This version of the form is not currently in use and is provided for reference only. Download this version of

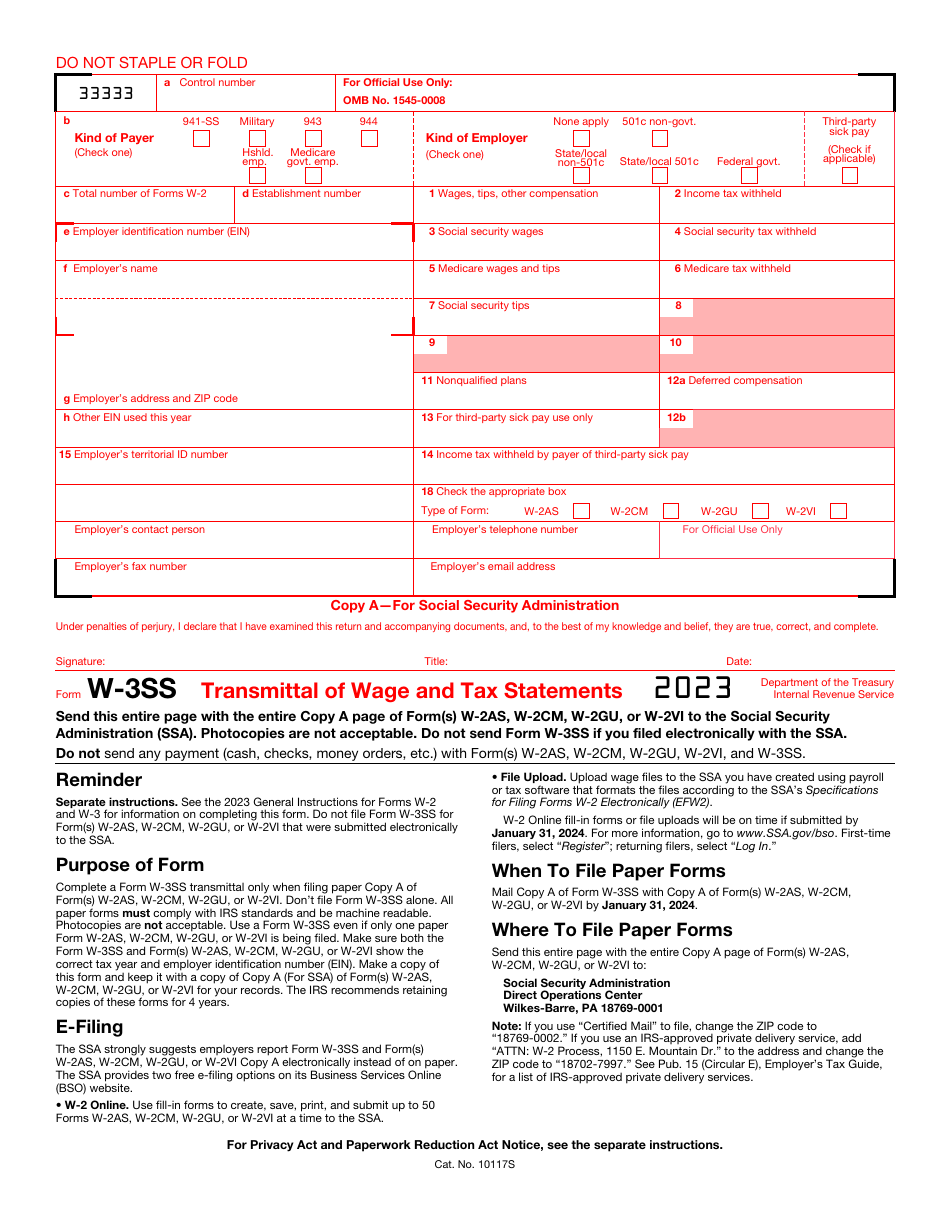

IRS Form W-3SS

for the current year.

IRS Form W-3SS Transmittal of Wage and Tax Statements

What Is IRS Form W-3SS?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form W-3SS?

A: IRS Form W-3SS is a transmittal form used to send wage and tax statements, such as Form W-2, to the Social Security Administration (SSA).

Q: Who needs to file IRS Form W-3SS?

A: Employers who are required to file wage and tax statements (Form W-2) must also file Form W-3SS to transmit these statements to the SSA.

Q: When is IRS Form W-3SS due?

A: Form W-3SS is due on the same date as the deadline for filing Form W-2. Generally, it is due by the end of January each year.

Q: What information is required on Form W-3SS?

A: Form W-3SS requires information such as the total number of Form W-2s being transmitted, total wages and tips, total social security wages, and total Medicare wages.

Q: Is Form W-3SS the same as Form W-3?

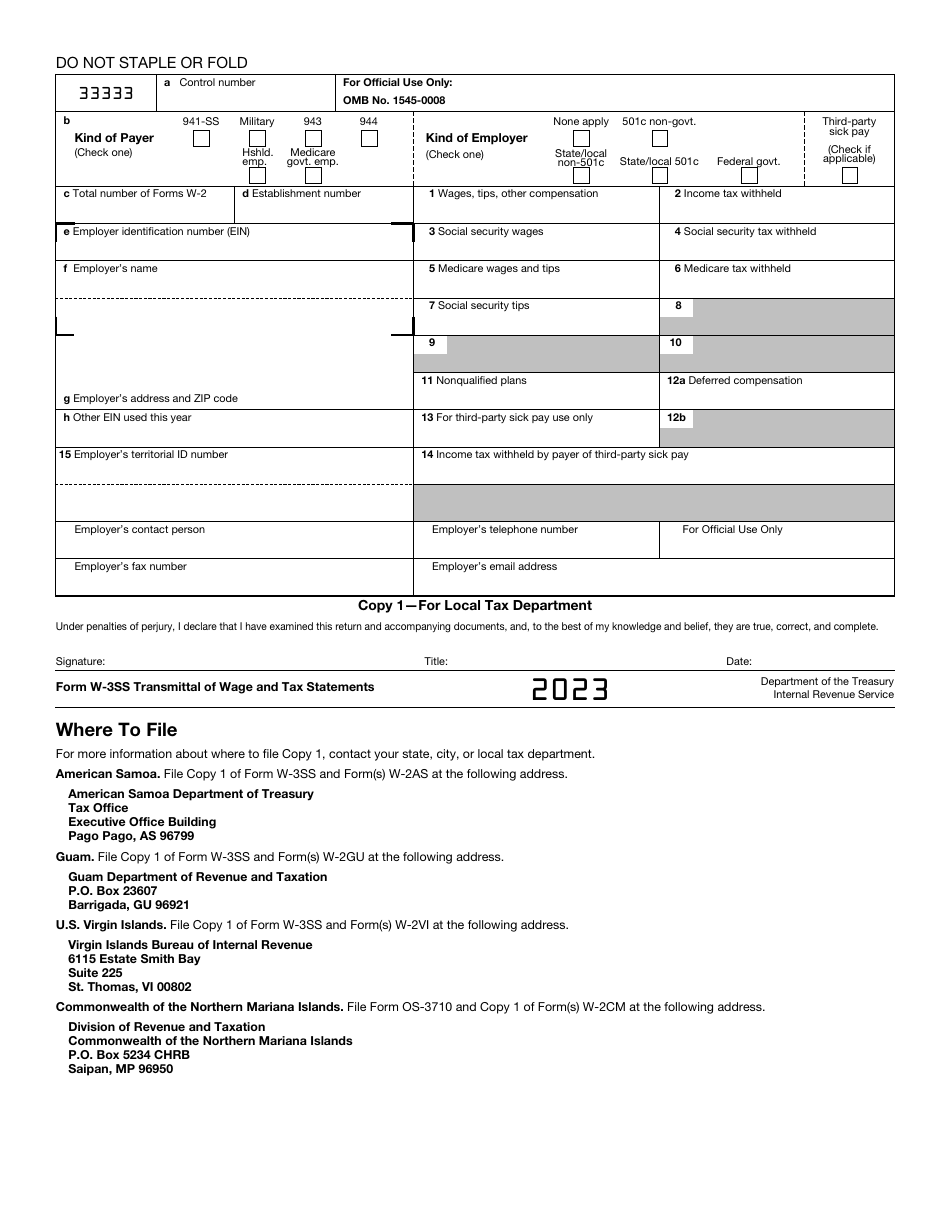

A: No, Form W-3SS is specifically used for transmitting wage and tax statements related to the U.S. Virgin Islands, Guam, American Samoa, the Commonwealth of the Northern Mariana Islands, and Puerto Rico. Form W-3 is used for transmitting statements related to the rest of the United States.

Form Details:

- A 3-page form available for download in PDF;

- This form will be used to file next year's taxes. Choose a previous version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form W-3SS through the link below or browse more documents in our library of IRS Forms.