This version of the form is not currently in use and is provided for reference only. Download this version of

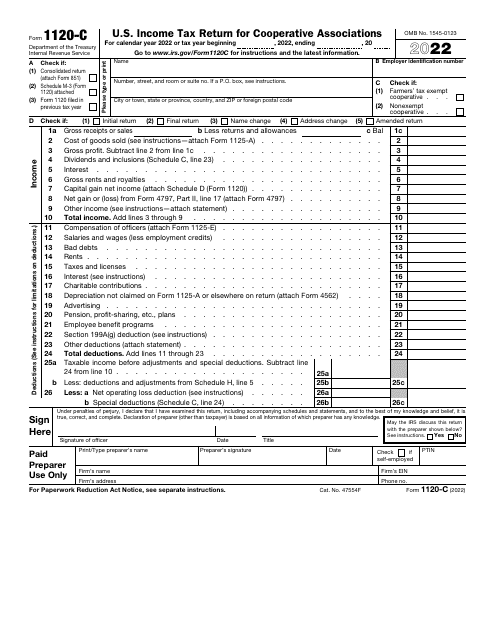

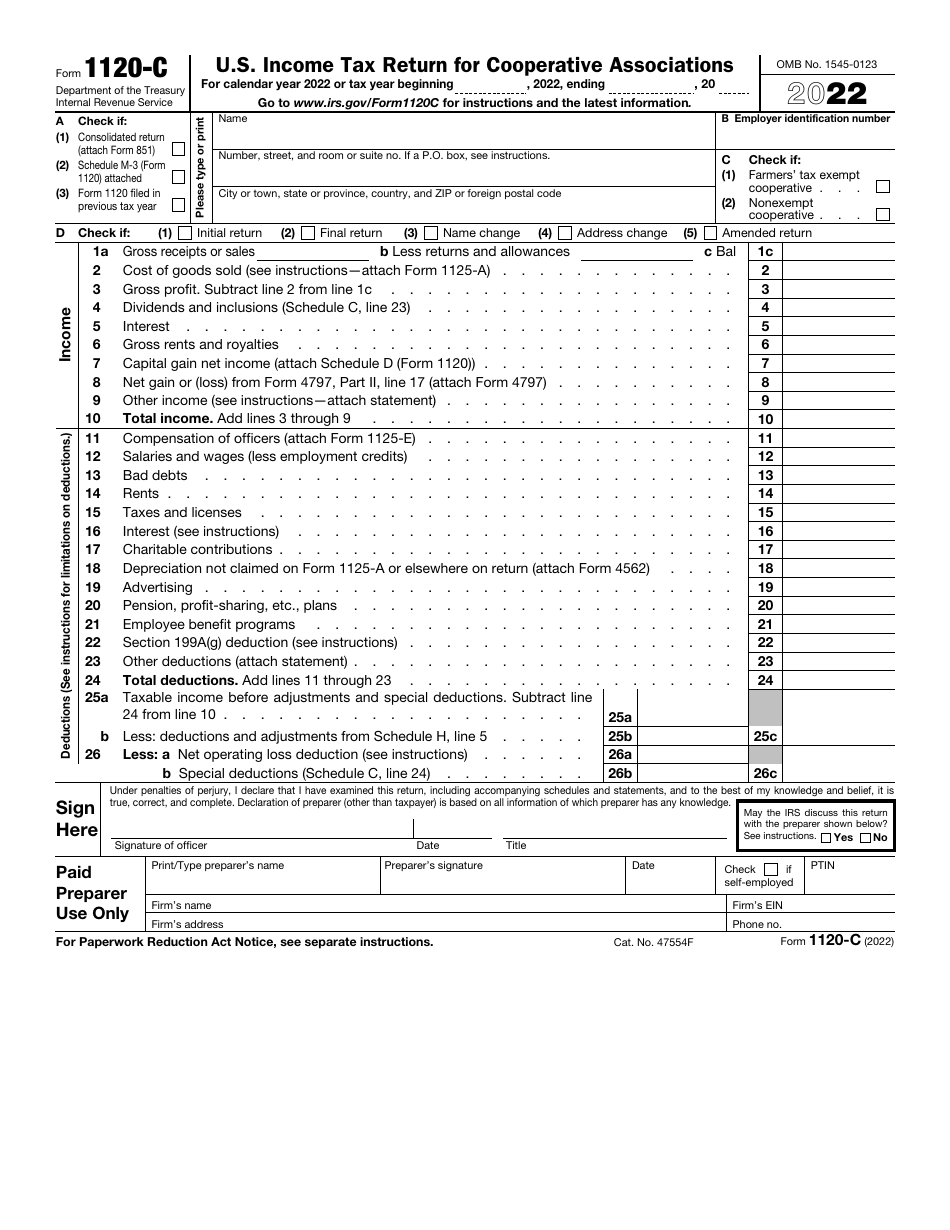

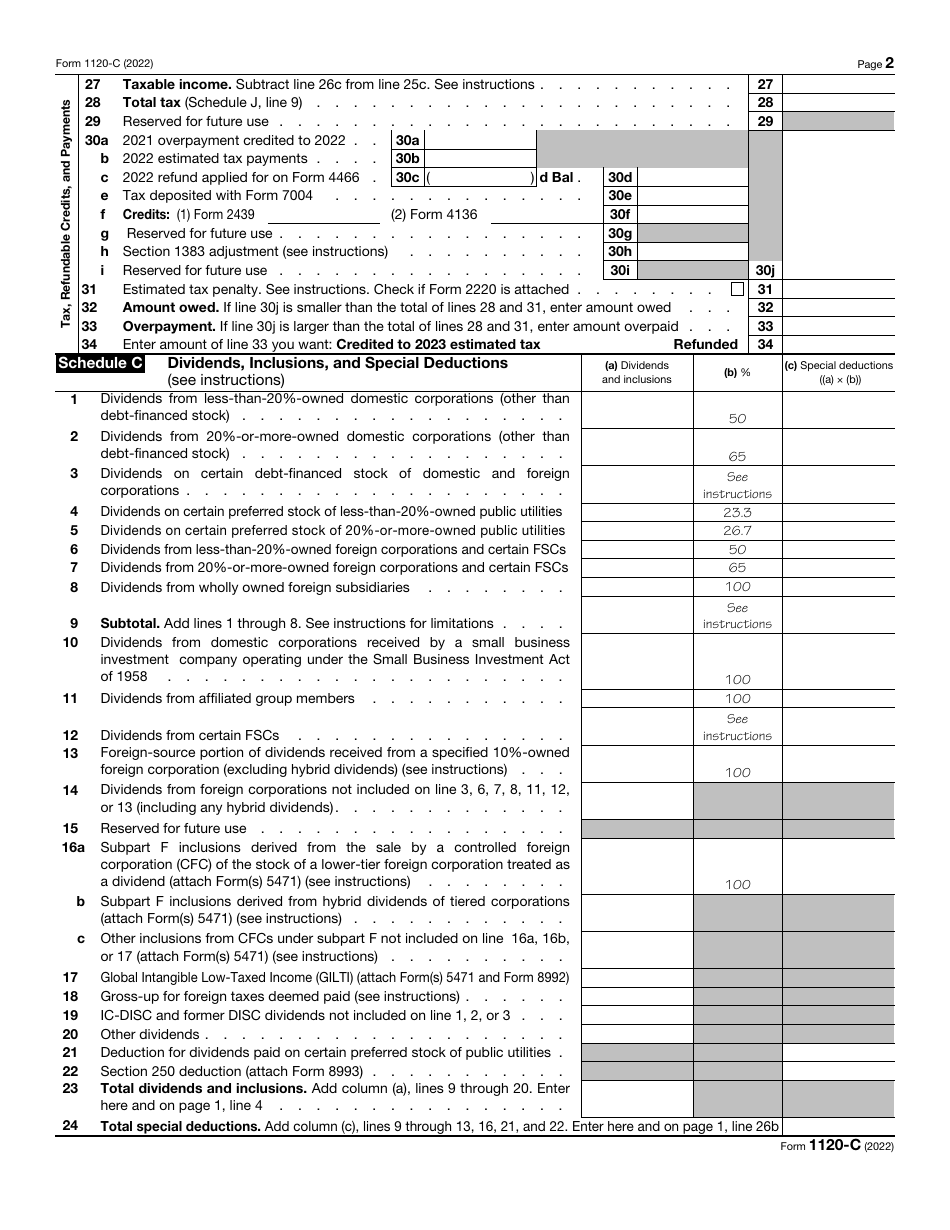

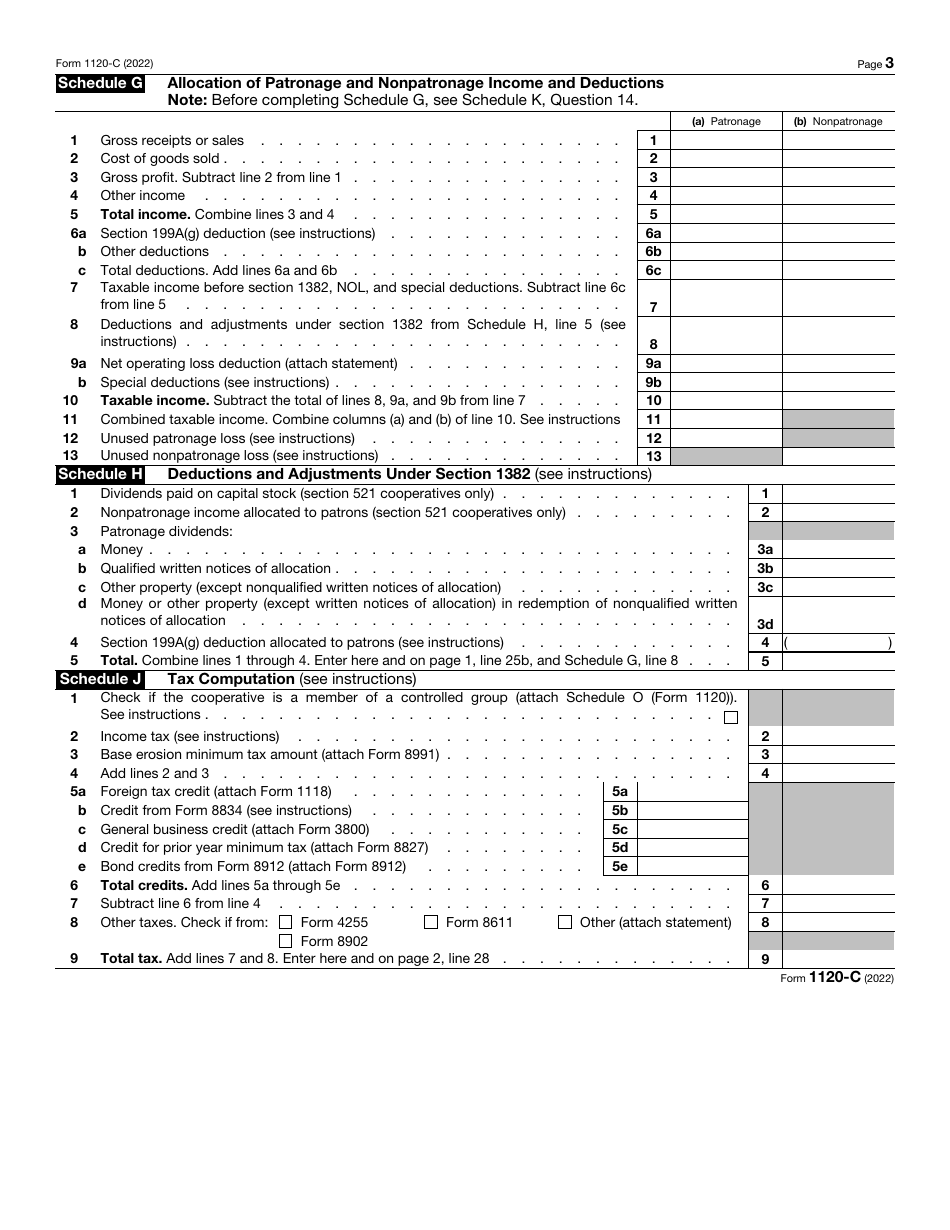

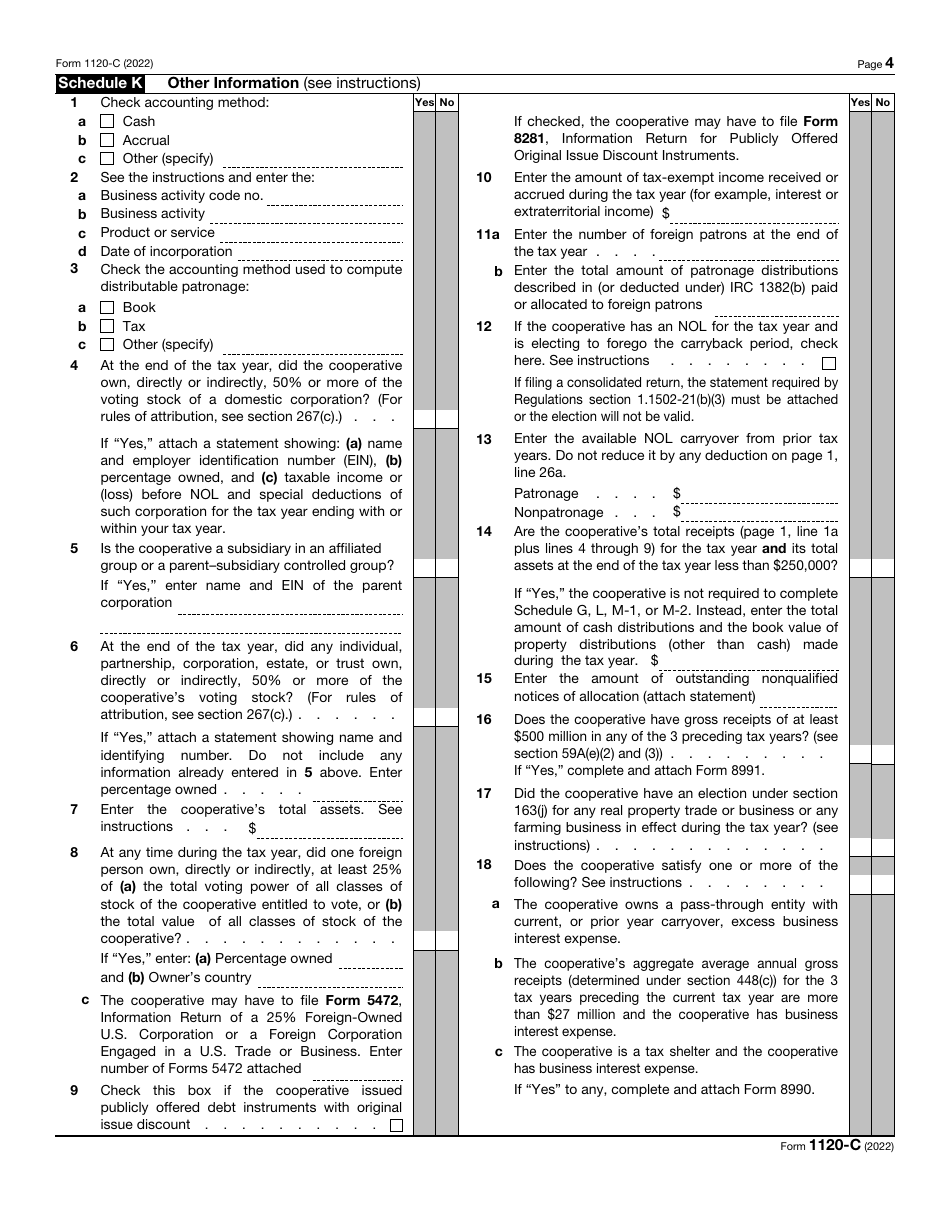

IRS Form 1120-C

for the current year.

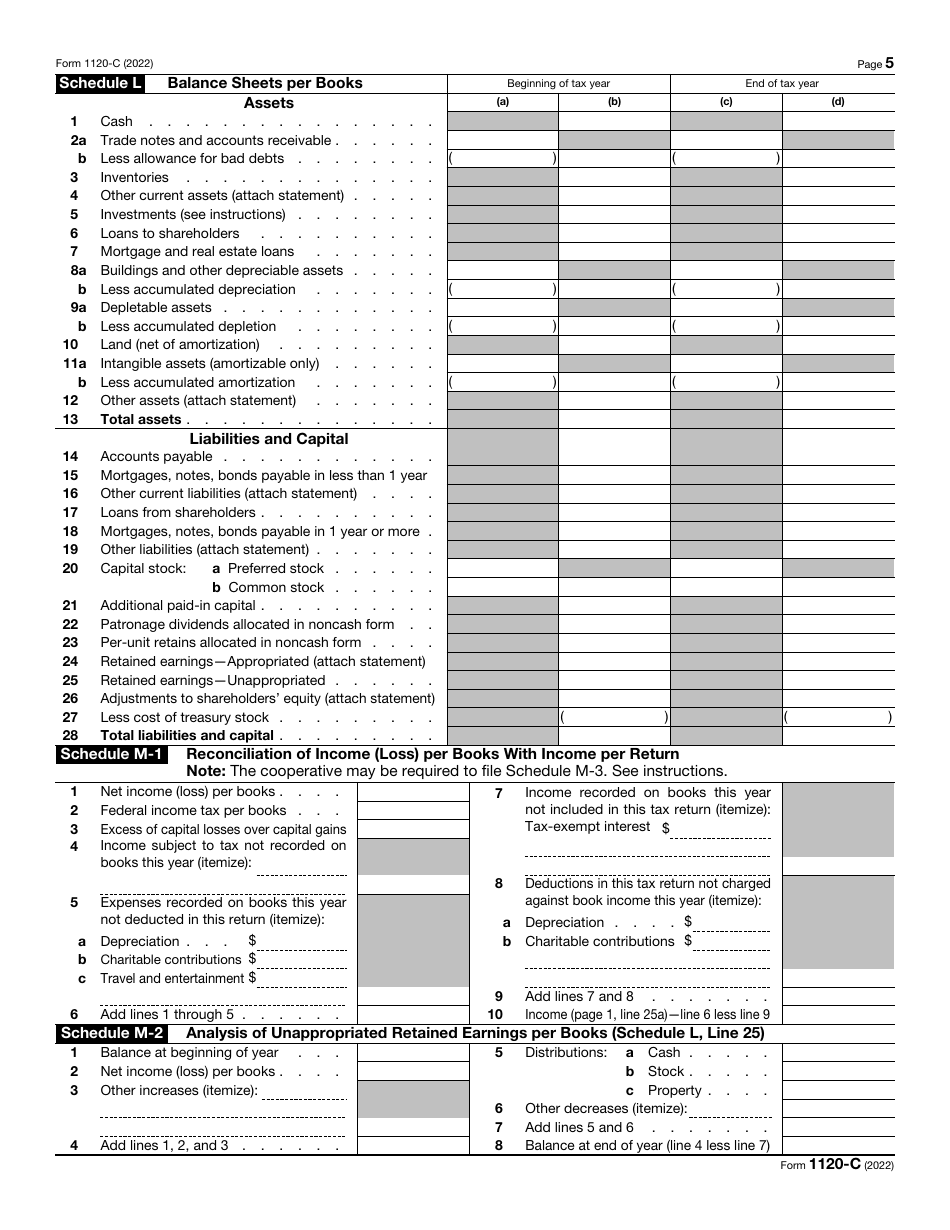

IRS Form 1120-C U.S. Income Tax Return for Cooperative Associations

What Is IRS Form 1120-C?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1120-C?

A: IRS Form 1120-C is the U.S. Income Tax Return specifically designed for Cooperative Associations.

Q: Who should file IRS Form 1120-C?

A: Cooperative Associations should file IRS Form 1120-C.

Q: What is the purpose of filing IRS Form 1120-C?

A: The purpose of filing IRS Form 1120-C is to report the income, deductions, credits, and other financial information of a Cooperative Association for federal tax purposes.

Q: When is the due date for filing IRS Form 1120-C?

A: The due date for filing IRS Form 1120-C is usually the 15th day of the 4th month following the end of the Cooperative Association's tax year.

Q: Are there any extensions available for filing IRS Form 1120-C?

A: Yes, you can request an extension by filing Form 7004, Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns.

Q: What penalties can be imposed for late or incorrect filing of IRS Form 1120-C?

A: Penalties may vary depending on factors such as the amount of tax owed, the reason for the failure, and whether it was intentionally disregarded. It is advisable to consult with a tax professional for specific penalty information.

Q: Is there a separate form for Canadian income tax return for Cooperative Associations?

A: No, IRS Form 1120-C is specifically for U.S. income tax return for Cooperative Associations. Canadian tax requirements may vary, and it is necessary to consult the Canada Revenue Agency (CRA) for the appropriate form and guidelines.

Form Details:

- A 5-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-C through the link below or browse more documents in our library of IRS Forms.