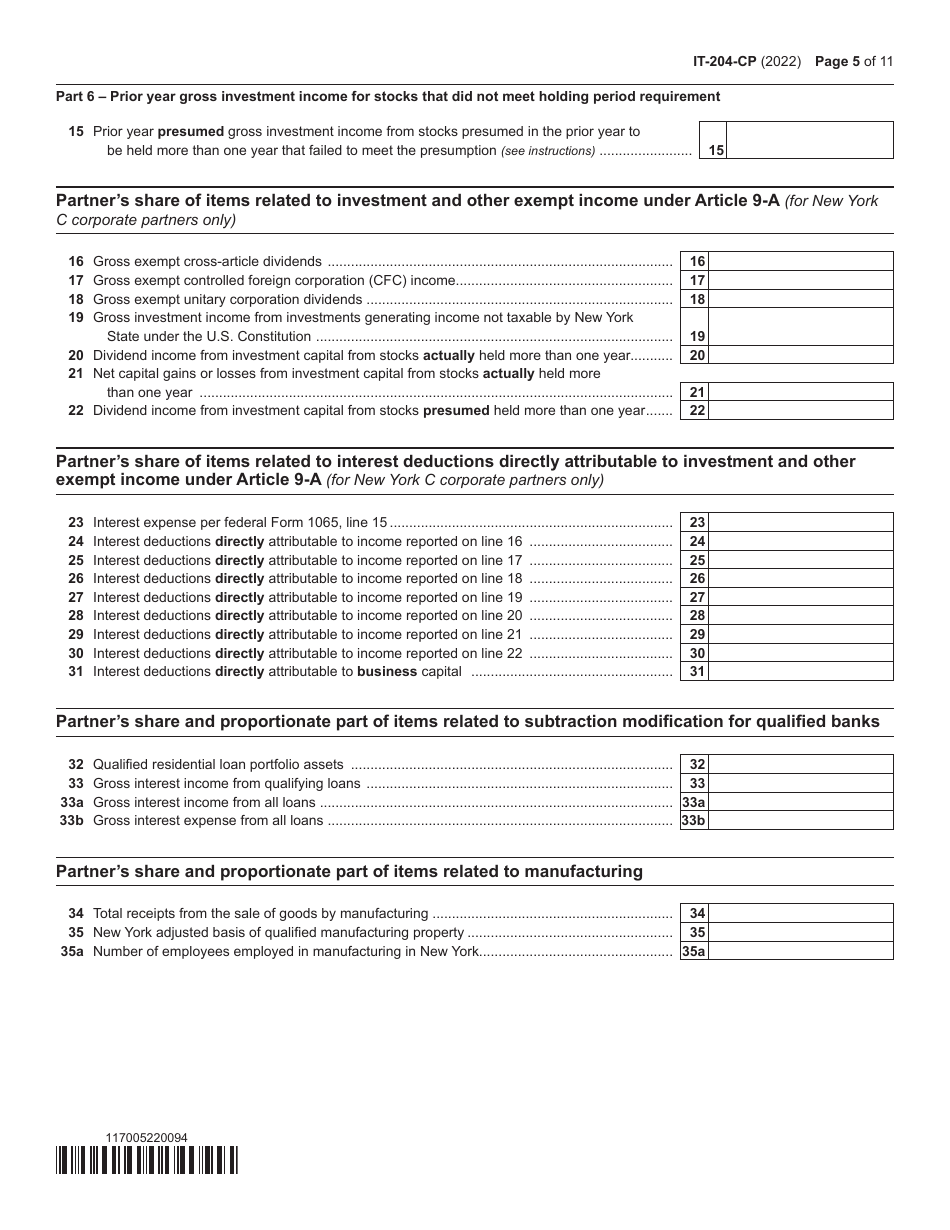

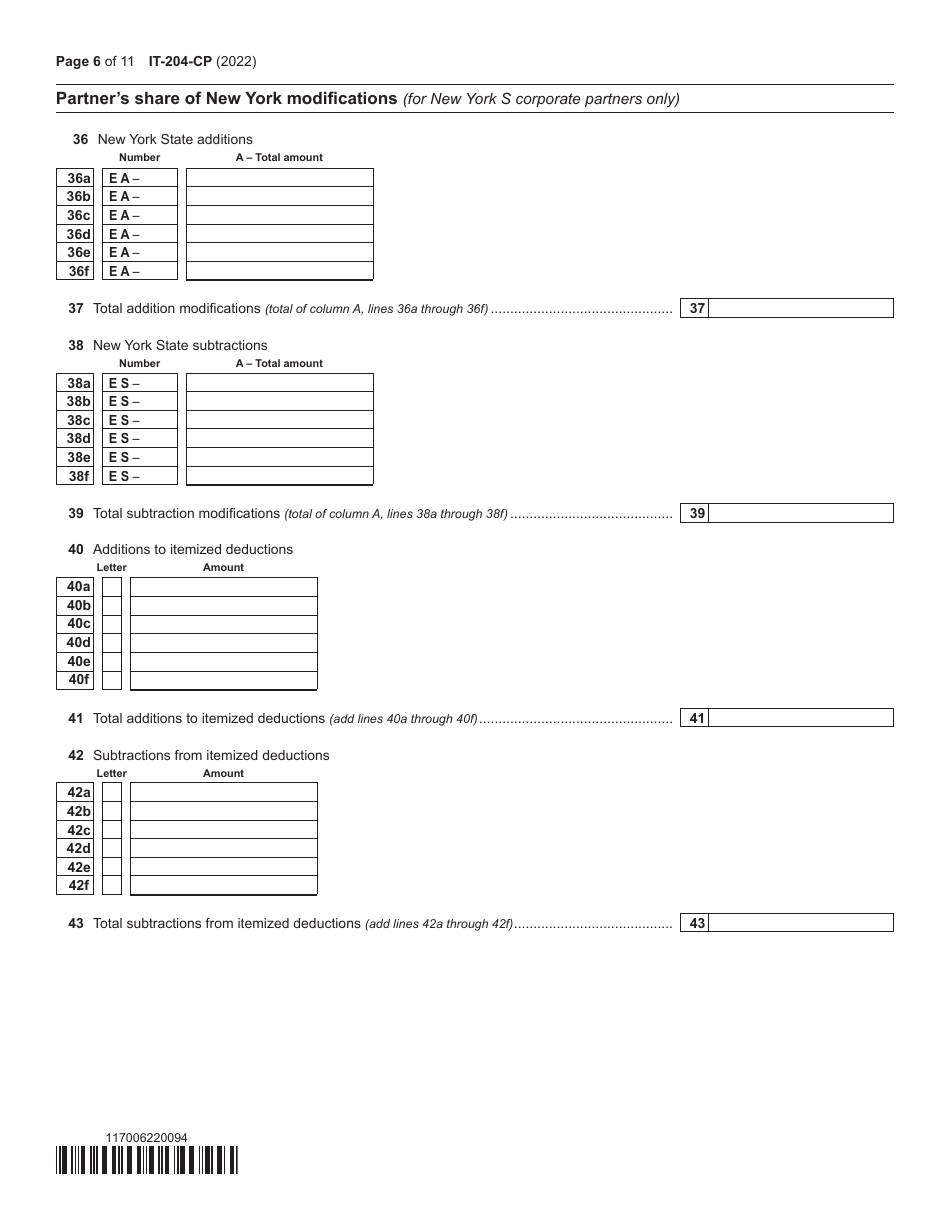

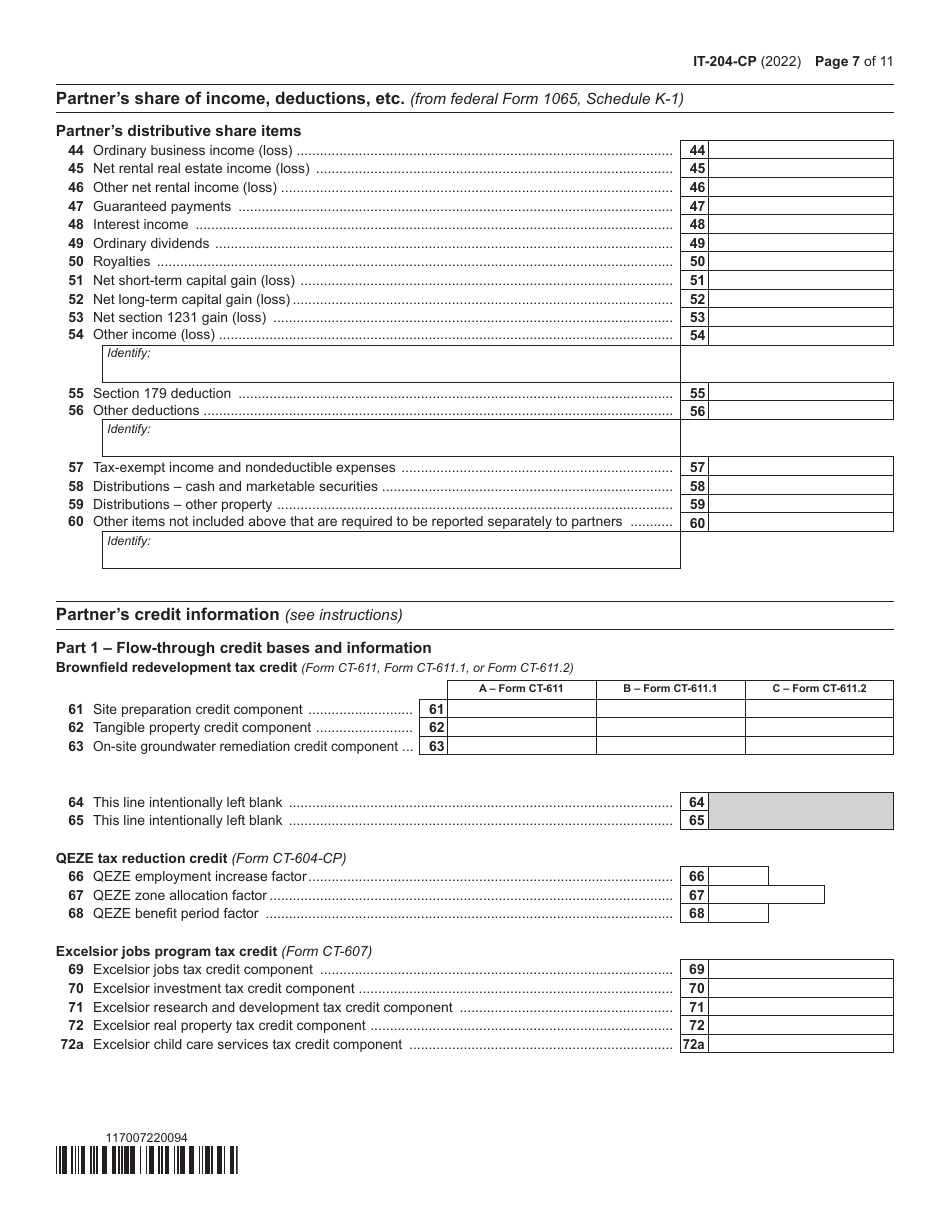

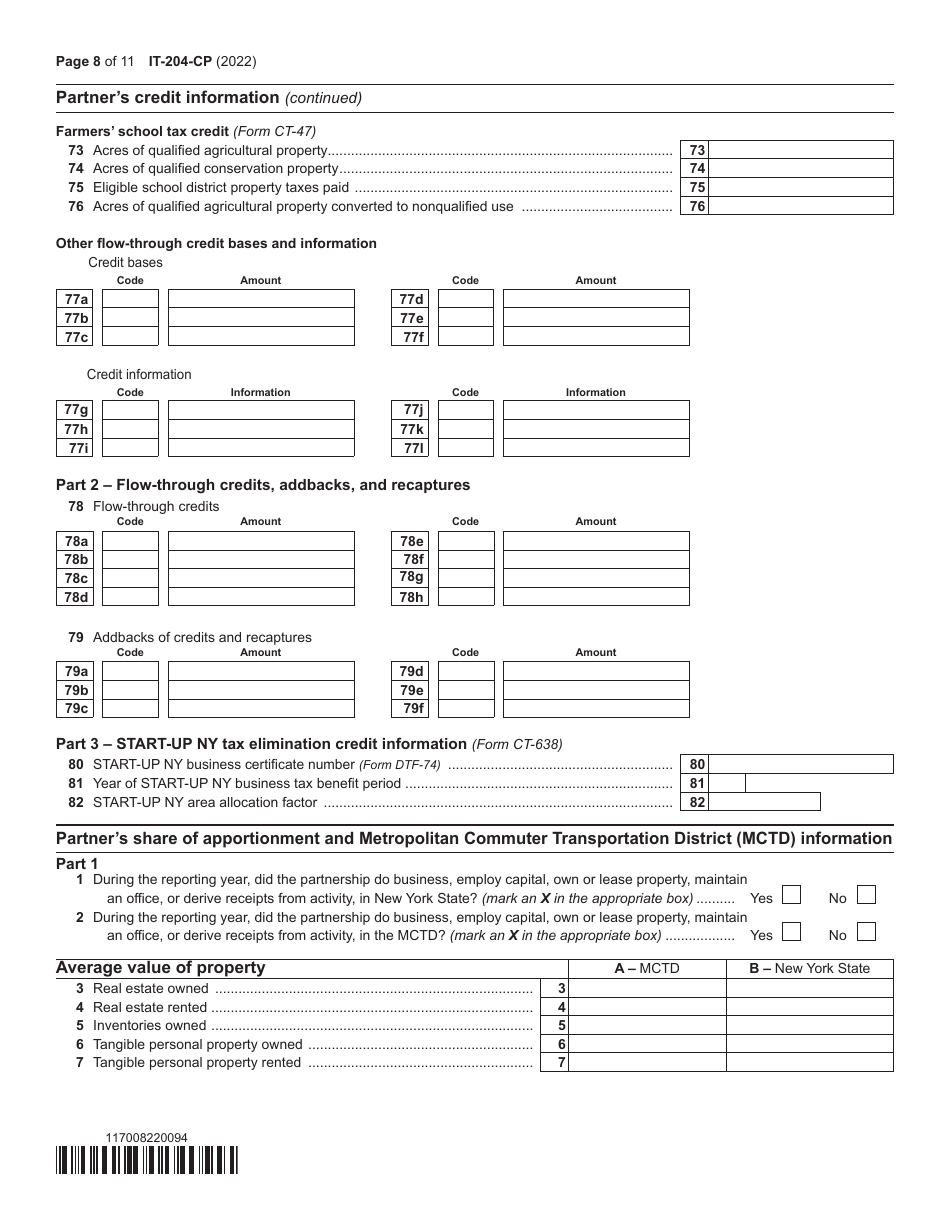

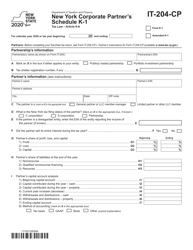

Form IT-204-CP Schedule K-1 New York Corporate Partner's Schedule - New York

What Is Form IT-204-CP Schedule K-1?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

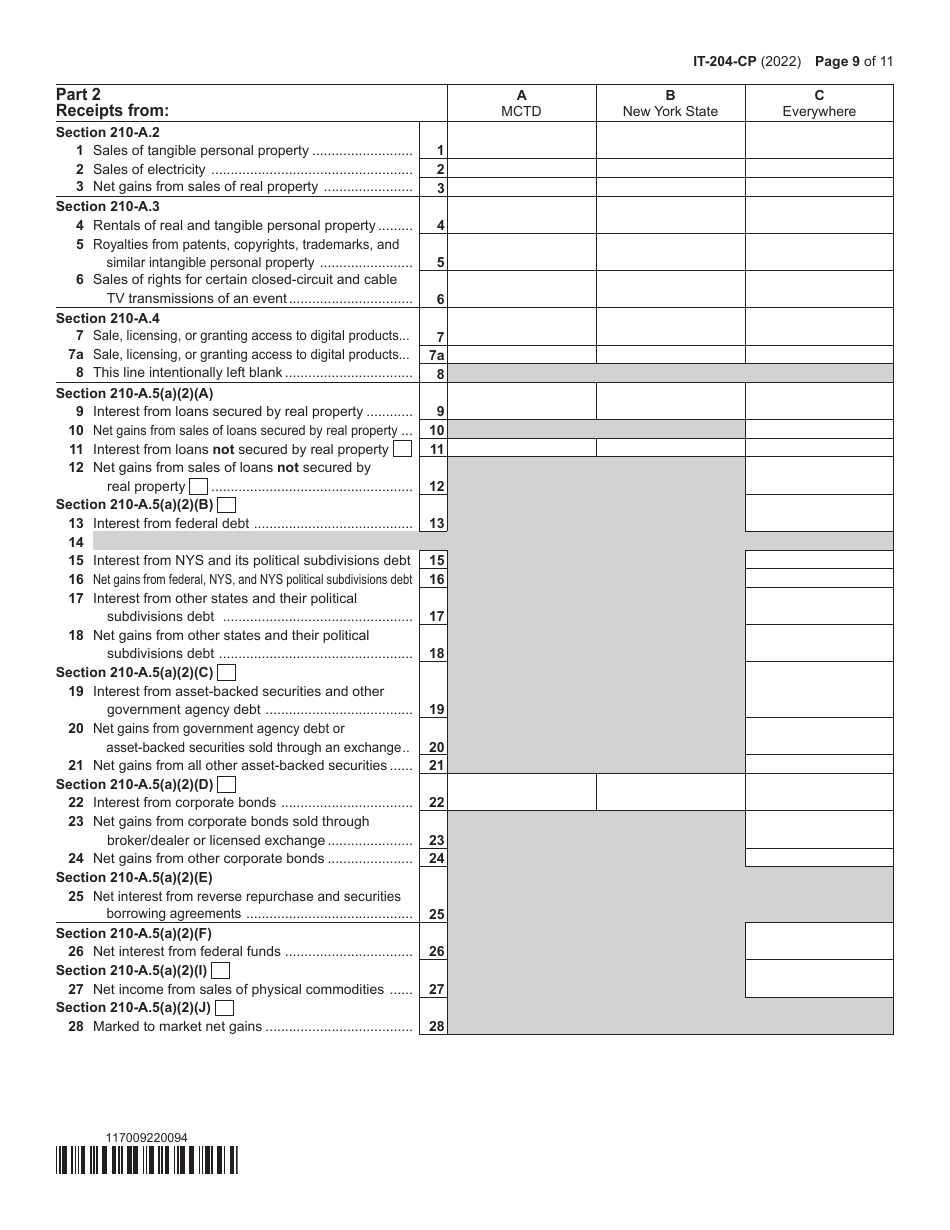

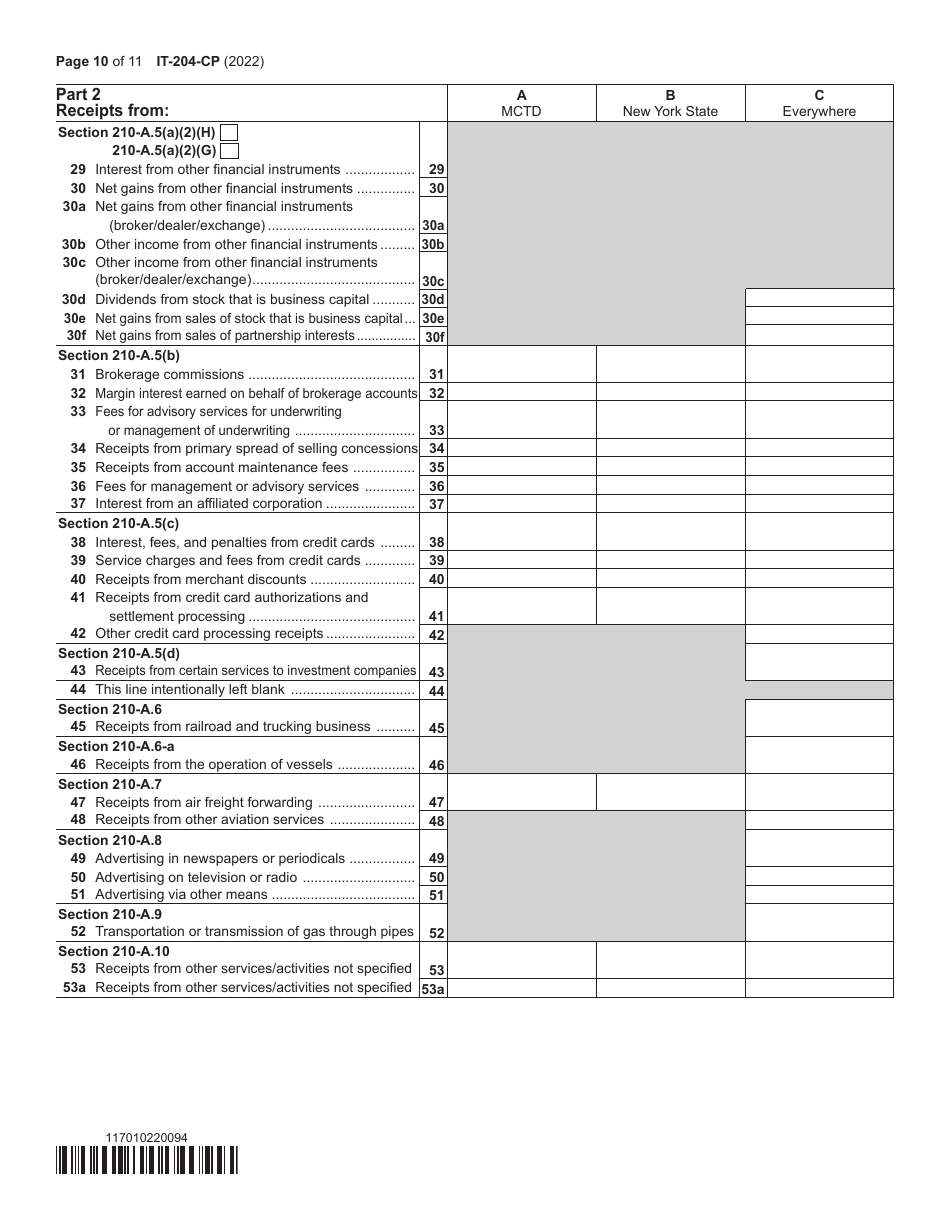

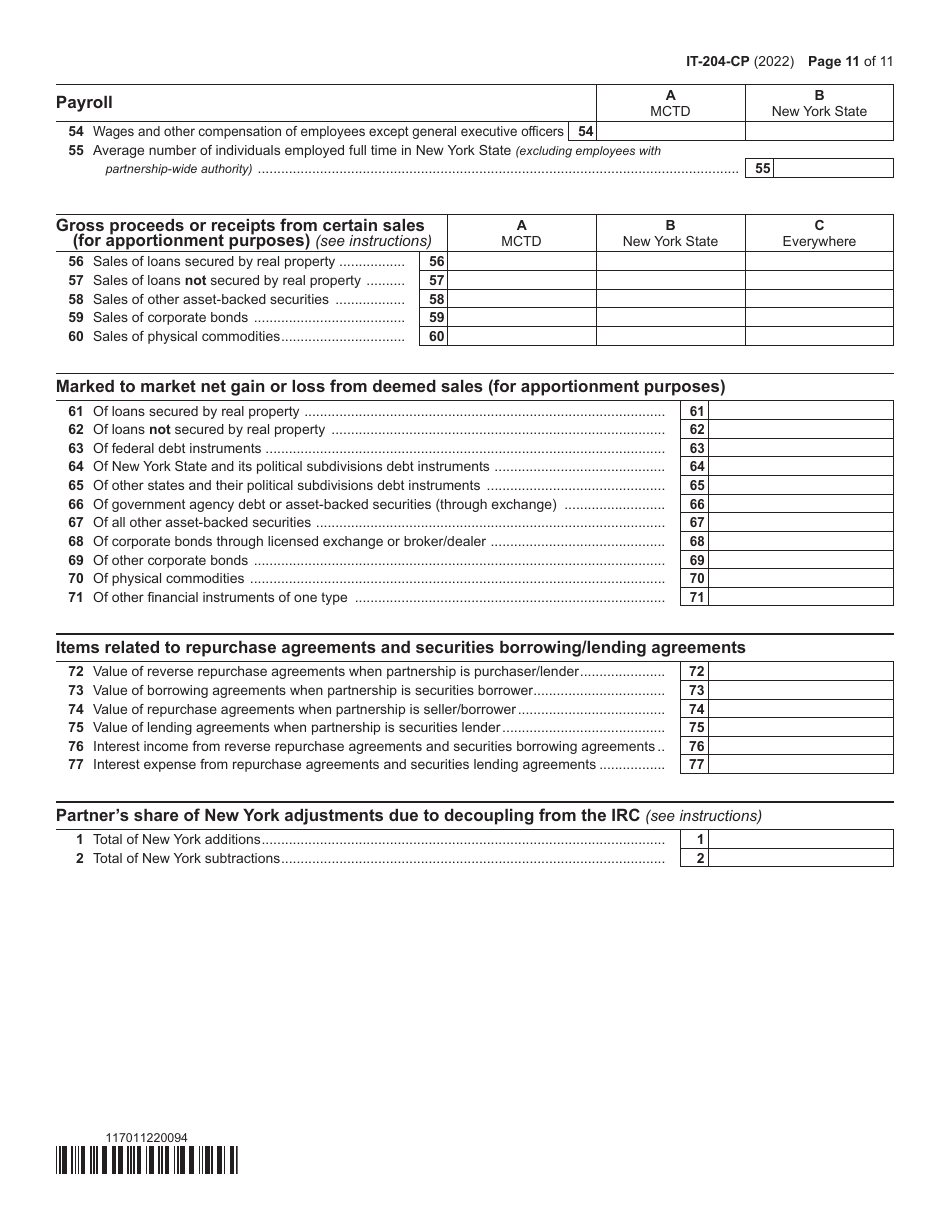

Q: What is IT-204-CP?

A: IT-204-CP is the New York Corporate Partner’s Schedule.

Q: What is Schedule K-1?

A: Schedule K-1 is a tax form used to report the income, deductions, and credits allocated to partners in a partnership or shareholders in an S corporation.

Q: Who needs to file IT-204-CP Schedule K-1?

A: New York corporate partners who are members of a partnership or shareholders of an S corporation that operates in New York need to file IT-204-CP Schedule K-1.

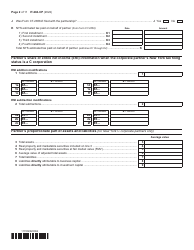

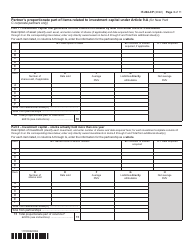

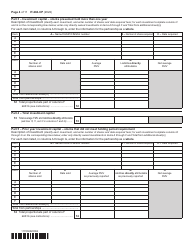

Q: What kind of information is reported on IT-204-CP Schedule K-1?

A: IT-204-CP Schedule K-1 reports the partner or shareholder's share of income, deductions, credits, and other relevant information.

Q: When is IT-204-CP Schedule K-1 due?

A: IT-204-CP Schedule K-1 is generally due on March 15th, but the deadline may vary depending on certain circumstances.

Q: Are there any penalties for not filing IT-204-CP Schedule K-1?

A: Yes, there can be penalties for not filing IT-204-CP Schedule K-1 or for filing it late. It is important to comply with the filing requirements to avoid penalties.

Q: Can I e-file IT-204-CP Schedule K-1?

A: Yes, you can e-file IT-204-CP Schedule K-1 using approved tax preparation software or through a tax professional who offers e-filing services.

Q: Do I need to attach IT-204-CP Schedule K-1 to my personal tax return?

A: No, IT-204-CP Schedule K-1 is not attached to your personal tax return. Instead, you should keep it for your records and provide it as necessary to the New York State Department of Taxation and Finance.

Q: Is IT-204-CP Schedule K-1 only applicable in New York?

A: Yes, IT-204-CP Schedule K-1 is specific to New York. Other states may have their own forms for reporting partnership or S corporation income, deductions, and credits.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-204-CP Schedule K-1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.