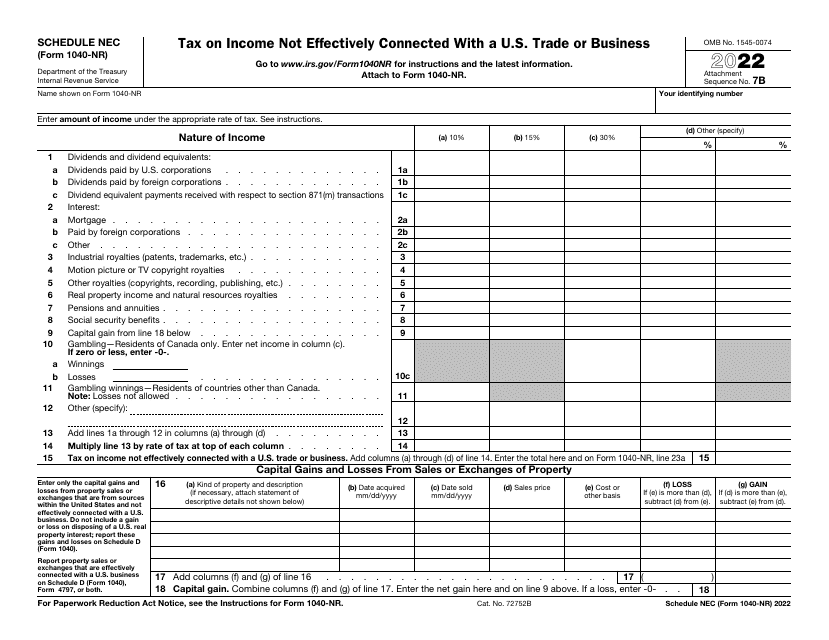

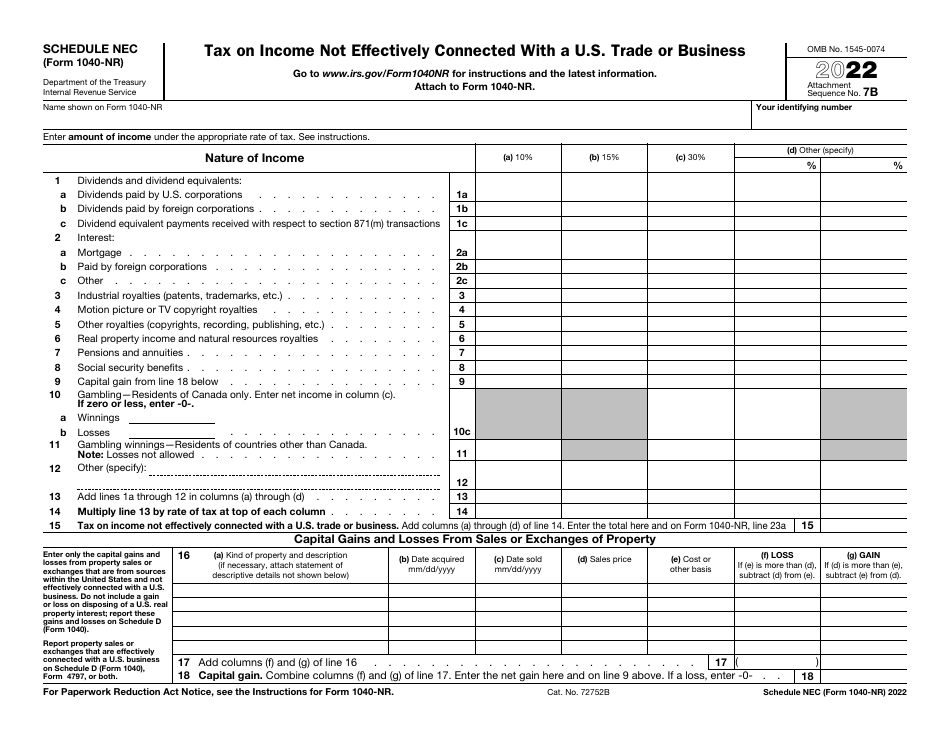

This version of the form is not currently in use and is provided for reference only. Download this version of

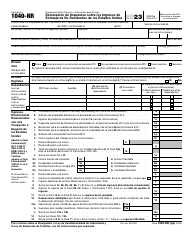

IRS Form 1040-NR Schedule NEC

for the current year.

IRS Form 1040-NR Schedule NEC Tax on Income Not Effectively Connected With a U.S. Trade or Business

What Is IRS Form 1040-NR Schedule NEC?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1040-NR, U.S. Nonresident Alien Income Tax Return. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1040-NR Schedule NEC?

A: IRS Form 1040-NR Schedule NEC is a form used to report taxes on income that is not effectively connected with a U.S. trade or business.

Q: What does 'not effectively connected with a U.S. trade or business' mean?

A: It means income that is not generated through a business or trade conducted within the United States.

Q: Who is required to fill out IRS Form 1040-NR Schedule NEC?

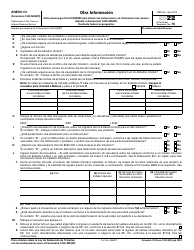

A: Non-resident aliens who earned income in the U.S. that is not effectively connected with a U.S. trade or business need to fill out this form.

Q: What kind of income should be reported on IRS Form 1040-NR Schedule NEC?

A: Income such as rents, royalties, dividends, interest, and certain gains from the sale of property or assets outside of the U.S. should be reported on this form.

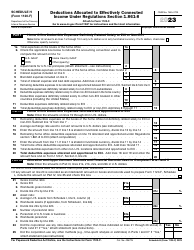

Q: Is there a specific deadline for filing IRS Form 1040-NR Schedule NEC?

A: Yes, the deadline for filing this form is usually April 15th, or the 15th day of the 6th month after the end of your tax year, if you use a fiscal year instead of a calendar year.

Q: Can I file IRS Form 1040-NR Schedule NEC electronically?

A: No, you cannot file this form electronically. It must be filed by mail.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040-NR Schedule NEC through the link below or browse more documents in our library of IRS Forms.