This version of the form is not currently in use and is provided for reference only. Download this version of

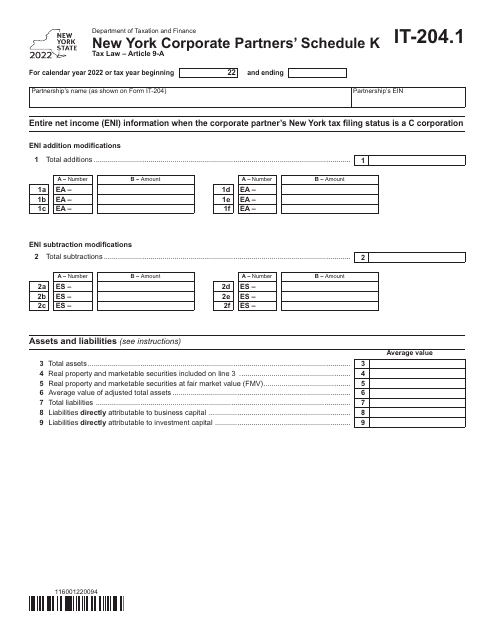

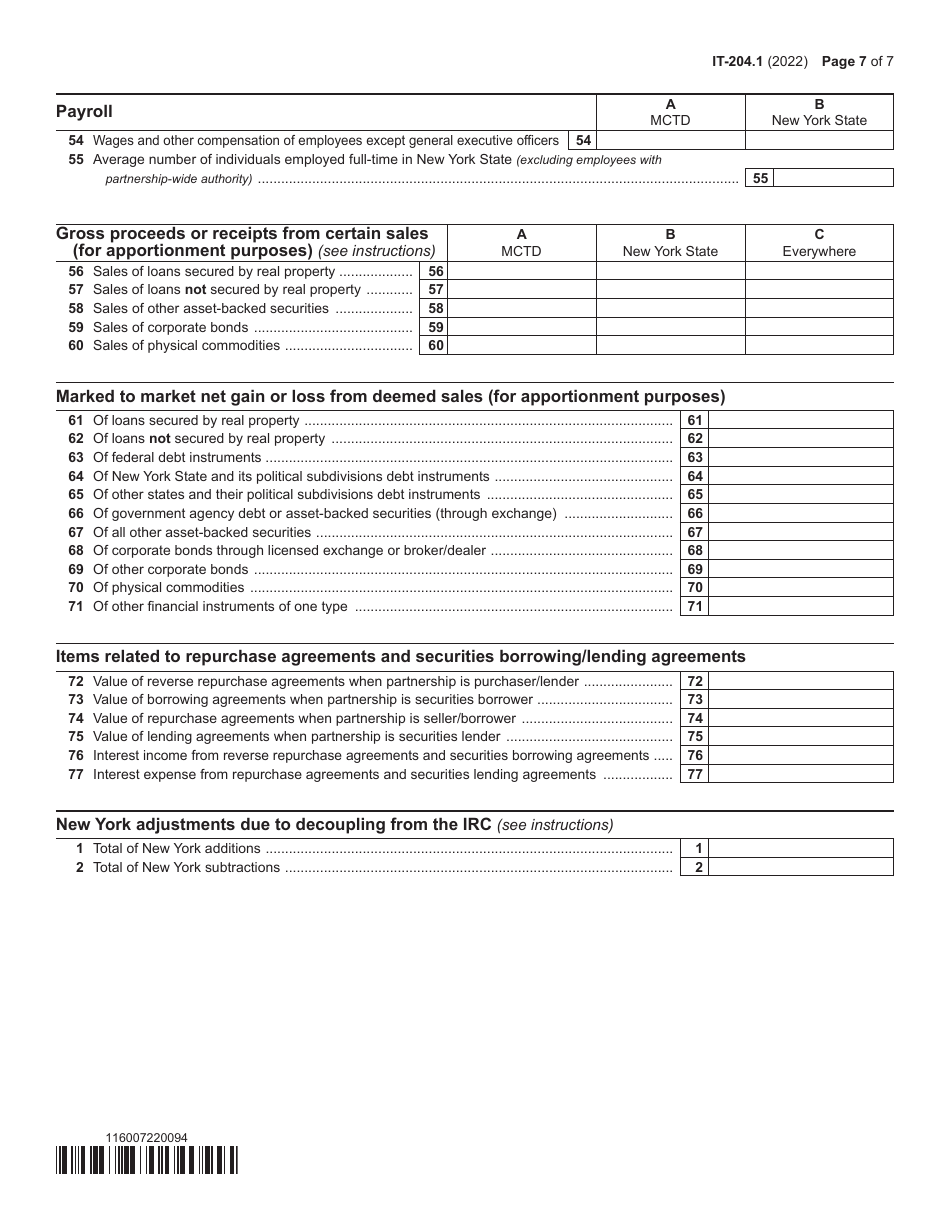

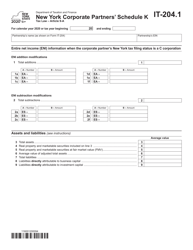

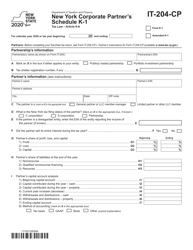

Form IT-204.1 Schedule K

for the current year.

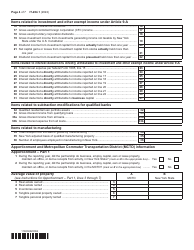

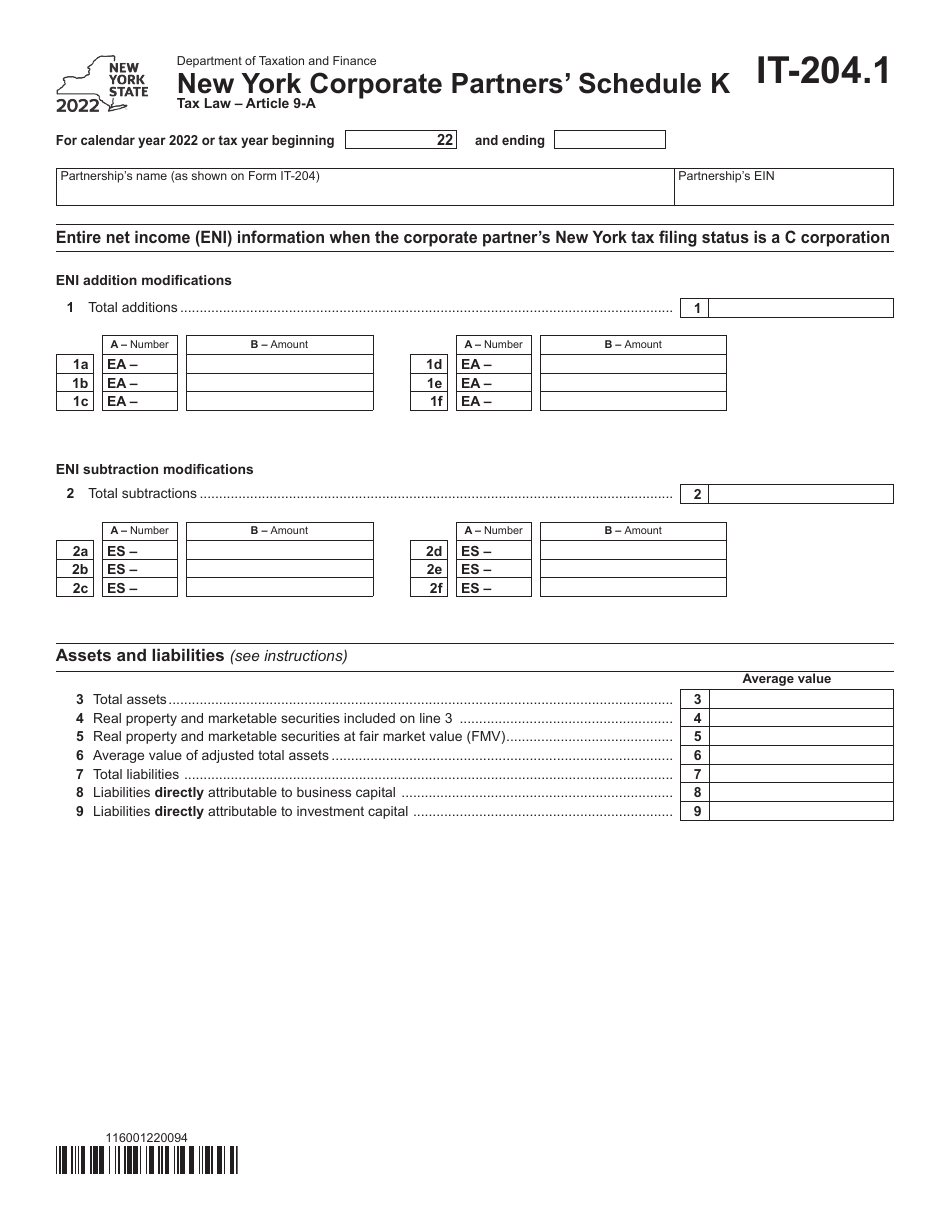

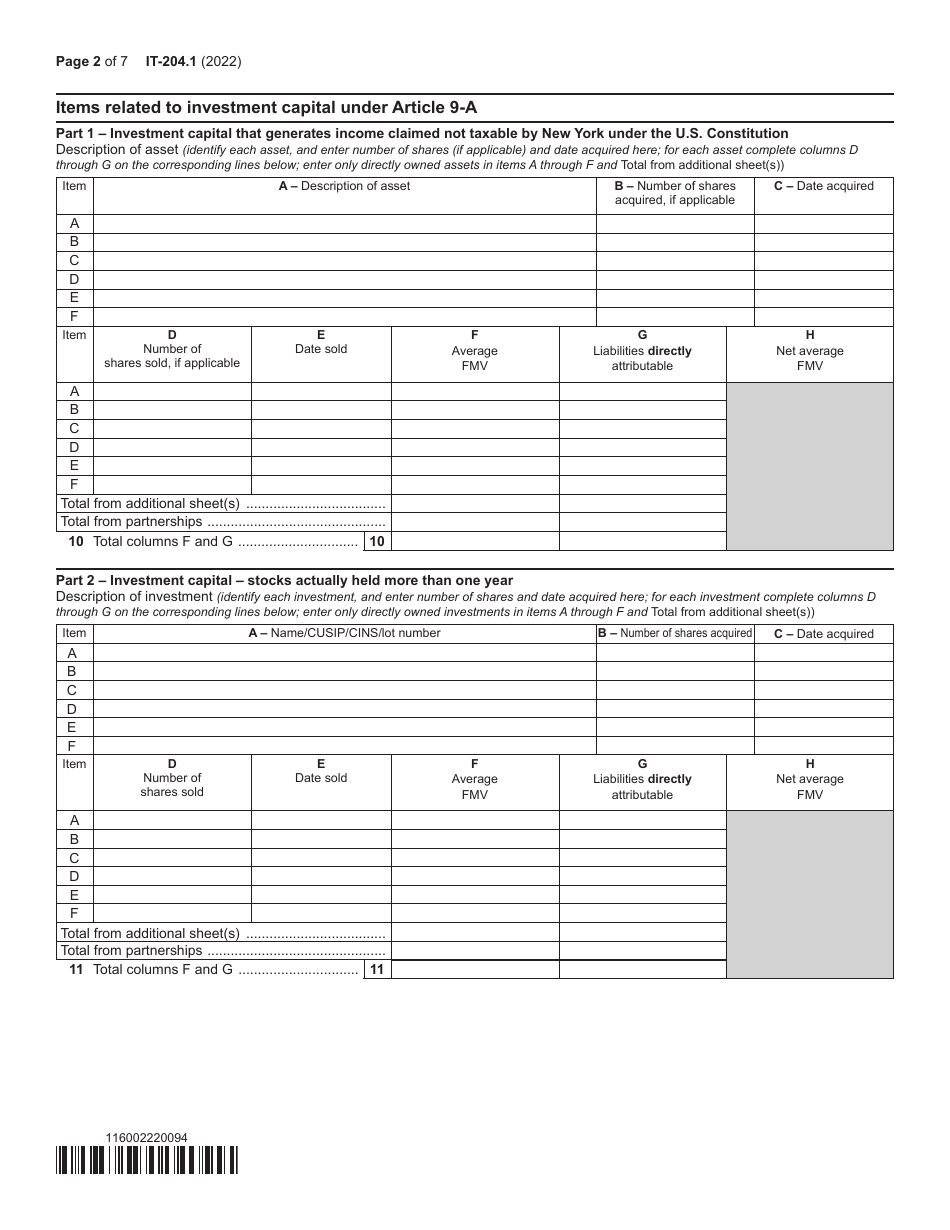

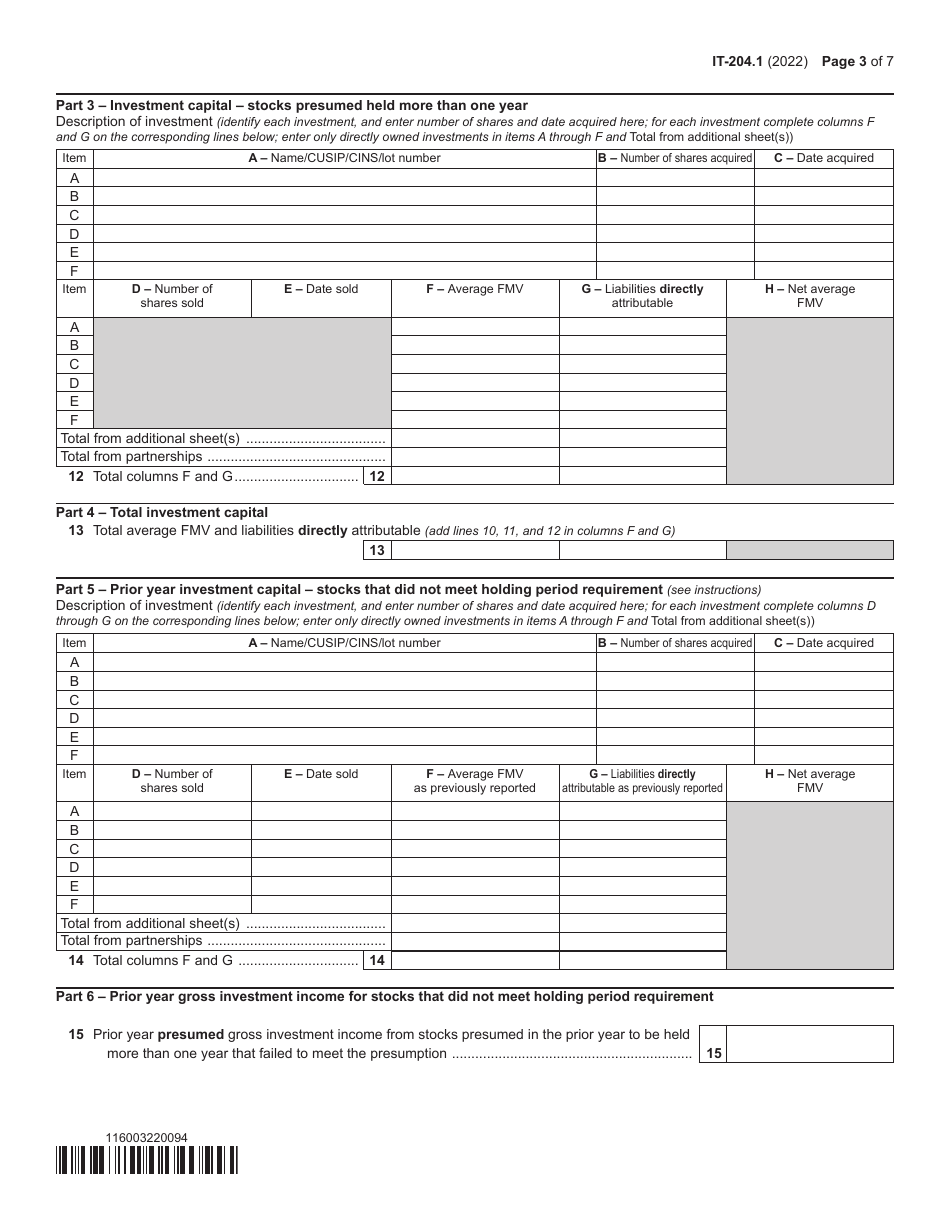

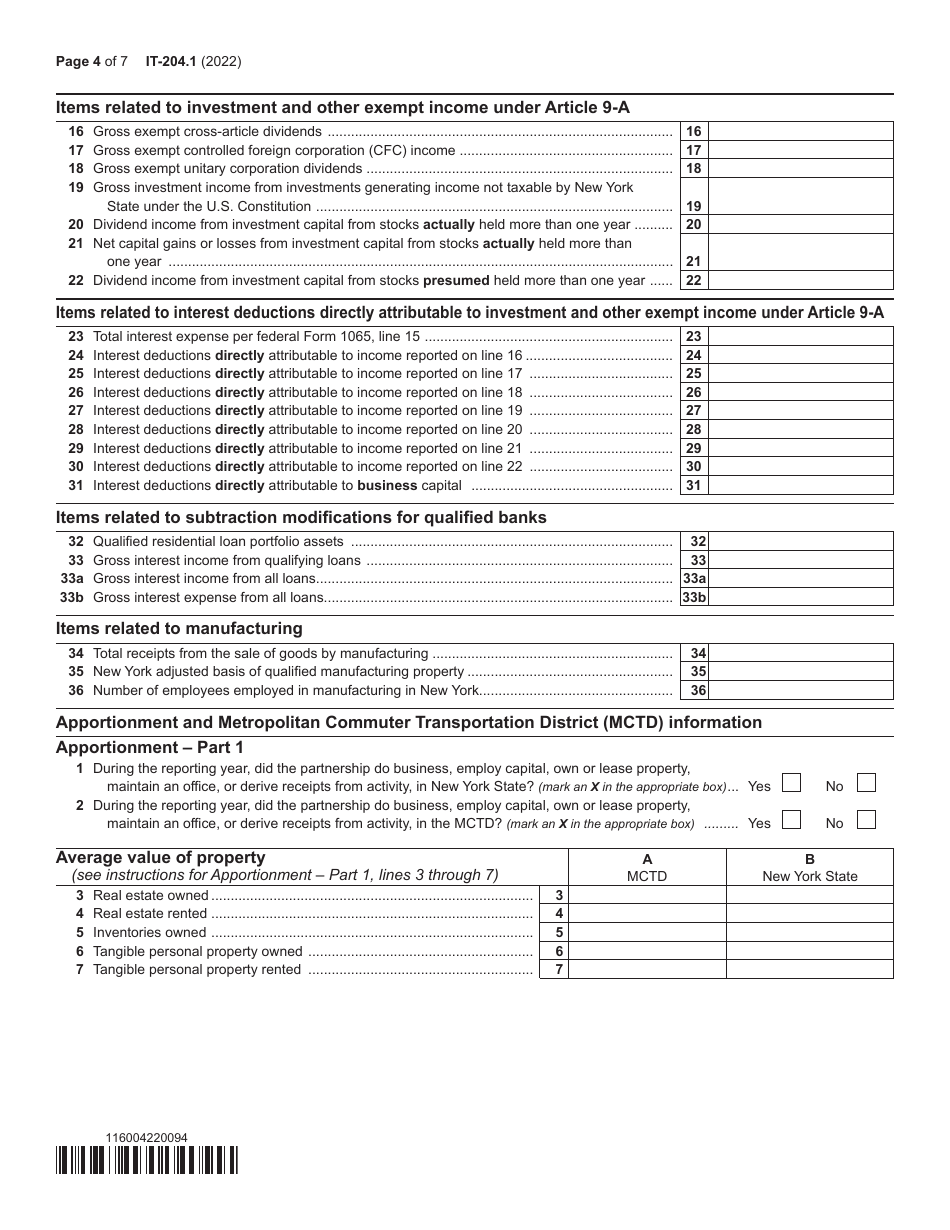

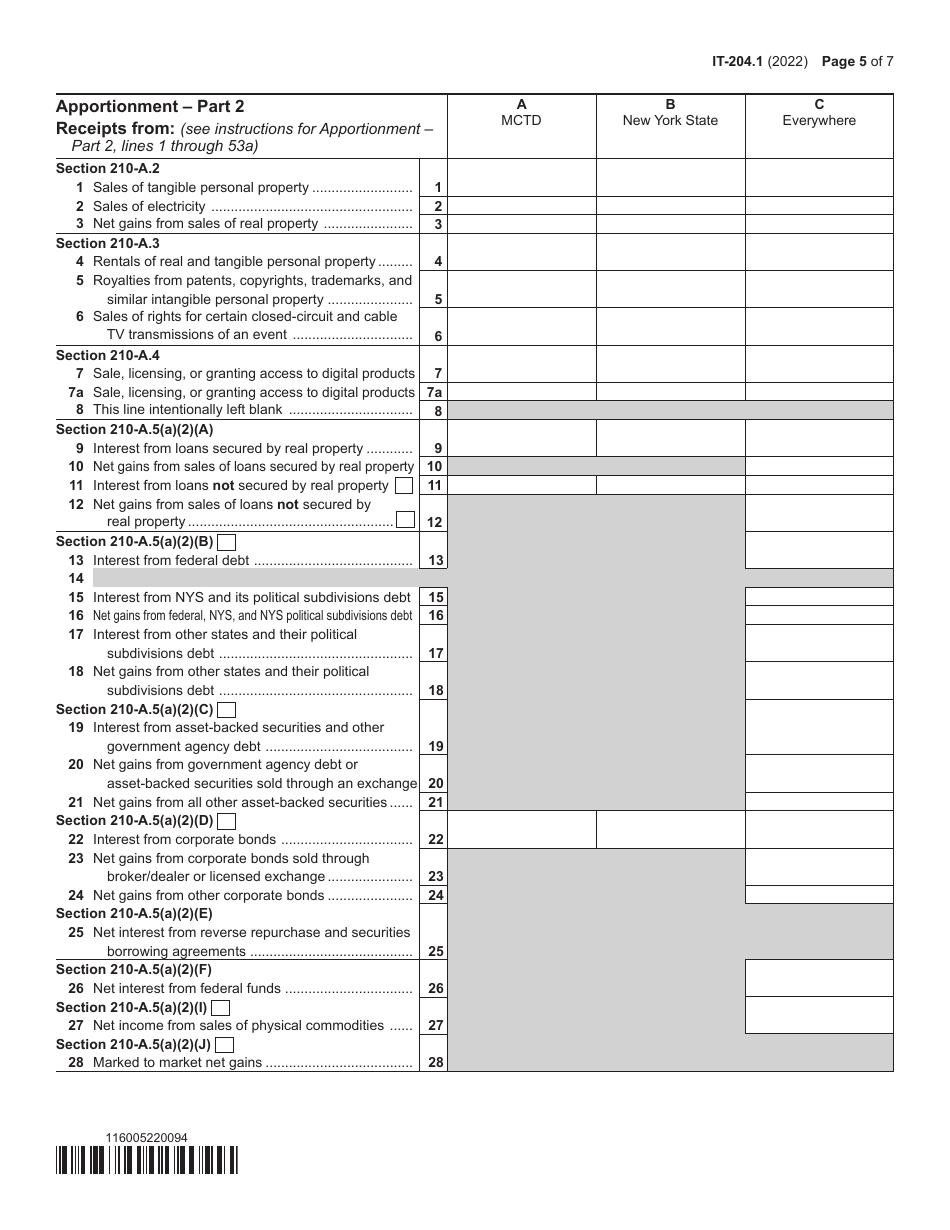

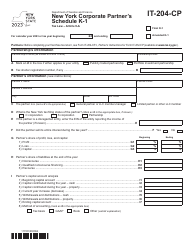

Form IT-204.1 Schedule K New York Corporate Partners' Schedule - New York

What Is Form IT-204.1 Schedule K?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-204.1?

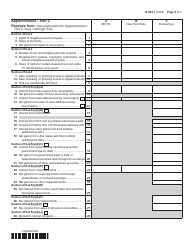

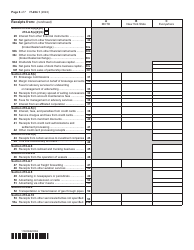

A: Form IT-204.1 is a schedule that is used by New York corporate partners to report their distributive share of income, deductions, credits, and other items from partnership activities.

Q: What is Schedule K?

A: Schedule K is a section of Form IT-204.1 where New York corporate partners provide detailed information on their distributive share of partnership income and deductions.

Q: Who needs to file Form IT-204.1 Schedule K?

A: New York corporate partners who have income or deductions from partnership activities need to file Form IT-204.1 Schedule K.

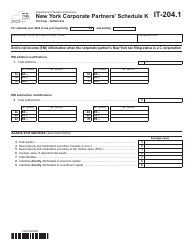

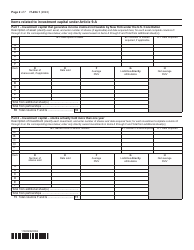

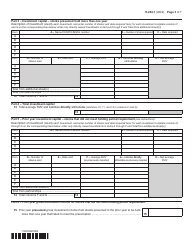

Q: What information is reported on Form IT-204.1 Schedule K?

A: Form IT-204.1 Schedule K reports a New York corporate partner's distributive share of partnership income, deductions, credits, and other items for tax purposes.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-204.1 Schedule K by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.