This version of the form is not currently in use and is provided for reference only. Download this version of

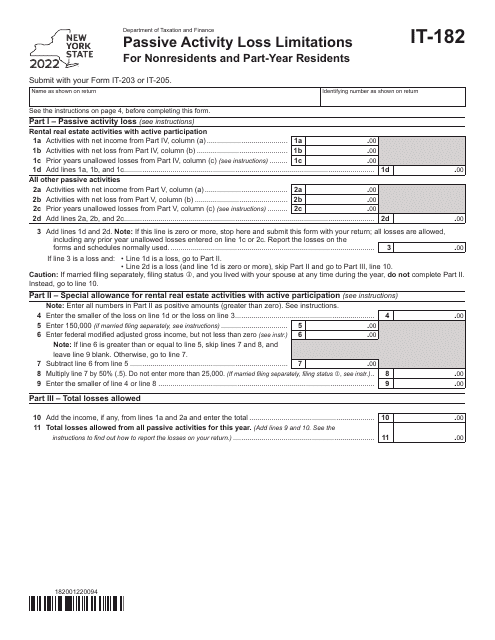

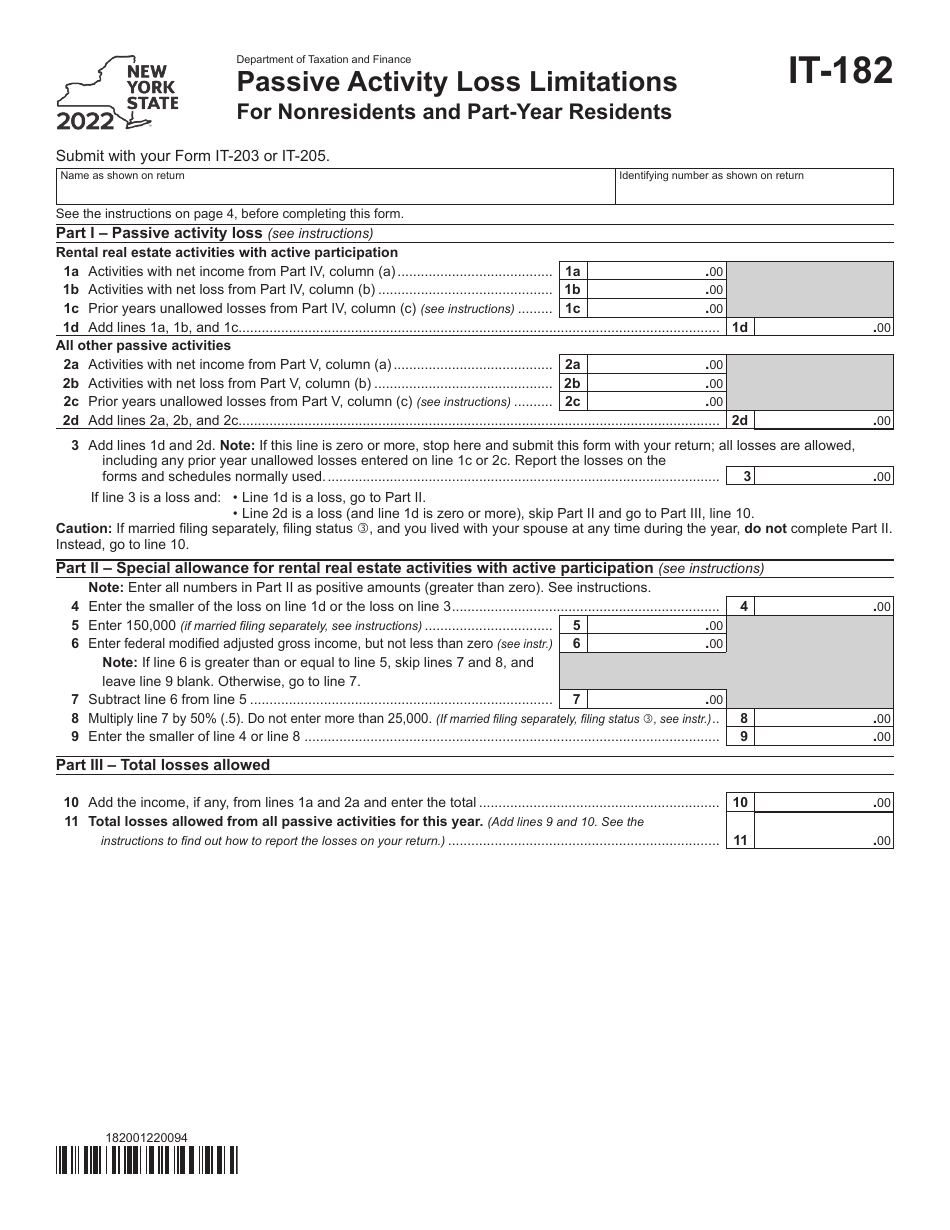

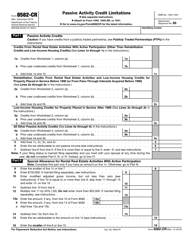

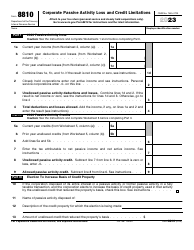

Form IT-182

for the current year.

Form IT-182 Passive Activity Loss Limitations for Nonresidents and Part-Year Residents - New York

What Is Form IT-182?

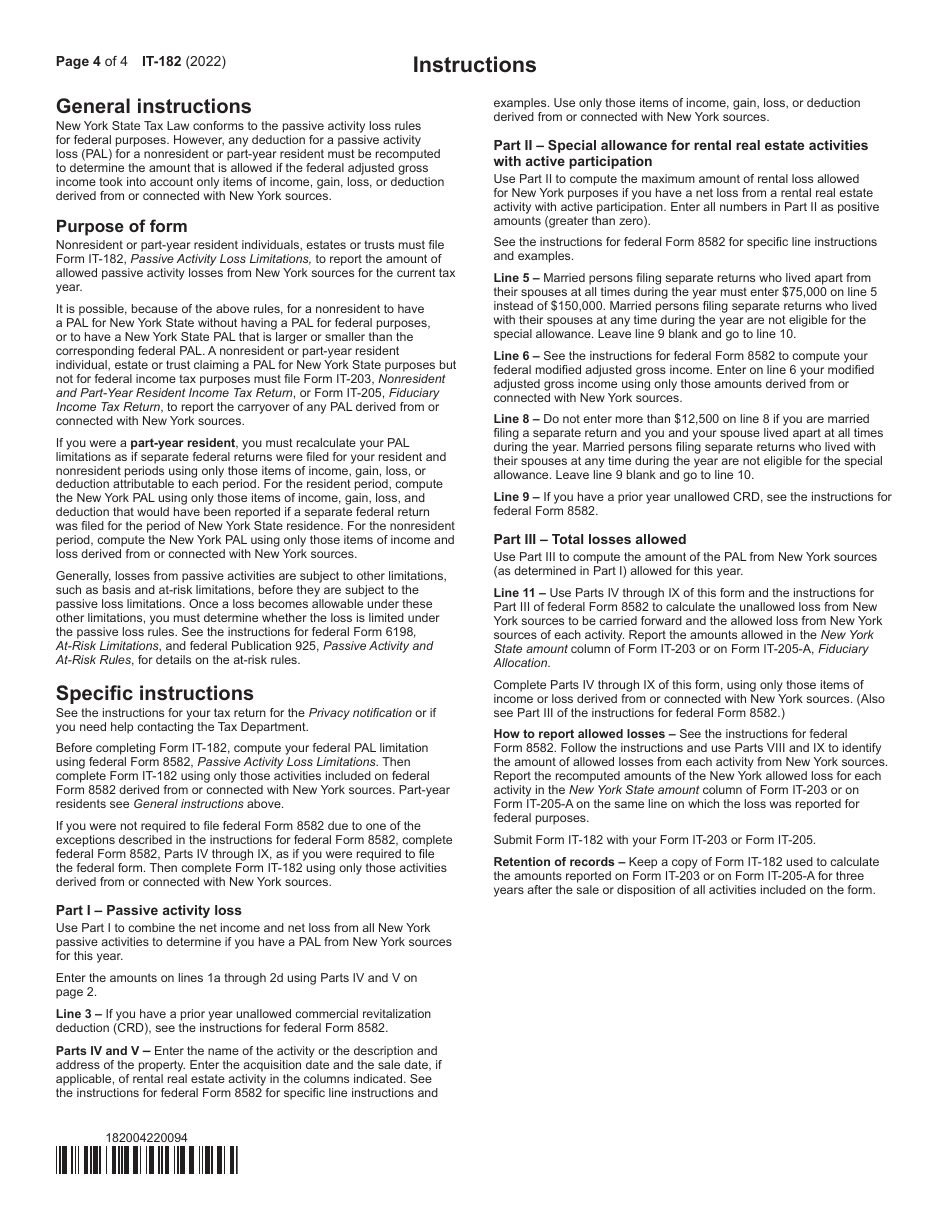

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: Who needs to file Form IT-182?

A: Nonresidents and part-year residents of New York who have passive activity losses.

Q: What is Form IT-182 used for?

A: Form IT-182 is used to calculate and determine the allowable passive activity loss limitations for nonresidents and part-year residents of New York.

Q: What are passive activity losses?

A: Passive activity losses are losses incurred from passive activities, such as rental properties or limited partnerships, where the taxpayer does not materially participate.

Q: Why are there limitations on passive activity losses?

A: The IRS imposes limitations on passive activity losses to prevent taxpayers from using them to offset other forms of income.

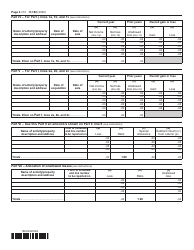

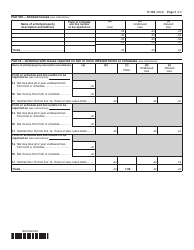

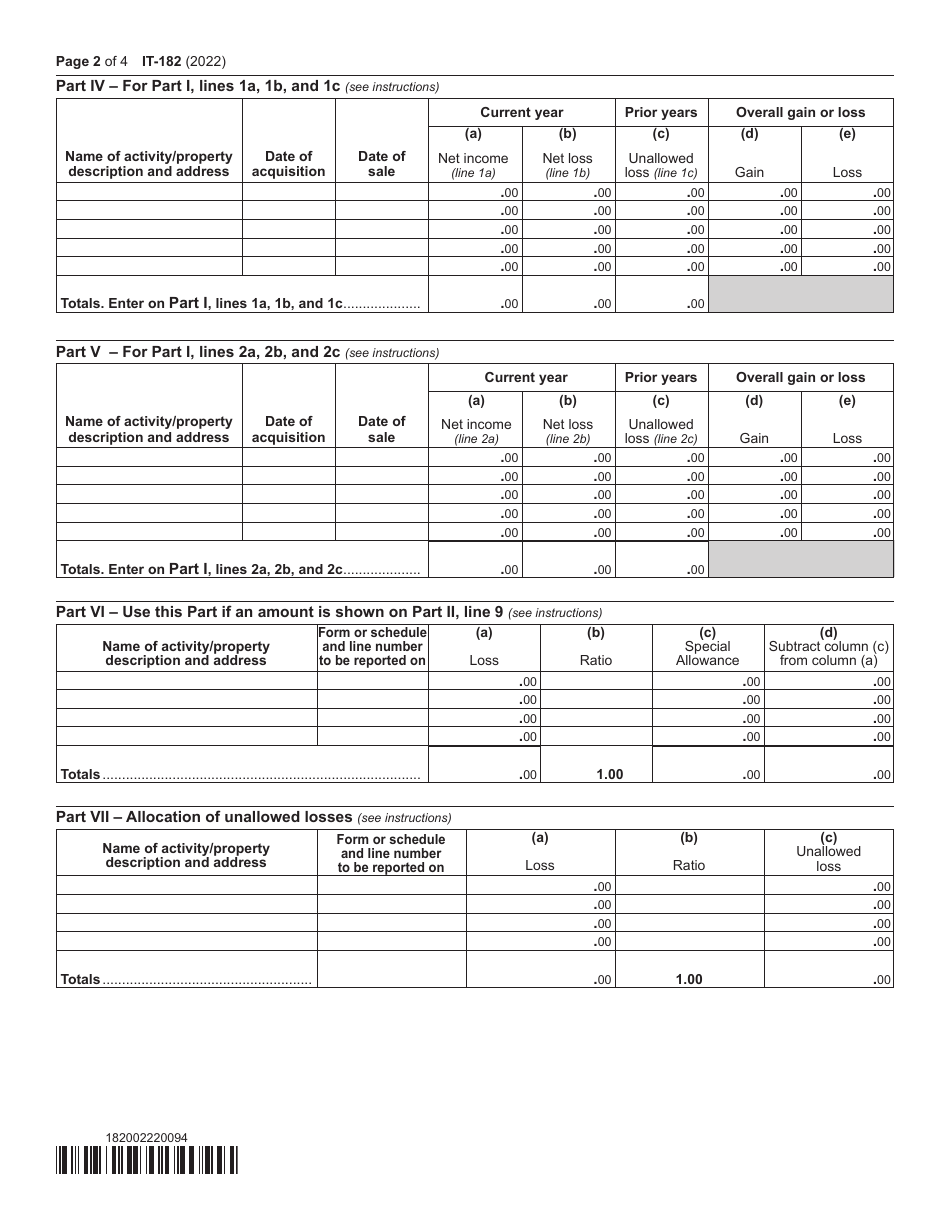

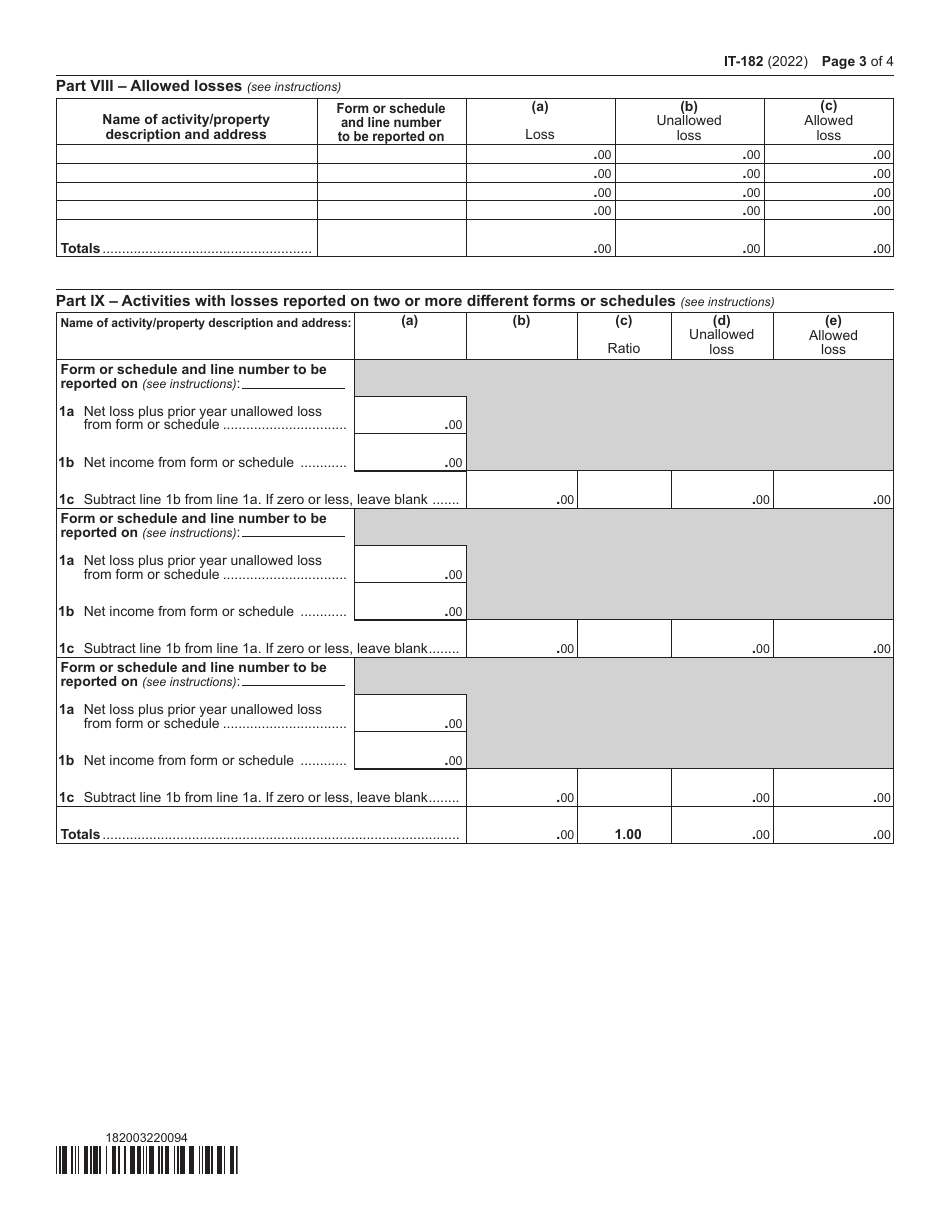

Q: How do I fill out Form IT-182?

A: You will need to provide information about your passive activities, including income and expenses, and follow the instructions provided on the form.

Q: When is Form IT-182 due?

A: Form IT-182 is generally due at the same time as your New York state income tax return, which is usually April 15th of the following year.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-182 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.