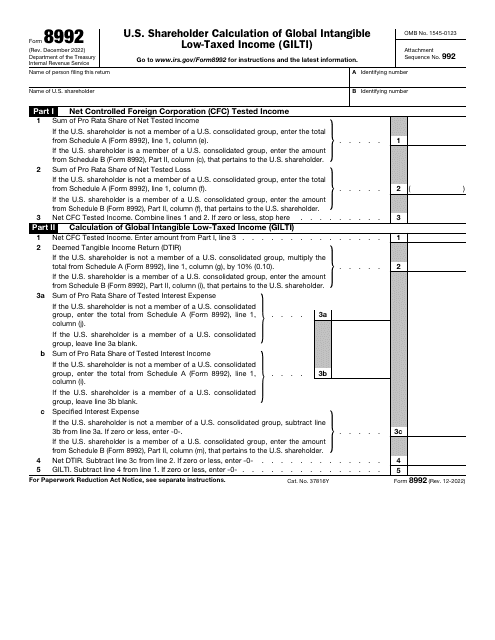

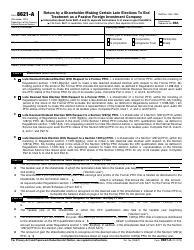

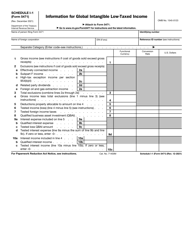

IRS Form 8892 U.S. Shareholder Calculation of Global Intangible Low-Taxed Income (Gilti)

What Is IRS Form 8892?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2022. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8892?

A: IRS Form 8892 is a form used by U.S. shareholders to calculate Global Intangible Low-Taxed Income (GILTI).

Q: Who uses IRS Form 8892?

A: U.S. shareholders use IRS Form 8892.

Q: What does IRS Form 8892 calculate?

A: IRS Form 8892 calculates Global Intangible Low-Taxed Income (GILTI).

Q: What is Global Intangible Low-Taxed Income (GILTI)?

A: GILTI refers to the income earned by a U.S. shareholder from controlled foreign corporations that exceed a certain threshold.

Q: Is IRS Form 8892 required for all U.S. shareholders?

A: No, IRS Form 8892 is only required for U.S. shareholders who have Global Intangible Low-Taxed Income (GILTI).

Q: Are there any penalties for not filing IRS Form 8892?

A: Yes, there can be penalties for not filing IRS Form 8892 or for providing inaccurate or incomplete information.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8892 through the link below or browse more documents in our library of IRS Forms.