This version of the form is not currently in use and is provided for reference only. Download this version of

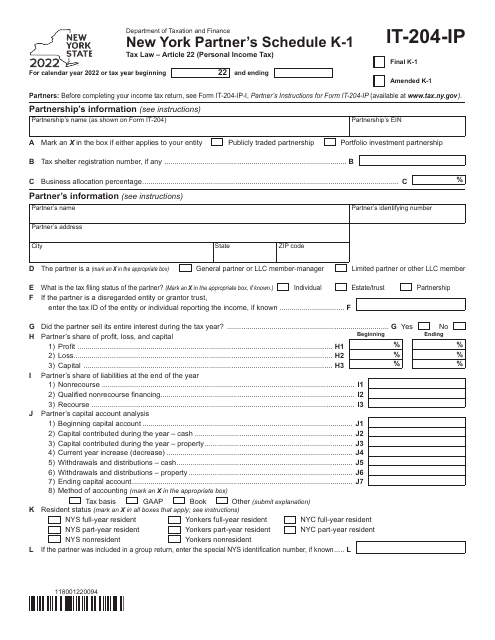

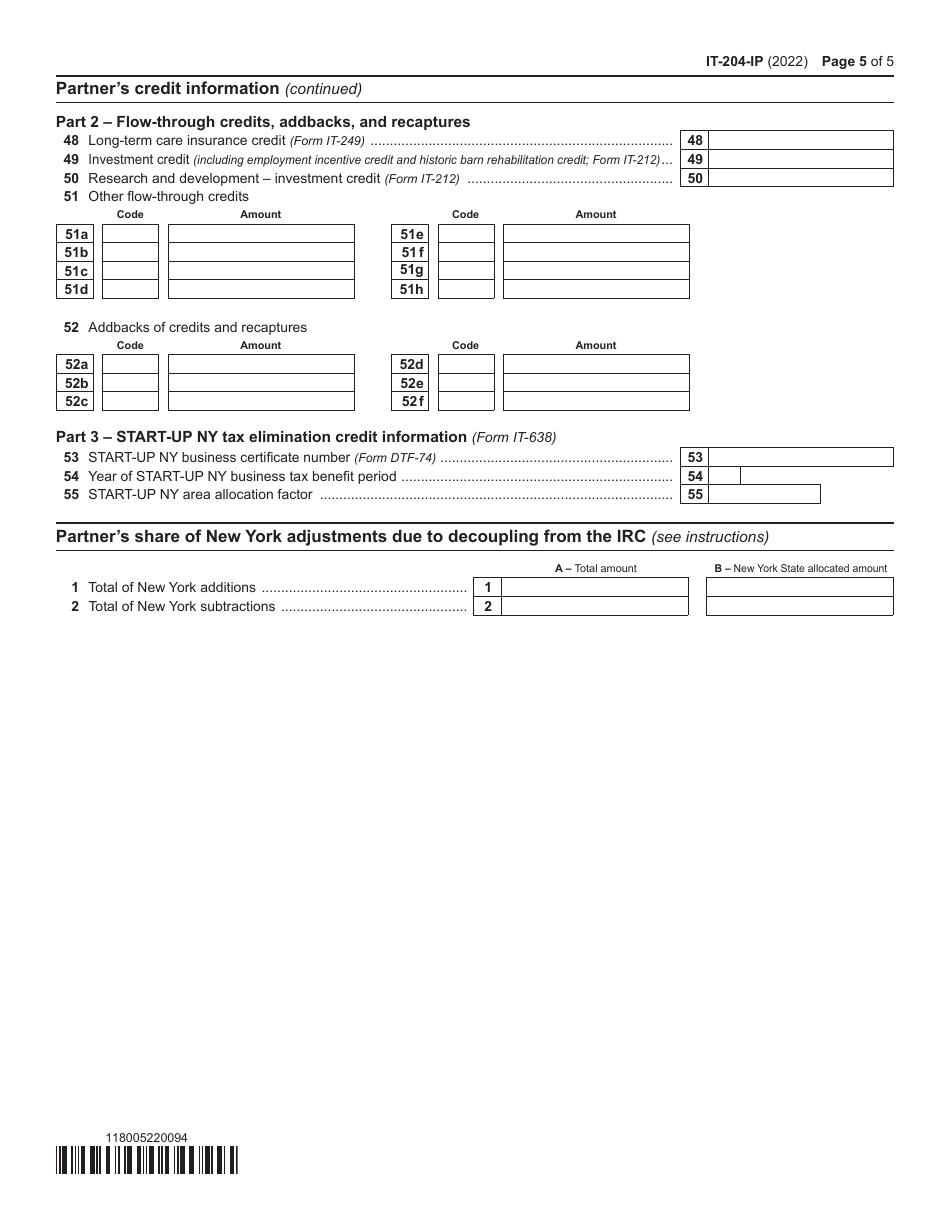

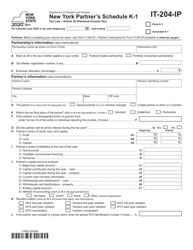

Form IT-204-IP Schedule K-1

for the current year.

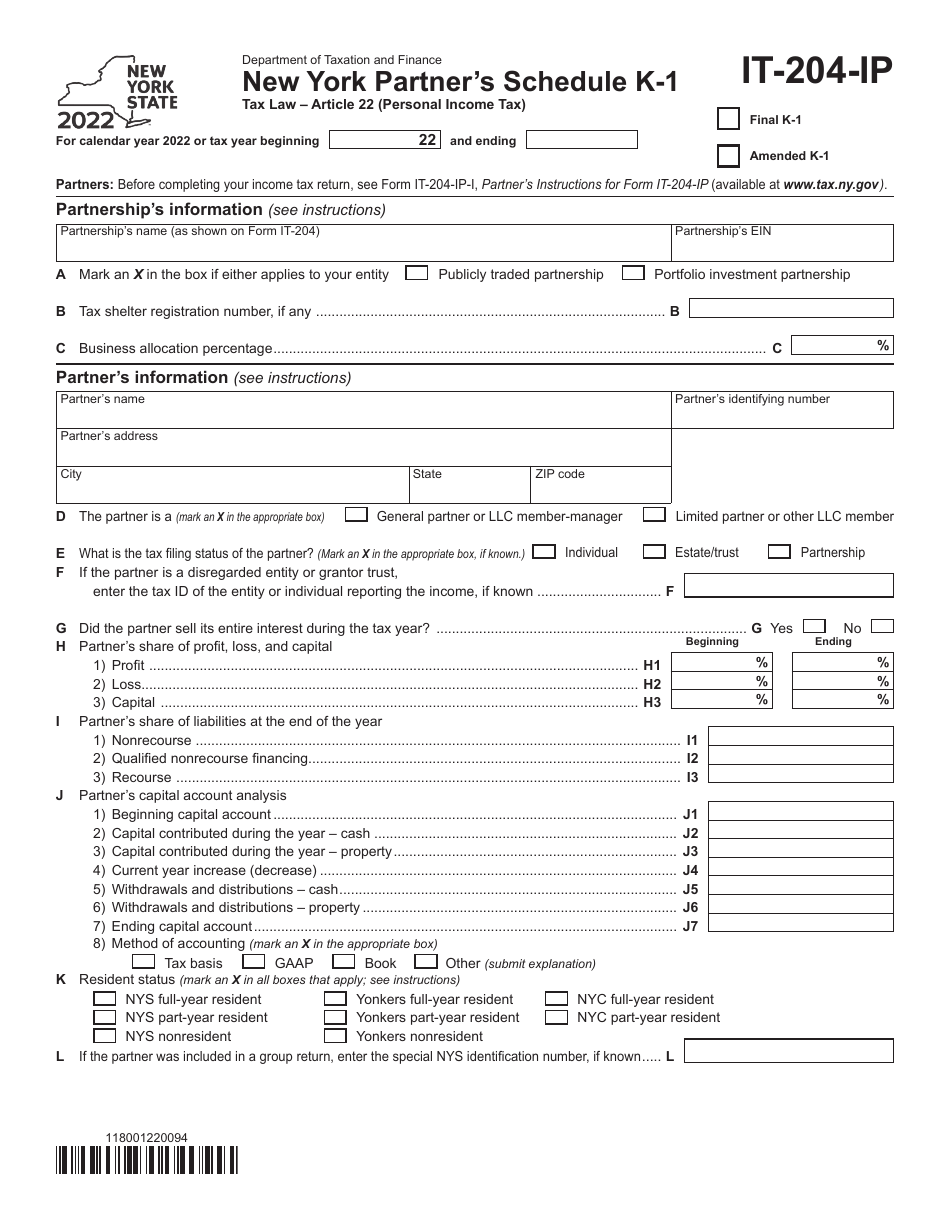

Form IT-204-IP Schedule K-1 New York Partner's Schedule - New York

What Is Form IT-204-IP Schedule K-1?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is IT-204-IP Schedule K-1?

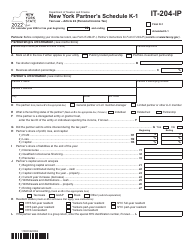

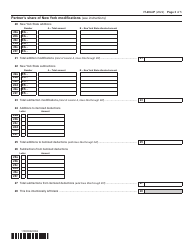

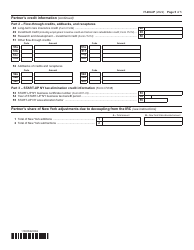

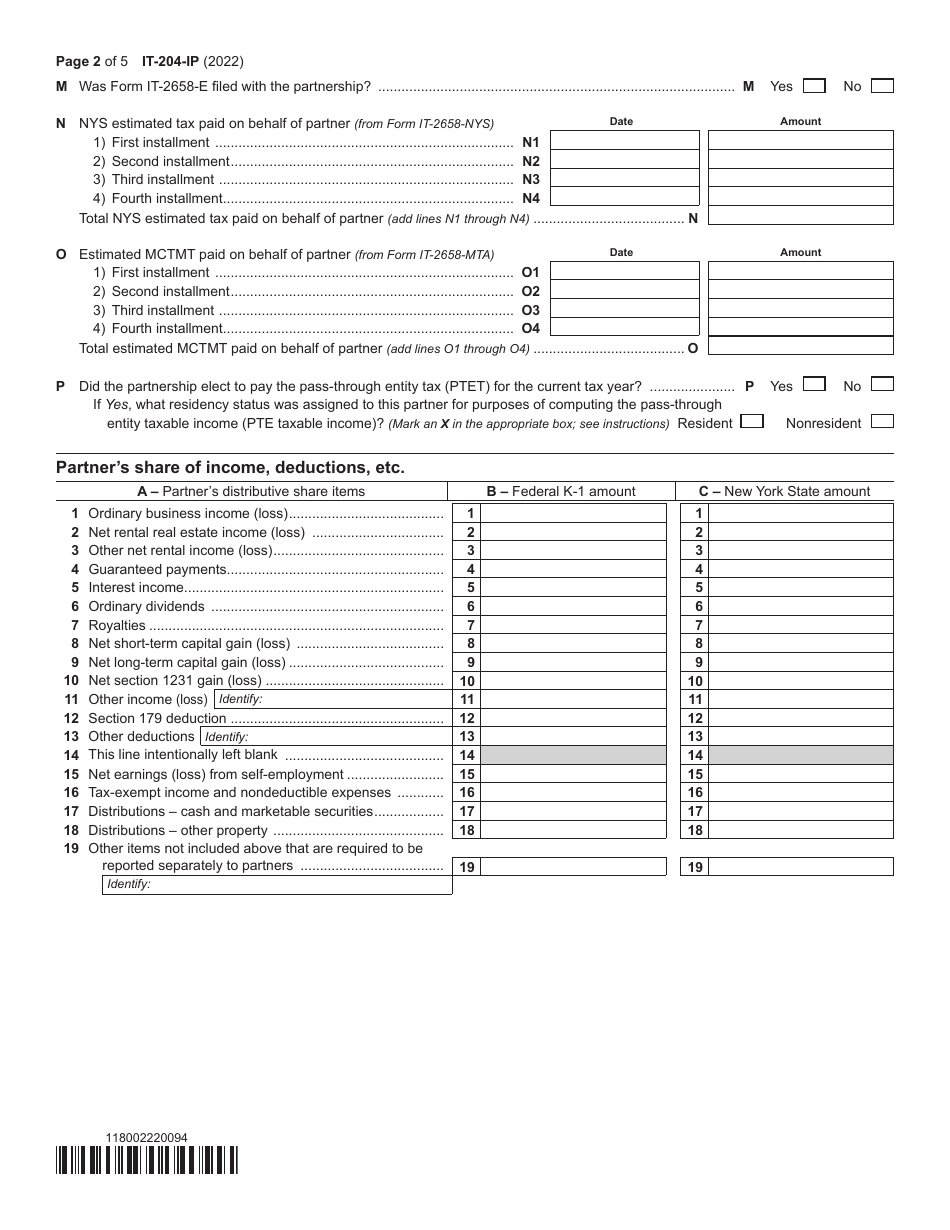

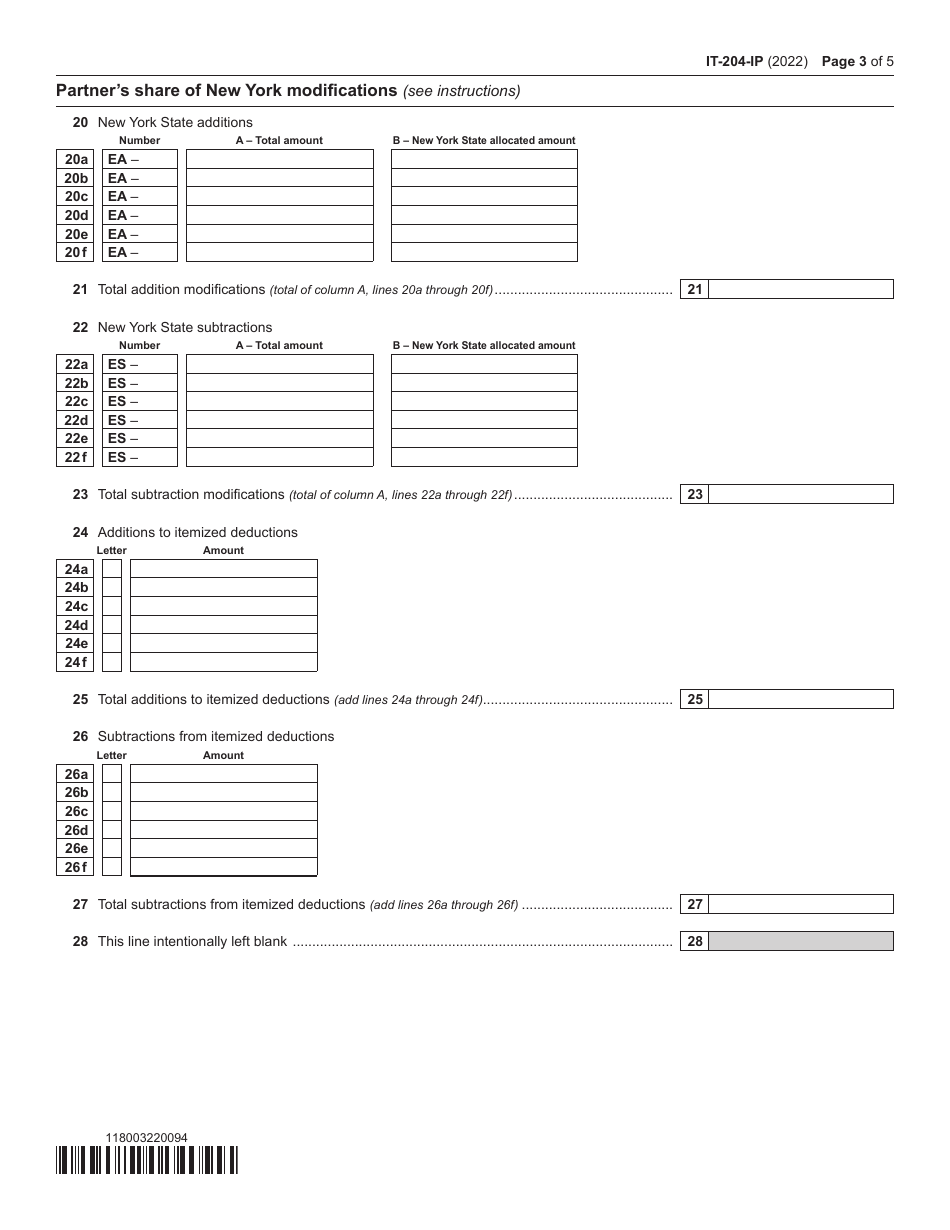

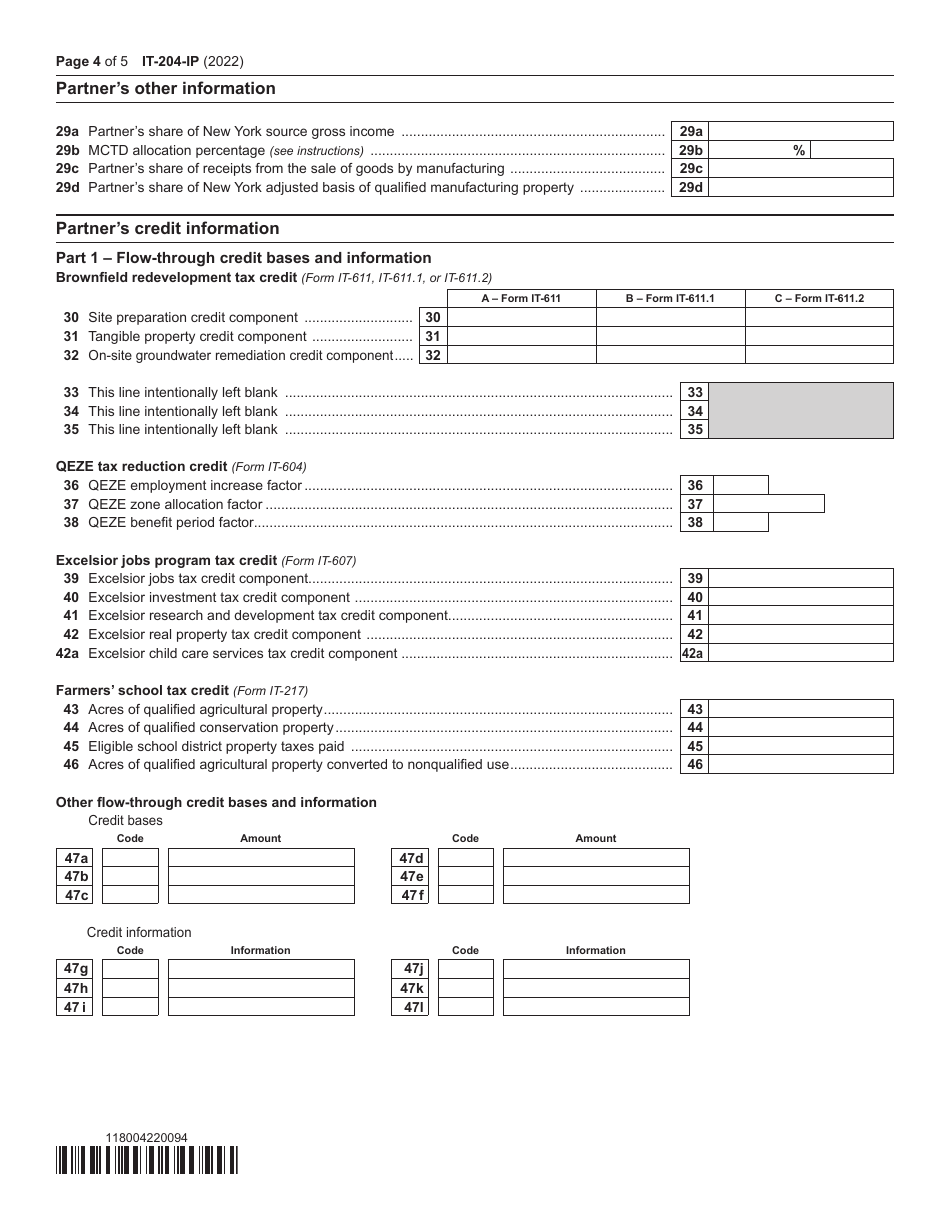

A: IT-204-IP Schedule K-1 is a tax form for New York partners to report their share of partnership income, deductions, and credits.

Q: Who needs to file IT-204-IP Schedule K-1?

A: New York partners who are part of a partnership that files Form IT-204-IP need to file Schedule K-1.

Q: What information is reported on IT-204-IP Schedule K-1?

A: IT-204-IP Schedule K-1 reports a partner's share of the partnership's income, losses, credits, and other tax-related information.

Q: How do I obtain IT-204-IP Schedule K-1?

A: Partners should receive IT-204-IP Schedule K-1 from the partnership they are a part of.

Q: What happens if I don't file IT-204-IP Schedule K-1?

A: Failing to file IT-204-IP Schedule K-1 can result in penalties or fines from the New York State Department of Taxation and Finance.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-204-IP Schedule K-1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.