This version of the form is not currently in use and is provided for reference only. Download this version of

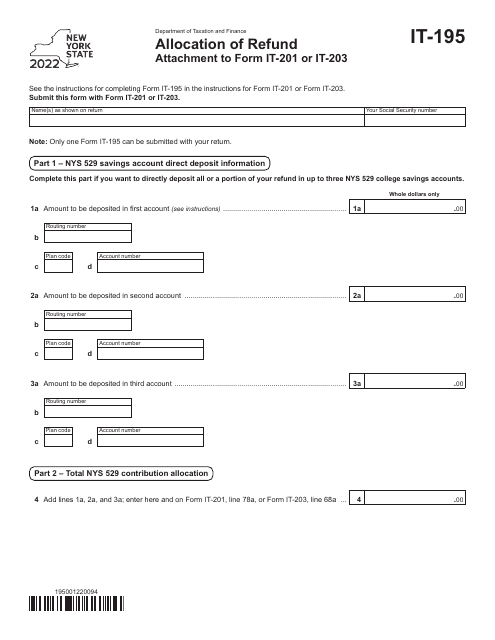

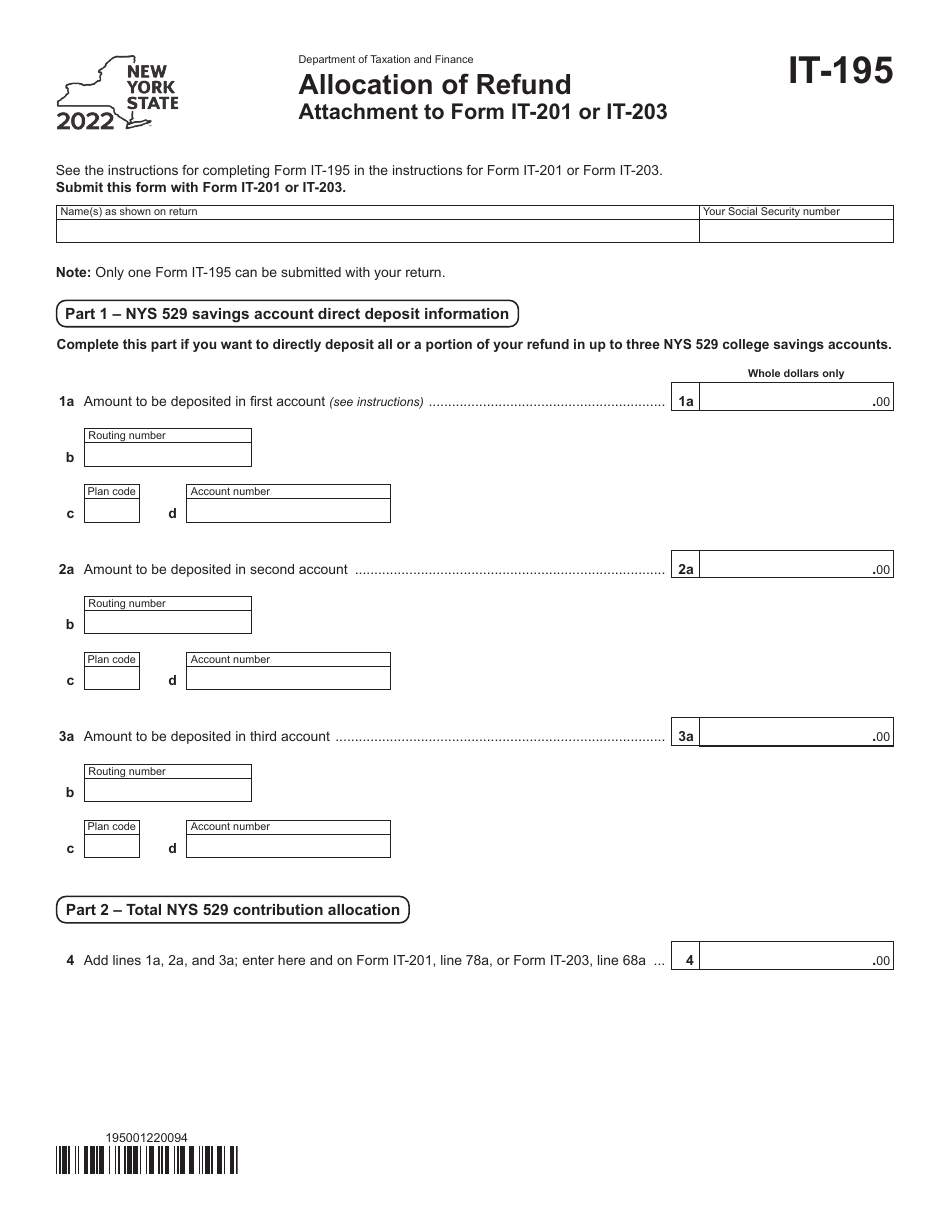

Form IT-195

for the current year.

Form IT-195 Allocation of Refund - New York

What Is Form IT-195?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-195?

A: Form IT-195 is the Allocation of Refund form for residents of New York.

Q: Who is required to file Form IT-195?

A: New York residents who are eligible for a refund and want to allocate their refund among multiple parties or accounts must file Form IT-195.

Q: What information should I provide on Form IT-195?

A: You should provide your personal information, the amount of refund to be allocated, and the details of the parties or accounts to which the refund should be allocated.

Q: When is the deadline to file Form IT-195?

A: Form IT-195 should be filed with your New York state tax return by the due date of the return.

Q: What happens after I file Form IT-195?

A: The New York State Department of Taxation and Finance will process your form and allocate the refund according to your instructions.

Q: Can I change the allocation of my refund after filing Form IT-195?

A: No, you cannot change the allocation once you have filed Form IT-195.

Q: Are there any fees associated with filing Form IT-195?

A: No, there are no fees associated with filing Form IT-195.

Q: Is Form IT-195 only for residents of New York?

A: Yes, Form IT-195 is specifically for residents of New York.

Q: Can I e-file Form IT-195?

A: No, currently you cannot e-file Form IT-195. It must be filed by mail.

Q: Do I need to attach any documents with Form IT-195?

A: No, you do not need to attach any documents with Form IT-195 unless specifically instructed by the New York State Department of Taxation and Finance.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-195 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.