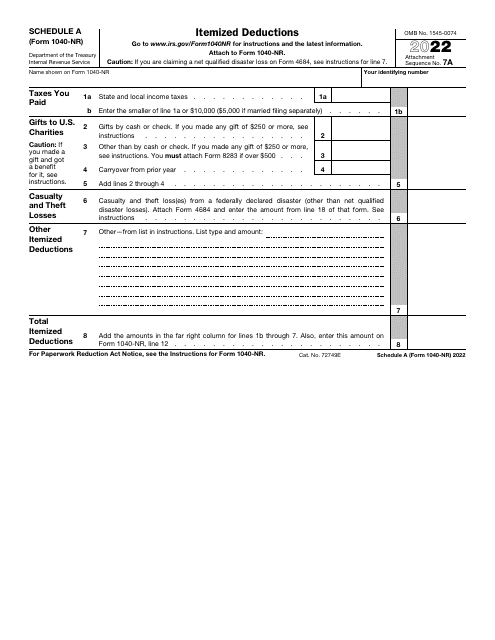

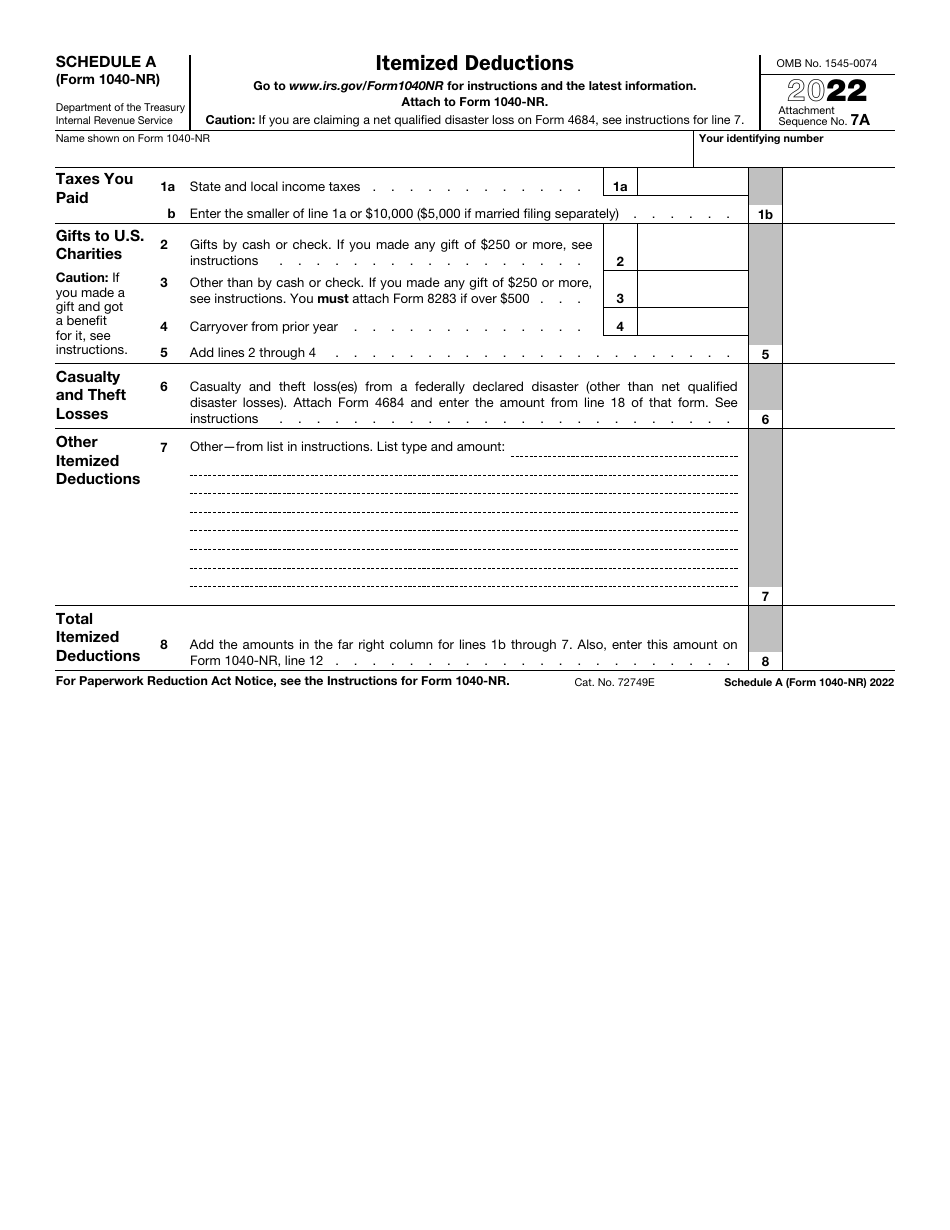

This version of the form is not currently in use and is provided for reference only. Download this version of

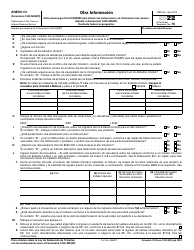

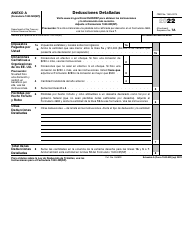

IRS Form 1040-NR Schedule A

for the current year.

IRS Form 1040-NR Schedule A Itemized Deductions

What Is IRS Form 1040-NR Schedule A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1040-NR, U.S. Nonresident Alien Income Tax Return. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1040-NR?

A: IRS Form 1040-NR is a tax form used by nonresident aliens to report their income and deductions.

Q: What is Schedule A?

A: Schedule A is a form that is attached to Form 1040-NR and is used to report itemized deductions.

Q: What are itemized deductions?

A: Itemized deductions are expenses that taxpayers can deduct from their taxable income, such as medical expenses, mortgage interest, and charitable contributions.

Q: What types of deductions can be claimed on Schedule A?

A: Some common deductions that can be claimed on Schedule A include state and local taxes, mortgage interest, medical expenses, and charitable contributions.

Q: Why would someone use Schedule A instead of taking the standard deduction?

A: Taxpayers may choose to use Schedule A if their total itemized deductions exceed the standard deduction amount and if it would result in a lower tax liability.

Q: Are there any limitations on itemized deductions?

A: Yes, there are limitations on certain itemized deductions, such as the deduction for state and local taxes, which is capped at $10,000.

Q: Do I need to file Schedule A if I don't have any itemized deductions?

A: No, if you don't have any itemized deductions, you don't need to file Schedule A. You can take the standard deduction instead.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040-NR Schedule A through the link below or browse more documents in our library of IRS Forms.